Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.

Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score– Even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® for all closed loans in September was 737, according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

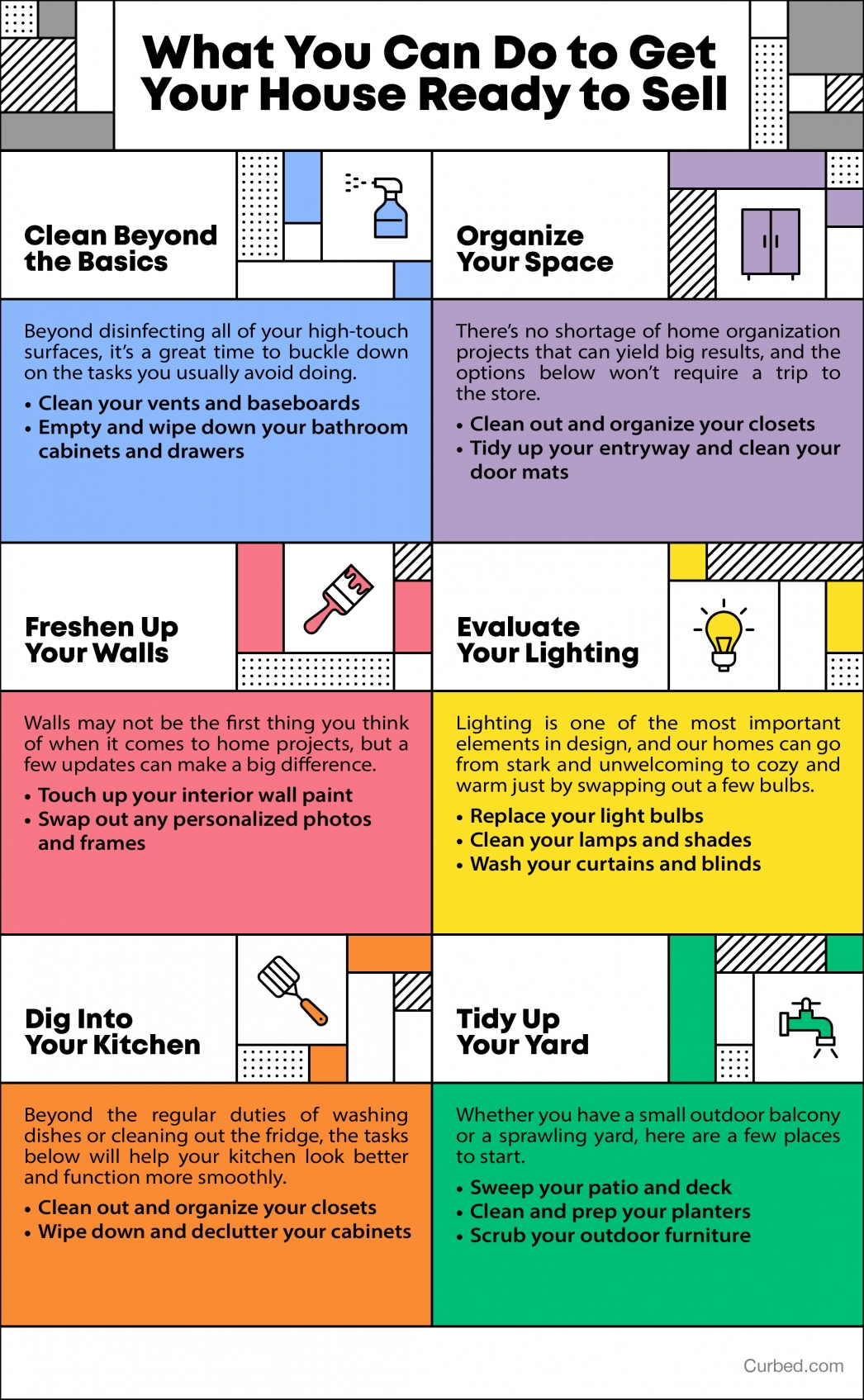

What You Can Do to Get Your House Ready to Sell

What You Can Do to Get Your House Ready to Sell Some Highlights: Believe it or not, there are lots of things you can do to prep your house for a sale without even going to the store. Your real estate plans don’t have to be completely on hold even while we’ve hit the...

Why Home Office Space Is More Desirable Than Ever

Why Home Office Space Is More Desirable Than EverFor years, we’ve all heard about the most desirable home features buyers are looking for, from upgraded kitchens to remodeled bathrooms, master suites, and more. The latest on the hotlist, however, might surprise...

Will Surging Unemployment Crush Home Sales?

Will Surging Unemployment Crush Home Sales?Ten million Americans lost their jobs over the last two weeks. The next announced unemployment rate on May 8th is expected to be in the double digits. Because the health crisis brought the economy to a screeching halt, many...

Auto DraftWhy Pre Approval Is a Great Step to Take Today

Why Pre Approval Is a Great Step to Take Today If you’re in the position to buy a home this year, pre-approval is something you can still do right now to get ahead in the homebuying process. Let’s connect to talk about your goals for 2020.

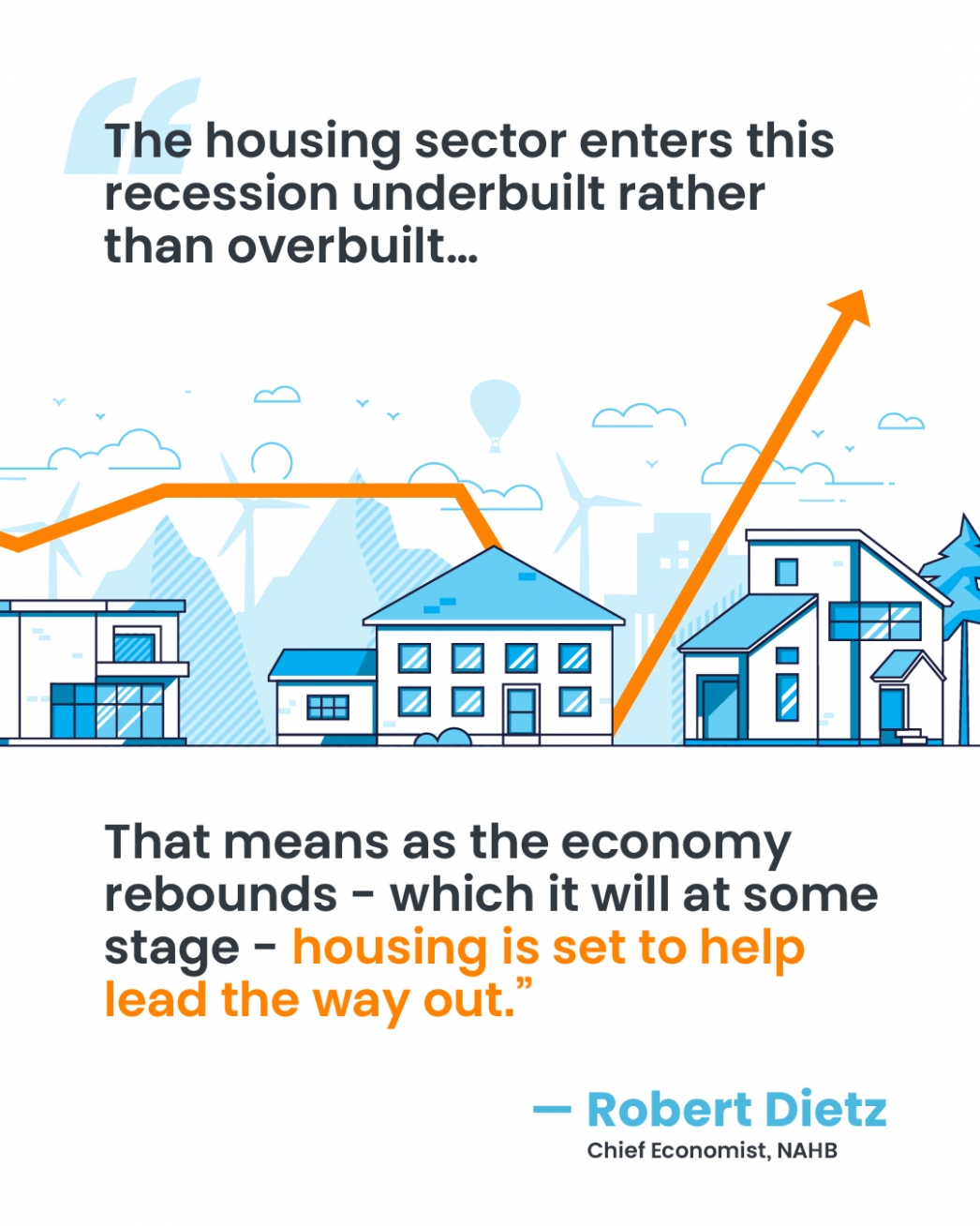

The Housing Market Is Positioned to Help the Economy Recover

The Housing Market Is Positioned to Help the Economy RecoverSome HighlightsExpert insights are painting a bright future for housing when the economy bounces back – and it will.We may be facing challenging economic times today, but the housing market is poised to help...

Looking to the Future: What the Experts Are Saying

Looking to the Future: What the Experts Are SayingAs our lives, our businesses, and the world we live in change day by day, we’re all left wondering how long this will last. How long will we feel the effects of the coronavirus? How deep will the impact go? The human...

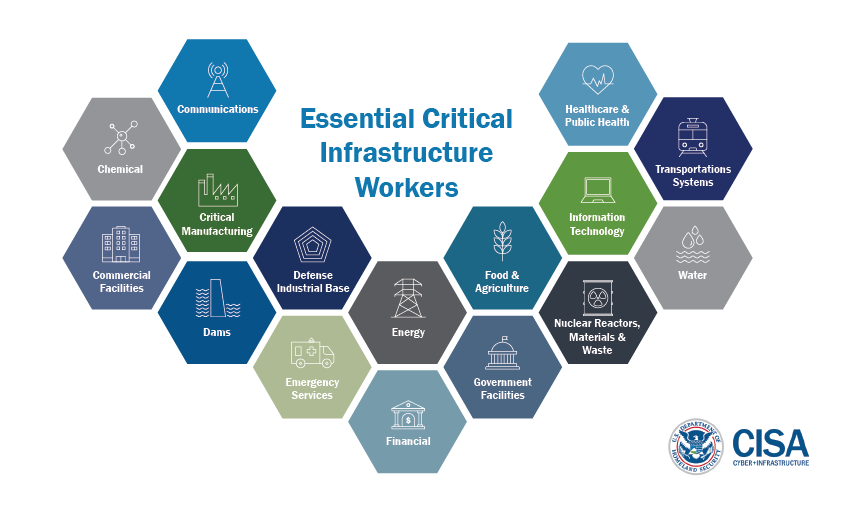

Real Estate Is an Essential Service According to U.S. Government

According to CISA (Cybersecurity and Infrastructure Security Agency)This list is advisory in nature. It is not, nor should it be considered, a federal directive or standard. Additionally, this advisory list is not intended to be the exclusive list of critical...

The Best Advice Does Not Mean Perfect Advice

The Best Advice Does Not Mean Perfect AdviceThe angst caused by the coronavirus has most people on edge regarding both their health and financial situations. It’s at times like these when we want exact information about anything we’re doing – even the correct protocol...

What You Can Do to Keep Your Dream of Homeownership Moving Forward

What You Can Do to Keep Your Dream of Homeownership Moving ForwardSome Highlights:Don’t put your homeownership plans on hold just because you’re stuck inside.There are several things you can do right now to keep your home search moving forward.Connect with an agent,...

With so much changing in today’s market