Utah Realty Blog & News

The Latest news for Real Estate both local and National.

Buyers

Sellers

Seniors

What’s Ahead for Mortgage Rates and Home Prices?

Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next year and what that may mean if you’re thinking about buying a home. Here’s a look at the latest expert insights on both mortgage rates and home prices so you can make your best move possible.

Mortgage Rates Will Continue To Respond to Inflation

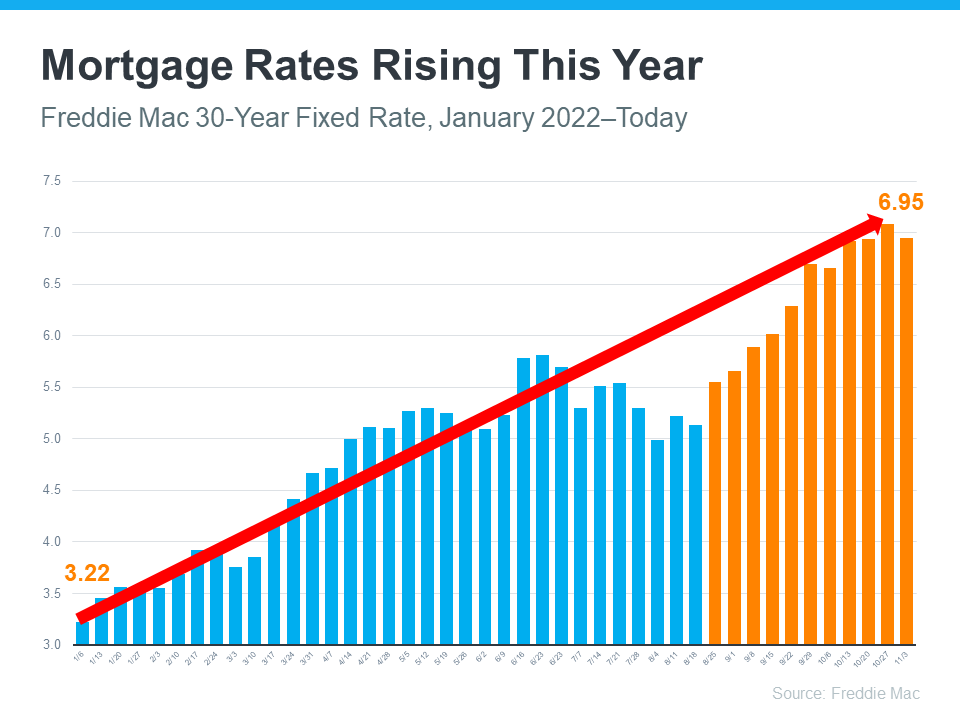

There’s no doubt mortgage rates have skyrocketed this year as the market responded to high inflation. The increases we’ve seen were fast and dramatic, and the average 30-year fixed mortgage rate even surpassed 7% at the end of last month. In fact, it’s the first time they’ve risen this high in over 20 years (see graph below):

In their latest quarterly report, Freddie Mac explains just how fast the climb in rates has been:

“Just one year ago, rates were under 3%. This means that while mortgage rates are not as high as they were in the 80’s, they have more than doubled in the past year. Mortgage rates have never doubled in a year before.”

Because we’re in unprecedented territory, it’s hard to say with certainty where mortgage rates will go from here. Projecting the future of mortgage rates is far from an exact science, but experts do agree that, moving forward, mortgage rates will continue to respond to inflation. If inflation stays high, mortgage rates likely will too.

Home Price Changes Will Vary by Market

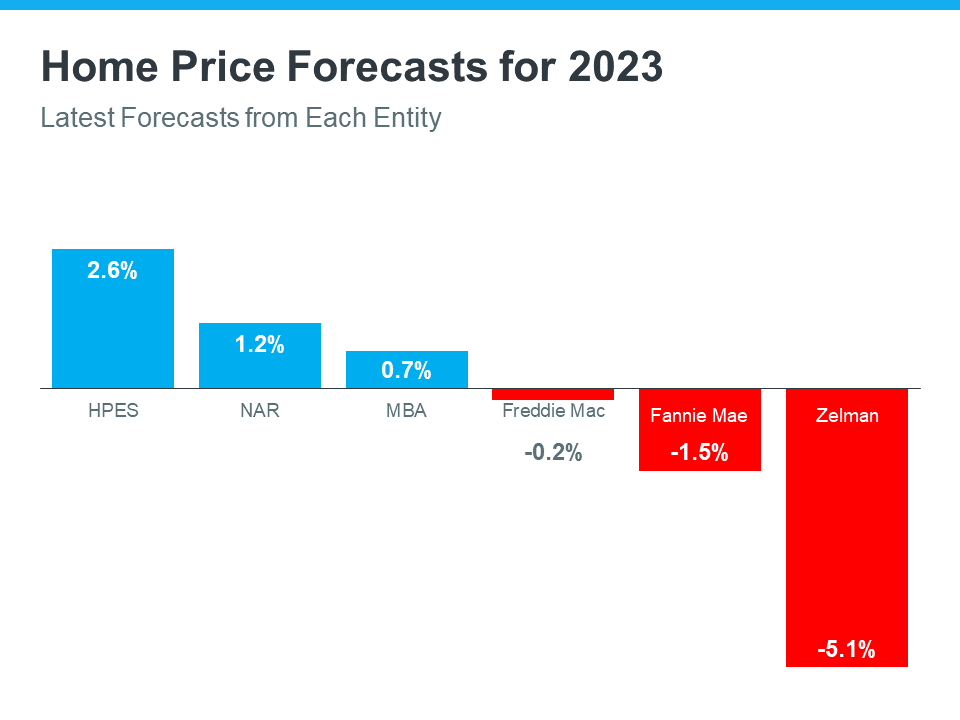

As buyer demand has eased this year in response to those higher mortgage rates, home prices have moderated in many markets too. In terms of the forecast for next year, expert projections are mixed. The general consensus is home price appreciation will vary by local market, with more significant changes happening in overheated areas. As Mark Fleming, Chief Economist at First American, says:

“House price appreciation has slowed in all 50 markets we track, but the deceleration is generally more dramatic in areas that experienced the strongest peak appreciation rates.”

Basically, some areas may still see slight price growth while others may see slight price declines. It all depends on other factors at play in that local market, like the balance between supply and demand. This may be why experts are divided on their latest national forecasts (see graph below):

Bottom Line

If you want to know what’s happening with home prices or mortgage rates, let’s connect so you have the latest on what experts are saying and what that means for our area.

Mortgage Rates Hit Record Lows for Three Consecutive Weeks

Mortgage Rates Hit Record Lows for Three Consecutive WeeksOver the past several weeks, Freddie Mac has reported the average 30-year fixed mortgage rate dropping to record lows, all the way down to 3.03%. Last week’s reported rate reached the lowest point in the...

Buyers: Are You Ready for a Bidding War?

Utah Buyers: Are You Ready for a Bidding War?Hiring an Expert with 34 Years of experience might just be what you need to rise to the top! With businesses reopening throughout the country and some experts indicating early signs of a much-anticipated...

Americans Rank Real Estate Best Investment for 7 Years Running

Americans Rank Real Estate Best Investment for 7 Years Running Some Highlights Real estate has outranked stocks, savings accounts, and gold as the best long-term investment among Americans for the past 7 years. The belief in the stability of housing as a long-term...

Best Time to Sell? When Competition Is at an All-Time Low

Best Time to Sell? When Competition Is at an All-Time Low In a recent survey of home sellers by Qualtrics, 87% of respondents said they were concerned their home won’t sell because of the pandemic and resulting economic recession. Of the respondents, 51% said they are...

Taking Advantage of Homebuying Affordability in Today’s Market

Taking Advantage of Homebuying Affordability in Today’s MarketEveryone is ready to buy a home at different times in their lives, and despite the health crisis, today is no exception. Understanding how affordability works and the main market factors that impact it may...

A Historic Rebound for the Housing Market

A Historic Rebound for the Housing Market Pending Home Sales increased by 44.3% in May, registering the highest month-over-month gain in the index since the National Association of Realtors (NAR) started tracking this metric in January 2001. So, what exactly are...

Join Our Newsletter

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus lacinia velit a feugiat finibus. Morbi iaculis diam id tellus iaculis, eu pretium metus fermentu