What Credit Score Do You Need To Buy A House?

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

- 16% Very Poor (300-579)

- 18% Fair (580-669)

- 21% Good (670-739)

- 25% Very Good (740-799)

- 20% Exceptional (800-850)

Randy Hopper, Senior Vice President of Mortgage Lending for Navy Federal Credit Union said,

“Just because you have a low credit score doesn’t mean you can’t purchase a home. There are a lot of options out there for consumers with low FICO® scores,”

There are many programs available with low or no credit score requirement. The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 if you want to qualify for the low down payment advantage. The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640. Veterans Affairs (VA) loans have no credit score requirement.

As you can see, none of them are above 700!

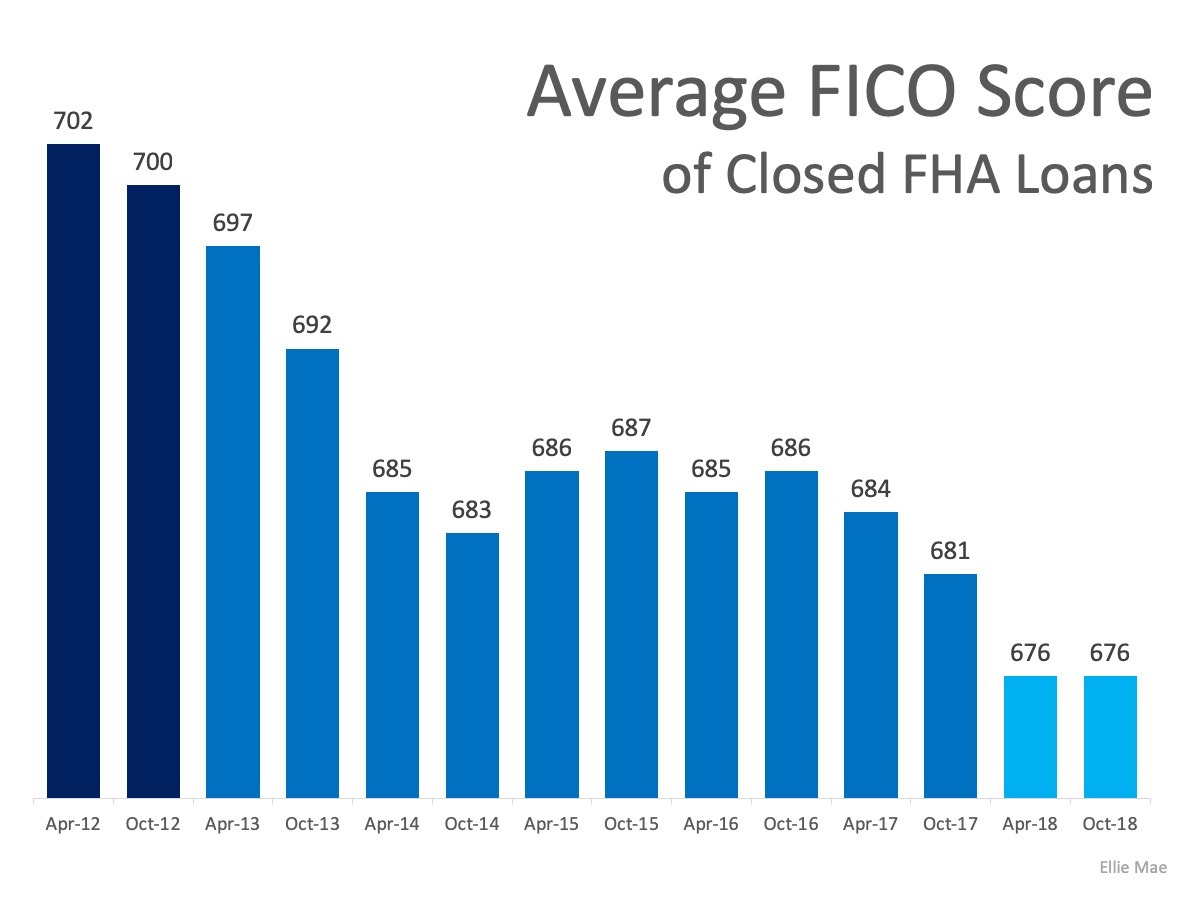

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year.

FICO® reported,

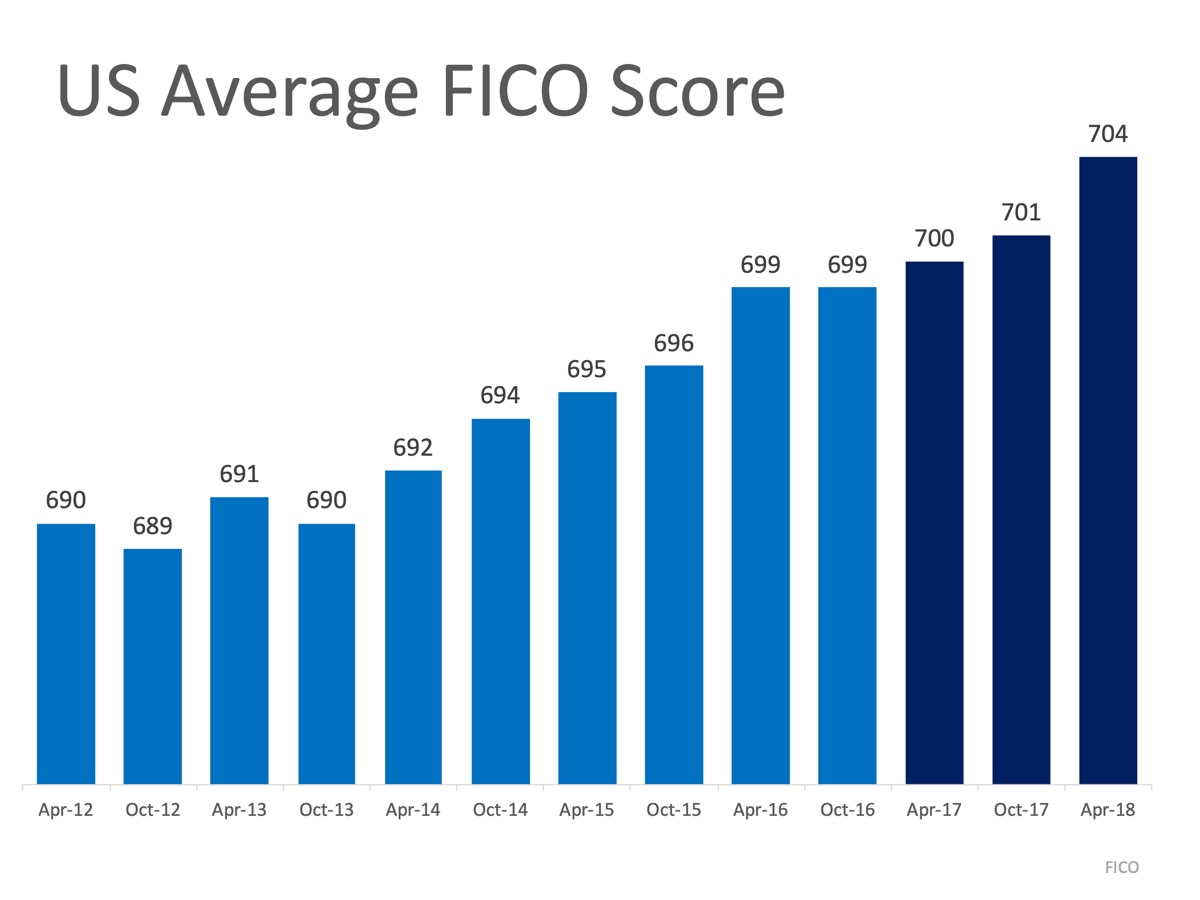

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

Bottom Line

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner, let’s get together to help you set a path to reach your dream!

Certified Divorce Specialist

4 Tips for Making Your Best Offer on a Home

4 Tips for Making Your Best Offer on a Home Are you planning to buy a home this spring? Though things are more balanced than they were at the height of the pandemic, it’s still a sellers’ market. So, when you find the home you want to buy, remember these four tips to...

2 Things Sellers Need To Know This Spring

2 Things Sellers Need To Know This Spring A lot has changed over the past year, and you might be wondering what’s in store for the spring housing market. If you’re planning to sell your house this season, here’s what real estate experts are saying you should keep in...

Could a Multigenerational Home Be the Right Fit for You?

Could a Multigenerational Home Be the Right Fit for You? During the pandemic, many of us reexamined the meaning of home for ourselves and our loved ones. Today, that can be seen in the recent rise in multigenerational households. According to Jessica Lautz, Deputy...

Is It Really Better To Rent Than To Own a Home Right Now?

Is It Really Better To Rent Than To Own a Home Right Now? You may have seen reports in the news recently saying it’s better to rent right now than it is to own your home. But before you let that impact your decisions, you should understand what these claims are based...

Where Will You Go After You Sell Your House?

Where Will You Go After You Sell Your House? Some Highlights If you’re thinking of selling your house, be sure to explore all the options you have for your next home. Both newly built homes and existing homes offer plenty of unique benefits. If you have questions...

An Expert Makes All the Difference When You Sell Your House

An Expert Makes All the Difference When You Sell Your House If you’re thinking of selling your house, it’s important to work with someone who understands how the market is changing and what it means for you. Here are five reasons working with a professional can ensure...

What You Should Know About Rising Mortgage Rates

What You Should Know About Rising Mortgage Rates After steadily falling over the winter, mortgage rates have started to rise in recent weeks. This is concerning to some potential homebuyers as the combination of higher mortgage rates and higher prices have made homes...

One Major Benefit of Investing in a Home

One Major Benefit of Investing in a Home One of the many reasons to buy a home is that it’s a major way to build wealth and gain financial stability. According to Freddie Mac: “Building equity through your monthly principal payments and appreciation is a critical part...

Checklist for Selling Your House This Spring

Checklist for Selling Your House This Spring Some Highlights As you get ready to sell your house, there are specific things you can add to your to-do list. These include decluttering, taking down personal photos and items, and power washing outdoor surfaces. Let’s...