3 Questions You Need To Ask Before Buying A Home

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.

Ask yourself the following three questions to help determine if now is a good time for you to buy in today’s market.

1. Why am I buying a home in the first place?

This is truly the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with money.

For example, a study by realtor.com found that “73% said buying in a good school district was “important” in their search.”

This report supports a study by the Joint Center for Housing Studies at Harvard University which revealed that the top four reasons Americans buy a home have nothing to do with money. The actual reasons are:

- A good place to raise children and provide them with a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of that space

What does owning a home mean to you? What non-financial benefits will you and your family gain from owning a home? The answer to that question should be the biggest reason you decide to purchase or not.

2. Where are home values headed?

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), the median price of homes sold in February (the latest data available) was $249,500. This is up 3.6% from last year. The increase also marks the 84th consecutive month with year-over-year gains.

Looking at home prices year over year, CoreLogic is forecasting an increase of 4.6%. In other words, a home that costs you $250,000 today will cost you an additional $11,500 if you wait until next year to buy it.

What does that mean to you?

Simply put, with prices increasing, it may cost you more if you wait until next year to buy. Your down payment will also need to be higher in order to account for the higher price of the home you wish to buy.

3. Where are mortgage interest rates headed?

A buyer must be concerned about more than just prices. The ‘long-term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates.

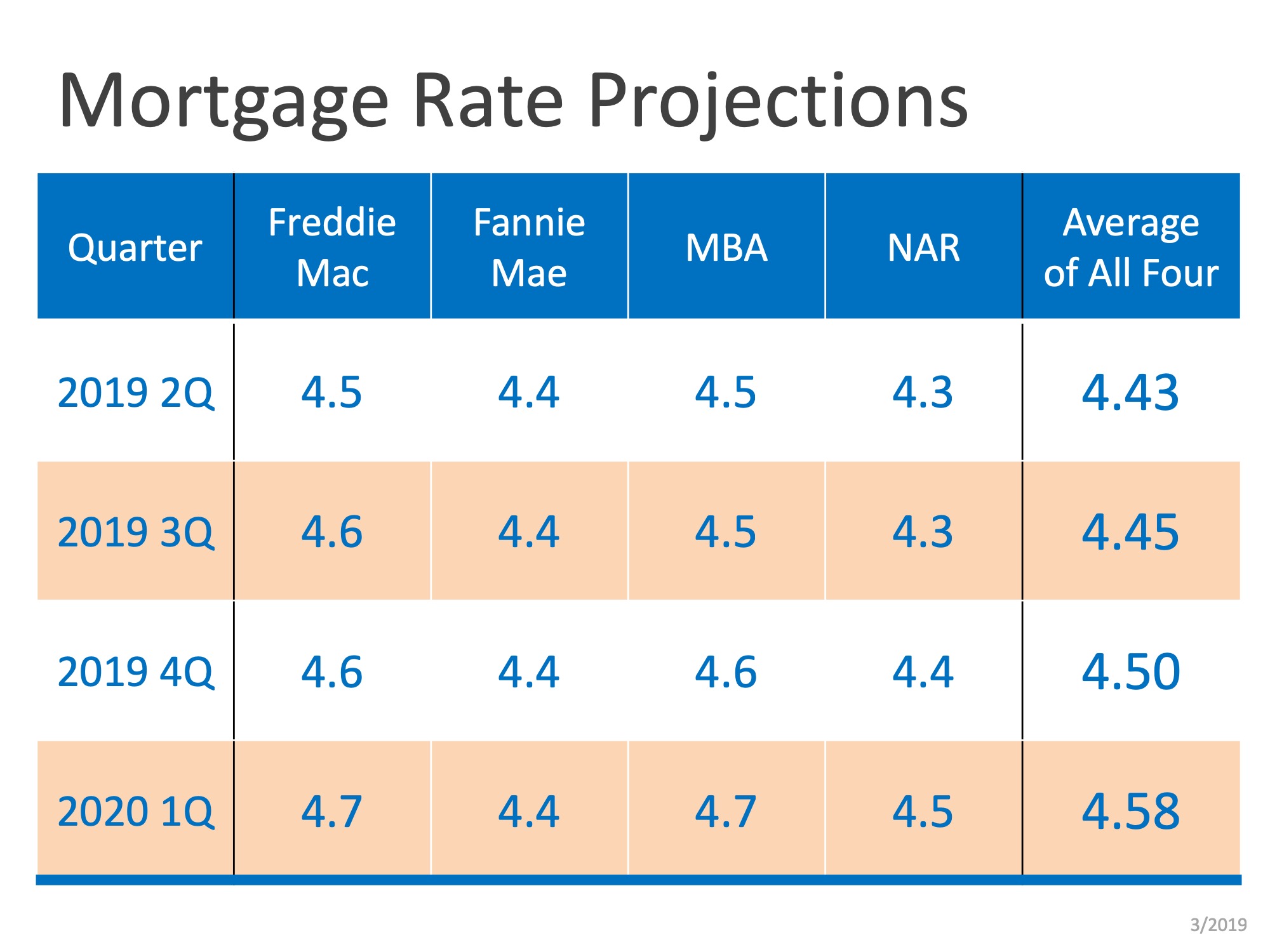

Freddie Mac, Fannie Mae, the Mortgage Bankers Association and NAR have all projected that mortgage interest rates will increase over the next twelve months, as you can see in the chart below:

Bottom Line

Only you and your family will know for certain if now is the right time to purchase a home. Answering these questions will help you make that decision.

The #1 Reason to List Your House Right Now

The #1 Reason to List Your House Right Now The success of the U.S. residential real estate market, like any other market, is determined by supply and demand. This means we need to look at how many potential purchasers are in the market versus the number of houses that...

Underwater with Two Mortgages? Here are 5 Ways to Refinance

Underwater with Two Mortgages? Here are 5 Ways to Refinance Having a second mortgage or home equity line can make refinancing an underwater mortgage nearly impossible, but one of these five strategies might bail out your refinance. The mortgage market is awash in...

Homeownership Rate on the Rise to a 6-Year High

Homeownership Rate on the Rise to a 6-Year High Regardless of the lack of inventory on the market, the U.S. homeownership rate has climbed to a 6-year high. The United States Census Bureau reported that it increased to 65.1% in the fourth quarter of 2019, representing...

How Pricing Your Home Right Makes a Big Difference

How Pricing Your Home Right Makes a Big Difference Even though there’s a big buyer demand for homes in today’s low inventory market, it doesn’t mean you should price your home as high as the sky when you’re ready to sell. Here’s why making sure you price it right is...

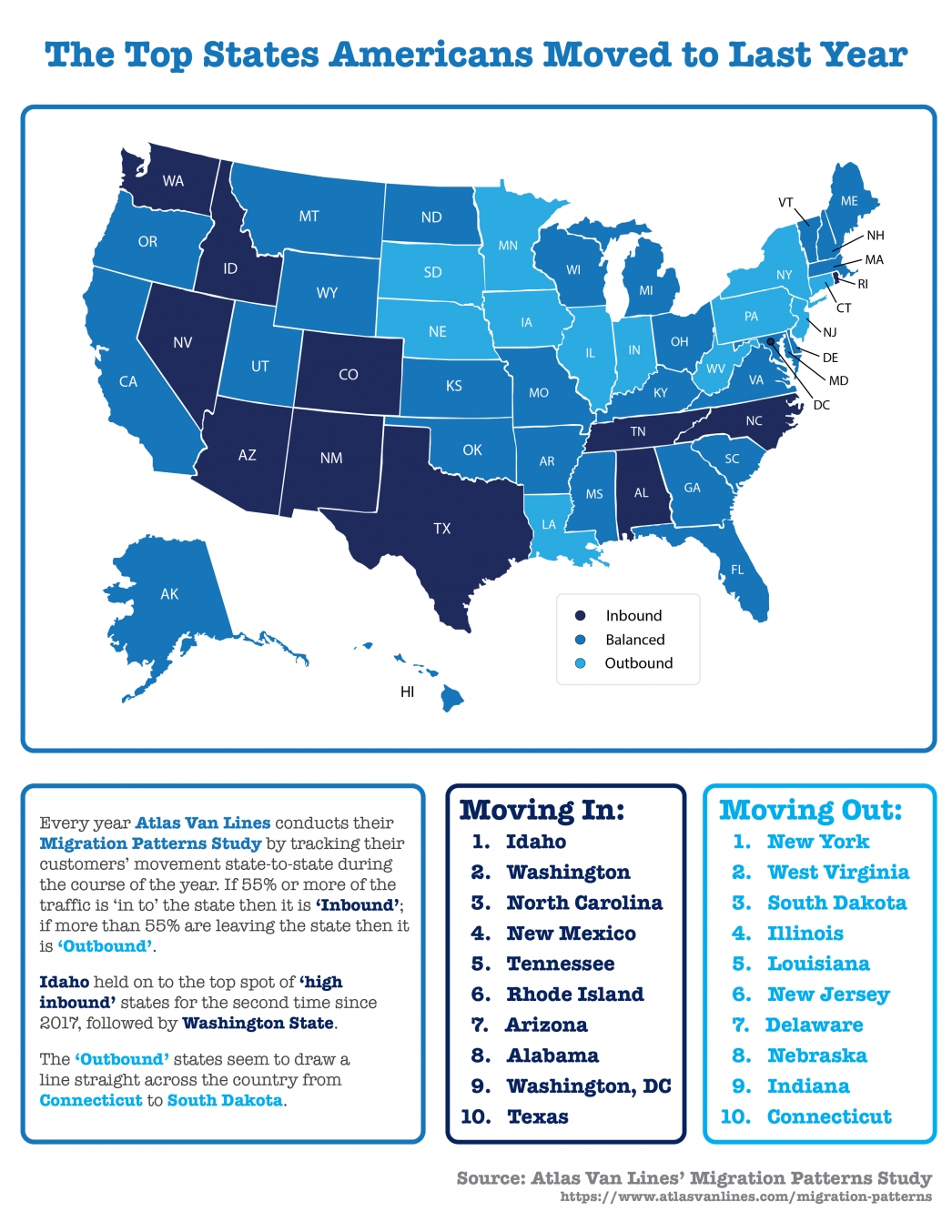

The Top States Americans Moved to Last Year

The Top States Americans Moved to Last Year Some Highlights: Americans are on the move, and the most recent Atlas Van Lines Migration Patterns Survey tracked the 2019 traffic flow from state-to-state. Idaho held on to the top spot of ‘high inbound’ states for the...

Great News for Renters Who Want to Buy a Home

Great News for Renters Who Want to Buy a Home Rents in the United States have been skyrocketing since 2012. This has caused many renters to face a tremendous burden when juggling their housing expenses and the desire to save for a down payment at the same time. The...

How Owning a Home Can Make You Happier

Think owning a home can make you happier? It sure can! Let's connect to see if homeownership can brighten your day.

Does “Aging in Place” Make the Most Sense?

Does “Aging in Place” Make the Most Sense? A desire among many seniors is to “age in place.” According to the Senior Resource Guide, the term means, “…that you will be remaining in your own home for the later years of your life; not moving into a smaller home,...

The U.S. expansion, now in its 11th year, will continue through the 2020 presidential election

Strength of the Economy Is Surprising the Experts We’re currently in the longest economic recovery in U.S. history. That has caused some to ask experts to project when the next economic slowdown (recession) could occur. Two years ago, 67% of the economists surveyed by...

The top 10 highest Utah median prices in the fourth quarter by ZIP code

The median single-family home price in Salt Lake County in the fourth quarter increased to $378,000, up 8 percent compared to a median price of $350,000 in 2018's fourth quarter. Strong demand for homes is being driven by net in-migration and population increase. In...