What Credit Score Do You Need To Buy A House?

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

- 16% Very Poor (300-579)

- 18% Fair (580-669)

- 21% Good (670-739)

- 25% Very Good (740-799)

- 20% Exceptional (800-850)

Randy Hopper, Senior Vice President of Mortgage Lending for Navy Federal Credit Union said,

“Just because you have a low credit score doesn’t mean you can’t purchase a home. There are a lot of options out there for consumers with low FICO® scores,”

There are many programs available with low or no credit score requirement. The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 if you want to qualify for the low down payment advantage. The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640. Veterans Affairs (VA) loans have no credit score requirement.

As you can see, none of them are above 700!

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year.

FICO® reported,

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

Bottom Line

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner, let’s get together to help you set a path to reach your dream!

How to Increase Your Equity Over The Next 5 Years

How to Increase Your Equity Over the Next 5 Years Many of the questions currently surrounding the real estate industry focus on home prices and where they are heading. The most recent Home Price Expectation Survey (HPES) helps target these projected answers. Here are...

If you are Thinking about Selling and Live in Utah? You should read this first!

If you are Thinking about Selling and Live in Utah? You should read this first! Why Now Is the Perfect Time to Sell Your House As a homeowner, it’s always tempting to dream about the next big project you’re going to tackle. The possibilities are endless. Should I...

Utah Realty Expert Insights On Inventory In The Current Market

3 Expert Insights On Inventory In The Current Market The current housing landscape presents greater home values, low interest rates, and high buyer demand. All of these factors point to the strong market forecasted to continue throughout the rest of the year. There...

What Experts are Saying About the Current Housing Market

What Experts are Saying About the Current Housing Market We’re halfway through the year, and with a decline in interest rates as well as home price and wage appreciation, many are wondering what the experts predict for the second half of 2019. Here’s what some have to...

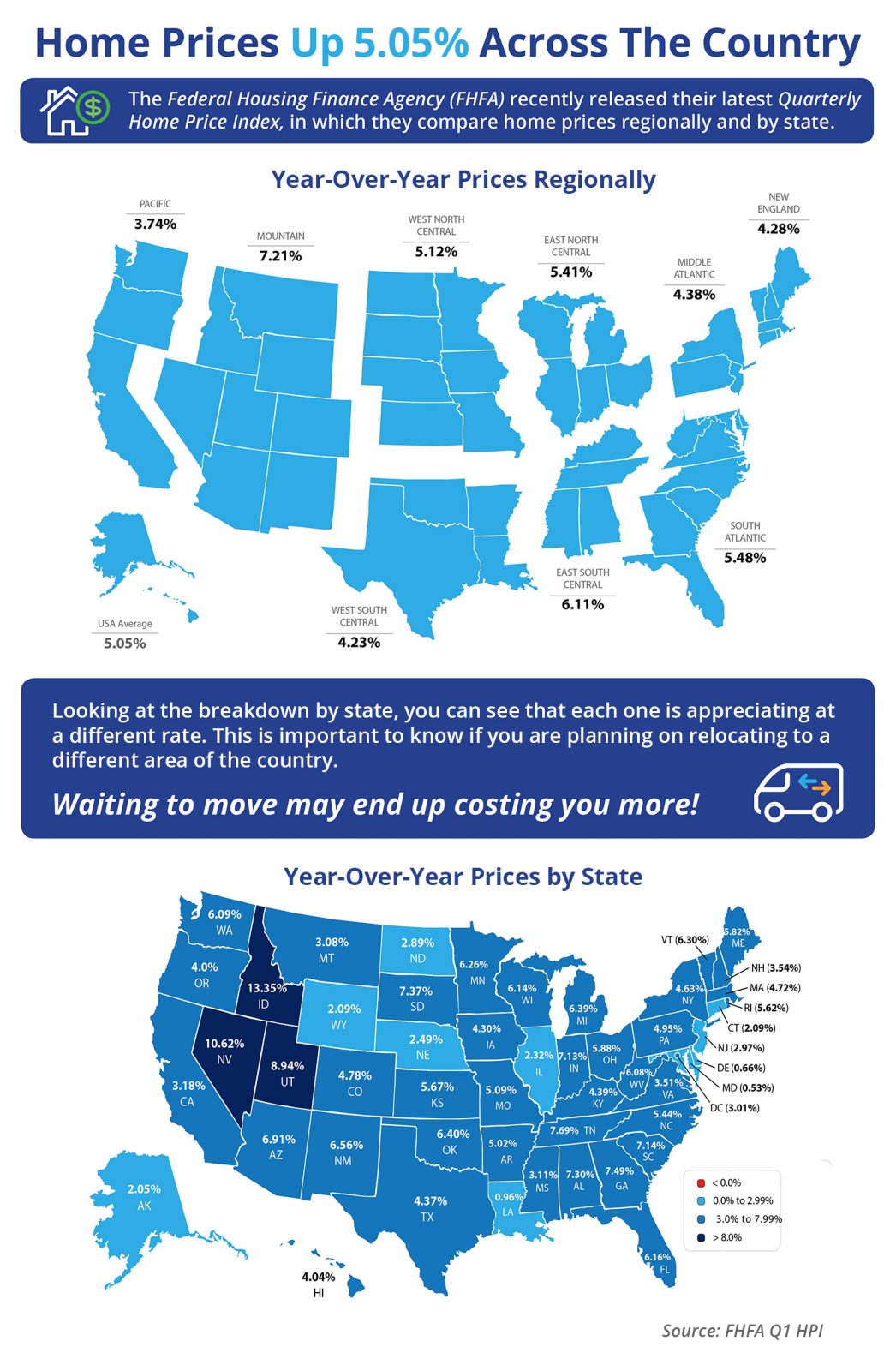

Home Prices Up 5.05% Across the Country Utah is just under nine percent

Home Prices Up 5.05% Across the Country [INFOGRAPHIC] Some Highlights: The Federal Housing Finance Agency (FHFA) recently released their latest Quarterly Home Price Index report. In the report, home prices are compared both regionally and by state. Based on the latest...

Salt Lake City Median House Prices

Wasatch Front median home prices bottomed in 2011, years after The Great Recession ended. Since then, home prices (all housing types) have been on the rise. The median price of Wasatch Front homes sold in the first quarter of this year was $308,000, 75 percent higher...

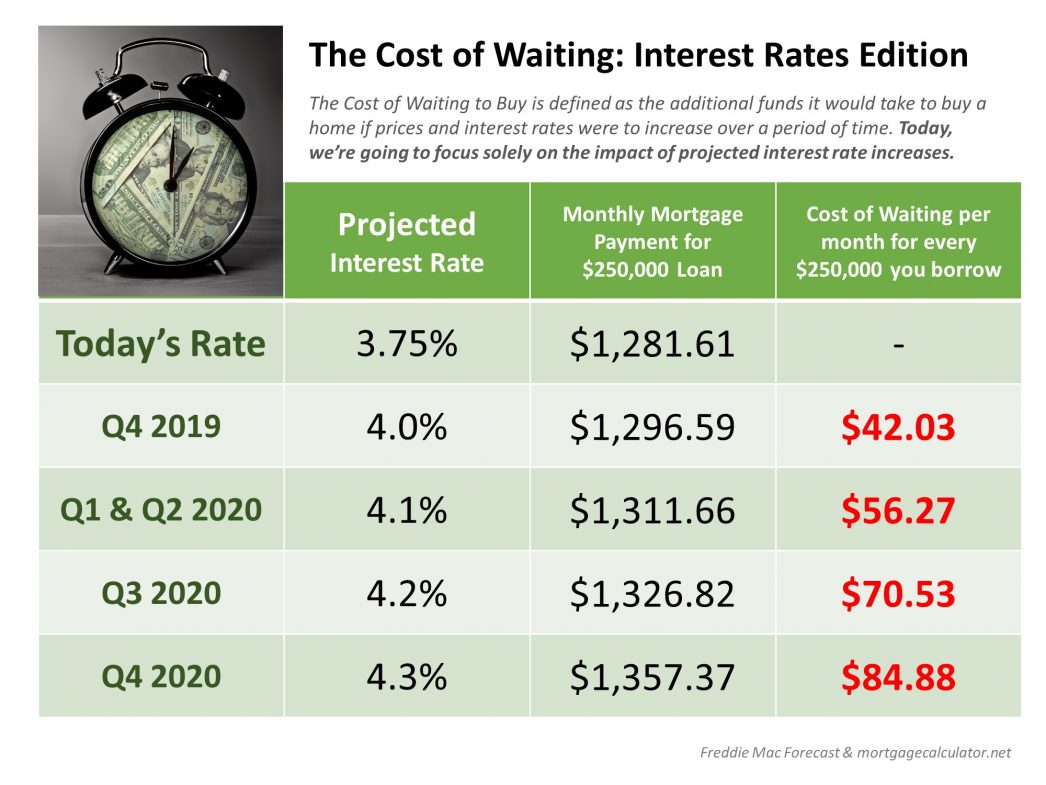

The Cost of Waiting: Interest Rates Edition

Some Highlights: Interest rates are projected to increase steadily heading into 2020. The higher your interest rate, the more money you will end up paying for your home and the higher your monthly payment will be. Rates are still low right now – don’t wait until they...

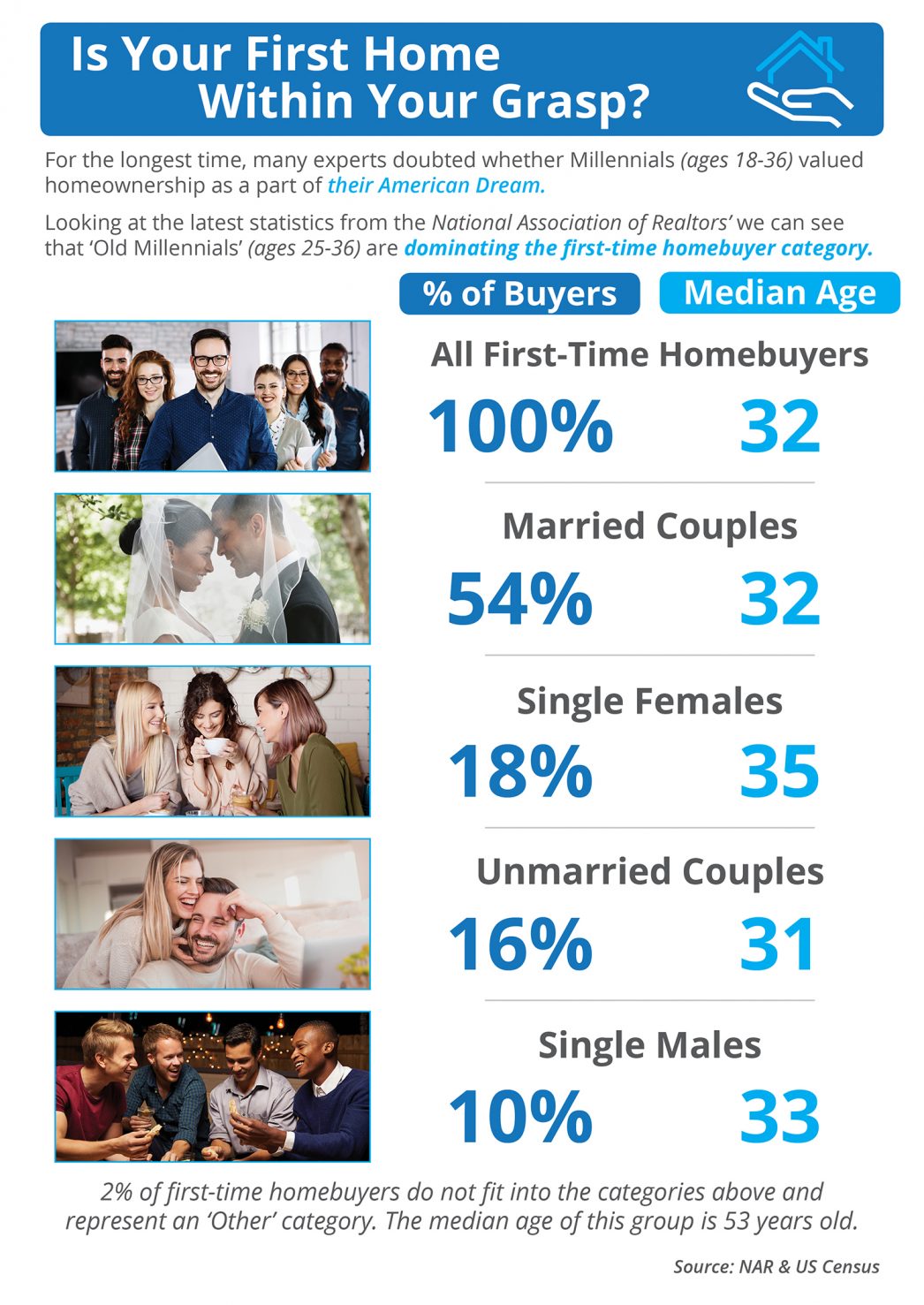

Is Your First Home Now Within Your Grasp?

Is Your First Home Now Within Your Grasp? Some Highlights: According to the US Census Bureau, “millennials” are defined as 18-36-year-olds. According to NAR’s latest Profile of Home Buyers & Sellers, the median age of all first-time home buyers is 32. More and...

Utah is Number Three in the nation in house-price appreciation.

Utah is No. 3 in the nation in house-price appreciation. In the first quarter, prices in the Beehive state increased 8.94 percent, according to the Federal Housing Finance Agency. Idaho was No. 1 in price increases. Maryland came in last place. Home prices there...

4 Tips to Sell Your Home Faster

4 Tips to Sell Your Home Faster Since June of last year, we have seen an increase in the inventory of homes for sale month per month. Every spring and summer, the inventory increases because people want to sell their home. For those with children, they may want to be...