Death of a Spouse and Selling Your Home

Selling your home after the passing of a Spouse can be Tricky

According to IRS Publication 523, when your spouse passes away, you are entitled to utilize their $250,000 capital gains exemption in addition to your own $250,000 one-time exemption for up to 2 years from the date of your spouse’s passing. However, if you sell more than 2 years after the death of your spouse, you are only entitled to use your own $250,000 one-time exemption on capital gains tax. If your home equity is likely to exceed $250,000 this could affect you dramatically.

Here’s a good place to start. The first number you need is how much you paid for your home when you bought it. The second number you will need is a total of all of the monies you paid for capital improvements on your property (i.e.: pools, new roofs, new furnaces, and other improvements). Hopefully, you have a file with all of these receipts you have saved over the period you have owned your home. The last number you will need is an idea of what your home is worth in today’s market and a “net sheet” indicating how much you will likely have in your pocket from a sale. These last items are ones that we are happy to help with. If you need to find out the potential market value of your home please fill the request out and we will reply.

Please check with your accountant to verify the current tax regulations.

Fall in Love with Homeownership

111,285 Reasons You Should Buy a Home This Year

111,285 Reasons You Should Buy a Home This Year The financial benefits of buying a home versus renting one are always up for debate. However, one element of the equation is often ignored – the ability to build wealth as a homeowner. According to the latest...

What Do Supply and Demand Tell Us About Today’s Housing Market

What Do Supply and Demand Tell Us About Today’s Housing Market? There’s a well-known economic theory – the law of supply and demand – that explains what’s happening with prices in the current real estate market. Put simply, when demand for an item is high, prices...

Early October is the Sweet Spot for Buyers

Early October is the Sweet Spot for Buyers Are you looking to buy a home? If so, we’ve got good news for you. While there’s no denying the housing market is having a great year, many of the headlines are focused on the perks for sellers. But what about buyers today?...

As Home Equity Rises, So Does Your Wealth

As Home Equity Rises, So Does Your Wealth Homeownership is still a crucial part of the American dream. For those people who own a home (and those looking to buy one), it’s clear that being a homeowner has considerable benefits both emotionally and financially. In...

Free Fall Selling Guide is Here! Get Yours!

Selling your home this fall? Free Fall Selling Guide is Here! Get Yours! [3d-flip-book mode="fullscreen" id="14431"][/3d-flip-book]

If You’re a Buyer, Is Offering Asking Price Enough?

If You’re a Buyer, Is Offering Asking Price Enough? In today’s real estate market, buyers shouldn’t shop for a home with the expectation they’ll be able to negotiate a lower sales price. In a typical housing market, buyers try to determine how much less than the...

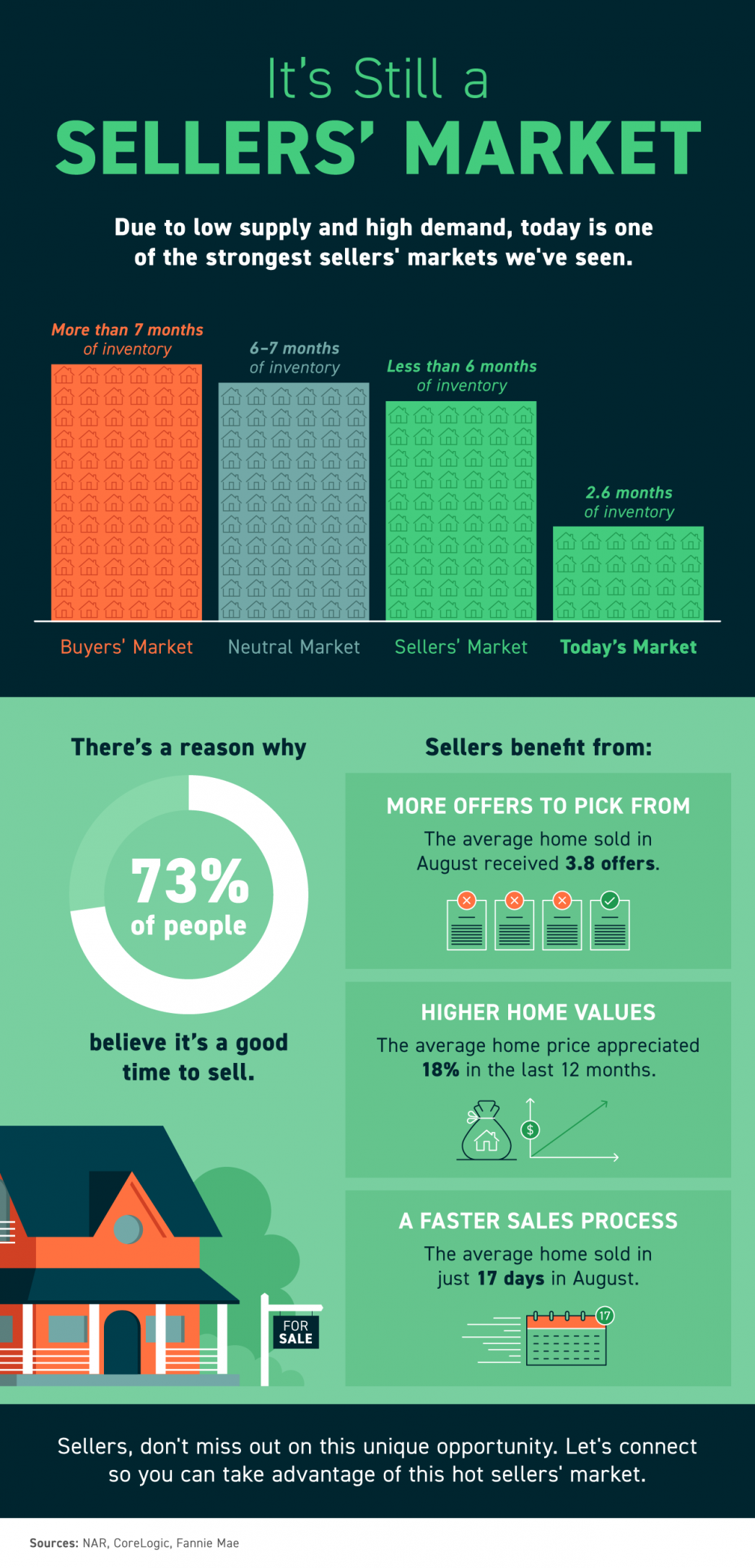

It’s Still a Sellers’ Market In Utah

It’s Still a Sellers’ Market Some Highlights Due to low supply and high demand, today is one of the strongest sellers’ markets we’ve seen. Sellers can benefit from more offers to pick from, higher home values, and a faster sales process. That might be why 73% of...

Is a 20% Down Payment Really Necessary To Purchase a Home?

Is a 20% Down Payment Really Necessary To Purchase a Home? There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from...

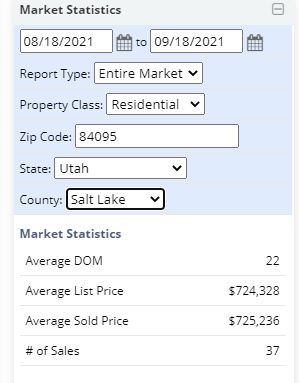

Market Stats for So Jo

South Jordan Market Update