Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.

Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score– Even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® for all closed loans in September was 737, according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

Mortgage Rates for 2018

https://goo.gl/Pw4cmy

Why Work with a Realtor

8 Reasons Why You Should Work With a REALTOR® Not all real estate practitioners are REALTORS®. The term REALTOR® is a registered trademark that identifies a real estate professional who is a member of the NATIONAL ASSOCIATION of REALTORS® and subscribes to...

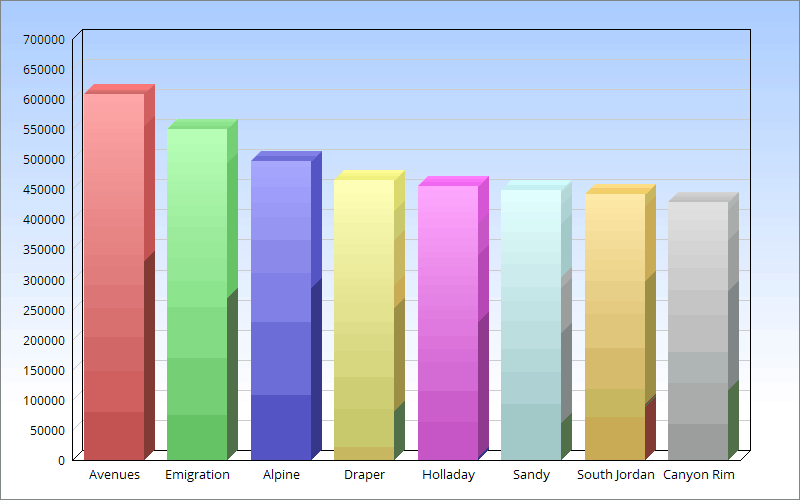

Salt Lake County Home Prices

[masterslider id="1"] SANDY (Oct. 31, 2017) – The price of a single-family home increased to its highest point ever before, according to the Salt Lake Board of Realtors®. In the July-August-September quarter, the median price of a Salt Lake County...

Realtors with HEART

Helping Families With Home Matters Real Estate With H.E.A.R.T. H onest, Helpful E xtraordinary A chieve, Action, Amazed R ealistic, Remarkable, Responsible, Ready T op Producing, Trustworthy NEVER MISS A PRICE DROP OR NEW LISTING SAVE...

Outdoor Kitchens

5 KITCHEN STYLES TO WATCH FOR

The L-shaped kitchen has nudged aside the U-shaped kitchen to become the most popular layout among U.S. homeowners changing their kitchen layout in a remodel, according to recent Houzz data. And farmhouse style has unseated traditional style for a spot in...

Find Cheap Homes for Sale in Utah

UTAH Short Sales, FSBO, Bank Owned, and Tax Sales Bargains Search bargain homes in Utah now to see the freshest listings of short sales, rent to own and tax sales. Buy from a seller using these creative sales strategies, and you can save you thousands on...

Wasatch County Cheap Homes

Bargain homes and other real estate in Wasatch County, Utah Search Wasatch County, Utah Bargain homes. See information on particular Bargain home or get Wasatch County, Utah real estate trend as you search. Besides our Bargain homes, you can find other...

Utah Realty News & Blog

South Jordan City Leisure Guide

[flipbook pdf="https://utahrealtyluxury.com/wp-content/uploads/2018/01/South-Jordan-Leisure-Guide-Jan1_18.pdf"] Here are the events that South Jordan City is planning on for Januarary thru April . South Jordan Leisure Guide Jan1_18