Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.

Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score– Even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® for all closed loans in September was 737, according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

Does the News have you Scared

Don’t Let Frightening Headlines Scare YouThere’s a lot of anxiety right now regarding the coronavirus pandemic. The health situation must be addressed quickly, and many are concerned about the impact on the economy as well.Amidst all this anxiety, anyone with a...

According to the Salt Lake Board of Realtors®Salt Lake home sales year-to-date are roughly the same as they were last year at this time. While everyday life has changed, the current economic quarantine could be short-lived, according to Lawrence Yun, chief economist...

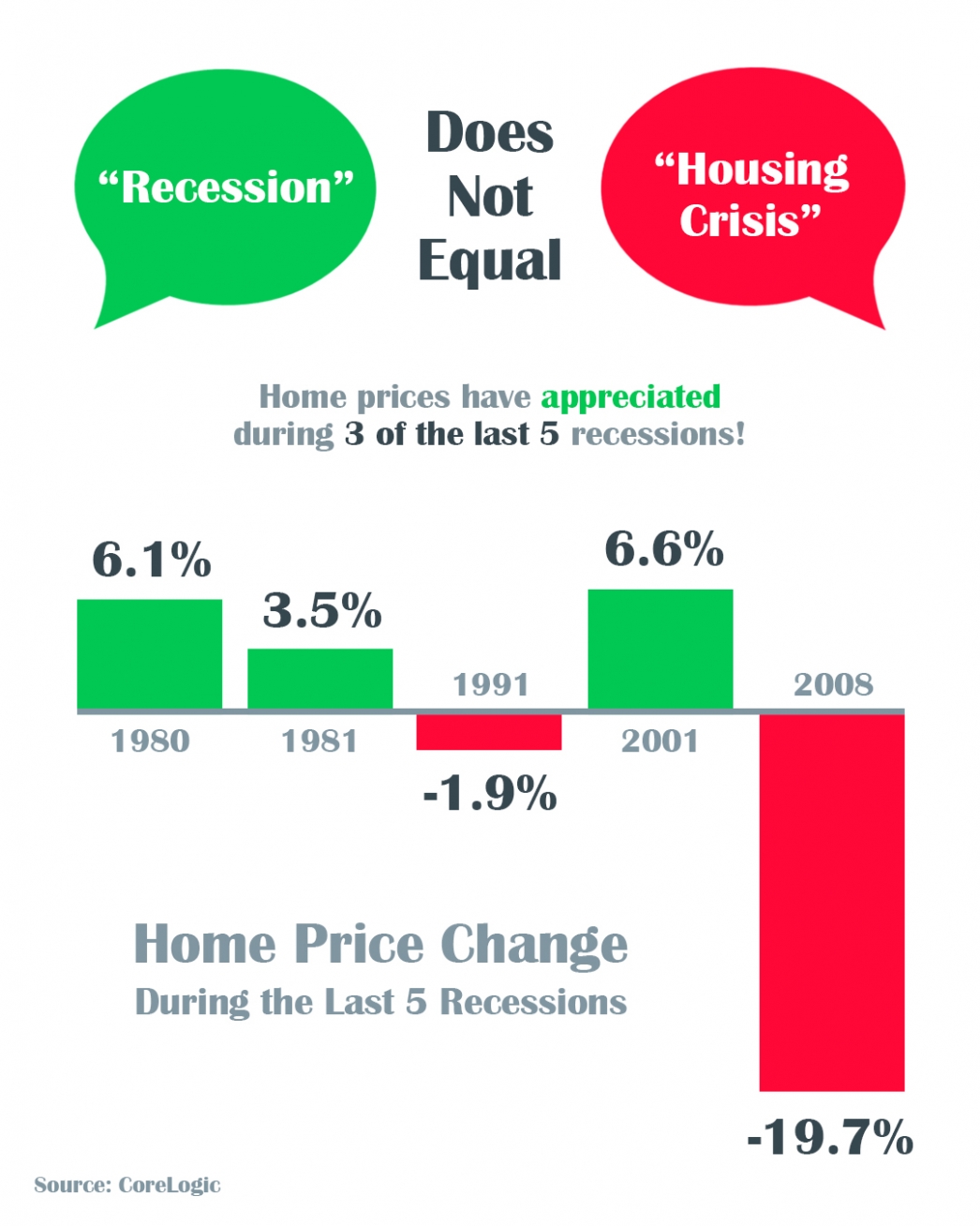

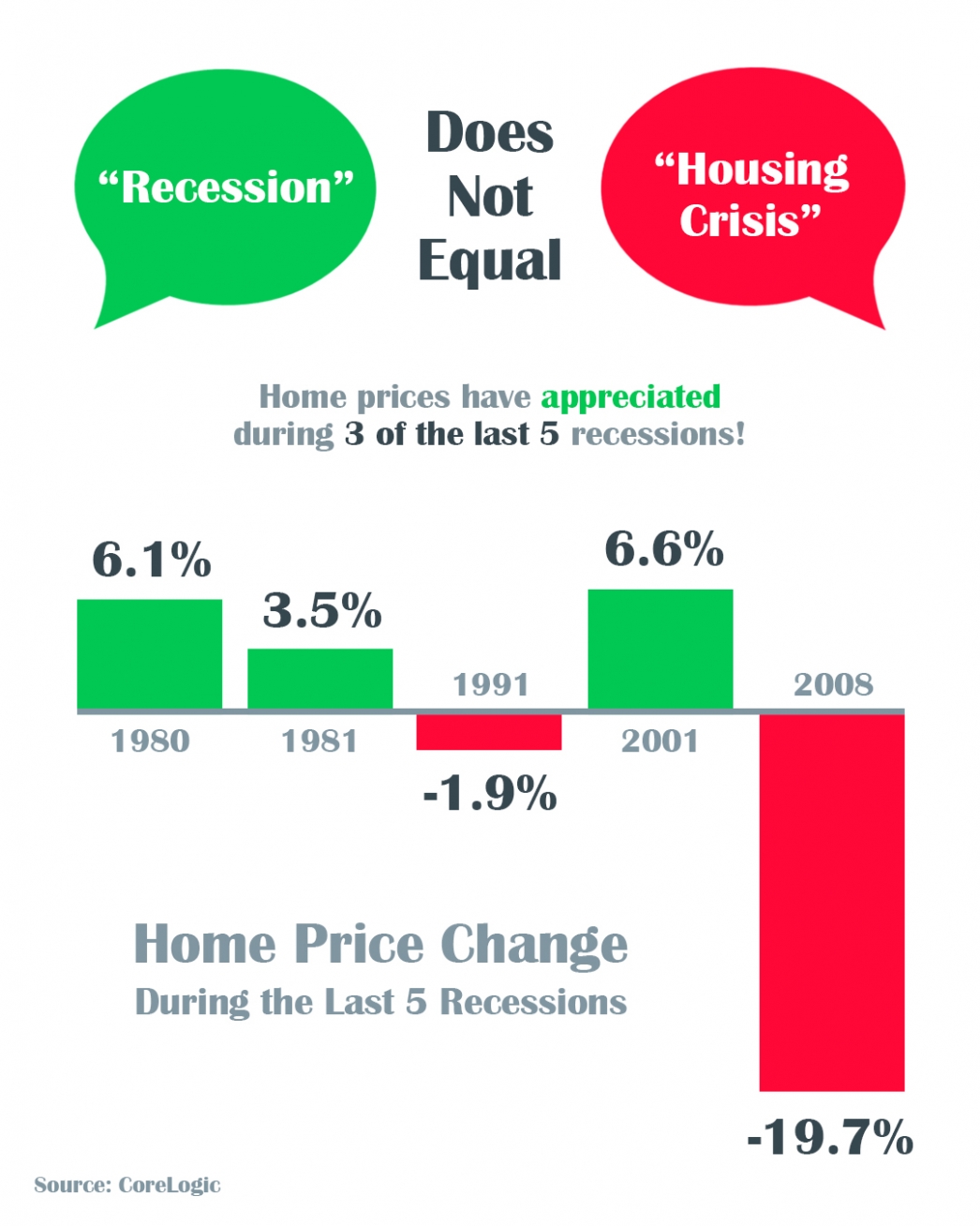

A Recession Does Not Equal a Housing Crisis

A Recession Does Not Equal a Housing Crisis Some HighlightsThe COVID-19 pandemic is causing an economic slowdown.The good news is, home values actually increased in 3 of the last 5 U.S. recessions and decreased by less than 2% in the 4th.All things considered, an...

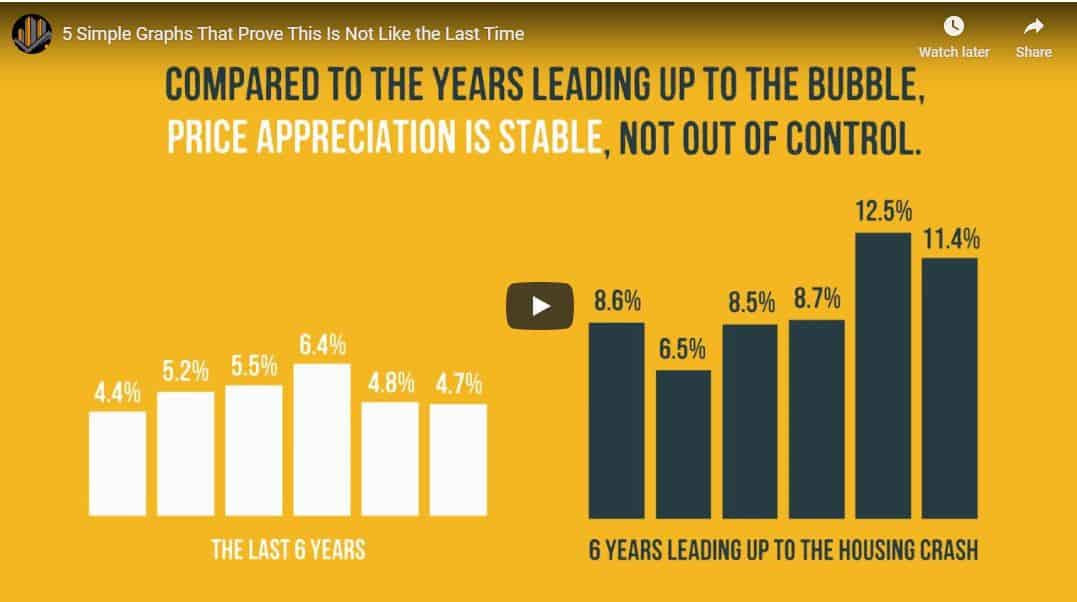

Why the Stock Market Correction Probably Won’t Impact Home Values

Why the Stock Market Correction Probably Won’t Impact Home ValuesWith the housing crash of 2006-2008 still visible in the rear-view mirror, many are concerned the current correction in the stock market is a sign that home values are also about to tumble. What’s taking...

5 Simple Graphs That Prove This Is Not Like the Last Time

A Recession Does Not Equal a Housing Crisis

A Recession Does Not Equal a Housing Crisis Some HighlightsThe COVID-19 pandemic is causing an economic slowdown.The good news is, home values actually increased in 3 of the last 5 U.S. recessions and decreased by less than 2% in the 4th.All things considered, an...

Coronavirus Map

View the the interactive map https://google.org/crisisresponse/covid19-map

Coronavirus (COVID-19)

Notice the On Set Dates Below

Three Reasons Why This Is Not a Housing Crisis

Three Reasons Why This Is Not a Housing Crisis In times of uncertainty, one of the best things we can do to ease our fears is to educate ourselves with research, facts, and data. Digging into past experiences by reviewing historical trends and understanding the peaks...