What FICO® Score Do You Need to Qualify for a Mortgage?

While a recent announcement from CNBC shares that the average national FICO® score has reached an all-time high of 706, the good news for potential buyers is that you don’t need a score that high to qualify for a mortgage. Let’s unpack the credit score myth so you can to become a homeowner sooner than you may think.

With today’s low interest rates, many believe now is a great time to buy – and rightfully so! Fannie Mae recently noted that 58% of Americans surveyed say it is a good time to buy. Similarly, the Q3 2019 HOME Survey by the National Association of Realtors said 63% of people believe now is a good time to buy a home. Unfortunately, fear and misinformation often hold qualified and motivated buyers back from taking the leap into homeownership.

According to the same CNBC article,

“For the first time, the average national credit score has reached 706, according to FICO®, the developer of one of the most commonly used scores by lenders.”

This is great news, as it means Americans are improving their credit scores and building toward a stronger financial future, especially after the market tumbled during the previous decade. With today’s strong economy and increasing wages, many Americans have had the opportunity to improve their credit over the past few years, driving this national average up.

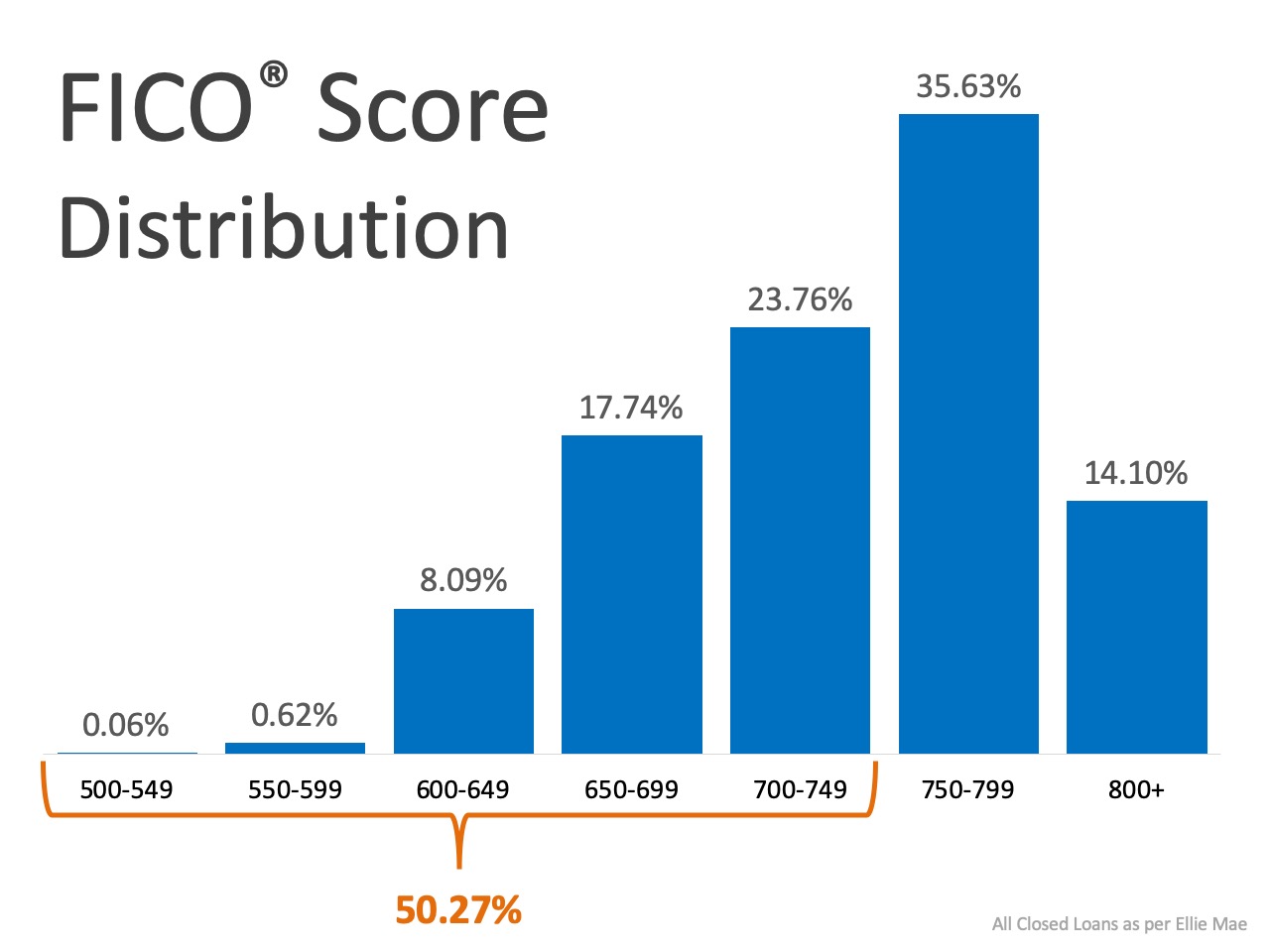

Since Americans with stronger credit are now entering the housing market, we are seeing an increase in the FICO® Score Distribution of Closed Loans (see graph below): But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

FHA Loan: “FHA loans are ideal for those who have less-than-perfect credit and may not be able to qualify for a conventional mortgage loan. The size of your required down payment for an FHA loan depends on the state of your credit score: If your credit score is between 500 and 579, you must put 10% down. If your credit score is 580 or above, you can put as little as 3.5% down (but you can put down more if you want to).”

Conventional Loan: “It’s possible to get approved for a conforming conventional loan with a credit score as low as 620, although some lenders may look for a score of 660 or better.”

USDA Loan: “While the USDA doesn’t have a set credit score requirement, most lenders offering USDA-guaranteed mortgages require a score of at least 640.”

VA Loan: “As with income levels, lenders set their own minimum credit requirements for VA loan borrowers. Lenders are likely to check credit scores as part of their screening process, and most will set a minimum score, or cutoff, that loan applicants must exceed to be considered.”

Bottom Line

As you can see, plenty of loans are granted to buyers with a FICO® score that is lower than the national average. If you’d like to understand the next steps to take when determining your credit score, let’s get together so you can learn more.

Homeownership can be yours

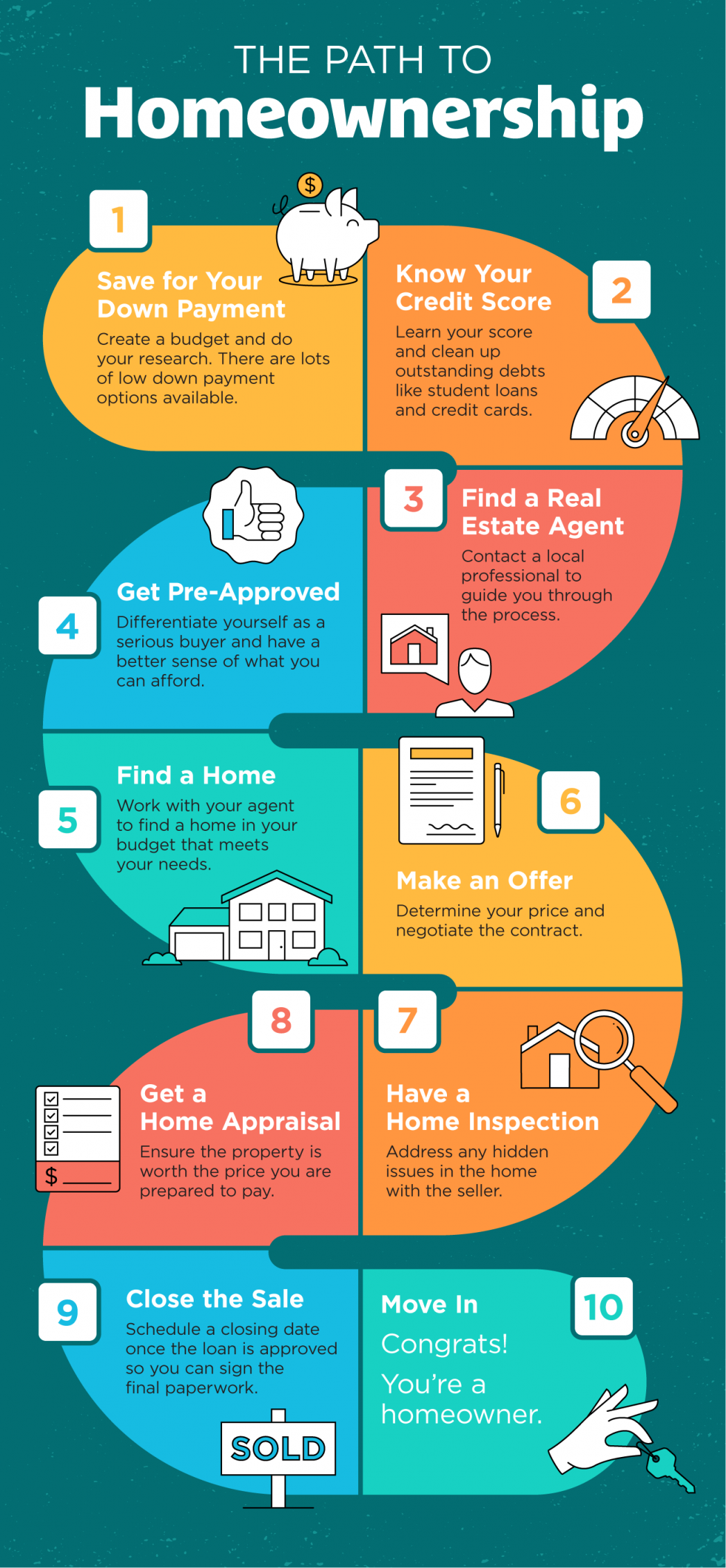

The Path to Homeownership Some Highlights If you’re thinking of buying a home and not sure where to start, you’re not alone. Here’s a map with 10 simple steps to follow in the homebuying process. Let’s connect today to discuss the specific steps along the way in our...

Shop for Homes in a Virtual World

A New Way to Shop for Homes in a Virtual WorldIn a year when we’re learning to do so much remotely, homebuying is no exception. From going to work to attending school, grocery shopping, and even seeing our doctors online, digital practices have changed the way we...

Thank You

Thank You for Your Support!

It Pays to Sell with a Real Estate Agent

It Pays to Sell with a Real Estate Agent Some HighlightsToday, it’s more important than ever to have an expert you trust to guide you as you sell your house.From your safety throughout the process to the complexity of negotiating...

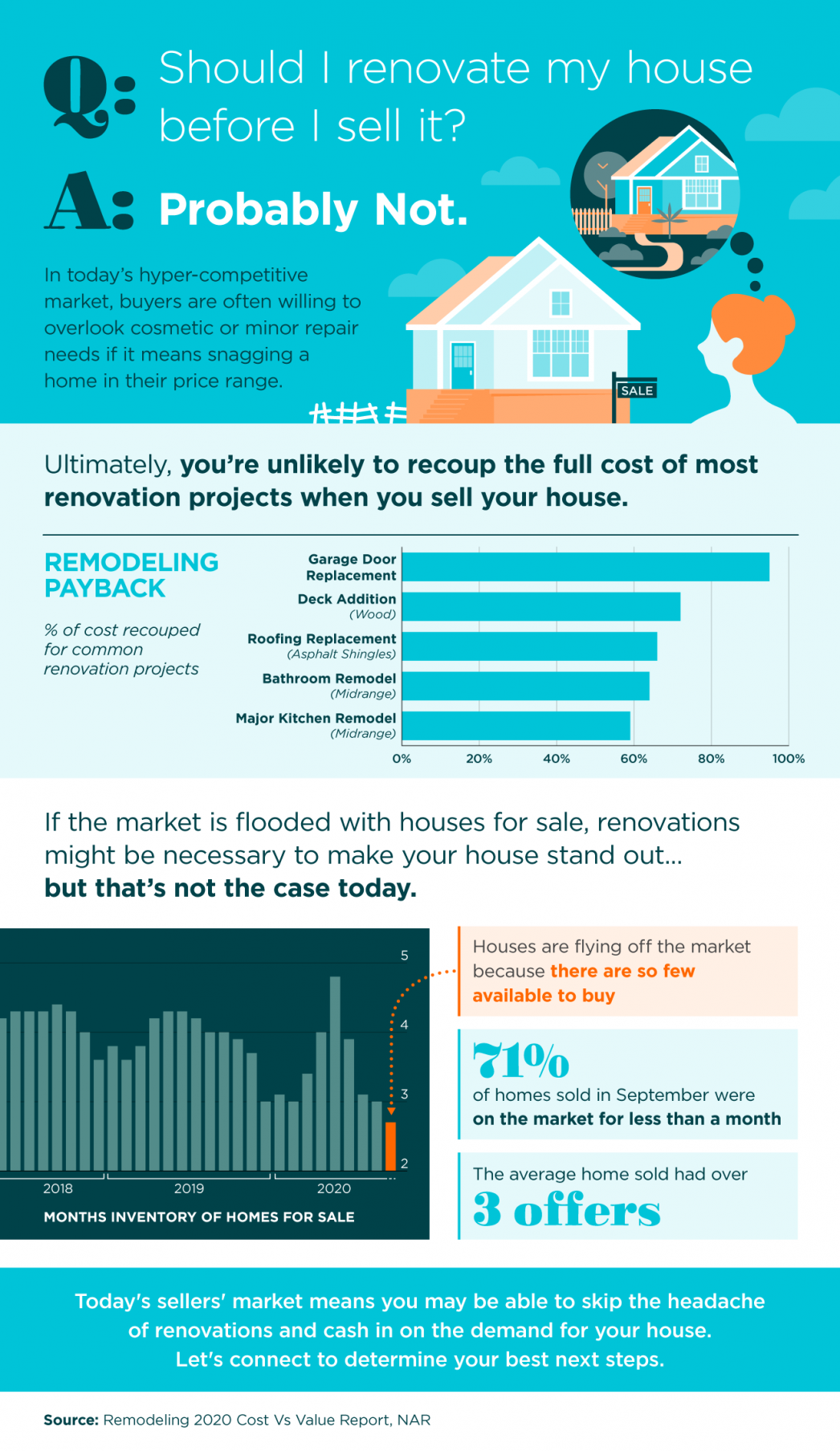

Should I Renovate My House Before I Sell It?

Should I Renovate My House Before I Sell It? Some HighlightsIn today’s hyper-competitive market, buyers are often willing to overlook cosmetic or minor repair needs if it means snagging a home in their price range.With so few houses available for sale today, you may...

Don’t Fear the Real Estate Market

Don't Fear the Real Estate Market October 29, 2020 Fear should never be a factor when navigating the housing market. Whether you're buying or selling a home this fall, let's connect to make sure you're empowered to take the safest path.

Why Selling Your House Before Next Spring Is Key

Why Selling Your House Before Next Spring Is Key Today's housing market is empowering homeowners with the control they want when selling their house, but as home inventory begins to rise, this fair weather won't last forever. Let's connect to start the process of...

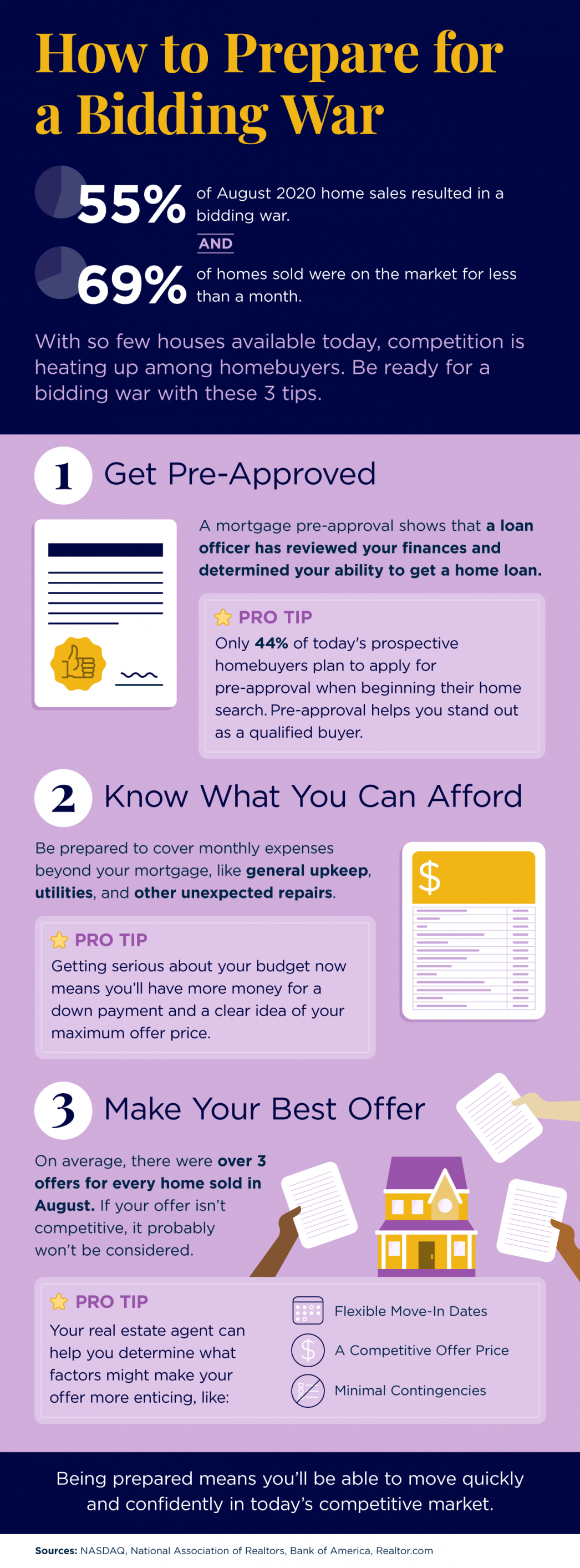

How to Prepare for a Bidding War

How to Prepare for a Bidding War Some HighlightsWith so few houses available on the market today, being ready for a bidding war is essential for prospective homebuyers.From pre-approval to making your best offer, here are three tips to make sure you can act quickly...

2020 Housing Market on Track to Beat Last Year’s Success

Housing Market on Track to Beat Last Year’s SuccessBack in March, as the nation’s economy was shut down because of the coronavirus, many were predicting the real estate market would face a major collapse. Some forecasts called for a 15-20% decline in transactions....

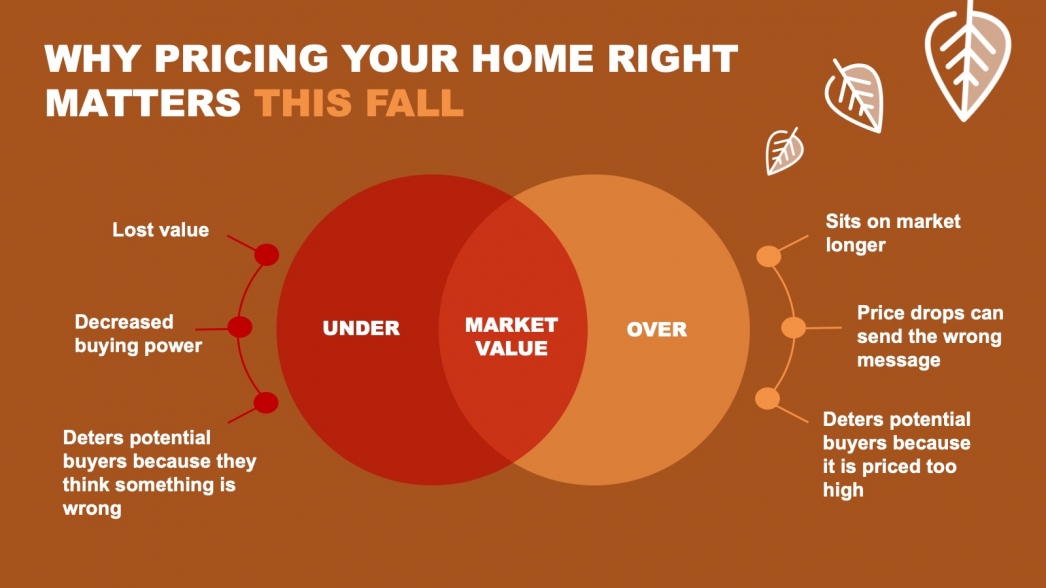

Why Pricing Your Home Right Matters This Fall

Why Pricing Your Home Right Matters This Fall Some HighlightsAs a seller today, you may think pricing your home on the high end will result in a higher final sale price, but the opposite is actually true.To sell your home quickly and for the best possible price, you...