Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.

Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score– Even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® for all closed loans in September was 737, according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

Will Home Prices Rise In 2019

What is Important to Boomers when Selling their House

What is Important to Boomers when Selling their House? If you are a “baby boomer” (born between 1946 and 1964), you may be thinking about selling your current home. Your children may have finally moved out. Your large, four-bedroom house with three bathrooms no longer...

The Feeling You Get from Owning Your Home – Utah Realty

The Feeling You Get from Owning Your Home We often talk about the financial reasons why buying a home makes sense. But, more often than not, the emotional reasons are the more powerful and compelling ones. No matter what shape or size your living space is, the concept...

Top 5 reasons to own a home

June is National Homeownership Month

Some Highlights: June is National Homeownership Month! Now is a great time to reflect on the many benefits of homeownership that go way beyond the financial. What reasons do you have to own your own home?

Housing Affordability Index Today

The Ultimate Truth about Housing Affordability Courtesy of Marty Gale Utah Realty There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the...

Utah Realty – Utah is Number Three with New Homes Built

Utah Realty – 2 Things You Need to Know to Properly Price Your Home

2 Things You Need to Know to Properly Price Your Home In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high...

Remember Our Fallen Heroes

All Gave Some. Some Gave All. The Memorial Day of May 27th 2019 We remember, today and always.

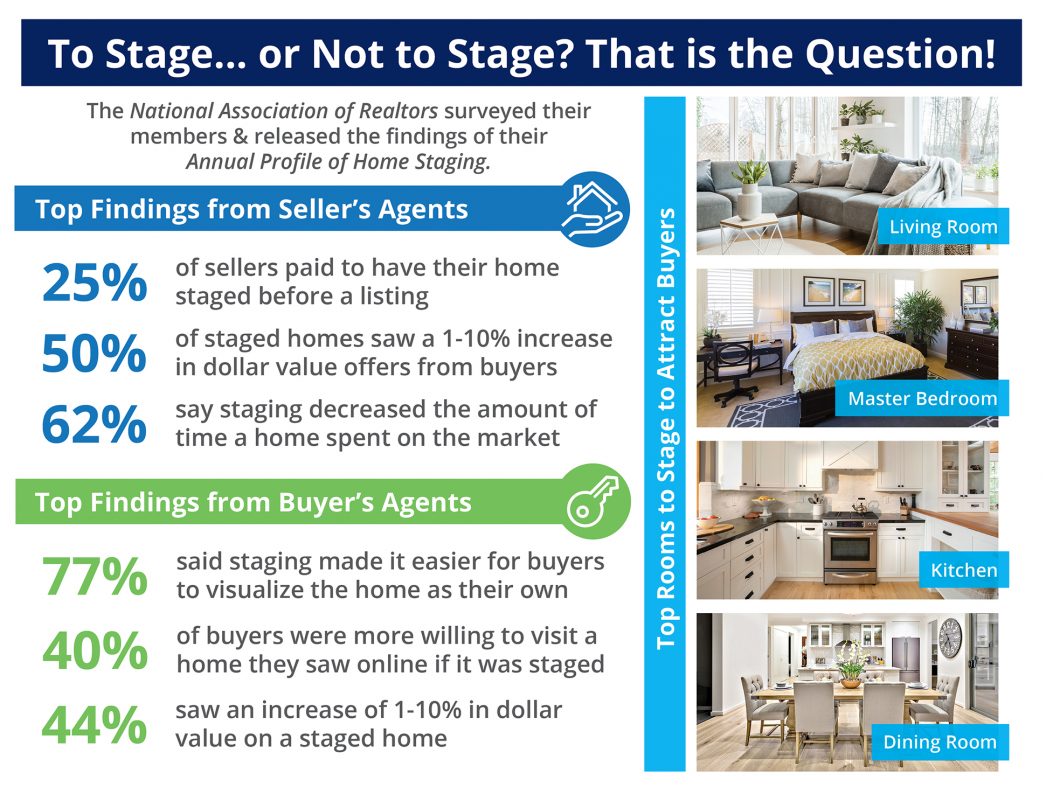

Utah Realty Blog of the day – Impact of home staging

The Impact Staging Your Home Has On Your Sale Price. Utah Realty educational blog of the day Some Highlights: The National Association of Realtors surveyed their members & released the findings of their Profile of Home Staging. 62% of seller’s agents say that...