A mother and her son are hugging in their living room. The mother is wearing a military uniform.

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice.

This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI Bill. Since 1944, this law has created opportunities for those who have served our country, ranging from vocational training to home loans.

Facts About VA Home Loans:

- Nearly 24 million home loans have been guaranteed by the Veterans Administration.

- Nearly 82% of VA home loans are made with no down payment.

- The VA also provides grants to help seriously disabled Veterans purchase, modify, or construct a home to meet their needs. Last year the VA provided 2,000 grants totaling $104 million.

Benefits of a VA Home Loan:

- No down payment

- No Private Mortgage Insurance*

- Lower credit score requirements

- Limitation on closing costs

- Lower average interest rates

*More information on VA Home Loan Fees

Bottom Line

The best thing you can do today to celebrate Veterans Day is to share this information with those who can benefit from these opportunities. For more information, or to find out how to qualify to use a VA Home Loan Benefit, let’s get together to navigate through the process. Thank you for your service!

The Many Benefits of Homeownership

The Many Benefits of Homeownership The past two years have taught us the true value of homeownership, especially the stability and the feeling of accomplishment it can provide. But homeownership has so much more to offer. Here’s a look at a few of the non-financial...

Why It’s Critical To Price Your House Right

Why It’s Critical To Price Your House Right When you make a move, you want to sell your house for the highest price possible. That might be why many homeowners are eager to list in today’s sellers’ market. After all, with record-low inventory and high buyer demand,...

This Spring Presents Sellers with a Golden Opportunity

This Spring Presents Sellers with a Golden Opportunity If you’re thinking of selling your house this year, timing is crucial. After all, you’ll want to balance getting the most out of the sale of your current home and making the best investment when you buy your next...

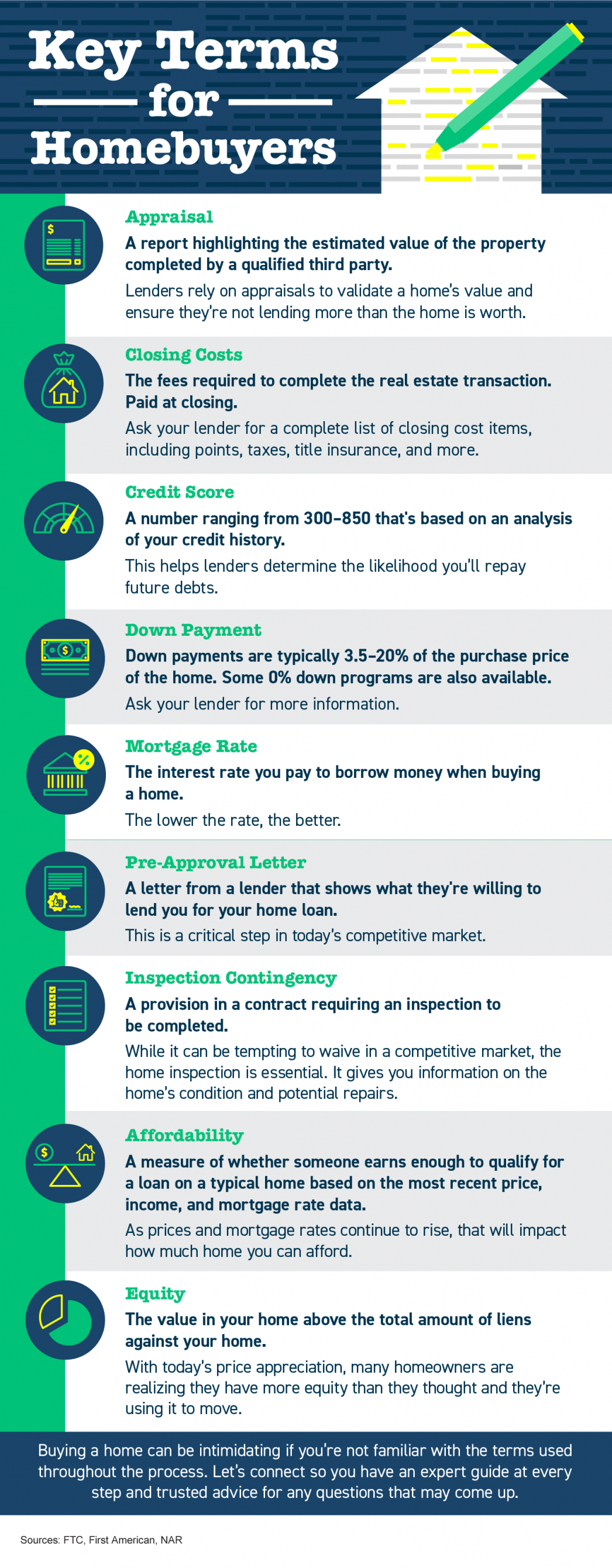

Key Terms for Homebuyers

Key Terms for Homebuyers Some Highlights Knowing key housing terms and how they relate to today’s market is important. For example, when mortgage rates and home prices rise, it impacts how much home you can afford. Terms like appraisal (what lenders rely on to...

Spring Home Buyers Guide for 2022 is Here!

Things-To-Avoid-After-Applying-for-a-Mortgage

Things-To-Avoid-After-Applying-for-a-Mortgage It's essential to avoid mishaps after applying for a mortgage. Let's connect so you know what to avoid during this part of the homebuying process. [video width="1920" height="1080"...

The #1 Reason To Sell Your House Today

Why Acting Strategically as a Seller Is Your Best Play

Positive: Professionalism, Responsiveness Marty sat down with my and wife and me to explain his process...

4 Simple Graphs Showing Why This Is Not a Housing Bubble

4 Simple Graphs Showing Why This Is Not a Housing Bubble A recent survey revealed that many consumers believe there’s a housing bubble beginning to form. That feeling is understandable, as year-over-year home price appreciation is still in the double digits. However,...

What Every Seller Needs To Know About Renovating This Year

What Every Seller Needs To Know About Renovating This Year If you’re planning to sell this year, you’re probably thinking about what you’ll need to do to get your house ready to appeal to the most buyers. It’s crucial to work with a trusted real estate professional...