Your House Could Be the Oasis in an Inventory Desert

Your House Could Be the Oasis in an Inventory Desert

Homebuyers are flooding the housing market right now to take advantage of record-low mortgage rates. Many have a sense of urgency to find a home soon since experts forecast a steady rise in both rates and home prices this year and next. As a result, buyer demand greatly outweighs the current housing supply. Here’s how the shortage of houses for sale sets yours up to be the oasis in an inventory desert.

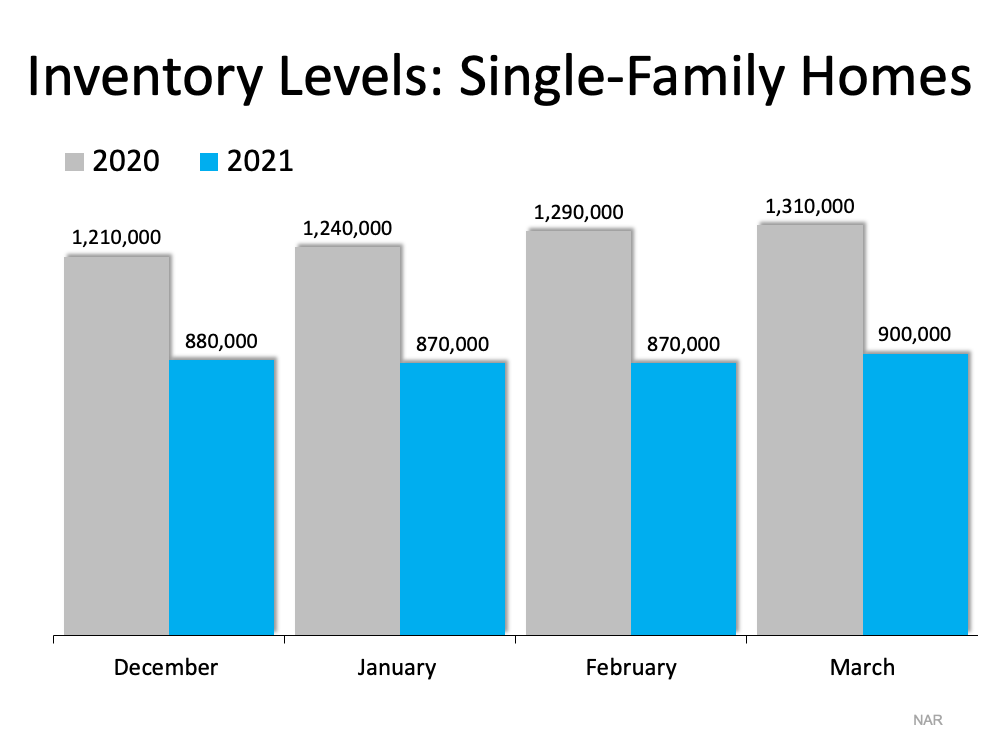

According to the National Association of Realtors (NAR), today’s housing inventory sits at an incredibly low 2.1-month supply, far below the 6-month mark for a neutral market. Inventory of single-family homes a year ago was already very low, and as you can see in the graph below, this year’s levels are even lower: Due to these market conditions, today’s buyers frequently enter fierce bidding wars while trying to purchase a home. This in turn drives up home prices and gives sellers incredible leverage in the negotiation process, two big wins if you’re going to sell your house this year.

Due to these market conditions, today’s buyers frequently enter fierce bidding wars while trying to purchase a home. This in turn drives up home prices and gives sellers incredible leverage in the negotiation process, two big wins if you’re going to sell your house this year.

Bottom Line

In such a hot market, it can feel as though the supply of homes has virtually dried up, leaving buyers to wander in an inventory desert. That’s why there’s never been a better time to sell. To a parched buyer needing to secure a home as soon as possible, your house could be a true oasis.

It’s Not Too Late To Apply For Forbearance

It’s Not Too Late To Apply For Forbearance

Over the past year, the pandemic made it challenging for some homeowners to make their mortgage payments. Thankfully, the government initiated a forbearance program to provide much-needed support. Unless they’re extended once again, some of these plans and the corresponding mortgage payment deferral options will expire soon. That said, there’s still time to request assistance. If your loan is backed by HUD/FHA, USDA, or VA, you can apply for initial forbearance by June 30, 2021.

Recently, the Consumer Finance Institute of the Federal Reserve Bank of Philadelphia surveyed a national sample of 1,172 homeowners with mortgages. They discussed their familiarity with and understanding of lender accommodations that might be available under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The results indicate that some borrowers didn’t take advantage of the support available through forbearance:

“Most borrowers who had not used forbearance during the pandemic reported that it was because they simply did not need it. However, among the remainder, a lack of understanding about available accommodations may also be playing a role. Around 2 out of 3 in this group reported not seeking forbearance because they were unsure or pessimistic about whether they would qualify — even though a high fraction of borrowers are eligible for forbearance under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.”

Here are some of the reasons why those borrowers didn’t opt for forbearance:

- They were concerned forbearance may be costly

- They didn’t understand how to request forbearance

- They didn’t understand how the plans worked and/or whether they would qualify

If you have similar questions or concerns, the following answers may ease your fears.

If you’re concerned forbearance may be costly:

The Consumer Financial Protection Bureau (CFPB) explains:

“For most loans, there will be no additional fees, penalties, or additional interest (beyond scheduled amounts) added to your account, and you do not need to submit additional documentation to qualify. You can simply tell your servicer that you have a pandemic-related financial hardship.”

It’s important to contact your mortgage provider (the company you send your mortgage payment to every month) to explain your current situation and determine the best plan available for your needs.

If you’re not sure how to request forbearance:

Here are 5 steps to follow when requesting mortgage forbearance:

- Find the contact information for your servicer

- Call your servicer

- Ask if you’re eligible for protection under the CARES Act

- Ask what happens when your forbearance period ends

- Ask your servicer to provide the agreement in writing

If you don’t understand how the plans work and/or whether you will qualify:

This is how the Consumer Financial Protection Bureau (CFPB) explains the program:

“Forbearance is when your mortgage servicer or lender allows you to pause or reduce your mortgage payments for a limited time while you build back your finances…

Forbearance doesn’t mean your payments are forgiven or erased. You are still obligated to repay any missed payments, which, in most cases, may be repaid over time or when you refinance or sell your home. Before the end of the forbearance, your servicer will contact you about how to repay the missed payments.”

The CFPB also addresses who qualifies for forbearance relief:

“You may have a right to a COVID hardship forbearance if:

- You experience financial hardship directly or indirectly due to the coronavirus pandemic.

- You have a federally backed mortgage, which includes HUD/FHA, VA, USDA, Fannie Mae, and Freddie Mac loans.

For mortgages that are not federally backed, servicers may offer similar forbearance options. If you are struggling to make your mortgage payments, servicers are generally required to discuss payment relief options with you, whether or not your loan is federally backed.”

Bottom Line

Like many Americans, your home may be your biggest asset. By acting quickly, you might be able to take advantage of critical relief options to help keep you in your home. Even if you tried to apply at the beginning of the pandemic and for some reason it didn’t work out, try again. Contact your mortgage provider today to determine if you qualify. If you have additional concerns, let’s connect to answer your questions and determine if there are other mortgage relief options in our area as well.

Americans Have Their Hearts Set on Homeownership

Call Today!

801-205-3500

Are Interest Rates Expected to Rise Over the Next Year?

Are Interest Rates Expected to Rise Over the Next Year?

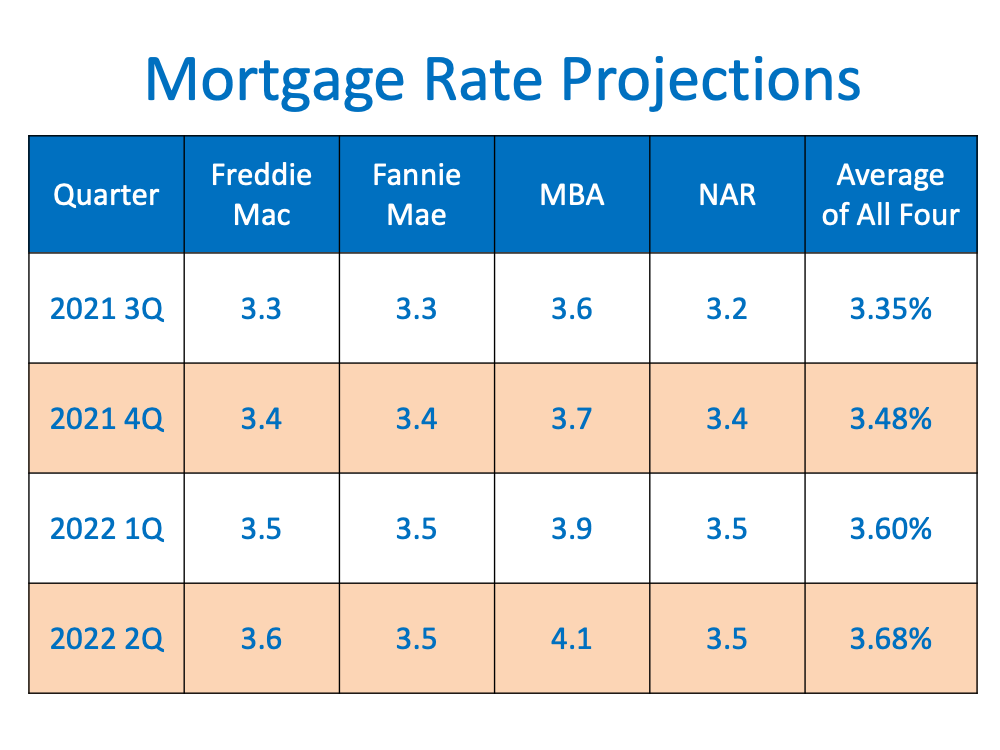

So far this year, mortgage rates continue to hover around 3%, encouraging many hopeful homebuyers to enter the housing market. However, there’s a good chance rates will increase later this year and going into 2022, ultimately making it more expensive to borrow money for a home loan. Here’s a look at what several experts have to say.

Danielle Hale, Chief Economist, realtor.com:

“Our long-term view for mortgage rates in 2021 is higher. As the economic outlook strengthens, thanks to progress against coronavirus and vaccines plus a dose of stimulus from the government, this pushes up expectations for economic growth . . . .”

Lawrence Yun, Chief Economist, National Association of Realtors (NAR):

“In 2021, I think rates will be similar or modestly higher . . . mortgage rates will continue to be historically favorable.”

Freddie Mac:

“We forecast that mortgage rates will continue to rise through the end of next year. We estimate the 30-year fixed mortgage rate will average 3.4% in the fourth quarter of 2021, rising to 3.8% in the fourth quarter of 2022.”

Below are the most recent mortgage rate forecasts from four top authorities – Freddie Mac, Fannie Mae, the Mortgage Bankers Association (MBA), and NAR:

Bottom Line

If you’re planning to buy a home, purchasing before mortgage interest rates rise may help you save significantly over the life of your home loan.

Single Family Inventory on The Rise for May