How the Housing Market Benefits with Uncertainty in the World

How the Housing Market Benefits with Uncertainty in the World

It’s hard to listen to today’s news without hearing about the uncertainty surrounding global markets, the spread of the coronavirus, and tensions in the Middle East, just to name a few. These concerns have caused some to question their investment plans going forward. As an example, in Vanguard’s Global Outlook for 2020, the fund explains,

“Slowing global growth and elevated uncertainty create a fragile backdrop for markets in 2020 and beyond.”

Is there a silver lining to this cloud of doubt?

Some worry this could cause concern for the U.S. housing market. The uncertainty, however, may actually mean good news for real estate.

Mark Fleming, Chief Economist at First American, discussed the situation in a recent report,

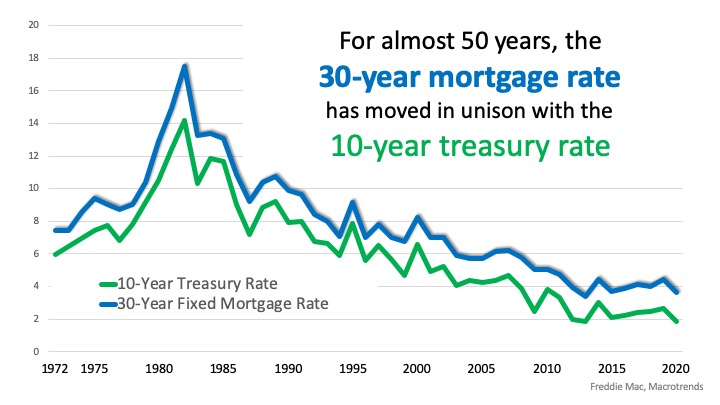

“Global events and uncertainty…impact the U.S. economy, and more specifically, the U.S. housing market…U.S. bonds, backed by the full faith and credit of the U.S. government, are widely considered the safest investments in the world. When global investors sense increased uncertainty, there is a ‘flight to safety’ in U.S. Treasury bonds, which causes their price to go up, and their yield to go down.”

Last week, in a HousingWire article, Kathleen Howley reaffirmed Fleming’s point,

“The death toll from the coronavirus already has passed Severe Acute Respiratory Syndrome, or SARS, that bruised the world’s economy in 2003…That’s making investors around the world anxious, and when they get anxious, they tend to sell off stocks and seek the safe haven of U.S. bonds. An increase in competition for bonds means investors, including the people who buy mortgage-backed bonds, have to take lower yields. That translates into lower mortgage rates.”

The yield from treasury bonds is the rate investors receive when they purchase the bond. Historically, when the treasury rate moves up or down, the 30-year mortgage rate follows. Here’s a powerful graph showing the relationship between the two over the last 48 years: How might concerns about global challenges impact the housing market in 2020? Fleming explains,

How might concerns about global challenges impact the housing market in 2020? Fleming explains,

“Even a small change in the 10-year Treasury due to increased uncertainty, let’s say a slight drop to 1.6 percent, would imply a 30-year, fixed mortgage rate as low as 3.3 percent. Assuming no change in household income, that would mean a house-buying power gain of $21,000, a five percent increase.”

Bottom Line

For a multitude of reasons, 2020 could be a challenging year. It seems, however, real estate will do just fine. As Fleming concluded in his report:

“Amid uncertainty, the house-buying power of U.S. consumers can benefit significantly.”

The #1 Reason to List Your House Right Now

The #1 Reason to List Your House Right Now

The success of the U.S. residential real estate market, like any other market, is determined by supply and demand. This means we need to look at how many potential purchasers are in the market versus the number of houses that are available to buy. With early 2020 housing data now rolling in, it’s quite evident there are two big stories impacting this year’s residential real estate market:

1. Buyer demand is already extremely strong

2. Housing supply is at a historically low level

Demand

ShowingTime is a firm that compiles data from property showings scheduled across the country. The latest ShowingTime Showing Index reveals how showings have increased in each of the country’s four regions for five months in a row.

Supply

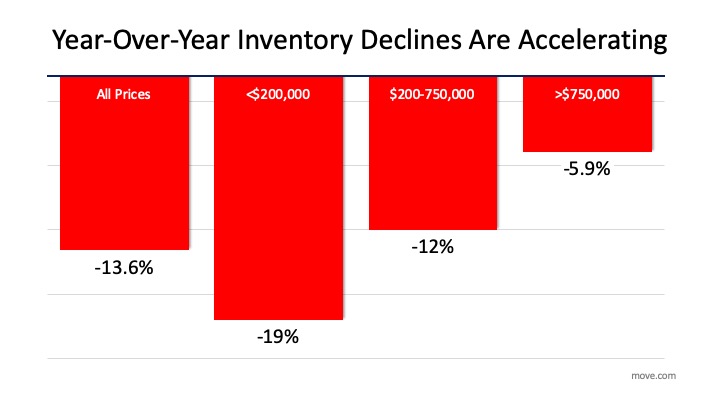

Move.com also just released information indicating that the number of homes currently for sale has declined rapidly and now sits at the lowest level in almost a decade. They explained,

“National housing inventory declined 13.6 percent in January, the steepest year-over-year decrease in more than 4 years, pushing the supply of for sale homes in the U.S. to its lowest level since realtor.com began tracking the data in 2012.”

In response to these numbers, Danielle Hale, Chief Economist at realtor.com, said,

“Homebuyers took advantage of low mortgage rates and stable listing prices to drive sales higher at the end of 2019, further depleting the already limited inventory of homes for sale. With fewer homes coming up for sale, we’ve hit another new low of for sale-listings in January.”

The decrease in inventory impacted every price range, too. Here’s a graph showing the data released by move.com:

Bottom Line

Since there’s a historic shortage of homes for sale, putting your home on the market today could drive an excellent price and give you additional negotiating leverage when selling your house. Let’s get together to determine if listing your house now is your best move.

Underwater with Two Mortgages? Here are 5 Ways to Refinance

Underwater with Two Mortgages? Here are 5 Ways to Refinance

Having a second mortgage or home equity line can make refinancing an underwater mortgage nearly impossible, but one of these five strategies might bail out your refinance.

The mortgage market is awash in programs to help underwater home owners refinance, but if you have a second mortgage or a home equity line that’s causing you to owe more than your home is worth, you could be left high and dry.

If the first and second mortgages on your home put together exceed its value, you’re underwater.

To understand why being underwater on your two mortgages is a problem, you need to know how first and second mortgages work:

- When you get your first mortgage, that lender is first in line to get paid off if you don’t pay your mortgage and your home is sold via foreclosure.

- When you then get a home equity line or second mortgage, it’s called a second mortgage because that lender is second in line to get paid.

- When you refinance your first mortgage, you actually pay off the original first mortgage. Unless you pay off the second mortgage, too, your second mortgage legally and automatically moves into place as your first mortgage.

- No lender will give you a low, first mortgage interest rate unless it can be first in line for the foreclosure sale proceeds if you don’t make your payments. If your second mortgage has moved into first position, any new loan would automatically be behind it in line.

Here are five options that can help you refinance your first mortgage anyway:

Homeownership Rate on the Rise to a 6-Year High

Homeownership Rate on the Rise to a 6-Year High

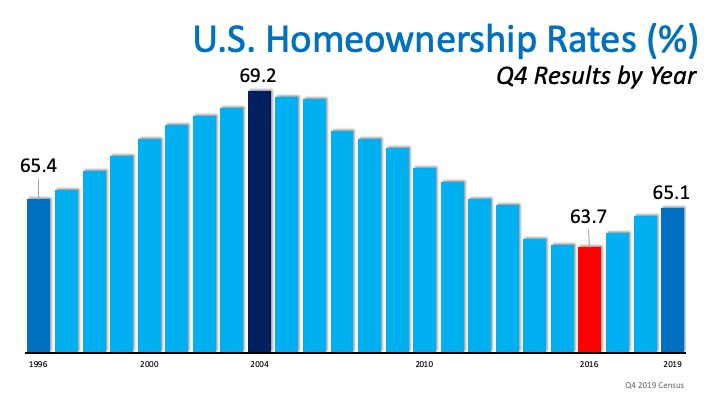

Regardless of the lack of inventory on the market, the U.S. homeownership rate has climbed to a 6-year high. The United States Census Bureau reported that it increased to 65.1% in the fourth quarter of 2019, representing the highest level in the past six years. See the graph below: This increase does not come as a surprise. According to realtor.com,

This increase does not come as a surprise. According to realtor.com,

“The largest cohort of the millennial generation turns 30-years-old in 2020 and they are hitting the housing market in full force. At the end of the fourth quarter of 2019, millennials made up the largest generational segment of homebuyers, growing their share of home purchase mortgages to 48 percent.”

With so many Millennials entering a homebuying phase of life and getting into the market, the Millennial Report also explains,

“Homeownership is an even bigger goal for younger generations. Of those with savings, 41 percent of Gen Z and 40 percent of younger millennials are saving to buy a home.”

Today’s low interest rates are providing a break to new homeowners too, regardless of generation, making homeownership more desirable and achievable at the same time. Freddie Mac explains,

“The combination of very low mortgage rates, a strong economy and more positive financial market sentiment all point to home purchase demand continuing to rise over the next few months.”

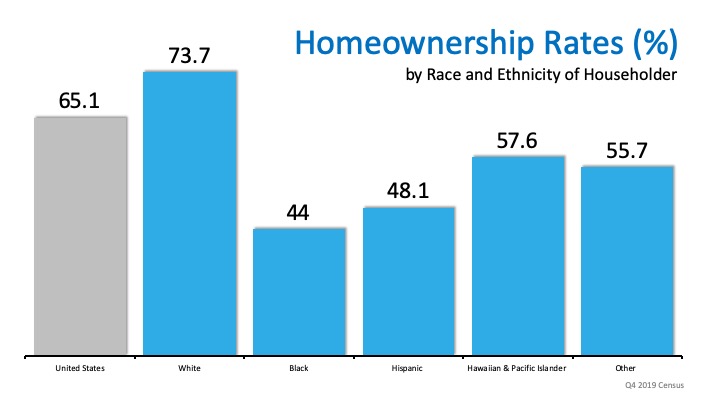

The increase in homeownership rate was also represented by race and ethnicity of the householders. HousingWire explains,

“The homeownership rate for black Americans in 2019’s fourth quarter rose to 44%, a seven-year high, increasing from the record low it reached in 2019’s second quarter. The rate for Hispanic Americans was 48.1%, a two-year high, the Census data showed…The rate for white Americans was 73.7%, an eight-year high.”

Bottom Line

If you’re considering buying a home this year, let’s get together to set a plan that will help you get one step closer to achieving your dream.

How Pricing Your Home Right Makes a Big Difference

How Pricing Your Home Right Makes a Big Difference

Even though there’s a big buyer demand for homes in today’s low inventory market, it doesn’t mean you should price your home as high as the sky when you’re ready to sell. Here’s why making sure you price it right is key to driving the best price for the sale.

If you’ve ever watched the show “The Price Is Right,” you know the only way to win the game is to be the one to correctly guess the price of the item up for bid without going over. That means your guess must be just slightly under the retail price.

When it comes to pricing your home, setting it at or slightly below market value will increase the visibility of your listing and drive more buyers your way. This strategy actually increases the number of buyers who will see your home in their search process. Why? When potential buyers look at your listing and see a great price for a fantastic home, they’re probably going to want to take a closer look. This means more buyers are going to be excited about your house and more apt to make an offer.

When this happens, you’re more likely to set up a scenario with multiple offers, potential bidding wars, and the ability to drive a higher final sale price. At the end of the day, even when inventory is tight, pricing it right – or pricing it to sell immediately – makes a big difference.

Here’s the other thing: homeowners who make the mistake of overpricing their homes will eventually have to lower the prices anyway after they sit on the market for an extended period of time. This leaves buyers wondering if the price drops were caused by something wrong with these homes when in reality, nothing was wrong, the initial prices were just too high.

Bottom Line

If you’re thinking about selling your home this year, let’s get together so you have a professional on your side to help you properly price your home and maximize demand from the start.