Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.

Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score– Even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® for all closed loans in September was 737, according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

If you are Thinking about Selling and Live in Utah? You should read this first!

If you are Thinking about Selling and Live in Utah? You should read this first! Why Now Is the Perfect Time to Sell Your House As a homeowner, it’s always tempting to dream about the next big project you’re going to tackle. The possibilities are endless. Should I...

Utah Realty Expert Insights On Inventory In The Current Market

3 Expert Insights On Inventory In The Current Market The current housing landscape presents greater home values, low interest rates, and high buyer demand. All of these factors point to the strong market forecasted to continue throughout the rest of the year. There...

What Experts are Saying About the Current Housing Market

What Experts are Saying About the Current Housing Market We’re halfway through the year, and with a decline in interest rates as well as home price and wage appreciation, many are wondering what the experts predict for the second half of 2019. Here’s what some have to...

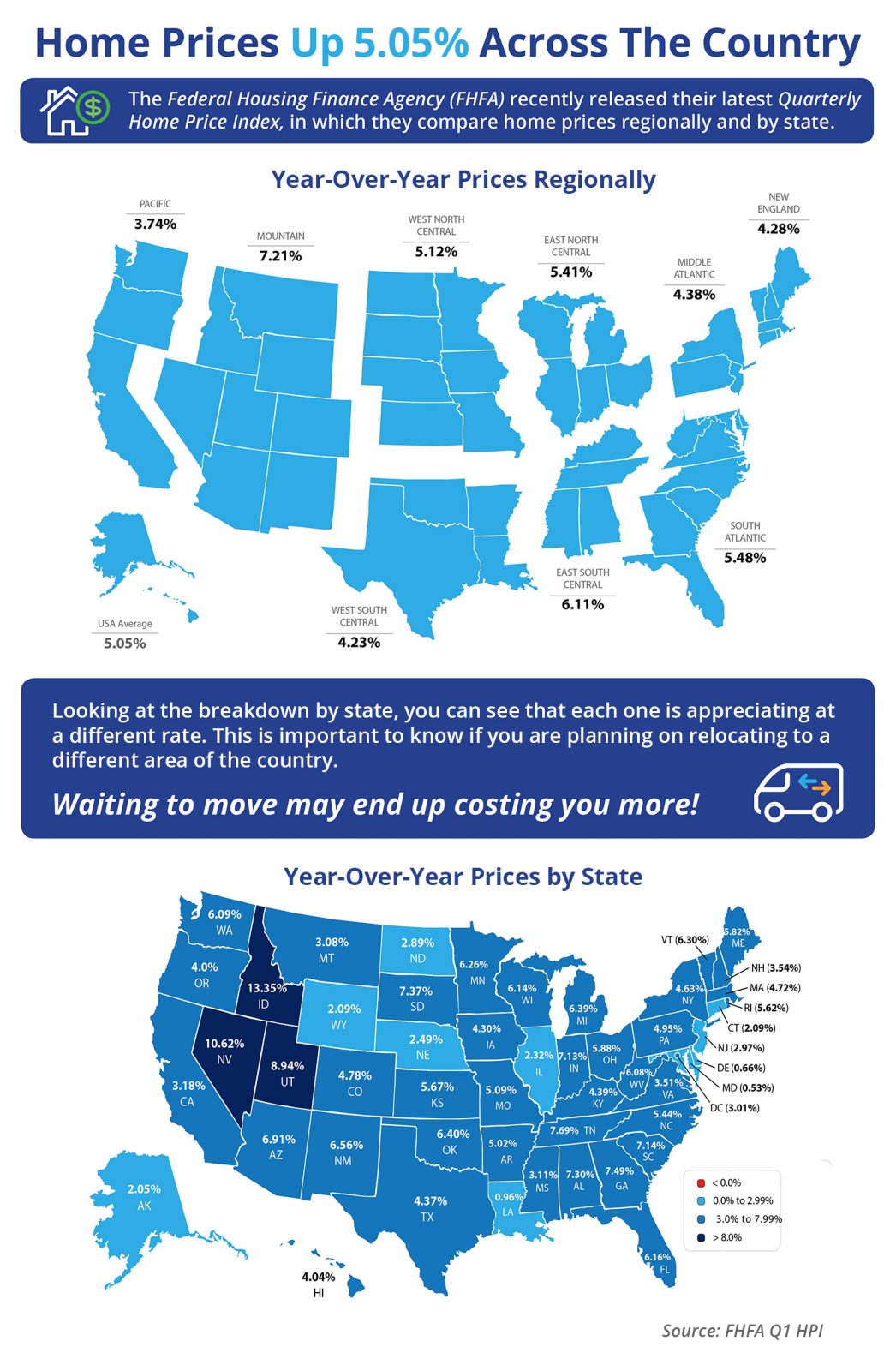

Home Prices Up 5.05% Across the Country Utah is just under nine percent

Home Prices Up 5.05% Across the Country [INFOGRAPHIC] Some Highlights: The Federal Housing Finance Agency (FHFA) recently released their latest Quarterly Home Price Index report. In the report, home prices are compared both regionally and by state. Based on the latest...

Salt Lake City Median House Prices

Wasatch Front median home prices bottomed in 2011, years after The Great Recession ended. Since then, home prices (all housing types) have been on the rise. The median price of Wasatch Front homes sold in the first quarter of this year was $308,000, 75 percent higher...

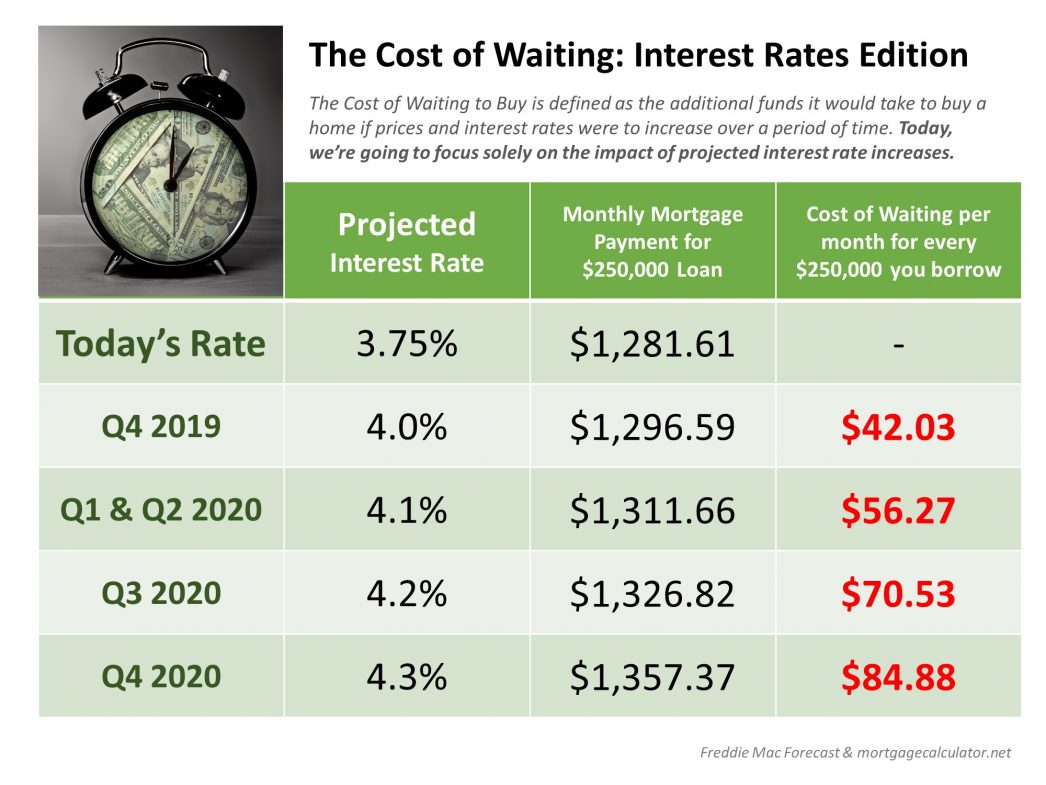

The Cost of Waiting: Interest Rates Edition

Some Highlights: Interest rates are projected to increase steadily heading into 2020. The higher your interest rate, the more money you will end up paying for your home and the higher your monthly payment will be. Rates are still low right now – don’t wait until they...

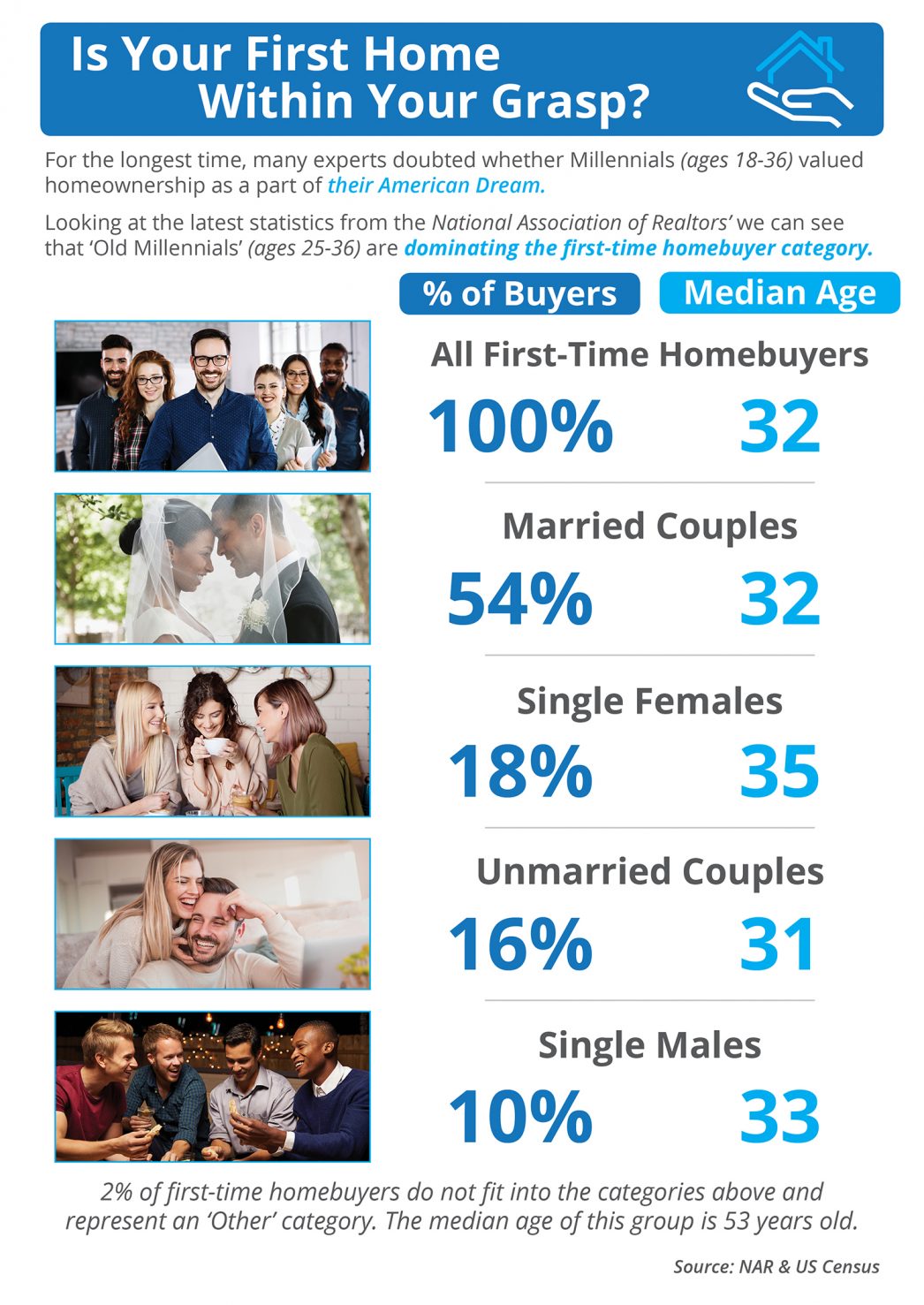

Is Your First Home Now Within Your Grasp?

Is Your First Home Now Within Your Grasp? Some Highlights: According to the US Census Bureau, “millennials” are defined as 18-36-year-olds. According to NAR’s latest Profile of Home Buyers & Sellers, the median age of all first-time home buyers is 32. More and...

Utah is Number Three in the nation in house-price appreciation.

Utah is No. 3 in the nation in house-price appreciation. In the first quarter, prices in the Beehive state increased 8.94 percent, according to the Federal Housing Finance Agency. Idaho was No. 1 in price increases. Maryland came in last place. Home prices there...

4 Tips to Sell Your Home Faster

4 Tips to Sell Your Home Faster Since June of last year, we have seen an increase in the inventory of homes for sale month per month. Every spring and summer, the inventory increases because people want to sell their home. For those with children, they may want to be...

Time to Move-Up and Upgrade Your Current Home With Utah Realty

Now’s the Time to Move-Up and Upgrade Your Current Home! Homes priced at the top 25% of the price range for a particular area of the country are considered "premium homes." In today’s real estate market, there are deals to be had at the higher end! This is great news...