VA Loans Can Help Veterans Achieve Their Dream of Homeownership

For over 78 years, Veterans Affairs (VA) home loans have provided millions of veterans with the opportunity to purchase homes of their own. If you or a loved one have served, it’s important to understand this program and its benefits.

Here are some things you should know about VA loans before you start the homebuying process.

What Are VA Loans?

VA home loans provide a pathway to homeownership for those who have served our nation. The U.S. Department of Veterans Affairs describes the program like this:

“VA helps Servicemembers, Veterans, and eligible surviving spouses become homeowners. As part of our mission to serve you, we provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal occupancy.”

Top Benefits of the VA Home Loan Program

In addition to helping eligible buyers achieve their homeownership dreams, VA loans have several other great benefits for buyers who qualify. According to the Department of Veteran Affairs:

- Qualified borrowers can often purchase a home with no down payment.

- Many other loans with down payments under 20% require Private Mortgage Insurance (PMI). VA Loans do not require PMI, which means veterans can save on their monthly housing costs.

- VA-Backed Loans often offer competitive terms and mortgage interest rates.

A recent article from Veterans United sums up just how impactful this loan option can be:

“For the vast majority of military borrowers, VA loans represent the most powerful lending program on the market. These flexible, $0-down payment mortgages have helped more than 24 million service members become homeowners since 1944.”

John Bell, Acting Executive Director of the Department of Veterans Affairs Loan Guaranty Service, also explains why this program is so powerful:

“It provides early ownership for many people that would not have that opportunity to begin with. Since there’s no down payment, it allows people to hold their wealth and it gives them the ability to have long term financial security by being able to own a house and let that equity grow.”

Bottom Line

Homeownership is the American Dream. Our veterans sacrifice so much in service of our nation, and one way we can honor and thank them is to ensure they have the best information about the benefits of VA home loans. Thank you for your service.

Utah Realty Blog & News

The Latest news for Real Estate both local and National.

Buyers

Sellers

Seniors

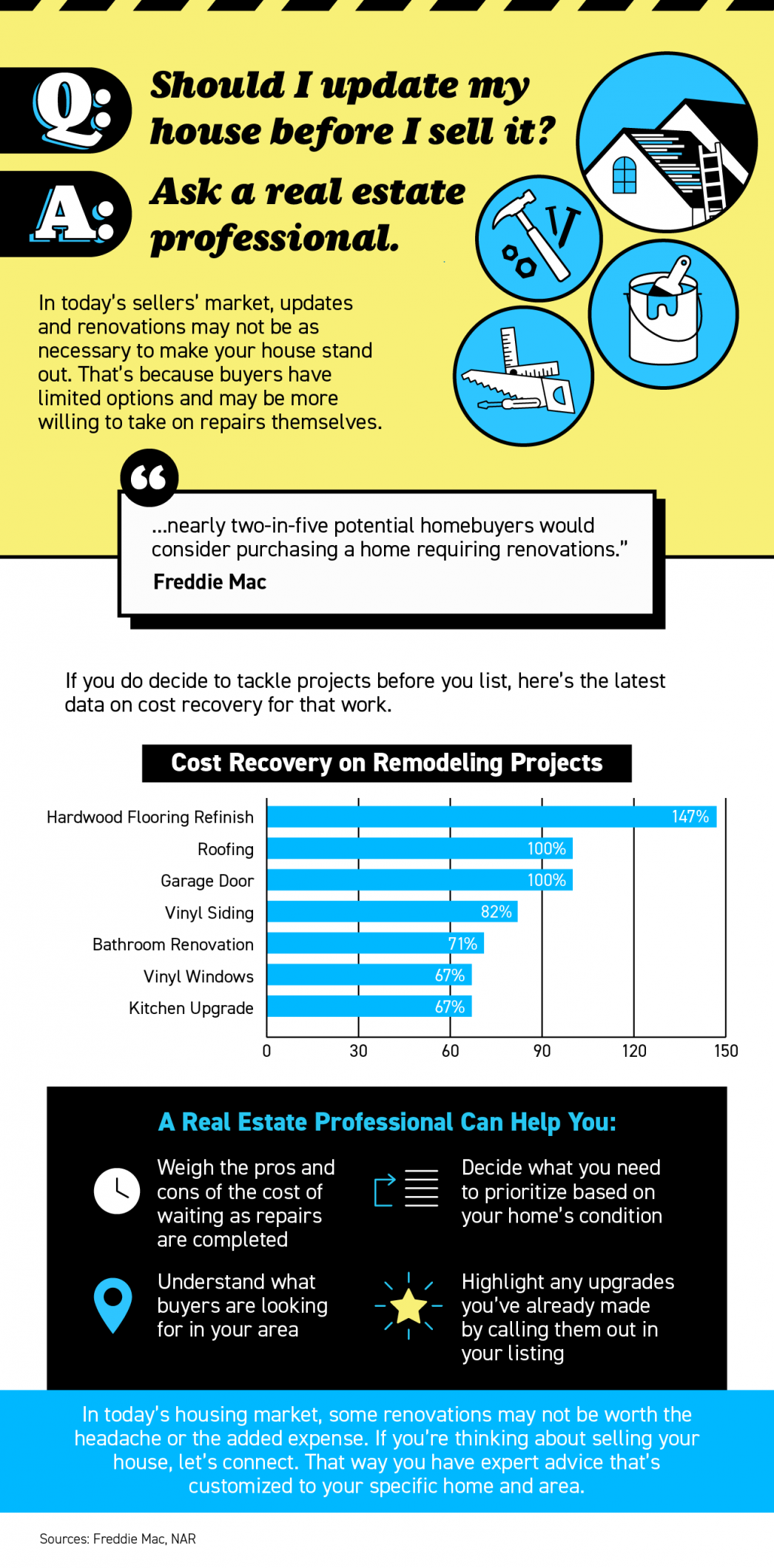

Should You Update Your House Before Selling? Ask a Real Estate Professional.

Should You Update Your House Before Selling? Ask a Real Estate Professional. Some Highlights If you’re deciding whether you should make updates before you sell your house, lean on your trusted real estate advisor to be your guide. In today’s sellers’ market, buyers...

Top Signs It’s Time To Sell According to Experts

What You Actually Need To Know About the Number of Foreclosures in Today’s Housing Market

What You Actually Need To Know About the Number of Foreclosures in Today’s Housing MarketWhile you may have seen recent stories about the volume of foreclosures today, context is important. During the pandemic, many homeowners were able to pause their mortgage...

Are There More Homes Coming to the Market?

Are There More Homes Coming to the Market? According to a recent survey from the National Association of Realtors (NAR), one of the top challenges buyers face in today’s housing market is finding a home that meets their needs. That’s largely because the inventory of...

Will Home Prices Fall This Year? Here’s What Experts Say

Will Home Prices Fall This Year? Here’s What Experts Say. Many people are wondering: will home prices fall this year? Whether you’re a potential homebuyer, seller, or both, the answer to this question matters for you. Let’s break down what’s happening with home...

The Dream of Homeownership Is Worth the Effort

The Dream of Homeownership Is Worth the Effort If you’re in the market to buy a home this season, stick with it. Homebuyers face challenges in any market, and today’s is no exception. But if you persevere, your decision to purchase a home will be worth the effort in...

Join Our Newsletter