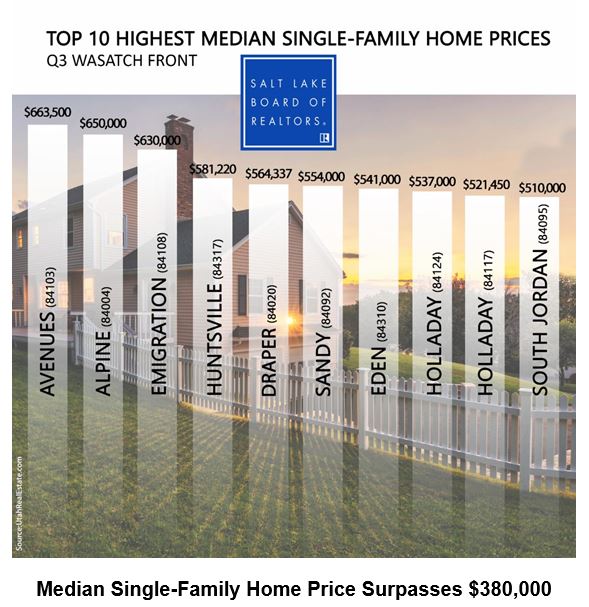

Top 10 Highest Median Single-Family Home Prices along the Greater Wasatch Front

Salt Lake County home prices climbed to an all-time high in the third quarter, according to the Salt Lake Board of Realtors®. The median single-family home price in the July-through-September period reached $381,500. That’s up 7.5 percent compared to a median price of $355,000 in last year’s third quarter. Just three years ago, the median single-family home price reached $300,000, which was then an all-time high price. The previous peak home price was in the third quarter of 2007, when home prices topped $256,000 (or $298,085 in inflation-adjusted dollars). Home prices increased across all Wasatch Front counties including: Davis, up 6.2 percent; Tooele, up 2.6 percent; Utah, up 4.4 percent; and Weber, up 10.3 percent. Sales of single-family homes in Salt Lake County were flat (up 0.7 percent) in the third quarter year-over-year. Davis County saw sales increase 9.8 percent. Sales in Tooele County were up 4.7 percent. Utah County sales were up 11.8 percent. Sales in Weber County were up 12.1 percent. In the third quarter, the typical Salt Lake home was on the market 37 days before it sold – six days longer than the average time for a home to sell during the third quarter of 2018

Does the News have you Scared

Don’t Let Frightening Headlines Scare YouThere’s a lot of anxiety right now regarding the coronavirus pandemic. The health situation must be addressed quickly, and many are concerned about the impact on the economy as well.Amidst all this anxiety, anyone with a...

According to the Salt Lake Board of Realtors®Salt Lake home sales year-to-date are roughly the same as they were last year at this time. While everyday life has changed, the current economic quarantine could be short-lived, according to Lawrence Yun, chief economist...

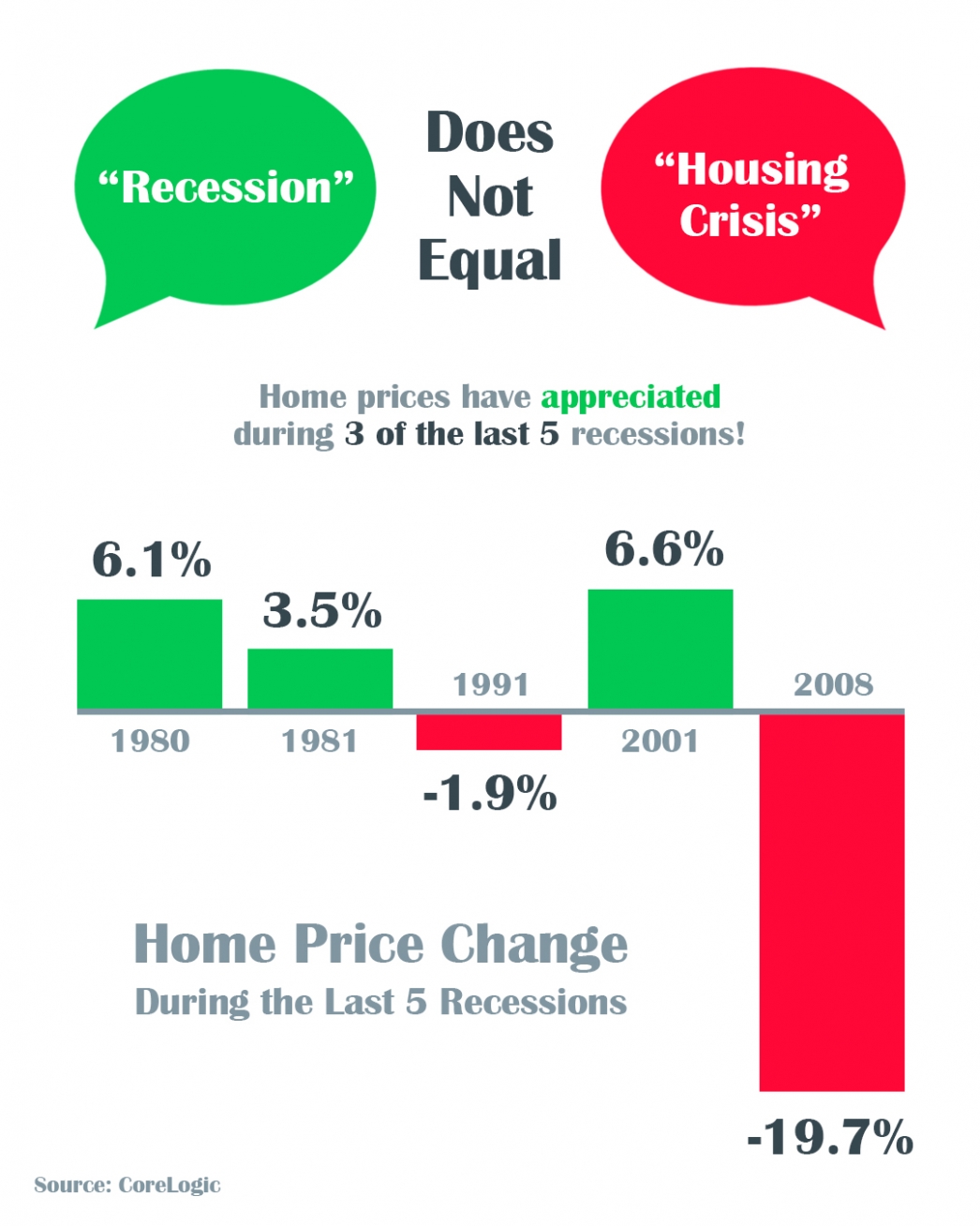

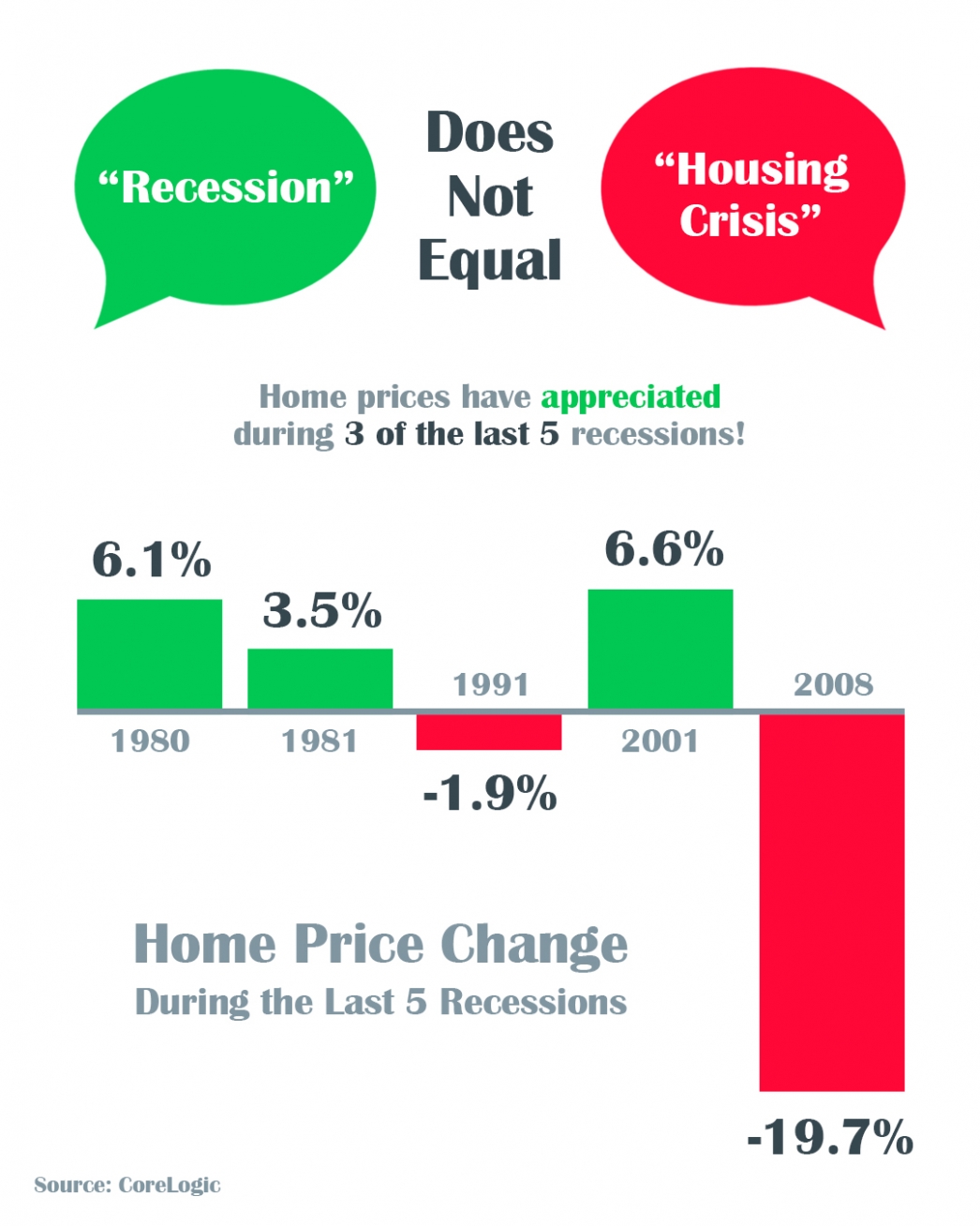

A Recession Does Not Equal a Housing Crisis

A Recession Does Not Equal a Housing Crisis Some HighlightsThe COVID-19 pandemic is causing an economic slowdown.The good news is, home values actually increased in 3 of the last 5 U.S. recessions and decreased by less than 2% in the 4th.All things considered, an...

Why the Stock Market Correction Probably Won’t Impact Home Values

Why the Stock Market Correction Probably Won’t Impact Home ValuesWith the housing crash of 2006-2008 still visible in the rear-view mirror, many are concerned the current correction in the stock market is a sign that home values are also about to tumble. What’s taking...

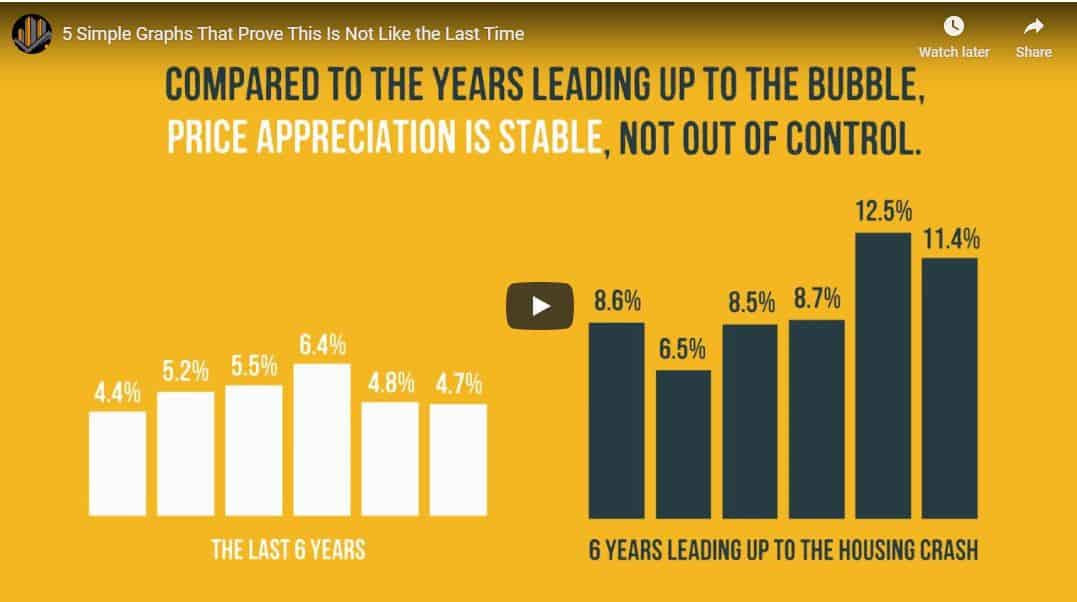

5 Simple Graphs That Prove This Is Not Like the Last Time

A Recession Does Not Equal a Housing Crisis

A Recession Does Not Equal a Housing Crisis Some HighlightsThe COVID-19 pandemic is causing an economic slowdown.The good news is, home values actually increased in 3 of the last 5 U.S. recessions and decreased by less than 2% in the 4th.All things considered, an...

Coronavirus Map

View the the interactive map https://google.org/crisisresponse/covid19-map

Coronavirus (COVID-19)

Notice the On Set Dates Below

Three Reasons Why This Is Not a Housing Crisis

Three Reasons Why This Is Not a Housing Crisis In times of uncertainty, one of the best things we can do to ease our fears is to educate ourselves with research, facts, and data. Digging into past experiences by reviewing historical trends and understanding the peaks...