What Credit Score Do You Need To Buy A House?

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

- 16% Very Poor (300-579)

- 18% Fair (580-669)

- 21% Good (670-739)

- 25% Very Good (740-799)

- 20% Exceptional (800-850)

Randy Hopper, Senior Vice President of Mortgage Lending for Navy Federal Credit Union said,

“Just because you have a low credit score doesn’t mean you can’t purchase a home. There are a lot of options out there for consumers with low FICO® scores,”

There are many programs available with low or no credit score requirement. The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 if you want to qualify for the low down payment advantage. The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640. Veterans Affairs (VA) loans have no credit score requirement.

As you can see, none of them are above 700!

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year.

FICO® reported,

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

Bottom Line

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner, let’s get together to help you set a path to reach your dream!

Homeownership can be yours

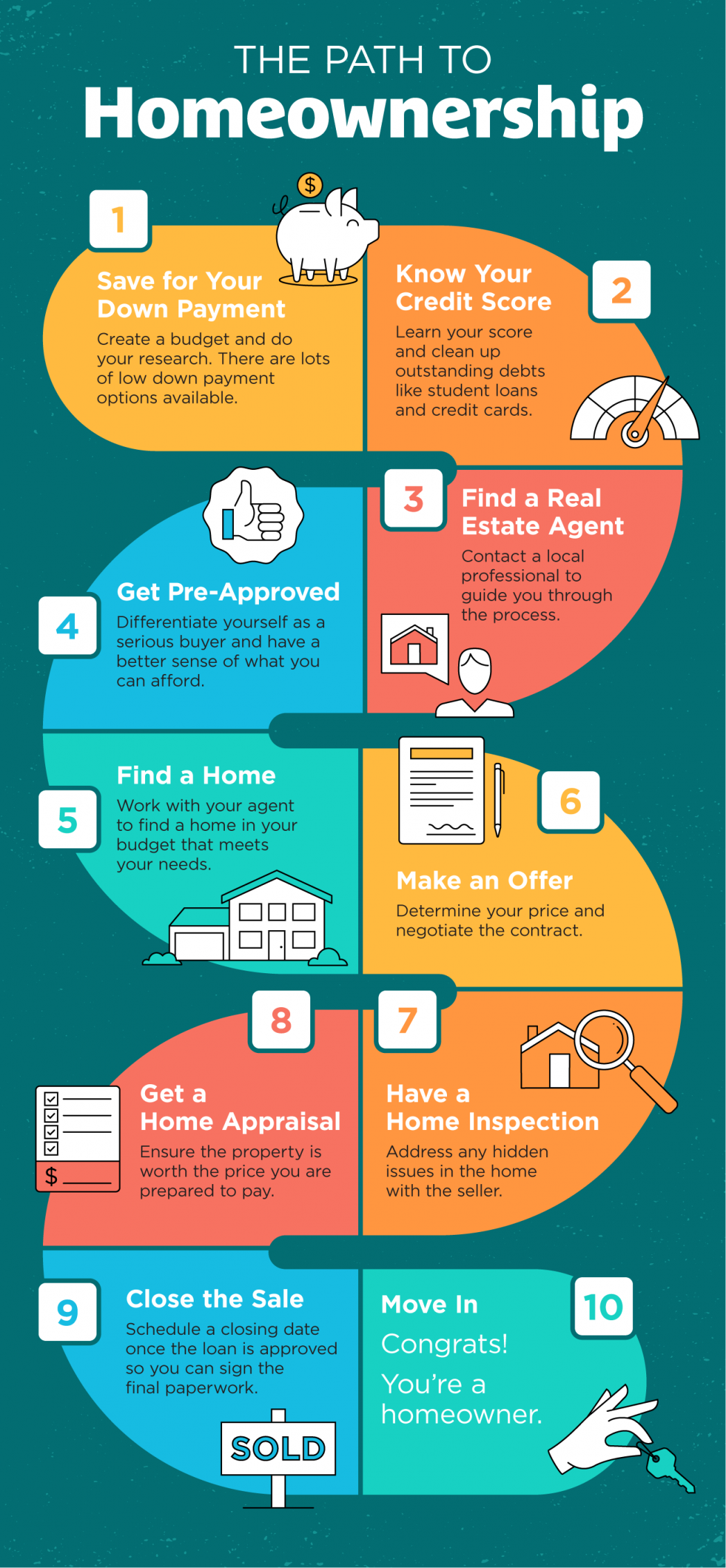

The Path to Homeownership Some Highlights If you’re thinking of buying a home and not sure where to start, you’re not alone. Here’s a map with 10 simple steps to follow in the homebuying process. Let’s connect today to discuss the specific steps along the way in our...

Shop for Homes in a Virtual World

A New Way to Shop for Homes in a Virtual WorldIn a year when we’re learning to do so much remotely, homebuying is no exception. From going to work to attending school, grocery shopping, and even seeing our doctors online, digital practices have changed the way we...

Thank You

Thank You for Your Support!

It Pays to Sell with a Real Estate Agent

It Pays to Sell with a Real Estate Agent Some HighlightsToday, it’s more important than ever to have an expert you trust to guide you as you sell your house.From your safety throughout the process to the complexity of negotiating...

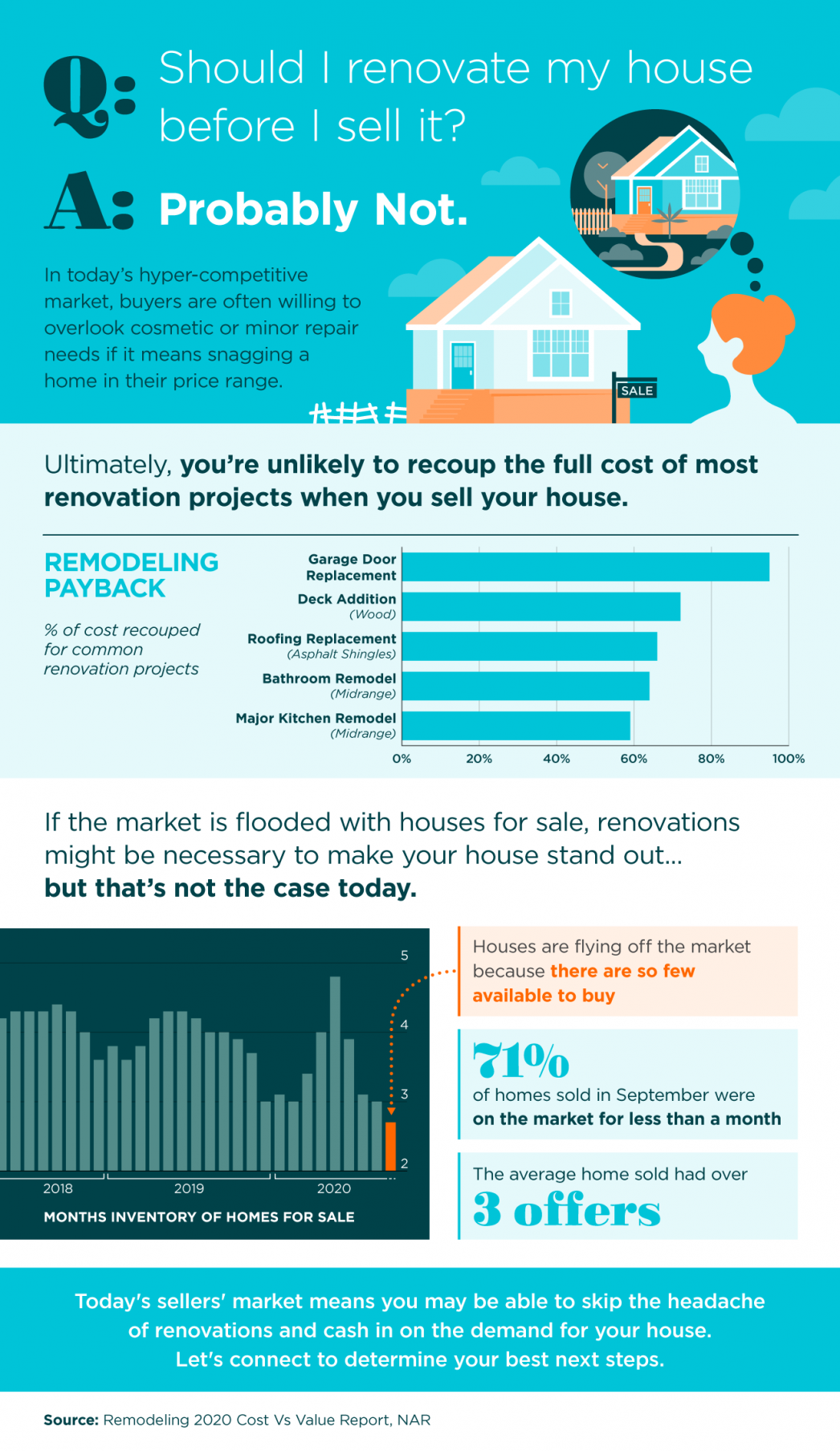

Should I Renovate My House Before I Sell It?

Should I Renovate My House Before I Sell It? Some HighlightsIn today’s hyper-competitive market, buyers are often willing to overlook cosmetic or minor repair needs if it means snagging a home in their price range.With so few houses available for sale today, you may...

Don’t Fear the Real Estate Market

Don't Fear the Real Estate Market October 29, 2020 Fear should never be a factor when navigating the housing market. Whether you're buying or selling a home this fall, let's connect to make sure you're empowered to take the safest path.

Why Selling Your House Before Next Spring Is Key

Why Selling Your House Before Next Spring Is Key Today's housing market is empowering homeowners with the control they want when selling their house, but as home inventory begins to rise, this fair weather won't last forever. Let's connect to start the process of...

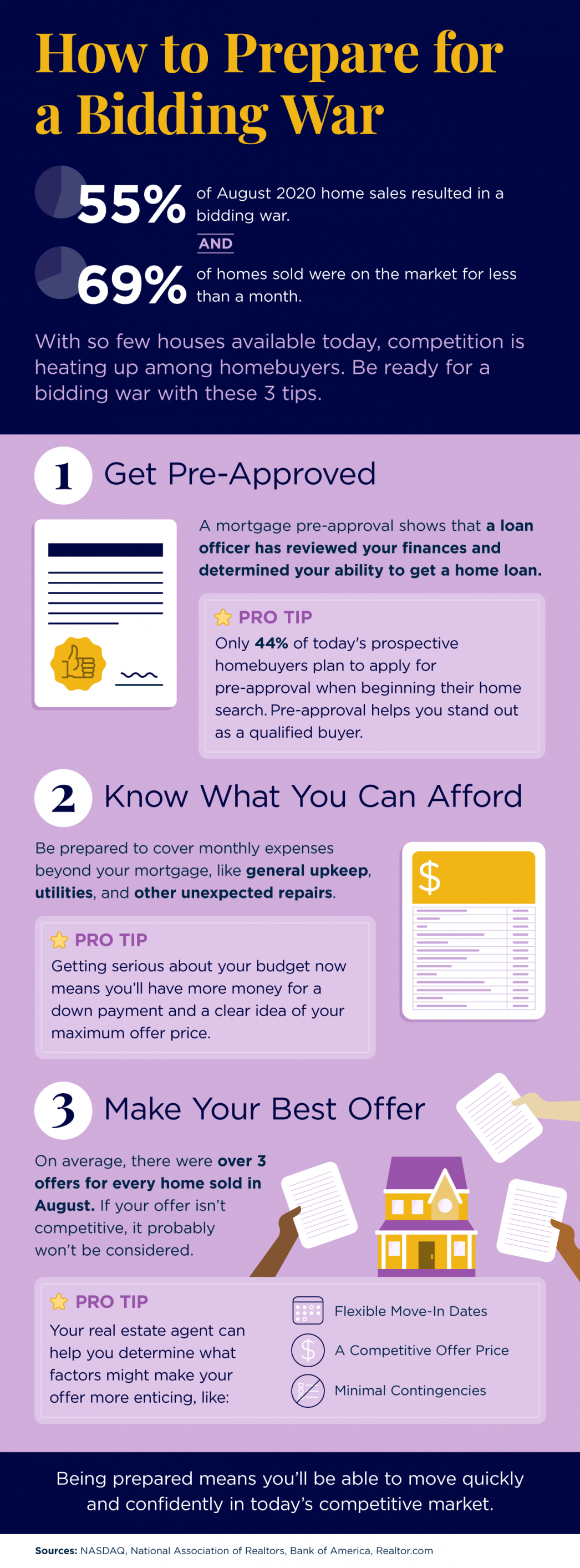

How to Prepare for a Bidding War

How to Prepare for a Bidding War Some HighlightsWith so few houses available on the market today, being ready for a bidding war is essential for prospective homebuyers.From pre-approval to making your best offer, here are three tips to make sure you can act quickly...

2020 Housing Market on Track to Beat Last Year’s Success

Housing Market on Track to Beat Last Year’s SuccessBack in March, as the nation’s economy was shut down because of the coronavirus, many were predicting the real estate market would face a major collapse. Some forecasts called for a 15-20% decline in transactions....

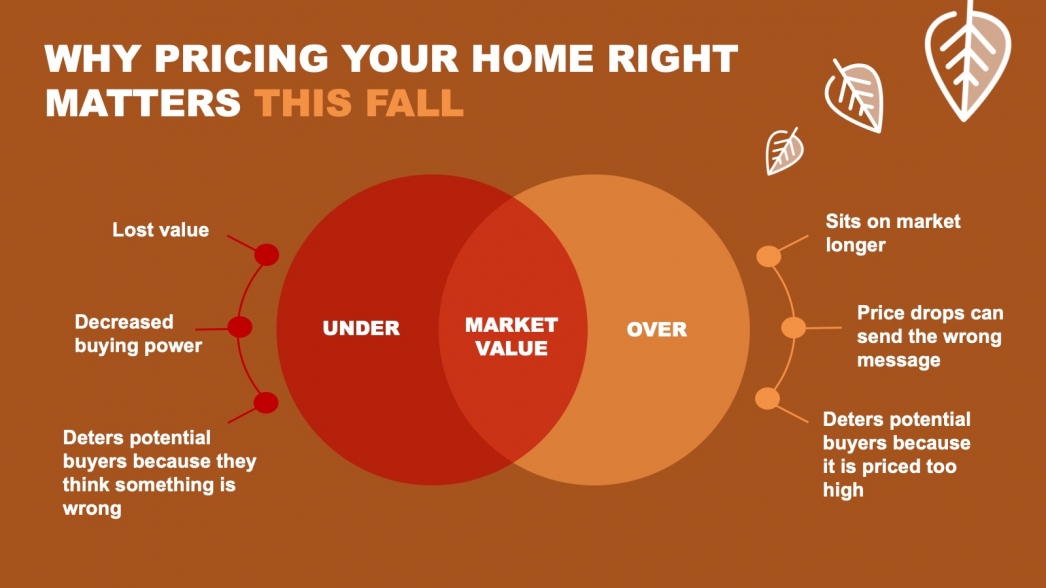

Why Pricing Your Home Right Matters This Fall

Why Pricing Your Home Right Matters This Fall Some HighlightsAs a seller today, you may think pricing your home on the high end will result in a higher final sale price, but the opposite is actually true.To sell your home quickly and for the best possible price, you...