2 Things You Need to Know to Properly Price Your Home

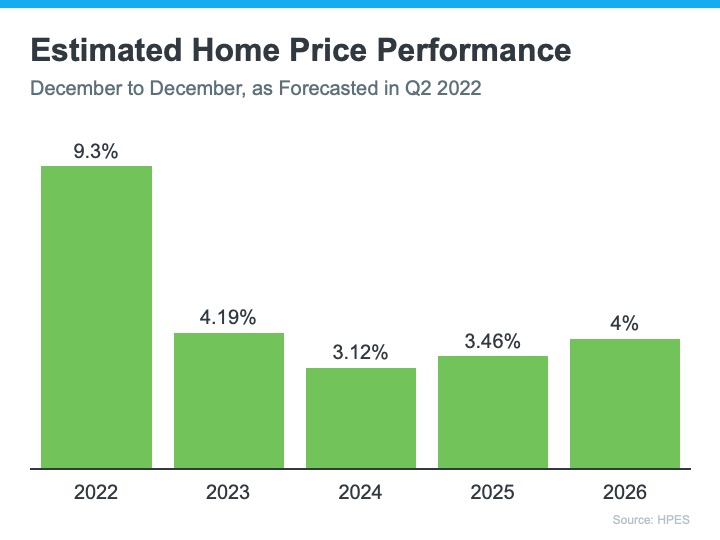

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

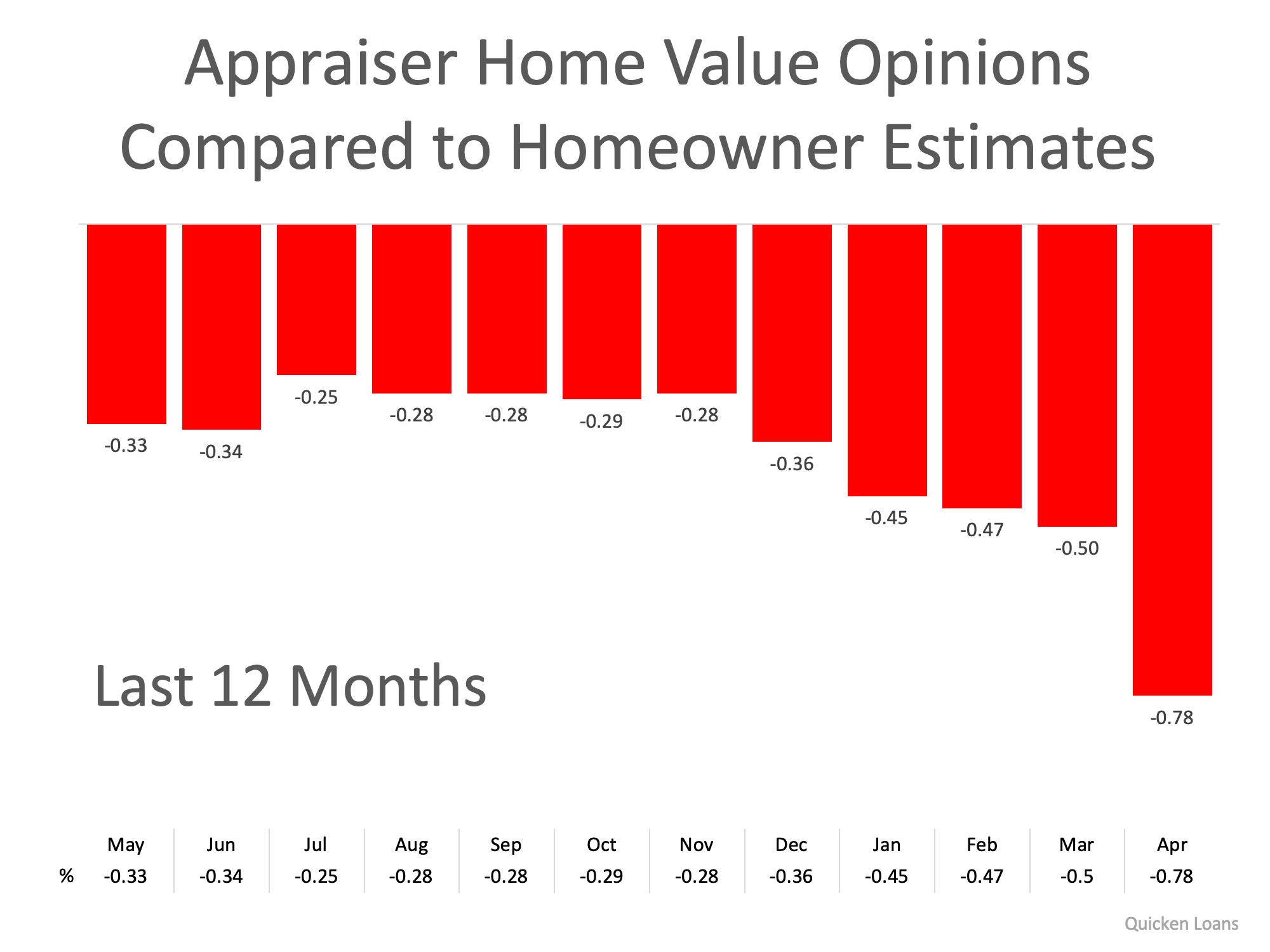

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

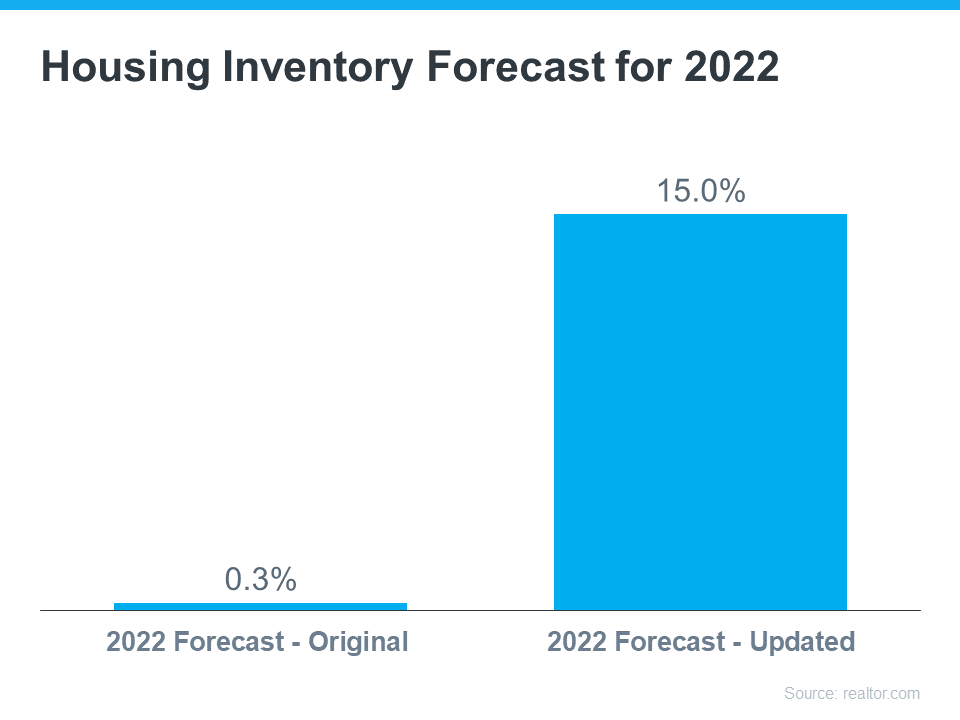

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

Buyers Are Regaining Some of Their Negotiation Power in Today’s Housing Market

Buyers Are Regaining Some of Their Negotiation Power in Today’s Housing Market If you're thinking about buying a home today, there's welcome news. Even though it’s still a sellers’ market, it’s a more moderate sellers’ market than last year. And the days of feeling...

Your Guides to Buying or Selling a Home This Fall

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...

Expert Forecasts on Mortgage Rates

Expert Forecasts on Mortgage Rates If you’ve been thinking of buying a home, you may have been watching what’s happened with mortgage rates over the past year. It’s true they’ve risen dramatically, but where will they go from here, especially as the market continues...

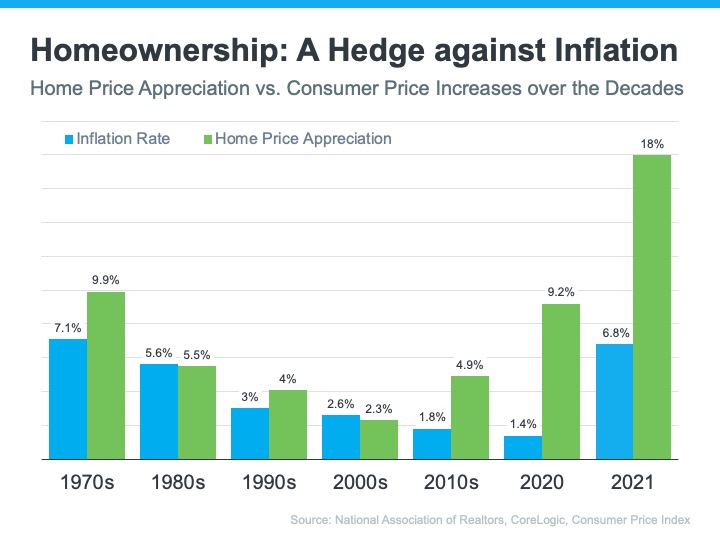

How Owning a Home Builds Your Net Worth

How Owning a Home Builds Your Net Worth Owning a home is a major financial milestone and an achievement to take pride in. One major reason: the equity you build as a homeowner gives your net worth a big boost. And with high inflation right now, the link between owning...

Should I wait to buy a home?

Part 4 Should I wait to buy a home? This is probably one of the biggest questions you’re getting asked right now, and it’s never been more important to have a good answer for it. Even though purchasing a home today may not be as easy as it was a couple of years ago,...

What will happen the second half of this year?

Part 3 What will happen the second half of this year? Yes, we are seeing a slowdown. However, we are really just heading back toward the market pace we saw pre-pandemic, and those were still great years for real estate. Focus on the big picture, and that’s this: the...

Expert Housing Market Forecasts for the Second Half of the Year

Expert Housing Market Forecasts for the Second Half of the Year The housing market is at a turning point, and if you’re thinking of buying or selling a home, that may leave you wondering: is it still a good time to buy a home? Should I make a move this year? To help...

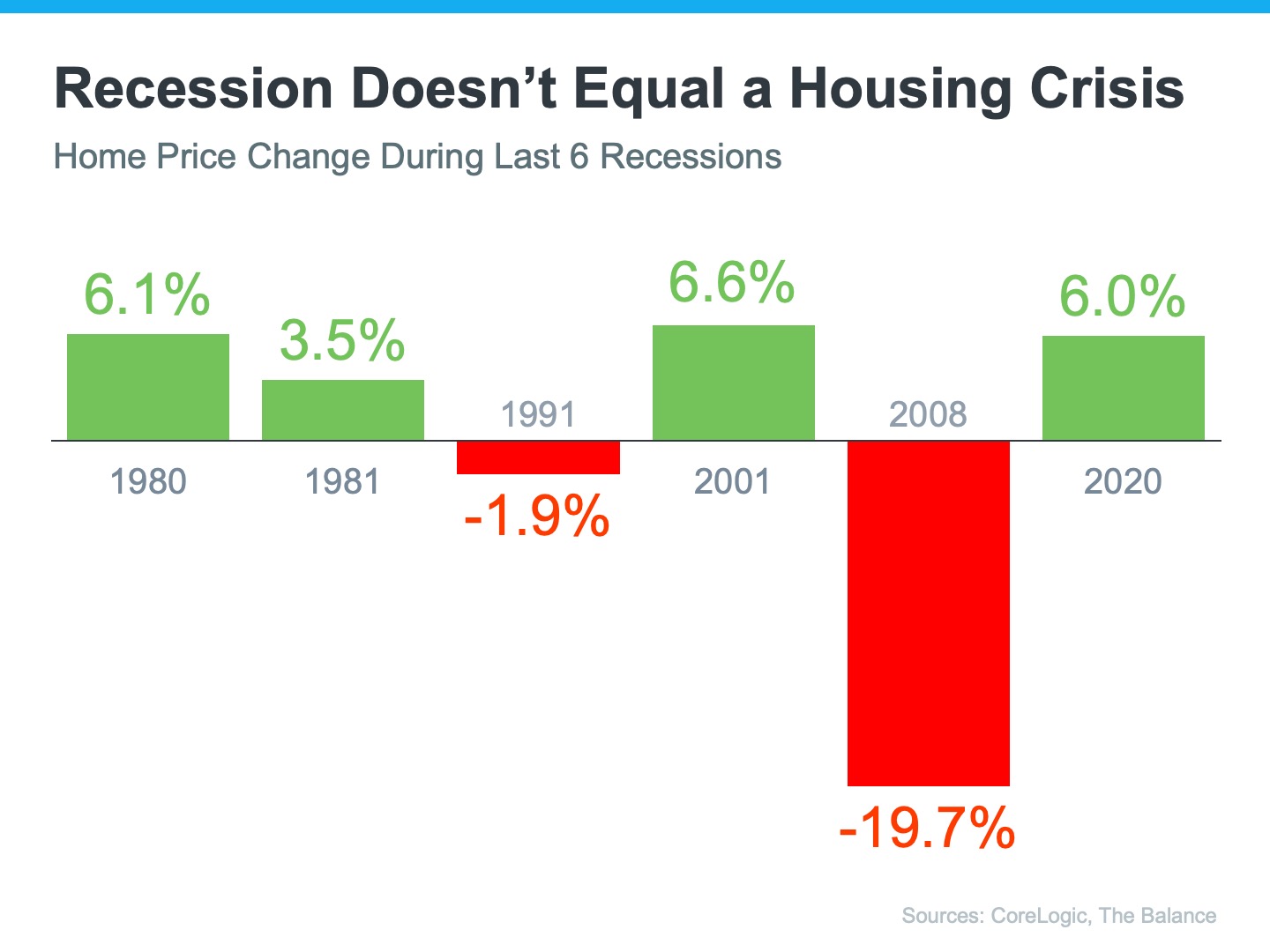

If the economy slows further, what does that mean for real estate?

IN TIMES OF UNCERTAINTY, PEOPLE FOLLOW THE CERTAIN Part 3 If the economy slows further, what does that mean for real estate? Post-2009, nothing will strike fear into the hearts of buyers and sellers like the word “recession.” But as the economy slows down, history...

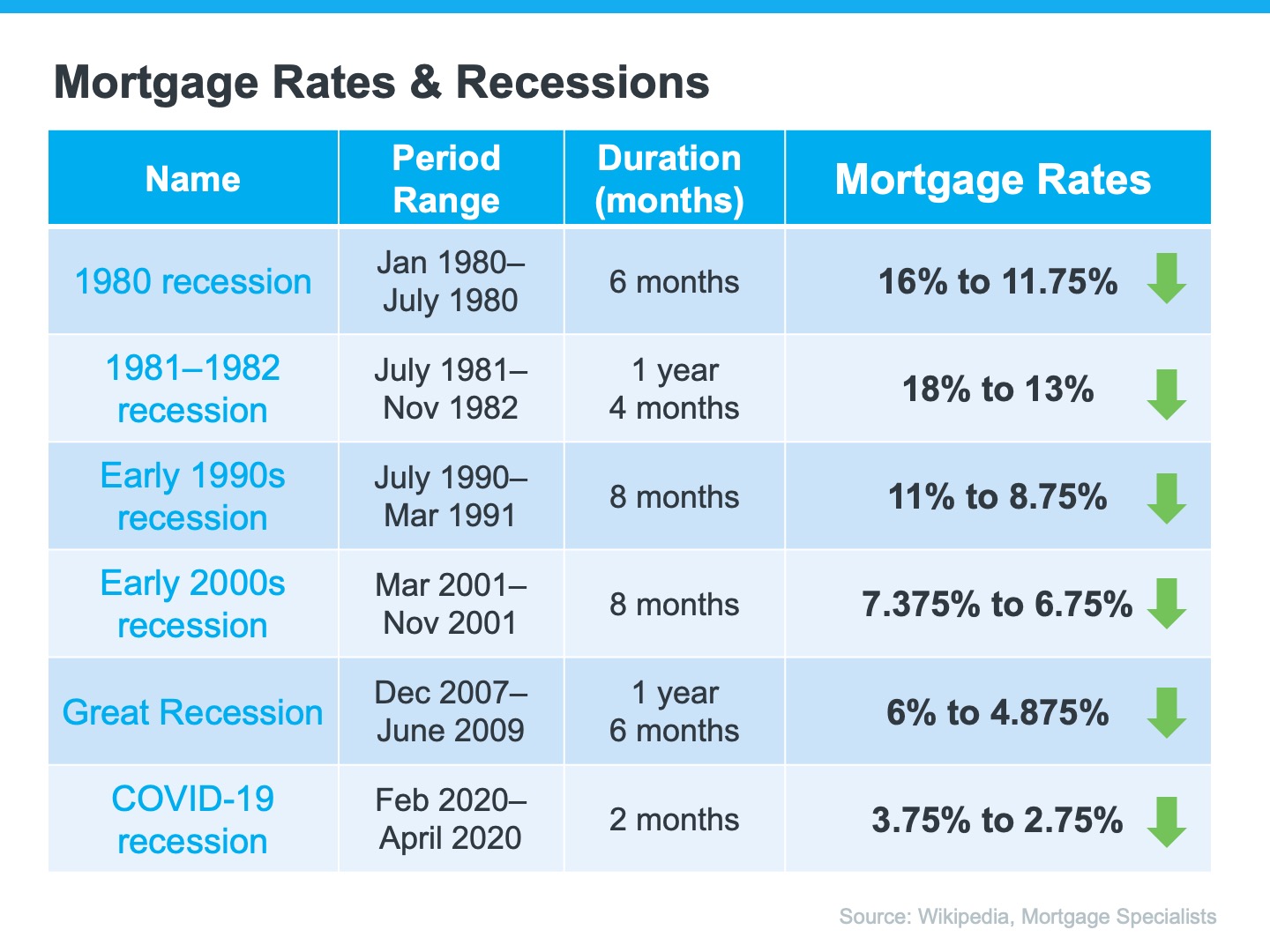

What’s happening with mortgage rates, now and in the future? Part 2

What’s happening with mortgage rates, now and in the future? Rising mortgage rates are no doubt one of the biggest factors impacting the housing market right now. But it’s important to remind your clients that the low rates of the last few years were an anomaly. As...

The market has shifted, and that’s a good thing.

IN TIMES OF UNCERTAINTY, PEOPLE FOLLOW THE CERTAIN – top five housing market questions Over the next 5 days we will post the top 5 questions everyone is asking. Question one: Is the housing market going to crash? Answer: Headlines right now scare consumers that the...