What Credit Score Do You Need To Buy A House?

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

- 16% Very Poor (300-579)

- 18% Fair (580-669)

- 21% Good (670-739)

- 25% Very Good (740-799)

- 20% Exceptional (800-850)

Randy Hopper, Senior Vice President of Mortgage Lending for Navy Federal Credit Union said,

“Just because you have a low credit score doesn’t mean you can’t purchase a home. There are a lot of options out there for consumers with low FICO® scores,”

There are many programs available with low or no credit score requirement. The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 if you want to qualify for the low down payment advantage. The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640. Veterans Affairs (VA) loans have no credit score requirement.

As you can see, none of them are above 700!

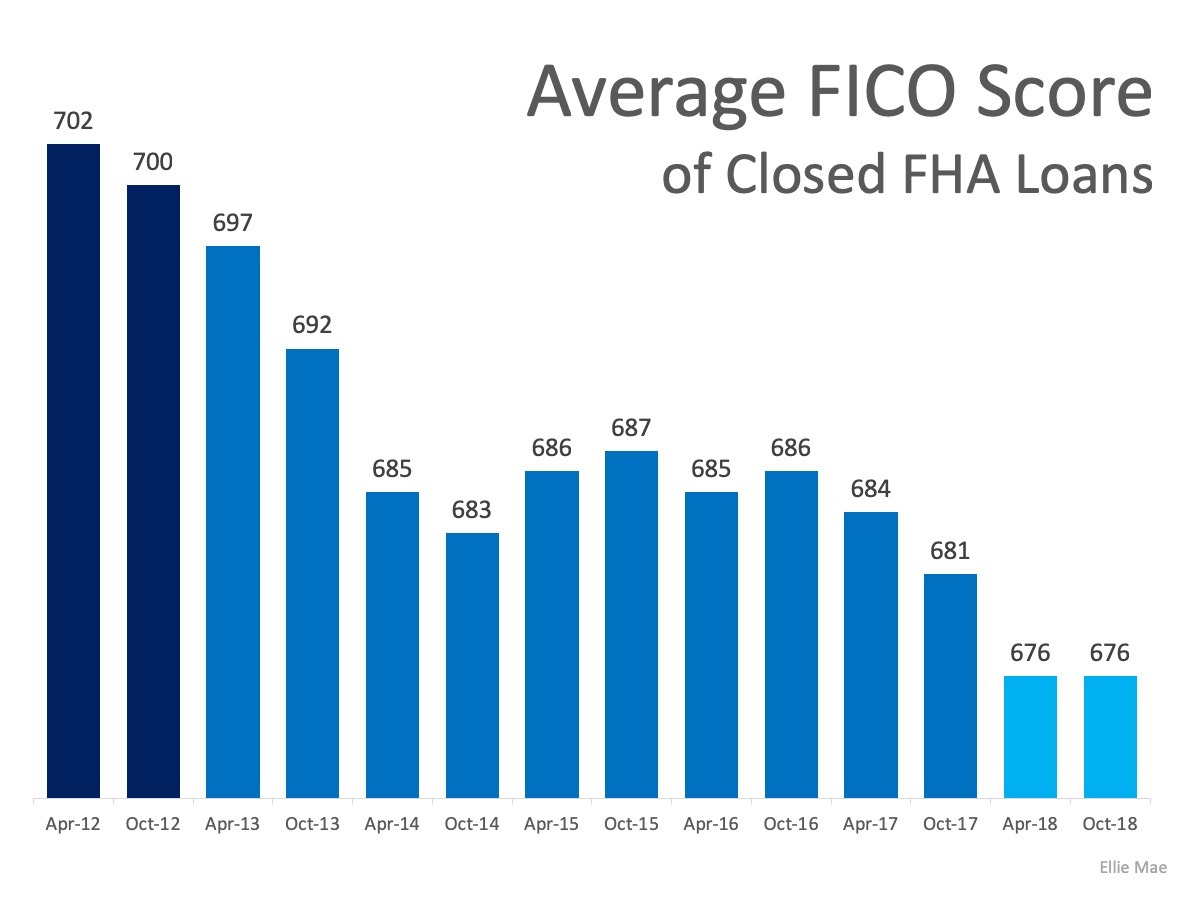

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year.

FICO® reported,

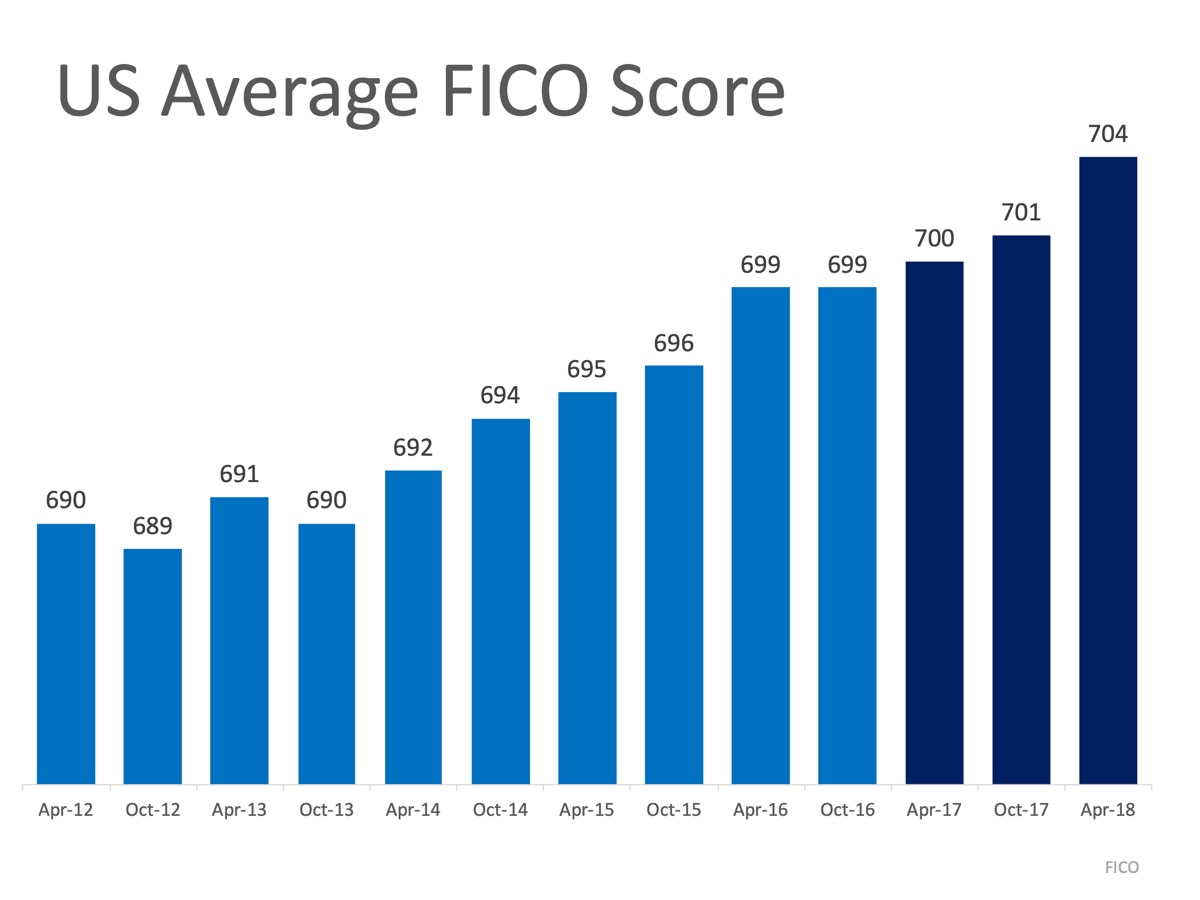

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

Bottom Line

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner, let’s get together to help you set a path to reach your dream!

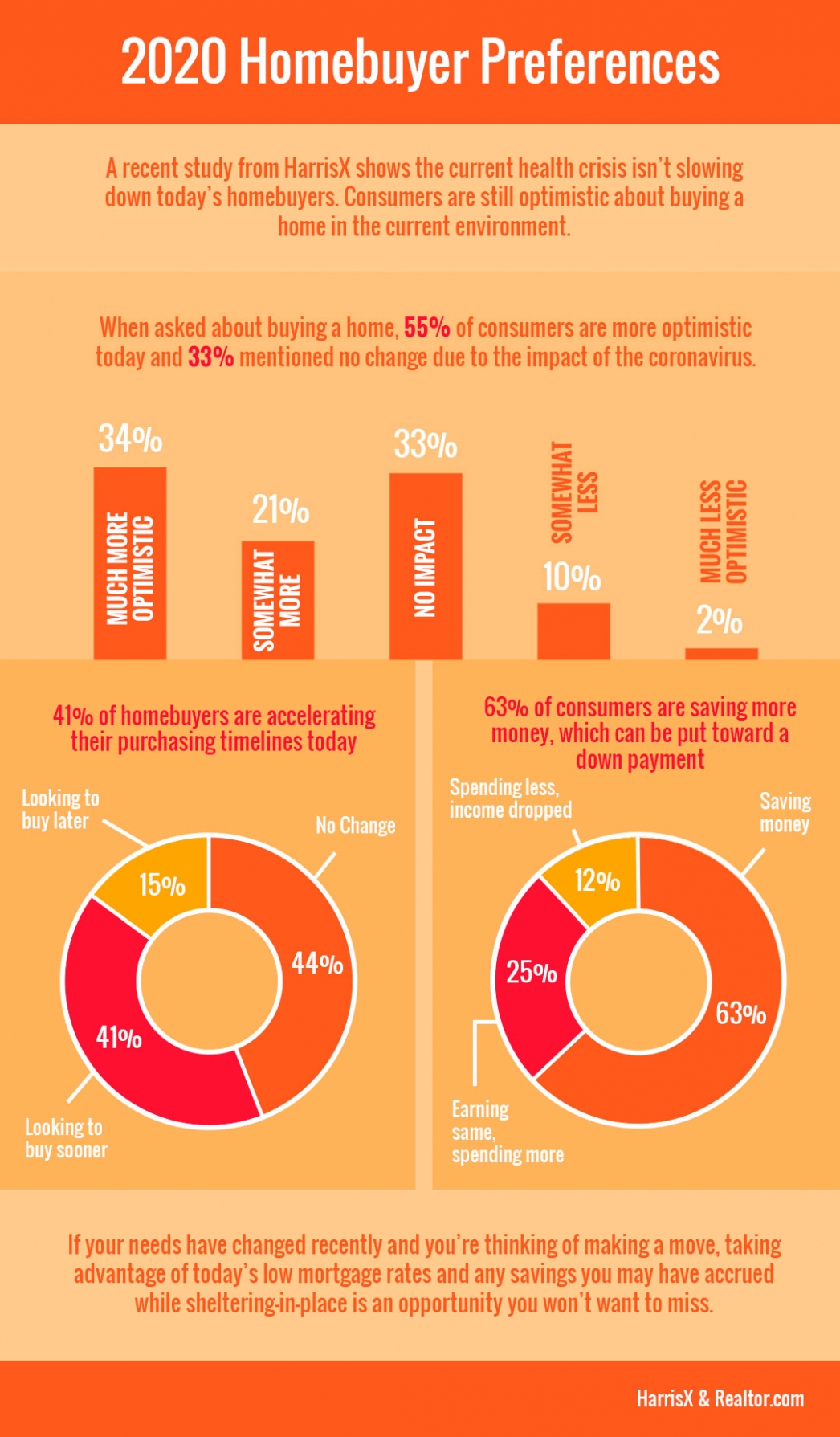

2020 Homebuyer Preferences

2020 Homebuyer PreferencesSome HighlightsA recent study from HarrisX shows the current health crisis isn’t slowing down today’s homebuyers.Many buyers are accelerating their timelines to take advantage of low mortgage rates, and staying home has enabled some to save...

Expert Reactions to the 2020 Housing Market Recovery

America Has a Surprising New Favorite Room in the House

Photo Copyright Marty Gale The family room has long been the favorite room in the house—it’s where homeowners get to spend quality time with other family members. However, as the significant increase in time spent at home during the pandemic has changed preferences,...

How Is Remote Work Changing Homebuyer Needs?

How Is Remote Work Changing Homebuyer Needs?With more companies figuring out how to efficiently and effectively enable their employees to work remotely (and for longer than most of us initially expected), homeowners throughout the country are re-evaluating their...

Why Homeowners Have Great Selling Power Today

Why Homeowners Have Great Selling Power TodayWe’re sitting in an optimal moment in time for homeowners who are ready to sell their houses and make a move this year. Today’s homeowners are, on average, staying in their...

Today’s Buyers Are Serious about Purchasing a Home

Today’s Buyers Are Serious about Purchasing a HomeToday’s homebuyers are not just talking about their plans, they’re actively engaged in the buying process – and they’re serious about it. A recent report by the National Association of Home Builders (NAHB)...

Home Sales Surging This Summer

Experts Weigh-In on the Remarkable Strength of the Housing Market

Experts Weigh-In on the Remarkable Strength of the Housing MarketAmerica has faced its share of challenges in 2020. A once-in-a-lifetime pandemic, a financial crisis leaving millions still unemployed, and an upcoming presidential election that may prove to be one of...

Homeownership Rate Continues to Rise in 2020

Homeownership Rate Continues to Rise in 2020So far, it’s been quite a ride this year, and our nation has truly seen its fair share of hurdles. From COVID-19 to record unemployment and then the resulting recession, just to name a few, the second quarter of 2020 has had...

Moving America Forward

Kids Go Back to School and Life goes on Says a group of Prominent Physicians