Selling Your House: Here’s Why You Need A Pro In Your Corner!

With home prices on the rise and buyer demand still strong, some sellers may be tempted to try to sell their homes on their own rather than using the services of a real estate professional.

Real estate agents are trained and experienced in negotiation while, in most cases, the seller is not. Sellers must realize that their ability to negotiate will determine whether or not they get the best deal for themselves and their families.

Here is a list of just some of the people with whom the seller must be prepared to negotiate with if they decide to For Sale by Owner (FSBO):

- The buyer, who wants the best deal possible

- The buyer’s agent, who solely represents the best interests of the buyer

- The buyer’s attorney (in some parts of the country)

- The home inspection companies, which work for the buyer and will almost always find some problems with the house

- The termite company, if there are challenges

- The buyer’s lender, if the structure of the mortgage requires the sellers’ participation

- The appraiser, if there is a question of value

- The title company, if there are challenges with certificates of occupancy (CO) or other permits

- The town or municipality, if you need to get the CO permits mentioned above

- The buyer’s buyer, in case there are challenges with the house your buyer is selling

Bottom Line

The percentage of sellers who have hired real estate agents to sell their homes has increased steadily over the last 20 years. Let’s get together to discuss all that we can do to make the process of selling your house easier for you.

How To Make Your Dream of Homeownership a Reality

How To Make Your Dream of Homeownership a Reality According to a recent Harris Poll survey, 8 in 10 Americans say buying a home is a priority, and 28 million Americans actually plan to buy within the next 12 months. Homeownership provides many financial and...

A Smaller Home Could Be Your Best Option

A Smaller Home Could Be Your Best Option Many people are reaching the point in their lives when they need to decide where they want to live when they retire. If you’re a homeowner approaching this stage, you have several options to explore. Jessica Lautz, Deputy Chief...

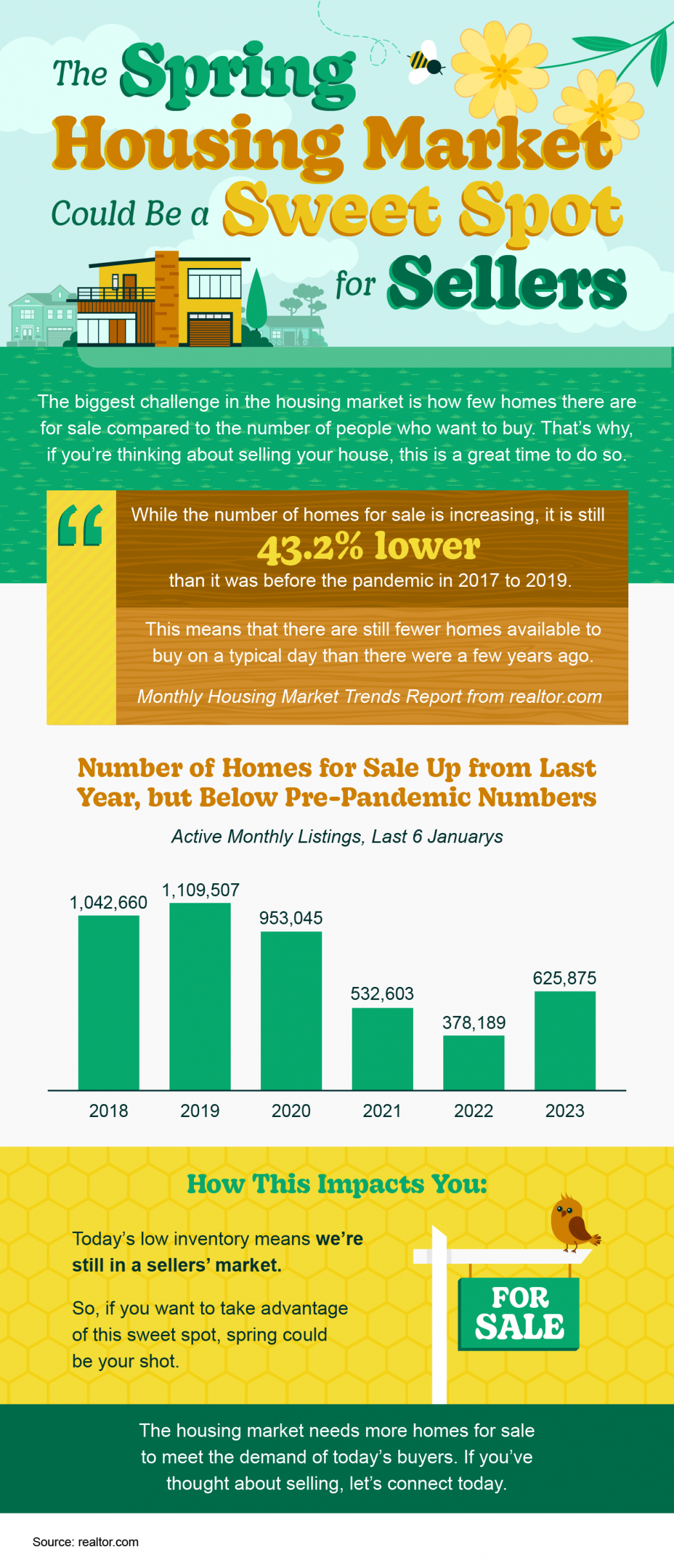

The Utah Spring Housing Market Could Be a Sweet Spot for Sellers

The Utah Spring Housing Market Could Be a Sweet Spot for Sellers Some Highlights The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy. The number of homes for sale is up from last year but...

Now helping navigate the solutions when coping with divorce and Real Property

National Association of Divorce Professionals Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential...

What You Should Know About Closing Costs

What You Should Know About Closing Costs Before you buy a home, it’s important to plan ahead. While most buyers consider how much they need to save for a down payment, many are surprised by the closing costs they have to pay. To ensure you aren’t caught off guard when...

How To Win as a Buyer in Today’s Housing Market In Utah

How To Win as a Buyer in Today’s Housing Market Some Highlights In today’s housing market, you can still be the champion if you have the right team and strategy. To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of...

Are We in a Housing Bubble?

The Top Reasons for Selling Your House

The Top Reasons for Selling Your House Many of today’s homeowners bought or refinanced their homes during the pandemic when mortgage rates were at history-making lows. Since rates doubled in 2022, some of those homeowners put their plans to move on hold, not wanting...

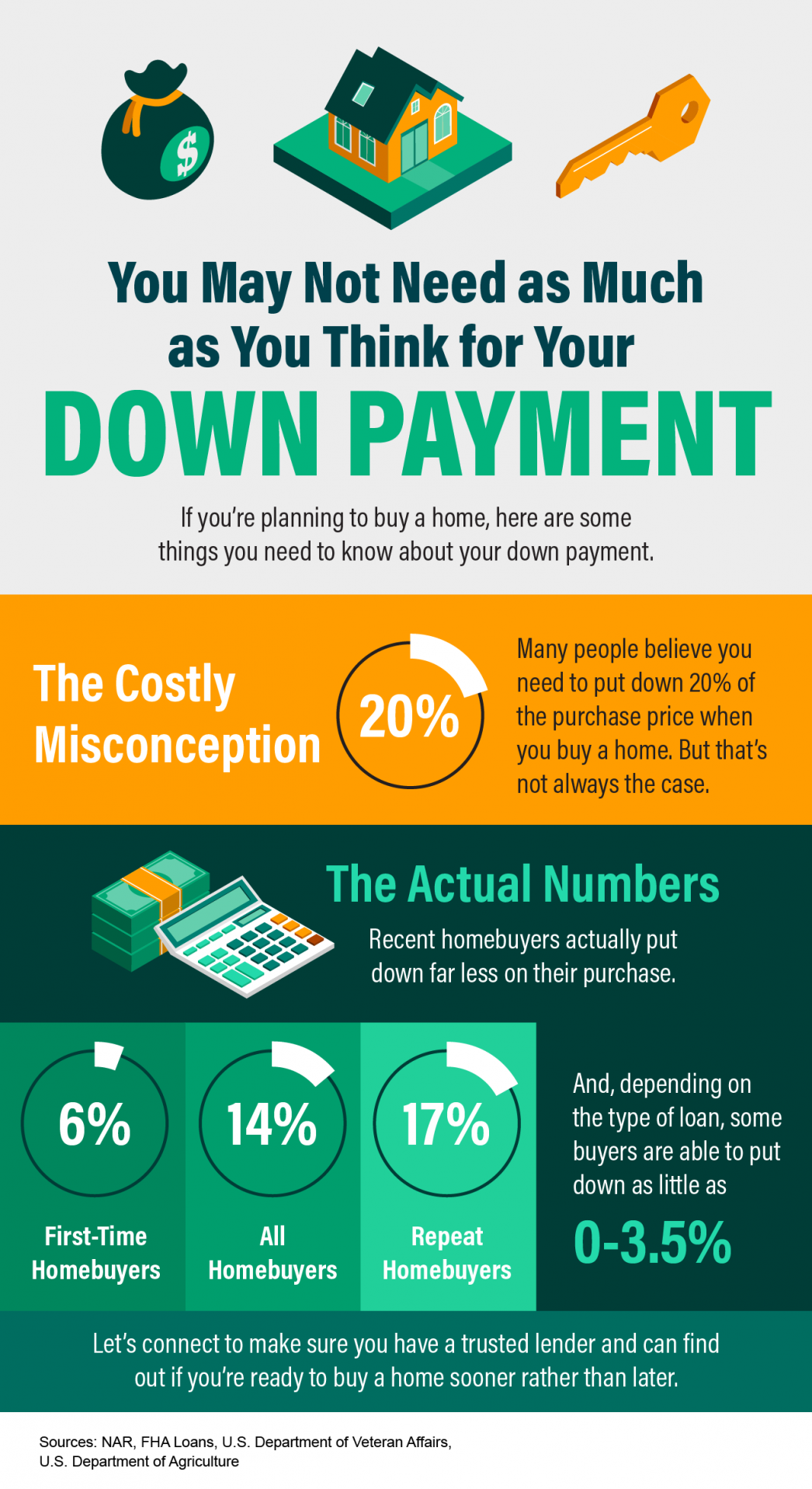

You May Not Need as Much as You Think for Your Down Payment

You May Not Need as Much as You Think for Your Down Payment Some Highlights Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase. And with programs like FHA loans, VA...