Your Fabulous New Dream Home is Now Available

Over the last several years, many “baby boomers” have undergone a metamorphosis. Their children have finally moved out and they can now dream about their own future. For many, a change in lifestyle might necessitate a change in the type of home they live in.

That two-story, four-bedroom colonial with three bathrooms no longer fits the bill. Taxes are too high. Utilities are too expensive. Cleaning and repair are too difficult. When they decide to travel to be with friends and family, locking up the house is too time-consuming and worrisome.

Instead, a nice ranch home with 2-3 bedrooms and two baths might better fulfill their new needs and lifestyle. The challenge many “boomers” have faced when trying to downsize to the perfect new home has been a lack of inventory.

The average number of years a family stays in their home has increased by fifty percent since 2008, causing fewer houses to come to the market. During the same time, new home builders were concentrating most of their efforts on large, luxury, expensive houses.

However, that is starting to change.

According to the U.S. Department of Housing and Urban Development and the U.S. Census Bureau, sales of newly built, single-family homes rose to a seasonally adjusted annual rate of 692,000 units in March. The great news is that more of those homes were sold at the lower end of the price range.

In a press release last week, the National Association of Home Builders (NAHB) explained that:

“The median sales price was $302,700, with strong gains in homes sold at lower price points. The median price of a new home sale a year earlier was $335,400.”

NAHB Chief Economist Robert Dietz offered further detail:

“We saw a large gain at lower price points where demand is strong. In March of 2019, 50% of new home sales were priced below $300,000, compared to 39% in March of 2018.”

Bottom Line

If you are a “boomer” thinking of selling your old house in order to buy a new home that better fits your current lifestyle, now may be the perfect time!

Is It Enough To Offer Asking Price in Today’s Housing Market?

Is It Enough To Offer Asking Price in Today’s Housing Market? If you’re planning to buy a home this season, you’re probably thinking about what you’ll need to do to get your offer accepted. In previous years, it was common for buyers to try and determine how much less...

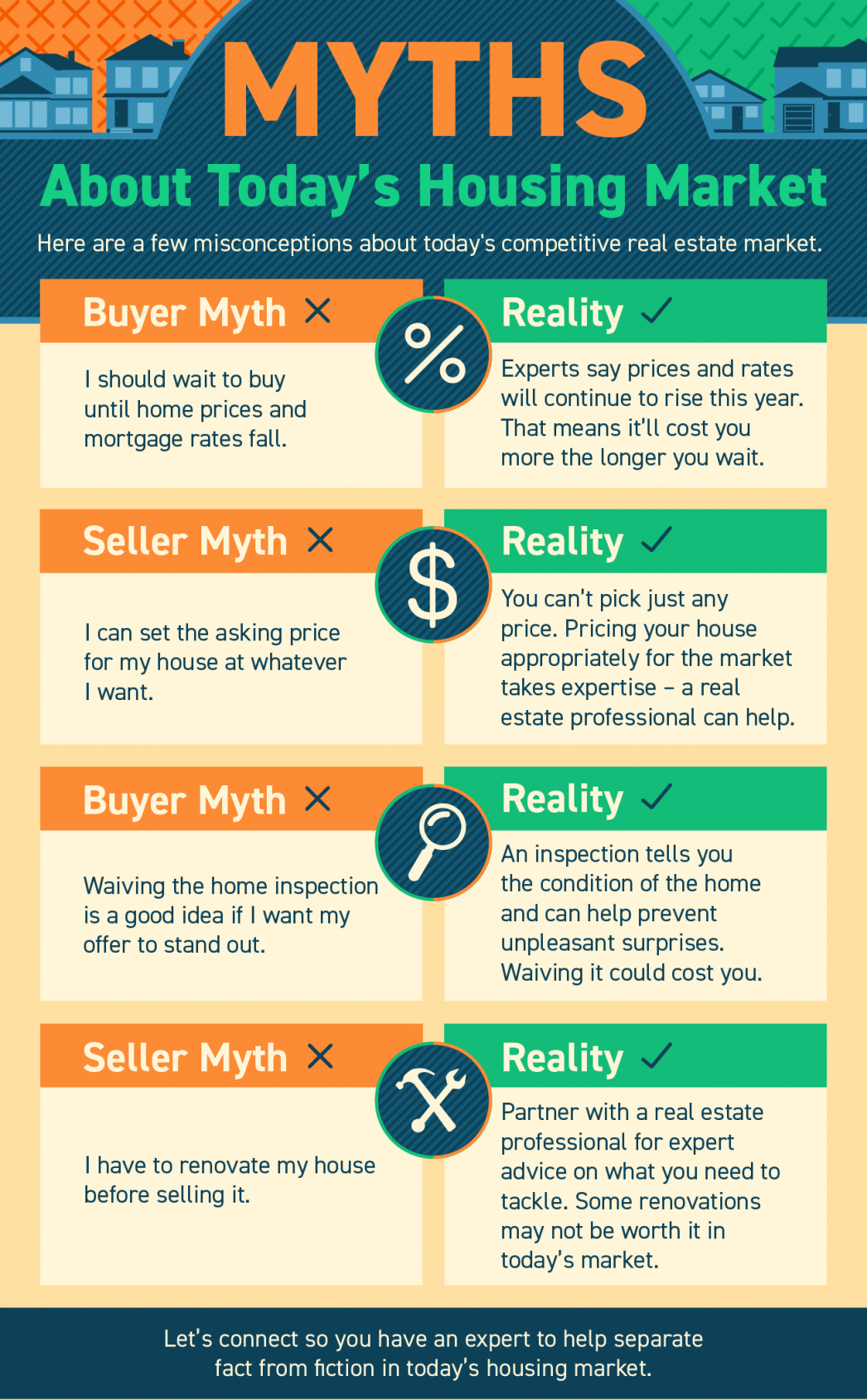

Myths About Today’s Housing Market

Myths About Today’s Housing Market Some Highlights If you’re planning to buy or sell a home today, it’s important to be aware of common misconceptions. Whether it’s timing your purchase as a buyer based on home prices and mortgage rates or knowing what to upgrade or...

Why This Housing Market Is Not a Bubble Ready To Pop

Why This Housing Market Is Not a Bubble Ready To Pop Homeownership has become a major element in achieving the American Dream. A recent report from the National Association of Realtors (NAR) finds that over 86% of buyers agree homeownership is still the American...

How the Appraisal and Inspection Empower You as a Homebuyer

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...

Where Are Mortgage Rates Headed?

Where Are Mortgage Rates Headed? There’s never been a truer statement regarding forecasting mortgage rates than the one offered last year by Mark Fleming, Chief Economist at First American: “You know, the fallacy of economic forecasting is: Don't ever try and forecast...

Why a Real Estate Professional Is Key When Selling Your House

Why a Real Estate Professional Is Key When Selling Your House With today’s real estate market moving as fast as it is, working with a real estate professional is more essential than ever. They have the skills, experience, and expertise it takes to navigate the highly...

Using Your Tax Refund To Achieve Your Homeownership Goals This Year

Using Your Tax Refund To Achieve Your Homeownership Goals This Year If you’re buying or selling a home this year, you’re likely saving up for a variety of expenses. For buyers, that might include things like your down payment and closing costs. And for sellers, you’re...

The Future of Home Price Appreciation and What It Means for You

The Future of Home Price Appreciation and What It Means for You Many consumers are wondering what will happen with home values over the next few years. Some are concerned that the recent run-up in home prices will lead to a situation similar to the housing crash 15...

Balancing Your Wants and Needs as a Homebuyer Today

Balancing Your Wants and Needs as a Homebuyer Today Since the number of homes for sale is low today, it can feel challenging to find one that checks all your boxes. But if you know which features are absolutely essential in your next home and which ones are just nice...

What’s Happening with Mortgage Rates, and Where Will They Go from Here?

What’s Happening with Mortgage Rates, and Where Will They Go from Here? Based on the Primary Mortgage Market Survey from Freddie Mac, the average 30-year fixed-rate mortgage has increased by 1.2% (3.22% to 4.42%) since January of this year. The rate jumped by more...