Death of a Spouse and Selling Your Home

Selling your home after the passing of a Spouse can be Tricky

According to IRS Publication 523, when your spouse passes away, you are entitled to utilize their $250,000 capital gains exemption in addition to your own $250,000 one-time exemption for up to 2 years from the date of your spouse’s passing. However, if you sell more than 2 years after the death of your spouse, you are only entitled to use your own $250,000 one-time exemption on capital gains tax. If your home equity is likely to exceed $250,000 this could affect you dramatically.

Here’s a good place to start. The first number you need is how much you paid for your home when you bought it. The second number you will need is a total of all of the monies you paid for capital improvements on your property (i.e.: pools, new roofs, new furnaces, and other improvements). Hopefully, you have a file with all of these receipts you have saved over the period you have owned your home. The last number you will need is an idea of what your home is worth in today’s market and a “net sheet” indicating how much you will likely have in your pocket from a sale. These last items are ones that we are happy to help with. If you need to find out the potential market value of your home please fill the request out and we will reply.

Please check with your accountant to verify the current tax regulations.

Buyers Are Regaining Some of Their Negotiation Power in Today’s Housing Market

Buyers Are Regaining Some of Their Negotiation Power in Today’s Housing Market If you're thinking about buying a home today, there's welcome news. Even though it’s still a sellers’ market, it’s a more moderate sellers’ market than last year. And the days of feeling...

Your Guides to Buying or Selling a Home This Fall

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...

Expert Forecasts on Mortgage Rates

Expert Forecasts on Mortgage Rates If you’ve been thinking of buying a home, you may have been watching what’s happened with mortgage rates over the past year. It’s true they’ve risen dramatically, but where will they go from here, especially as the market continues...

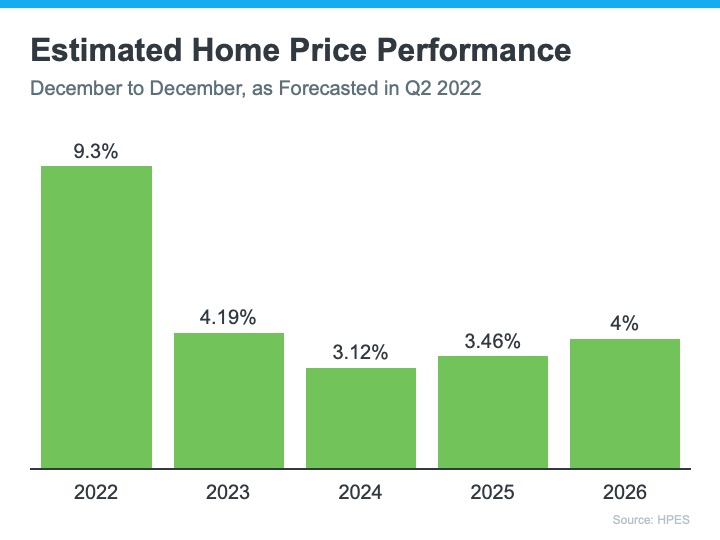

How Owning a Home Builds Your Net Worth

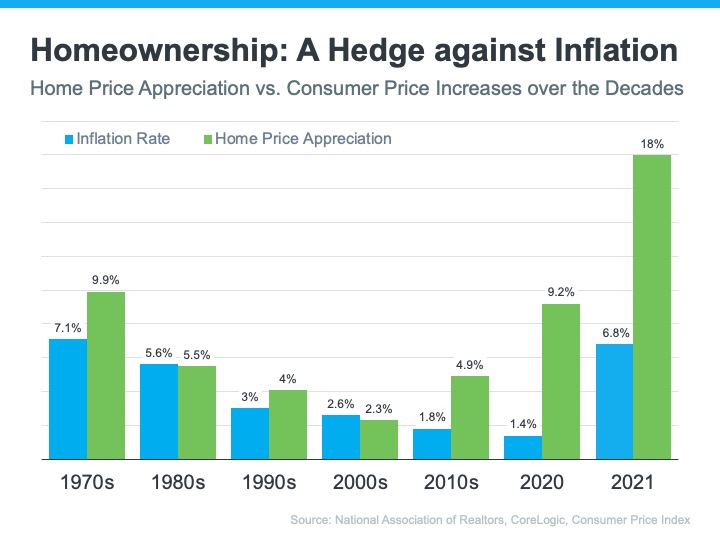

How Owning a Home Builds Your Net Worth Owning a home is a major financial milestone and an achievement to take pride in. One major reason: the equity you build as a homeowner gives your net worth a big boost. And with high inflation right now, the link between owning...

Should I wait to buy a home?

Part 4 Should I wait to buy a home? This is probably one of the biggest questions you’re getting asked right now, and it’s never been more important to have a good answer for it. Even though purchasing a home today may not be as easy as it was a couple of years ago,...

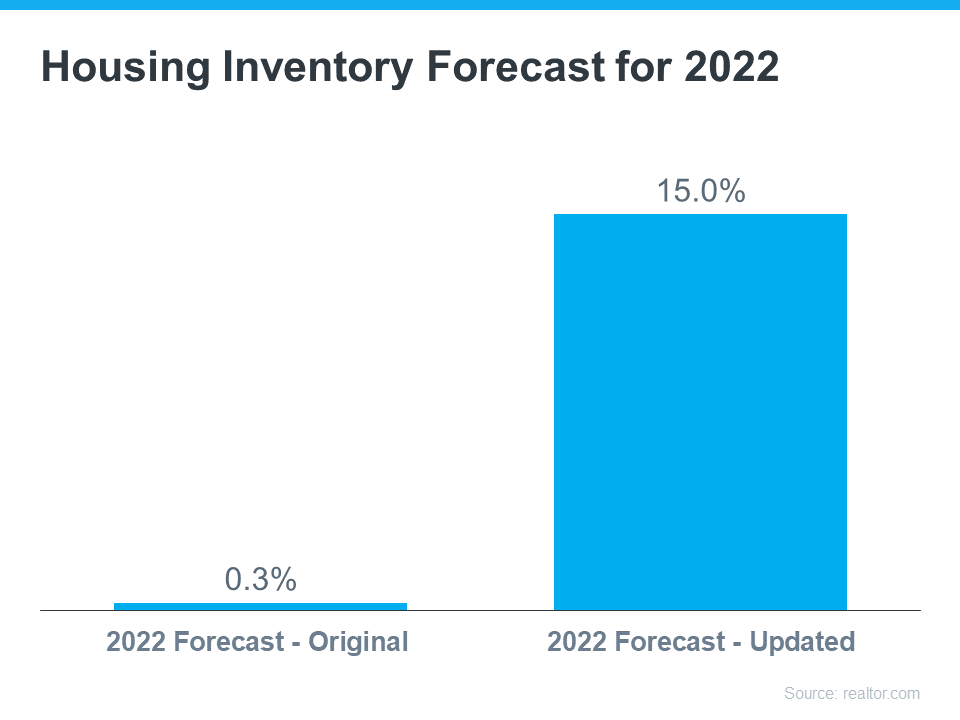

What will happen the second half of this year?

Part 3 What will happen the second half of this year? Yes, we are seeing a slowdown. However, we are really just heading back toward the market pace we saw pre-pandemic, and those were still great years for real estate. Focus on the big picture, and that’s this: the...

Expert Housing Market Forecasts for the Second Half of the Year

Expert Housing Market Forecasts for the Second Half of the Year The housing market is at a turning point, and if you’re thinking of buying or selling a home, that may leave you wondering: is it still a good time to buy a home? Should I make a move this year? To help...

If the economy slows further, what does that mean for real estate?

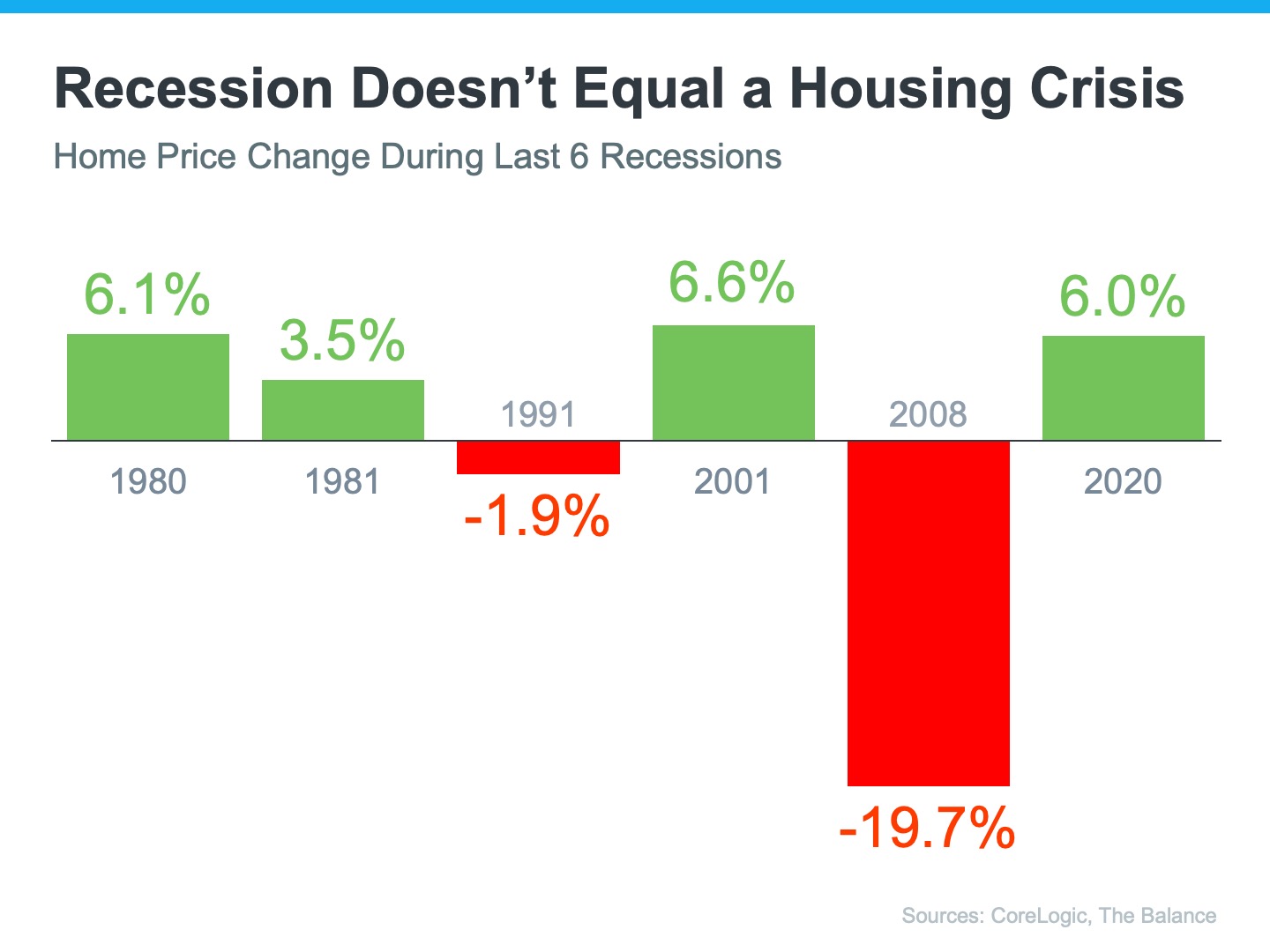

IN TIMES OF UNCERTAINTY, PEOPLE FOLLOW THE CERTAIN Part 3 If the economy slows further, what does that mean for real estate? Post-2009, nothing will strike fear into the hearts of buyers and sellers like the word “recession.” But as the economy slows down, history...

What’s happening with mortgage rates, now and in the future? Part 2

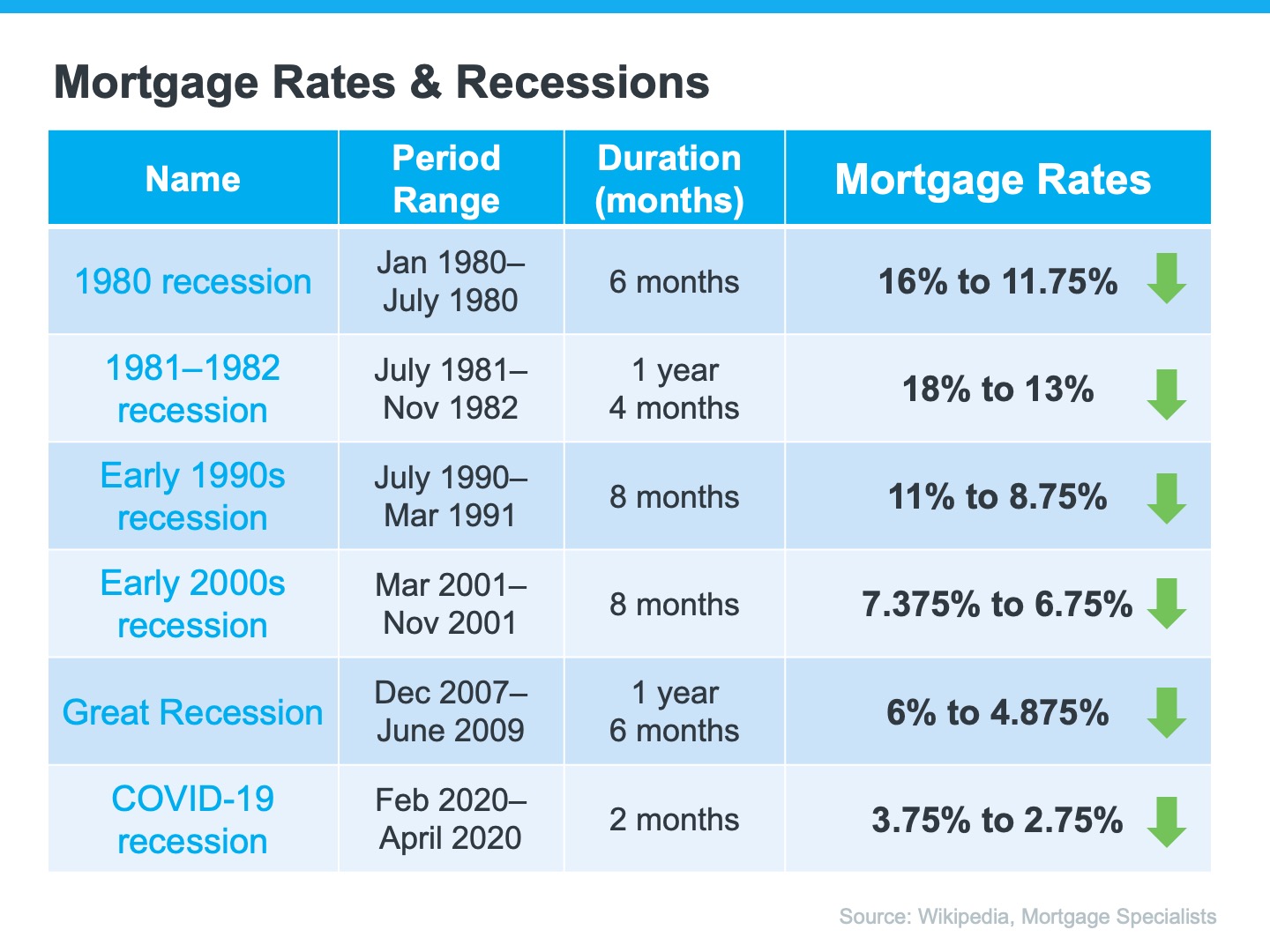

What’s happening with mortgage rates, now and in the future? Rising mortgage rates are no doubt one of the biggest factors impacting the housing market right now. But it’s important to remind your clients that the low rates of the last few years were an anomaly. As...

The market has shifted, and that’s a good thing.

IN TIMES OF UNCERTAINTY, PEOPLE FOLLOW THE CERTAIN – top five housing market questions Over the next 5 days we will post the top 5 questions everyone is asking. Question one: Is the housing market going to crash? Answer: Headlines right now scare consumers that the...