Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.

Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score– Even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® for all closed loans in September was 737, according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

Applying For a Mortgage? Here’s What You Should Avoid Once You Do.

Applying For a Mortgage? Here’s What You Should Avoid Once You Do. While it’s exciting to start thinking about moving in and decorating after you’ve applied for your mortgage, there are some key things to keep in mind before you close. Here’s a list of things you may...

Financial Fundamentals for First-Time Homebuyers Are you prepping to buy your first home? If so, one of the steps you should take early on is making sure you’re financially ready for your purchase. Here are just a few of the financial fundamentals you’ll need to focus...

Utah Realty Marty & Laurie Gale

Thank You for All of Your Support

What To Expect From the Housing Market in 2023

What To Expect From the Housing Market in 2023 The 2022 housing market has been defined by two key things: inflation and rapidly rising mortgage rates. And in many ways, it's put the market into a reset position. As the Federal Reserve (the Fed) made moves this year...

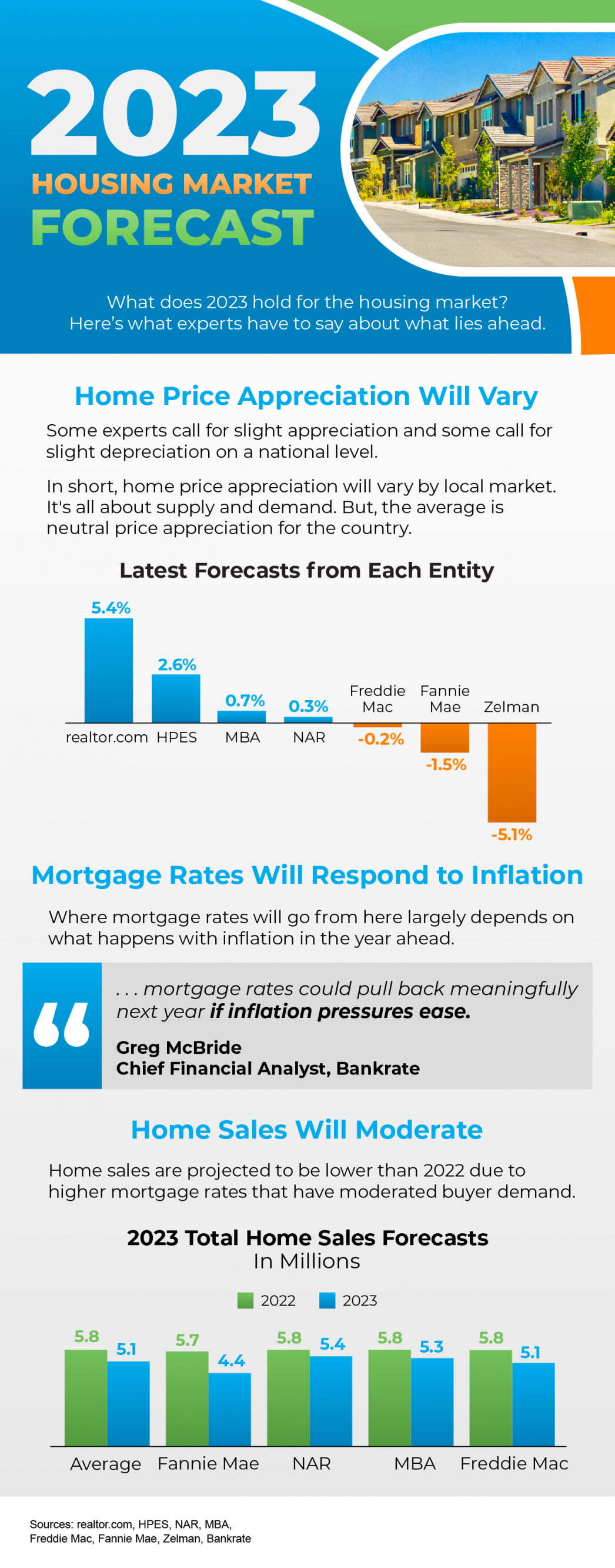

2023 Housing Market Forecast (National)

2023 Housing Market Forecast Some Highlights From home sales to prices, the 2023 housing market will be defined by mortgage rates. And where rates go depends on what happens with inflation. If you’re thinking of buying or selling a home this year, let’s connect so you...

Planning to Retire? It Could Be Time To Make a Move

Planning to Retire? It Could Be Time To Make a Move. If you’re thinking about retirement or have already retired this year, you may be planning your next steps. One of your goals could be selling your house and finding a home that more closely fits your needs....

You May Have More Negotiation Power When You Buy a Home Today

You May Have More Negotiation Power When You Buy a Home Today Did the frequency and intensity of bidding wars over the past two years make you put your home search on hold? If so, you should know the hyper competitive market has cooled this year as buyer demand has...

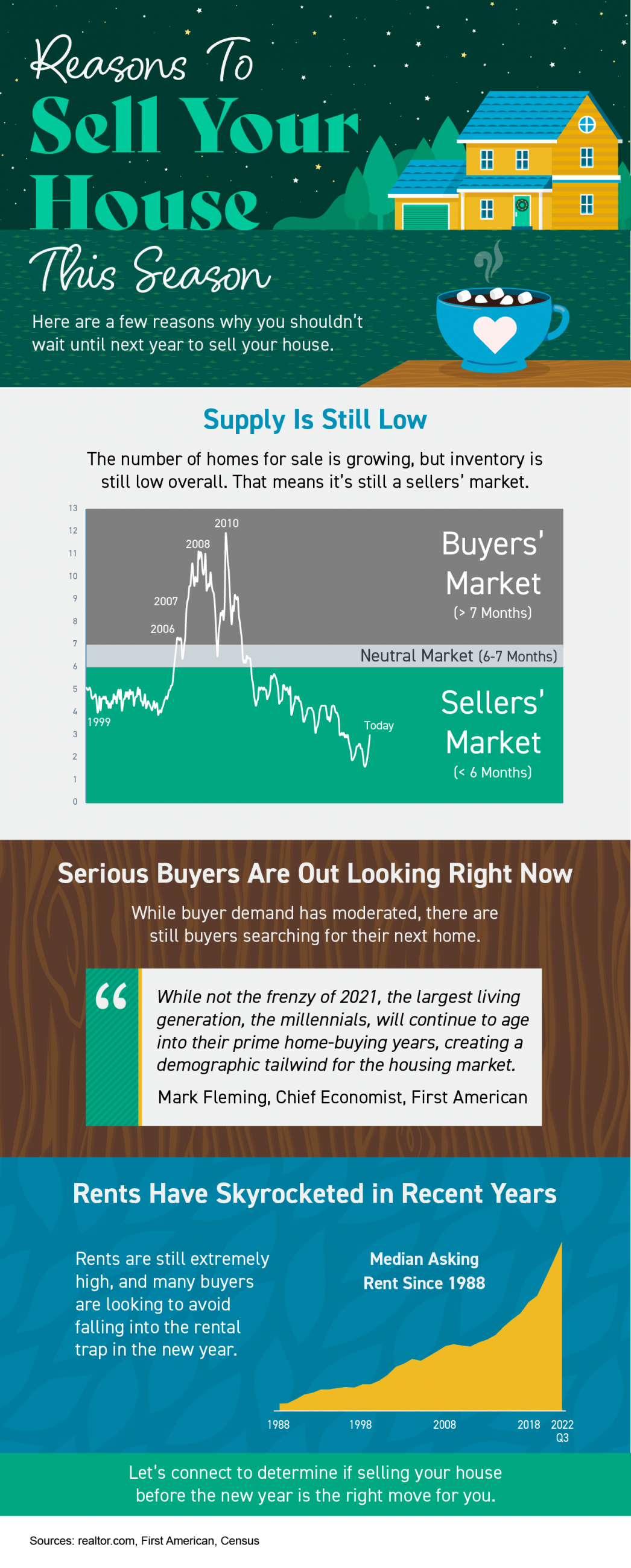

Reasons To Sell Your House This Season

Reasons To Sell Your House This Season Some Highlights If you’re planning to make a move but aren’t sure if now’s the right time, here are a few reasons why you shouldn’t wait to sell your house. The supply of homes for sale, while growing, is still low today....

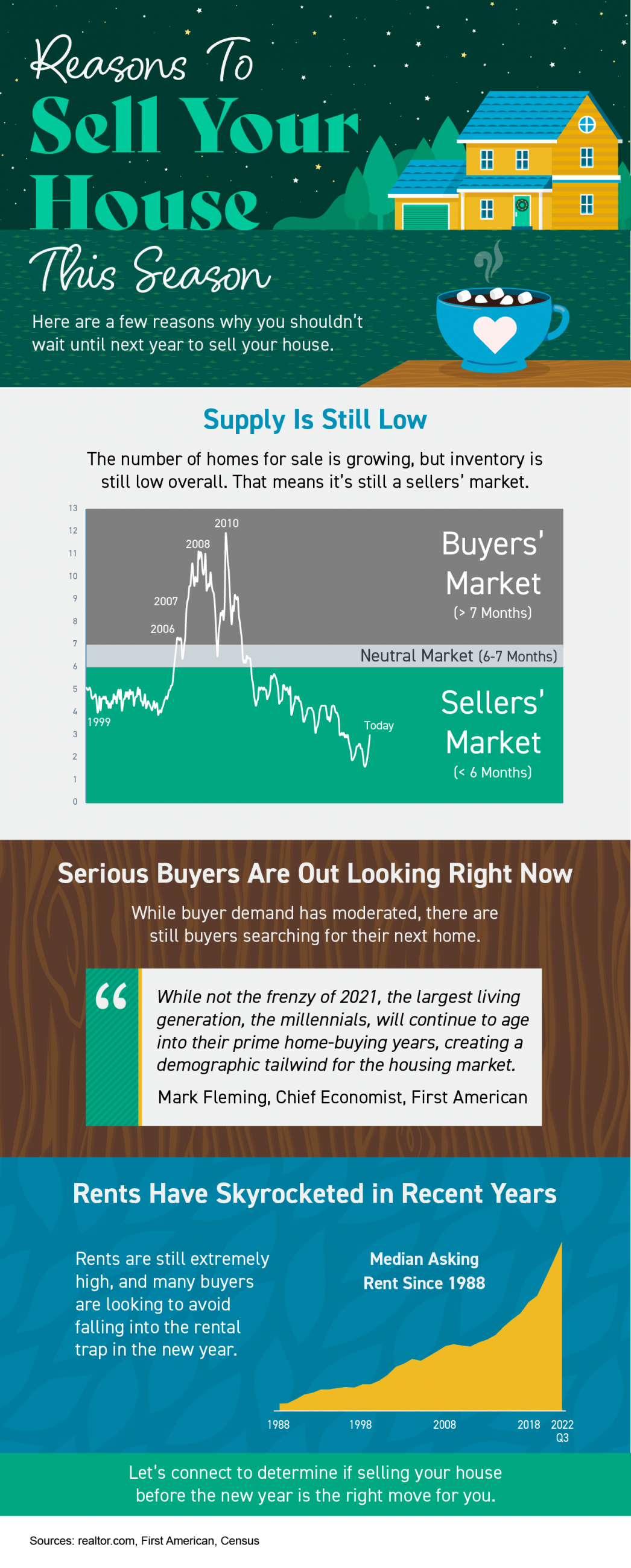

Reasons To Sell Your House This Season

Reasons To Sell Your House This Season Some Highlights If you’re planning to make a move but aren’t sure if now’s the right time, here are a few reasons why you shouldn’t wait to sell your house. The supply of homes for sale, while growing, is still low today....

Homeownership Is an Investment in Your Future

Homeownership Is an Investment in Your Future There are many people thinking about buying a home, but with everything affecting the economy, some are wondering if it’s a smart decision to buy now or if it makes more sense to wait it out. As Bob Broeksmit, President...