Death of a Spouse and Selling Your Home

Selling your home after the passing of a Spouse can be Tricky

According to IRS Publication 523, when your spouse passes away, you are entitled to utilize their $250,000 capital gains exemption in addition to your own $250,000 one-time exemption for up to 2 years from the date of your spouse’s passing. However, if you sell more than 2 years after the death of your spouse, you are only entitled to use your own $250,000 one-time exemption on capital gains tax. If your home equity is likely to exceed $250,000 this could affect you dramatically.

Here’s a good place to start. The first number you need is how much you paid for your home when you bought it. The second number you will need is a total of all of the monies you paid for capital improvements on your property (i.e.: pools, new roofs, new furnaces, and other improvements). Hopefully, you have a file with all of these receipts you have saved over the period you have owned your home. The last number you will need is an idea of what your home is worth in today’s market and a “net sheet” indicating how much you will likely have in your pocket from a sale. These last items are ones that we are happy to help with. If you need to find out the potential market value of your home please fill the request out and we will reply.

Please check with your accountant to verify the current tax regulations.

The Many Benefits of Homeownership

The Many Benefits of Homeownership The past two years have taught us the true value of homeownership, especially the stability and the feeling of accomplishment it can provide. But homeownership has so much more to offer. Here’s a look at a few of the non-financial...

Why It’s Critical To Price Your House Right

Why It’s Critical To Price Your House Right When you make a move, you want to sell your house for the highest price possible. That might be why many homeowners are eager to list in today’s sellers’ market. After all, with record-low inventory and high buyer demand,...

This Spring Presents Sellers with a Golden Opportunity

This Spring Presents Sellers with a Golden Opportunity If you’re thinking of selling your house this year, timing is crucial. After all, you’ll want to balance getting the most out of the sale of your current home and making the best investment when you buy your next...

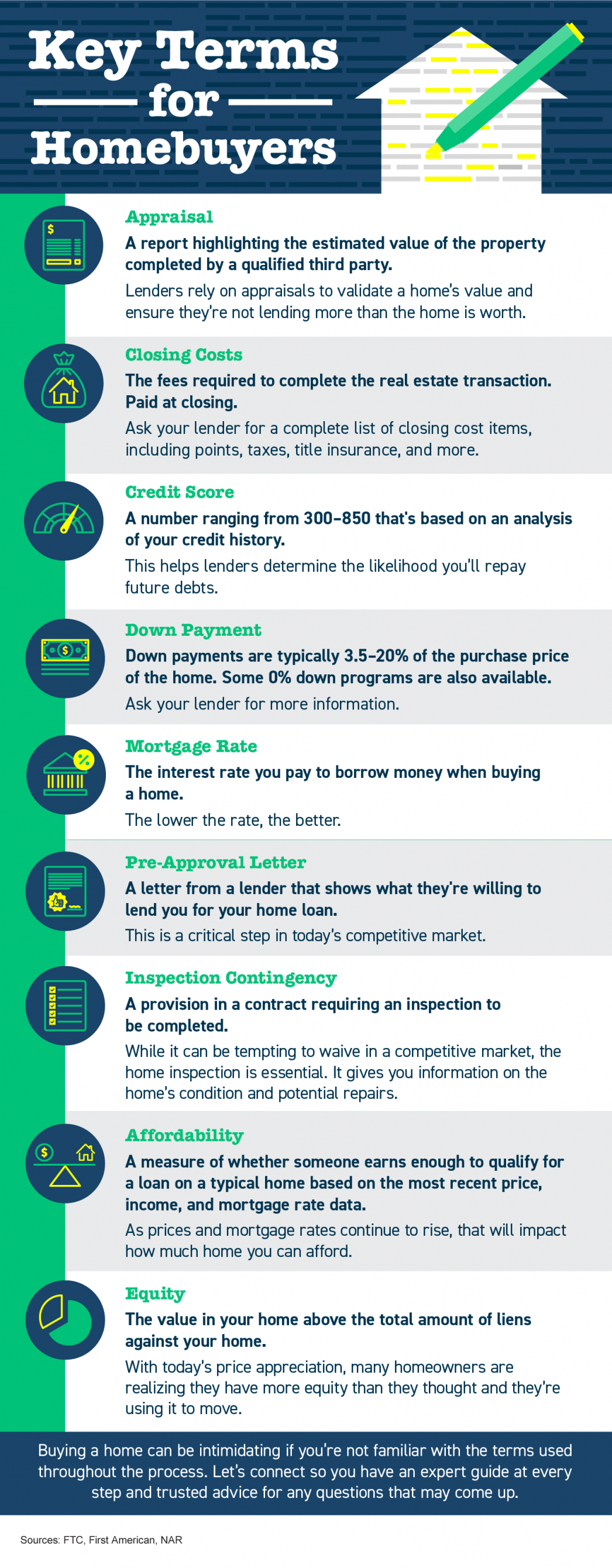

Key Terms for Homebuyers

Key Terms for Homebuyers Some Highlights Knowing key housing terms and how they relate to today’s market is important. For example, when mortgage rates and home prices rise, it impacts how much home you can afford. Terms like appraisal (what lenders rely on to...

Spring Home Buyers Guide for 2022 is Here!

Things-To-Avoid-After-Applying-for-a-Mortgage

Things-To-Avoid-After-Applying-for-a-Mortgage It's essential to avoid mishaps after applying for a mortgage. Let's connect so you know what to avoid during this part of the homebuying process. [video width="1920" height="1080"...

The #1 Reason To Sell Your House Today

Why Acting Strategically as a Seller Is Your Best Play

Positive: Professionalism, Responsiveness Marty sat down with my and wife and me to explain his process...

4 Simple Graphs Showing Why This Is Not a Housing Bubble

4 Simple Graphs Showing Why This Is Not a Housing Bubble A recent survey revealed that many consumers believe there’s a housing bubble beginning to form. That feeling is understandable, as year-over-year home price appreciation is still in the double digits. However,...

What Every Seller Needs To Know About Renovating This Year

What Every Seller Needs To Know About Renovating This Year If you’re planning to sell this year, you’re probably thinking about what you’ll need to do to get your house ready to appeal to the most buyers. It’s crucial to work with a trusted real estate professional...