Hand Picked Top Lenders We Know, Trust and Recommend

Hand Picked Top Lenders We Know, Trust and Recommend

Each of these individuals have their own unique qualities and loan programs

Meet Our Mortgage Lenders

Samantha Quirante

Mortgage Loan Officer – Mountain America Credit Union

5899 S State St

Murray UT 84107

Office: 801-325-6172

Cell: 801-793-0511

NMLS 487126

squirante@macu.com

https://www.macu.com/squirante

Marc Johnson –

Anthony VanDyke

Mortgage Broker & President

7390 Creek Rd #201 Sandy, UT 84093

Phone: 801-206-4343

801-206-4343

anthony@alvmortgage.com

Anna Sengsouvanna

Loan Advisor

Jordan Landing

Office: 801-260-7801

Cell: 801-230-4543

Fax: 801-988-8317

NMLS ID#: 807021

Cyprus Credit Union Website

Asegns@cypruscu.com

Abigail Rasmussen

Mortgage Loan Officer NMLS#1005501

Key Bank Special Loan Programs

Mortgage Loan Officer | Abigail Rasmussen | KeyBank

Office: 801-344-7039

Cell: 801-735-2888

Fax: 801-225-8388

Lori Thompson

Branch Manager – Veritas Funding

News and Blog Posts

Is It Enough To Offer Asking Price in Today’s Housing Market?

Is It Enough To Offer Asking Price in Today’s Housing Market? If you’re planning to buy a home this season, you’re probably thinking about what you’ll need to do to get your offer accepted. In previous years, it was common for buyers to try and determine how much less...

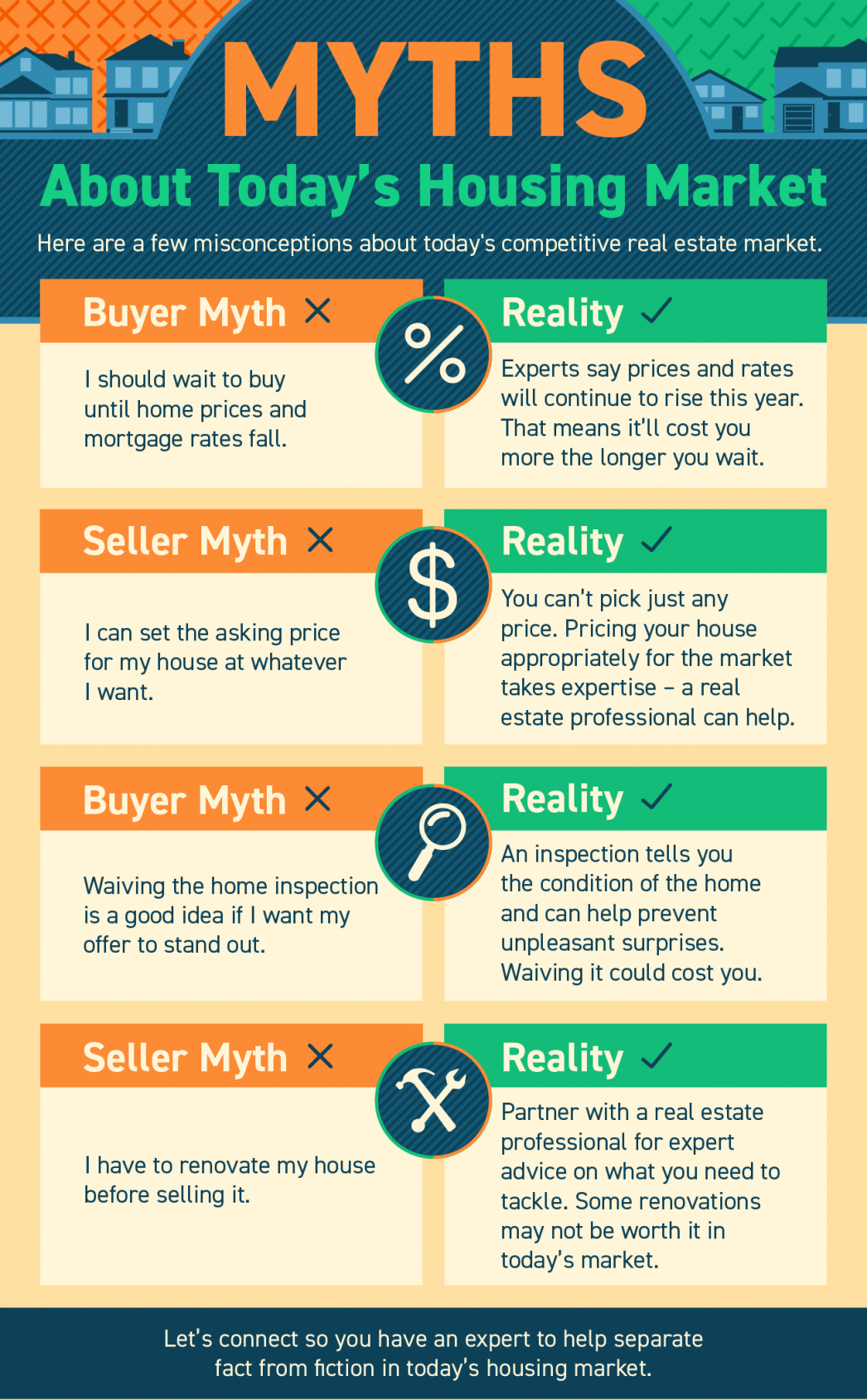

Myths About Today’s Housing Market

Myths About Today’s Housing Market Some Highlights If you’re planning to buy or sell a home today, it’s important to be aware of common misconceptions. Whether it’s timing your purchase as a buyer based on home prices and mortgage rates or knowing what to upgrade or...

Why This Housing Market Is Not a Bubble Ready To Pop

Why This Housing Market Is Not a Bubble Ready To Pop Homeownership has become a major element in achieving the American Dream. A recent report from the National Association of Realtors (NAR) finds that over 86% of buyers agree homeownership is still the American...

How the Appraisal and Inspection Empower You as a Homebuyer

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...

Where Are Mortgage Rates Headed?

Where Are Mortgage Rates Headed? There’s never been a truer statement regarding forecasting mortgage rates than the one offered last year by Mark Fleming, Chief Economist at First American: “You know, the fallacy of economic forecasting is: Don't ever try and forecast...

Why a Real Estate Professional Is Key When Selling Your House

Why a Real Estate Professional Is Key When Selling Your House With today’s real estate market moving as fast as it is, working with a real estate professional is more essential than ever. They have the skills, experience, and expertise it takes to navigate the highly...

Using Your Tax Refund To Achieve Your Homeownership Goals This Year

Using Your Tax Refund To Achieve Your Homeownership Goals This Year If you’re buying or selling a home this year, you’re likely saving up for a variety of expenses. For buyers, that might include things like your down payment and closing costs. And for sellers, you’re...

The Future of Home Price Appreciation and What It Means for You

The Future of Home Price Appreciation and What It Means for You Many consumers are wondering what will happen with home values over the next few years. Some are concerned that the recent run-up in home prices will lead to a situation similar to the housing crash 15...

Balancing Your Wants and Needs as a Homebuyer Today

Balancing Your Wants and Needs as a Homebuyer Today Since the number of homes for sale is low today, it can feel challenging to find one that checks all your boxes. But if you know which features are absolutely essential in your next home and which ones are just nice...

What’s Happening with Mortgage Rates, and Where Will They Go from Here?

What’s Happening with Mortgage Rates, and Where Will They Go from Here? Based on the Primary Mortgage Market Survey from Freddie Mac, the average 30-year fixed-rate mortgage has increased by 1.2% (3.22% to 4.42%) since January of this year. The rate jumped by more...

Some of our past clients comments, raves and recommendations.

“Marty Gale far exceeded our expectations as a Buyers Agent in the recent purchase of our home. His knowledge of the Utah real estate market is exceptional and with his experience in residential home construction he was able to provide beneficial advice in selecting well-built homes. The network of professionals that Marty works with are top shelf, his recommendations for home inspection and mortgage broker were perfect. Customer service from this team of professionals is some of the best we have worked with; this is our fifth home purchase. You will not be disappointed in choosing to work with Marty!”