What FICO® Score Do You Need to Qualify for a Mortgage?

While a recent announcement from CNBC shares that the average national FICO® score has reached an all-time high of 706, the good news for potential buyers is that you don’t need a score that high to qualify for a mortgage. Let’s unpack the credit score myth so you can to become a homeowner sooner than you may think.

With today’s low interest rates, many believe now is a great time to buy – and rightfully so! Fannie Mae recently noted that 58% of Americans surveyed say it is a good time to buy. Similarly, the Q3 2019 HOME Survey by the National Association of Realtors said 63% of people believe now is a good time to buy a home. Unfortunately, fear and misinformation often hold qualified and motivated buyers back from taking the leap into homeownership.

According to the same CNBC article,

“For the first time, the average national credit score has reached 706, according to FICO®, the developer of one of the most commonly used scores by lenders.”

This is great news, as it means Americans are improving their credit scores and building toward a stronger financial future, especially after the market tumbled during the previous decade. With today’s strong economy and increasing wages, many Americans have had the opportunity to improve their credit over the past few years, driving this national average up.

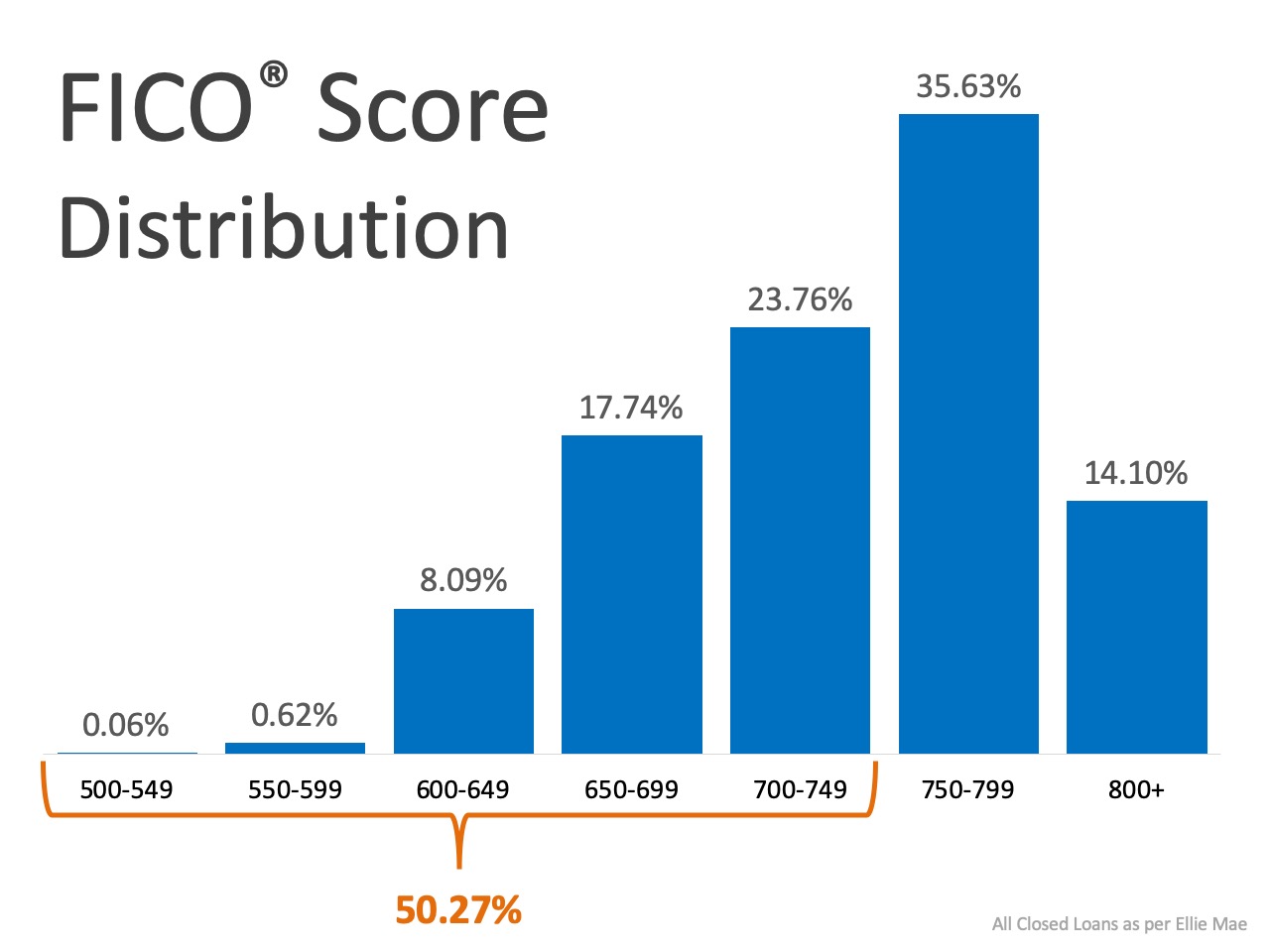

Since Americans with stronger credit are now entering the housing market, we are seeing an increase in the FICO® Score Distribution of Closed Loans (see graph below): But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

FHA Loan: “FHA loans are ideal for those who have less-than-perfect credit and may not be able to qualify for a conventional mortgage loan. The size of your required down payment for an FHA loan depends on the state of your credit score: If your credit score is between 500 and 579, you must put 10% down. If your credit score is 580 or above, you can put as little as 3.5% down (but you can put down more if you want to).”

Conventional Loan: “It’s possible to get approved for a conforming conventional loan with a credit score as low as 620, although some lenders may look for a score of 660 or better.”

USDA Loan: “While the USDA doesn’t have a set credit score requirement, most lenders offering USDA-guaranteed mortgages require a score of at least 640.”

VA Loan: “As with income levels, lenders set their own minimum credit requirements for VA loan borrowers. Lenders are likely to check credit scores as part of their screening process, and most will set a minimum score, or cutoff, that loan applicants must exceed to be considered.”

Bottom Line

As you can see, plenty of loans are granted to buyers with a FICO® score that is lower than the national average. If you’d like to understand the next steps to take when determining your credit score, let’s get together so you can learn more.

Union Workers Make Our Nation Great!

Up to $2000 Cash Back when you sell your home with us! We are here to earn your respect as the trusted adviser when it comes to your home. Utah Realty has created a unique program that rewards you with cash at closing for calling us instead of another agent when you...

Top Agent in West Jordan Utah

Searching for a Top Realtor in West Jordan, Utah? When searching for a top agent or Realtor in West Jordan, Utah is it best to find the most popular or the most qualified? Believe it or not there is a difference. You can find the guy or gal the advertises on the...

Search Utah MLS Salt Lake City Listings

Search Salt Lake MLS Listings. We specialize in assisting buyers and sellers all over the state of Utah. Searching for Real Estate in Utah? Our website contains every listing that is active. ALL listings from ALL Real Estate Companies in Utah including Salt Lake...

The House The Pot Belly Pig, and the Crazy Aunt

BY MARTY AND LAURIE GALE Real Estate Broker/Owner with Utah Realty 5451933-PB00 Share: May 20, 2010 04:58 AM The characters consist of my past client, her grandmother (the retired librarian on oxygen), the grandma's caregiver (live-at-home bachelor son) and the aunt...

need to sell my house fast

There are a number of reasons people need to sell their house. So if you’re on a deadline to sell quick, you might feel entirely alone in your circumstance. This is because most people who sell their home do it the traditional method, believing that there is no...

What to Check During the Final Walk-through:

Those 24 hours before closing — the home stretch to homeownership — is crucial. Preparation is key. The “final walk through” is your chance to make sure the buyer is getting exactly what they’re paying for. Bring a copy of your contract to ensure all included...

Tips for Moving Into Your New Home

Congratulations, you've bought your home and it's move-in time. Wait! Before you move in, read on to get some practical and important tips. Change the locks. You've closed escrow and the keys to your new home are yours. The first thing you should do is change the...

Divorced and Selling My Home

Selling the House When You Divorce One of the options you have to deal with the house during divorce is to sell it and divide the proceeds. If neither spouse wants to stay in the family home, or if neither can afford to buy out the other, you can put the...

March Madness Give Away

March Madness March Madness Referral Bonus and Rebate - $650 total Spring is upon us and we are excited for the opportunity to work with the people around you. If you can think of anyone that needs to buy or sell that could use an extra $500! If you, your company or a...

CRS March – April Newsletter

Newsletter for our readers