Death of a Spouse and Selling Your Home

Selling your home after the passing of a Spouse can be Tricky

According to IRS Publication 523, when your spouse passes away, you are entitled to utilize their $250,000 capital gains exemption in addition to your own $250,000 one-time exemption for up to 2 years from the date of your spouse’s passing. However, if you sell more than 2 years after the death of your spouse, you are only entitled to use your own $250,000 one-time exemption on capital gains tax. If your home equity is likely to exceed $250,000 this could affect you dramatically.

Here’s a good place to start. The first number you need is how much you paid for your home when you bought it. The second number you will need is a total of all of the monies you paid for capital improvements on your property (i.e.: pools, new roofs, new furnaces, and other improvements). Hopefully, you have a file with all of these receipts you have saved over the period you have owned your home. The last number you will need is an idea of what your home is worth in today’s market and a “net sheet” indicating how much you will likely have in your pocket from a sale. These last items are ones that we are happy to help with. If you need to find out the potential market value of your home please fill the request out and we will reply.

Please check with your accountant to verify the current tax regulations.

How To Make Your Dream of Homeownership a Reality

How To Make Your Dream of Homeownership a Reality According to a recent Harris Poll survey, 8 in 10 Americans say buying a home is a priority, and 28 million Americans actually plan to buy within the next 12 months. Homeownership provides many financial and...

A Smaller Home Could Be Your Best Option

A Smaller Home Could Be Your Best Option Many people are reaching the point in their lives when they need to decide where they want to live when they retire. If you’re a homeowner approaching this stage, you have several options to explore. Jessica Lautz, Deputy Chief...

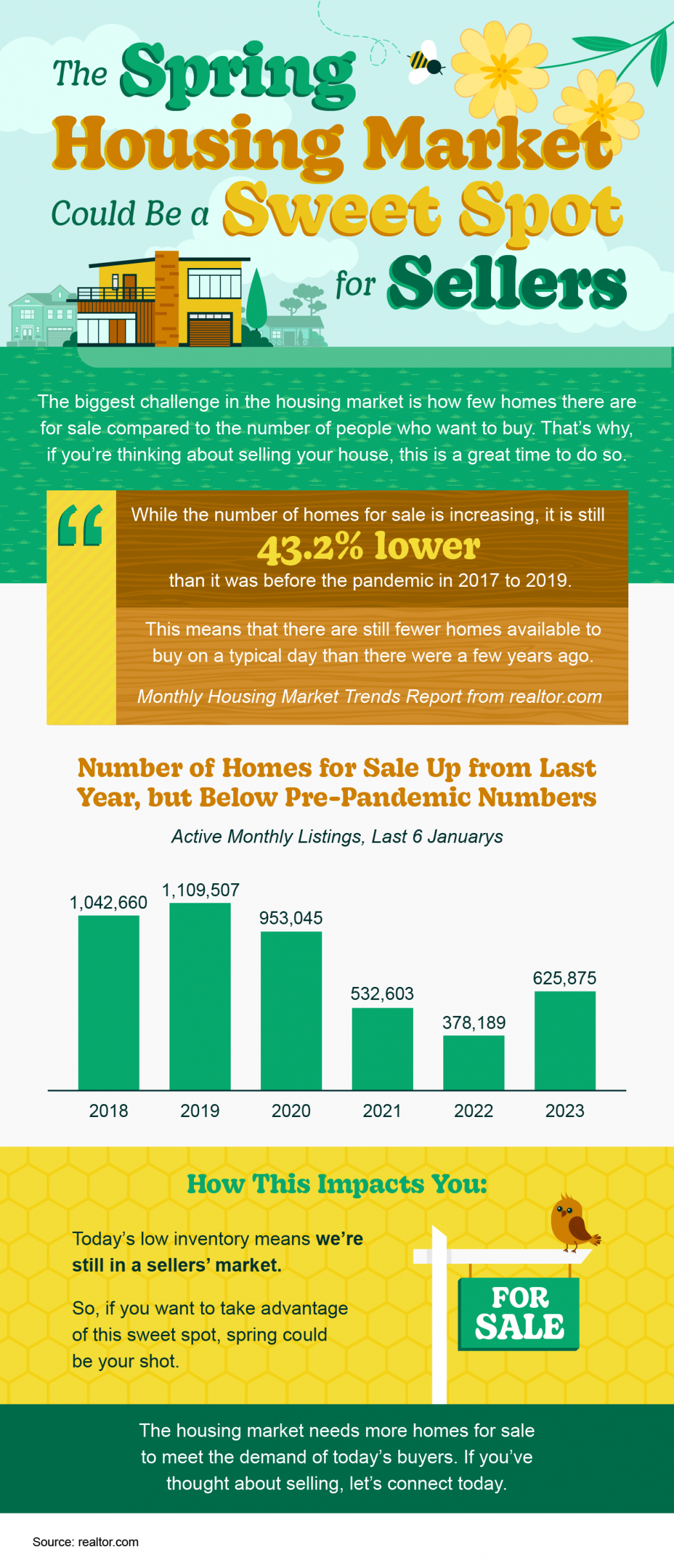

The Utah Spring Housing Market Could Be a Sweet Spot for Sellers

The Utah Spring Housing Market Could Be a Sweet Spot for Sellers Some Highlights The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy. The number of homes for sale is up from last year but...

Now helping navigate the solutions when coping with divorce and Real Property

National Association of Divorce Professionals Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential...

What You Should Know About Closing Costs

What You Should Know About Closing Costs Before you buy a home, it’s important to plan ahead. While most buyers consider how much they need to save for a down payment, many are surprised by the closing costs they have to pay. To ensure you aren’t caught off guard when...

How To Win as a Buyer in Today’s Housing Market In Utah

How To Win as a Buyer in Today’s Housing Market Some Highlights In today’s housing market, you can still be the champion if you have the right team and strategy. To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of...

Are We in a Housing Bubble?

The Top Reasons for Selling Your House

The Top Reasons for Selling Your House Many of today’s homeowners bought or refinanced their homes during the pandemic when mortgage rates were at history-making lows. Since rates doubled in 2022, some of those homeowners put their plans to move on hold, not wanting...

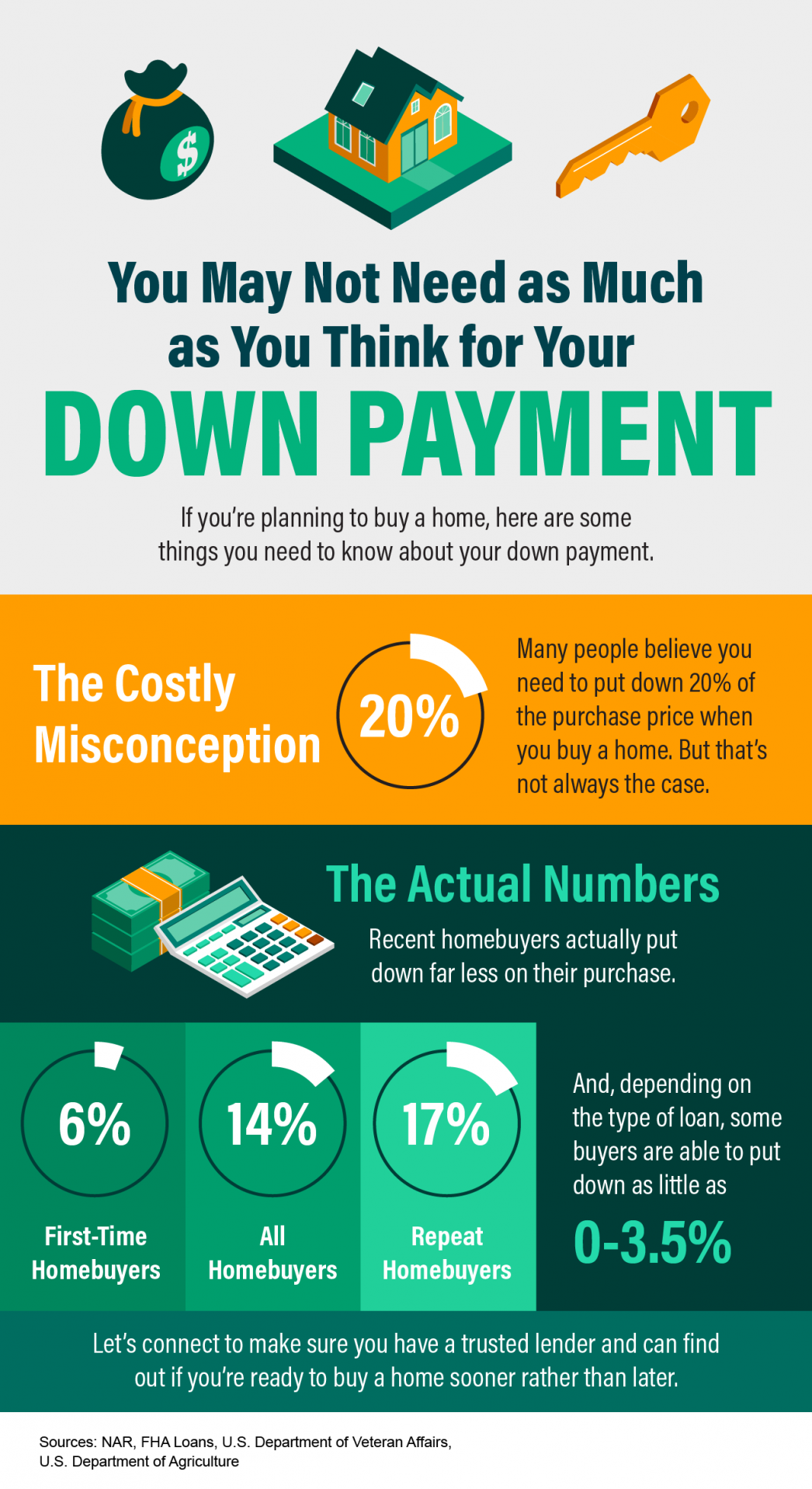

You May Not Need as Much as You Think for Your Down Payment

You May Not Need as Much as You Think for Your Down Payment Some Highlights Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase. And with programs like FHA loans, VA...