Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.

Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score– Even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® for all closed loans in September was 737, according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

Utah Realty Wishes you a Wonderful 2020

Utah Realty had the best year ever in 2019! Thanks to all our clients, friends, Chambers and Connections! Here’s to a Wonderful 2020! We hope 2020 is a great year for you, both personally and professionally!

Expert Insights on the 2020 Housing Market

Expert Insights on the 2020 Housing Market When closing out another year, it’s normal to wonder what’s ahead for the housing market. Though there will be future inventory issues, we expect interest rates to stay low and appreciation to continue. Here’s what three...

Here are the top 5 reasons not to FSBO (For Sale By Owner)

Why You Shouldn’t “For Sale By Owner” Rising home prices coupled with the current inventory in today's market may cause some homeowners to consider selling their homes on their own (known in the industry as a For Sale By Owner). However, a FSBO might be hard to...

When a House Becomes a Happy Home

When a House Becomes a Happy Home We talk a lot about why it makes financial sense to buy a home, but more often than not we’re drawn to the emotional reasons for homeownership. No matter the size or shape of a living space, the feeling of a home means different...

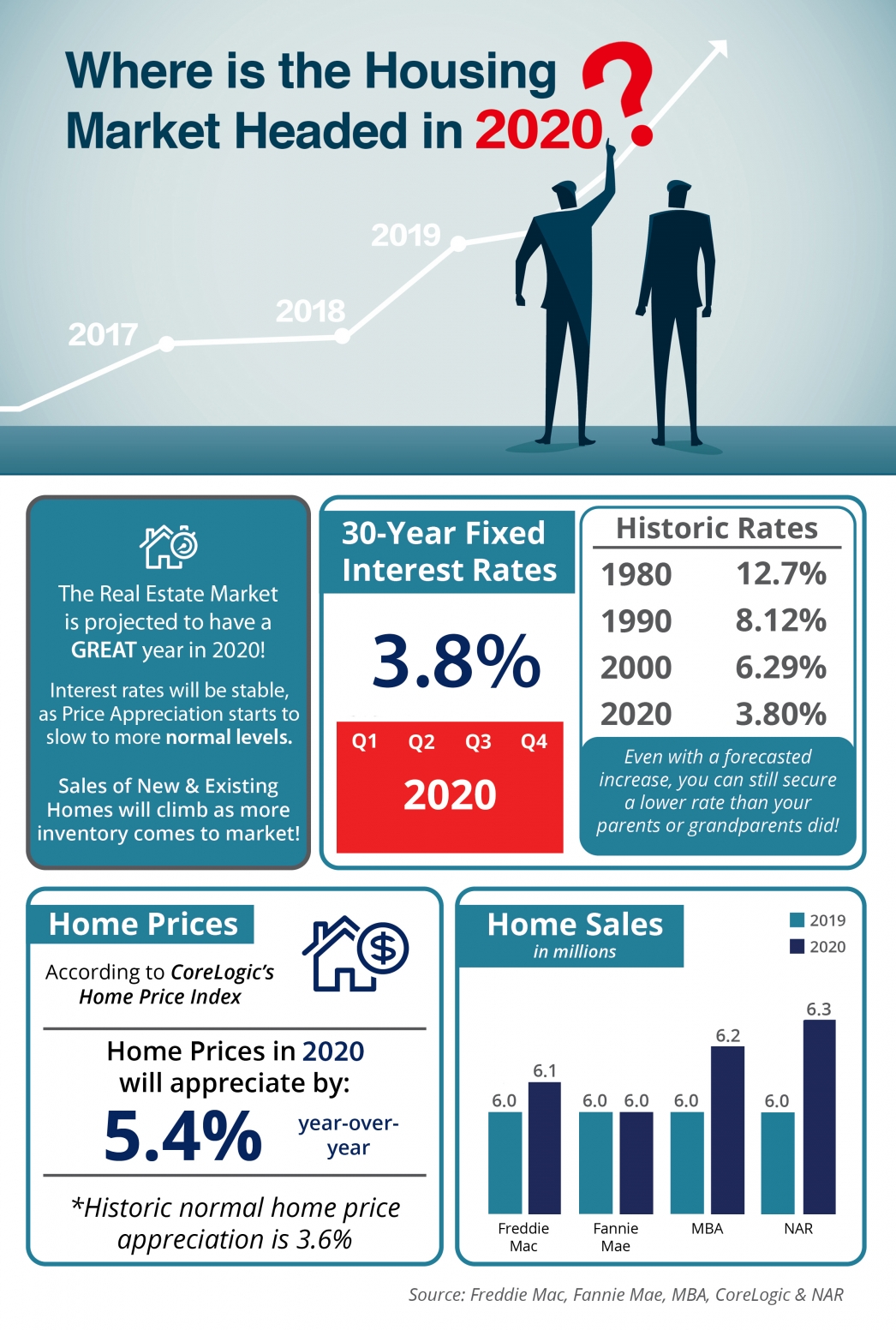

Where is the Housing Market Headed in 2020?

Where is the Housing Market Headed in 2020? [INFOGRAPHIC] Some Highlights: Interest rates will be lower than they have been since before 1980 at 3.8% and are projected to remain steady throughout 2020! According to CoreLogic, home prices will appreciate at a rate of...

2020 Buying and Selling Guides are here!

Get Your House Ready To Sell This Winter – Utah Realty

Get Your House Ready To Sell This Winter Some Highlights Winter is a great time to list a house, since inventory is traditionally low, and most sellers are holding off until spring to put their homes on the market. Waiting for warmer weather when more competition is...

5 Reasons to Sell This Winter -Utah Realty

5 Reasons to Sell This Winter Below are five compelling reasons to list your house this winter. 1. Demand Is Strong The latest Buyer Traffic Report from the National Association of Realtors (NAR) shows that buyer demand remains strong throughout the vast majority of...

Thank You for Your Support from the Gale Team

Thank You for Your Support

Thank You for making me your Trusted Adviser