What FICO® Score Do You Need to Qualify for a Mortgage?

While a recent announcement from CNBC shares that the average national FICO® score has reached an all-time high of 706, the good news for potential buyers is that you don’t need a score that high to qualify for a mortgage. Let’s unpack the credit score myth so you can to become a homeowner sooner than you may think.

With today’s low interest rates, many believe now is a great time to buy – and rightfully so! Fannie Mae recently noted that 58% of Americans surveyed say it is a good time to buy. Similarly, the Q3 2019 HOME Survey by the National Association of Realtors said 63% of people believe now is a good time to buy a home. Unfortunately, fear and misinformation often hold qualified and motivated buyers back from taking the leap into homeownership.

According to the same CNBC article,

“For the first time, the average national credit score has reached 706, according to FICO®, the developer of one of the most commonly used scores by lenders.”

This is great news, as it means Americans are improving their credit scores and building toward a stronger financial future, especially after the market tumbled during the previous decade. With today’s strong economy and increasing wages, many Americans have had the opportunity to improve their credit over the past few years, driving this national average up.

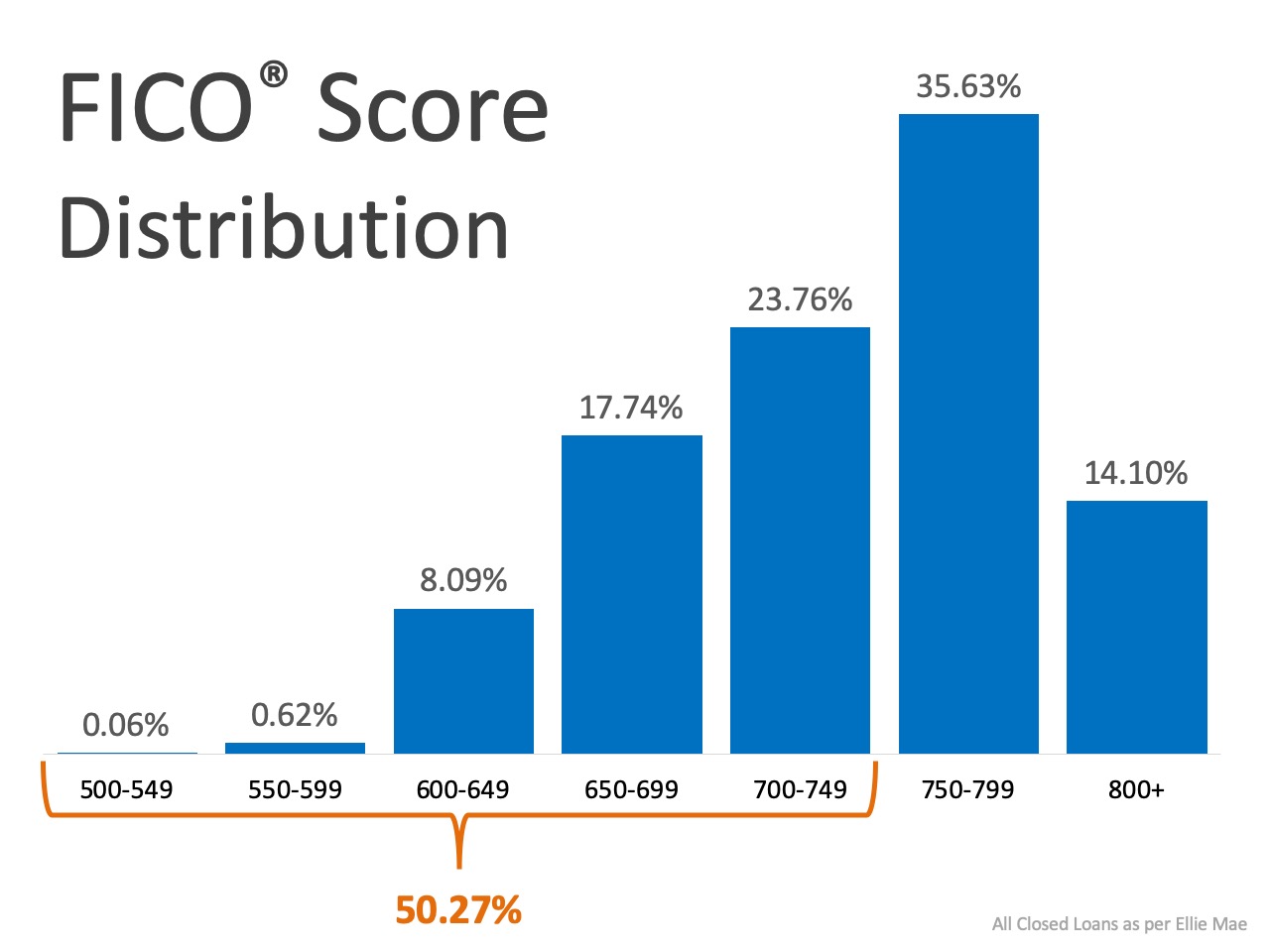

Since Americans with stronger credit are now entering the housing market, we are seeing an increase in the FICO® Score Distribution of Closed Loans (see graph below): But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

FHA Loan: “FHA loans are ideal for those who have less-than-perfect credit and may not be able to qualify for a conventional mortgage loan. The size of your required down payment for an FHA loan depends on the state of your credit score: If your credit score is between 500 and 579, you must put 10% down. If your credit score is 580 or above, you can put as little as 3.5% down (but you can put down more if you want to).”

Conventional Loan: “It’s possible to get approved for a conforming conventional loan with a credit score as low as 620, although some lenders may look for a score of 660 or better.”

USDA Loan: “While the USDA doesn’t have a set credit score requirement, most lenders offering USDA-guaranteed mortgages require a score of at least 640.”

VA Loan: “As with income levels, lenders set their own minimum credit requirements for VA loan borrowers. Lenders are likely to check credit scores as part of their screening process, and most will set a minimum score, or cutoff, that loan applicants must exceed to be considered.”

Bottom Line

As you can see, plenty of loans are granted to buyers with a FICO® score that is lower than the national average. If you’d like to understand the next steps to take when determining your credit score, let’s get together so you can learn more.

2020 Homeowner Wish List

Some HighlightsIn a recent study by realtor.com, homeowners noted some of the main things they would change about their homes to make them more livable.Not surprisingly, more space, an updated kitchen, and a home gym rose to the top of the list.If you’re thinking of...

What the Experts See Coming for the Housing Market May 14th, 2020

What the Experts See Coming for the Housing Market Experts are optimistic that the housing market will rebound as the country emerges from stay-at-home orders. Let's connect to discuss how these key insights may fuel your plans to buy or sell a home this year.

Will the Utah Housing Market Turn Around This Year?

Will the Housing Market Turn Around This Year?Today, many people are asking themselves if they should buy or sell a home in 2020. Some have shifted their plans or put them on hold over the past couple of months, and understandably so. Everyone seems to be wondering if...

A Surprising Shift to the ‘Burbs May Be on the Rise

A Surprising Shift to the ‘Burbs May Be on the RiseWhile many people across the U.S. have traditionally enjoyed the perks of an urban lifestyle, some who live in more populated city limits today are beginning to rethink their current neighborhoods. Being in close...

Unemployment Report: No Need to Be Terrified

Unemployment Report: No Need to Be TerrifiedLast Friday, the Bureau of Labor Statistics (BLS) released its latest jobs report. It revealed that the economic shutdown made necessary by COVID-19 caused the unemployment rate to jump to 14.7%. Many anticipate that next...

Will Utah Home Values Appreciate or Depreciate in 2020?

Will Home Values Appreciate or Depreciate in 2020?With the housing market staggered to some degree by the health crisis the country is currently facing, some potential purchasers are questioning whether home values will be impacted. The price of any item is determined...

A Day When Americans Can Return to Work

A Day When Americans Can Return to WorkSome HighlightsTaking a moment to reflect upon what we’ve heard from historical leaders can teach us a lot about getting through the many challenges we face today.We're all eager for the day when every American can safely return...

Unemployment: Hope on the Horizon

Unemployment: Hope on the HorizonTomorrow, the unemployment rate for April 2020 will be released by the U.S. Bureau of Labor Statistics. It will hit a peak this country has never seen before, with data representing real families and lives affected by this economic...

Caremongering Spreads Goodness, Not Fear

Caremongering Spreads Goodness, Not Fear As news of Covid-19 started gearing up, Allison Bradley felt heartbroken when she spotted seniors running errands and grocery shopping around her town, Kelowna, B.C. “My goodness, you are risking so much by being out here. It’s...

Why Home Equity Is a Bright Spark in the Housing Market

Why Home Equity Is a Bright Spark in the Housing MarketGiven how we have seen more unemployment claims than ever before over the past several weeks, fear is spreading widely. Some good news, however, shows that more than 4 million initial unemployment filers have...