What Credit Score Do You Need To Buy A House?

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

- 16% Very Poor (300-579)

- 18% Fair (580-669)

- 21% Good (670-739)

- 25% Very Good (740-799)

- 20% Exceptional (800-850)

Randy Hopper, Senior Vice President of Mortgage Lending for Navy Federal Credit Union said,

“Just because you have a low credit score doesn’t mean you can’t purchase a home. There are a lot of options out there for consumers with low FICO® scores,”

There are many programs available with low or no credit score requirement. The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 if you want to qualify for the low down payment advantage. The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640. Veterans Affairs (VA) loans have no credit score requirement.

As you can see, none of them are above 700!

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year.

FICO® reported,

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

Bottom Line

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner, let’s get together to help you set a path to reach your dream!

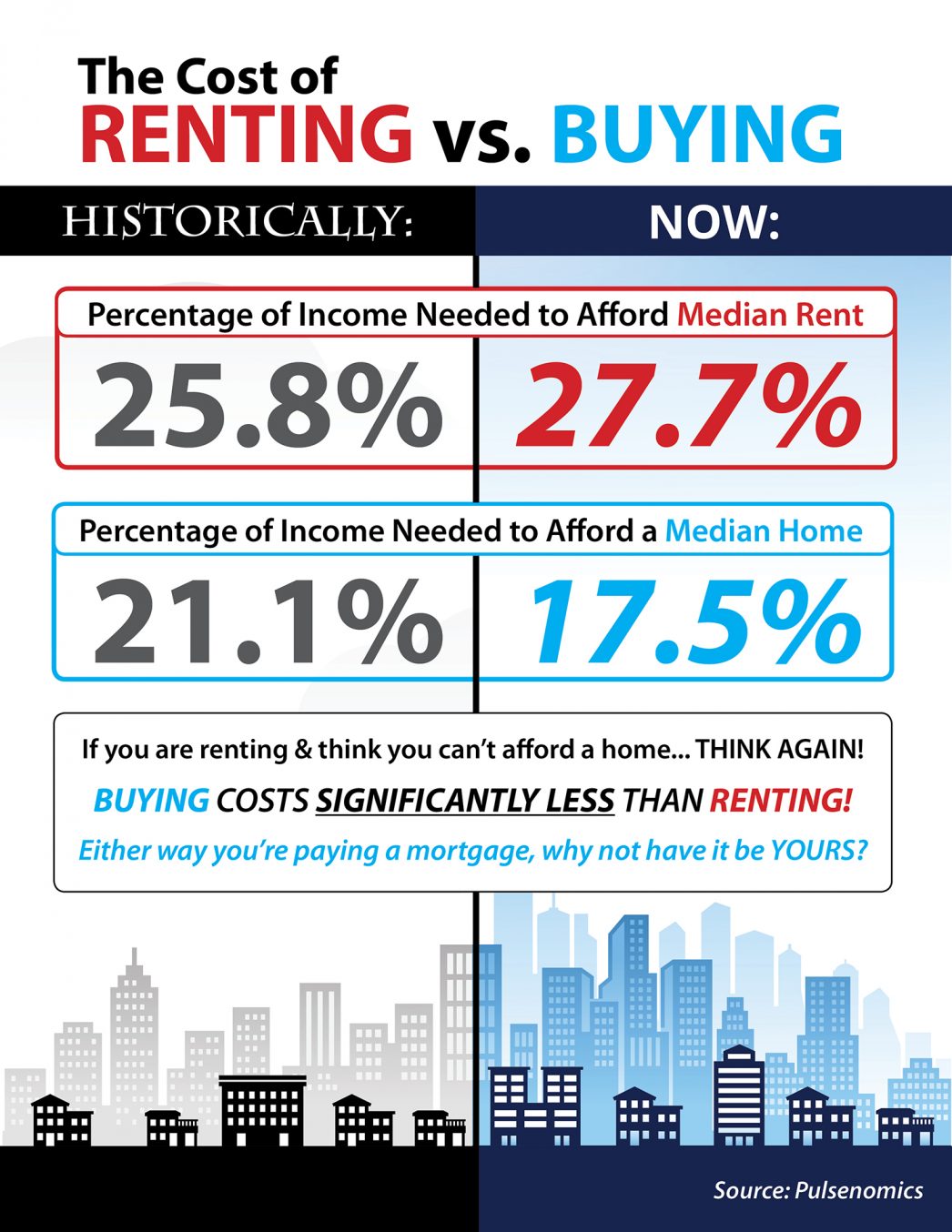

Cost of Renting vs Buying – Utah Realty

The Cost of Renting vs. Buying This Spring Some Highlights: Historically, the choice between renting or buying a home has been a tough decision. Looking at the percentage of income needed to rent a median-priced home today (27.7%) vs. the percentage needed to buy a...

Your Fabulous New Dream Home is Now Available

Your Fabulous New Dream Home is Now Available Over the last several years, many “baby boomers” have undergone a metamorphosis. Their children have finally moved out and they can now dream about their own future. For many, a change in lifestyle might necessitate a...

How Quickly Can You Save Your Down Payment

How Quickly Can You Save Your Down Payment? Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save...

5 Reasons to Sell Your Homes this Spring in Utah

Low Inventories Leave You Choices That Take Some TLC

With Inventory Low: Will Your Dream Home Need Some TLC? According to a new survey from Move.com, the wave of first-time homebuyers hitting the market this summer has resulted in an interesting statistic. Nearly 60% of buyers searching for a home this spring are...

Utah Realty can Knock out a Great Deal for You

Selling Your House: Here’s Why You Need A Pro In Your Corner! With home prices on the rise and buyer demand still strong, some sellers may be tempted to try to sell their homes on their own rather than using the services of a real estate professional. Real estate...

Homeowners – Now Is A Good Time To Sell Your House

Homeowners: Now Is A Good Time To Sell Your House Every month, the National Association of Realtors (NAR) releases their Seller Traffic Index as a part of their Realtors Confidence Index. In the latest release, NAR reported that homeowners have been reluctant to sell...

Buyer Demand Surging in Utah as Spring Market Begins

Buyer Demand Surging in Utah as Spring Market Begins Last fall, some predicted that the 2019 residential real estate market would be a disaster. There was even belief we might experience a housing crash like the one that occurred during the last decade. However,...

Are Low Interest Rates Here to Stay

Are Low Interest Rates Here to Stay? Interest rates for a 30-year fixed rate mortgage have been on the decline since November, now reaching lows last seen in January 2018. According to Freddie Mac’s latest Primary Mortgage Market Survey, rates came in at 4.12% last...

3 Questions You Need To Ask Before Buying A Home

3 Questions You Need To Ask Before Buying A Home If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is...