Have you ever been flipping through the channels, only to find yourself glued to the couch in an HGTV binge session? We’ve all been there, watching entire seasons of “Love it or List it,” “Million Dollar Listing,” “House Hunters,” “Property Brothers,” and so many more all in one sitting.

When you’re in the middle of your real estate themed show marathon, you might start to think that everything you see on TV must be how it works in real life, but you may need a reality check.

Reality TV Show Myths vs. Real Life:

Myth #1: Buyers look at 3 homes and decide to purchase one of them.

Truth: There may be buyers who fall in love and buy the first home they see, but according to the National Association of Realtors the average homebuyer tours 10 homes as a part of their search.

Myth #2: The houses the buyers are touring are still for sale.

Truth: Everything is staged for TV. Many of the homes being shown are already sold and are off the market.

Myth #3: The buyers haven’t made a purchase decision yet.

Truth: Since there is no way to show the entire buying process in a 30-minute show, TV producers often choose buyers who are further along in the process and have already chosen a home to buy.

Myth #4: If you list your home for sale, it will ALWAYS sell at the open house.

Truth: Of course, this would be great! Open houses are important to guarantee the most exposure to buyers in your area but are only a PIECE of the overall marketing of your home. Keep in mind that many homes are sold during regular listing appointments as well.

Myth #5: Homeowners decide to sell their homes after a 5-minute conversation.

Truth: Similar to the buyers portrayed on the shows, many of the sellers have already spent hours deliberating the decision to list their homes and move on with their lives/goals.

What’s Ahead for Mortgage Rates and Home Prices?

Utah Realty Blog & News The Latest news for Real Estate both local and National. Buyers Sellers SeniorsWhat’s Ahead for Mortgage Rates and Home Prices? Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next...

The Majority of Americans Still View Homeownership as the American Dream

The Majority of Americans Still View Homeownership as the American Dream Buying a home is a powerful decision, and it remains a key part of the American Dream. In fact, the 2022 Consumer Insights Report from Mynd found the majority of people polled still view...

Key Factors Affecting Home Affordability Today

Key Factors Affecting Home Affordability Today Every time there’s a news segment about the housing market, we hear about the affordability challenges buyers are facing today. Those headlines are focused on how much mortgage rates have climbed this year. And while it’s...

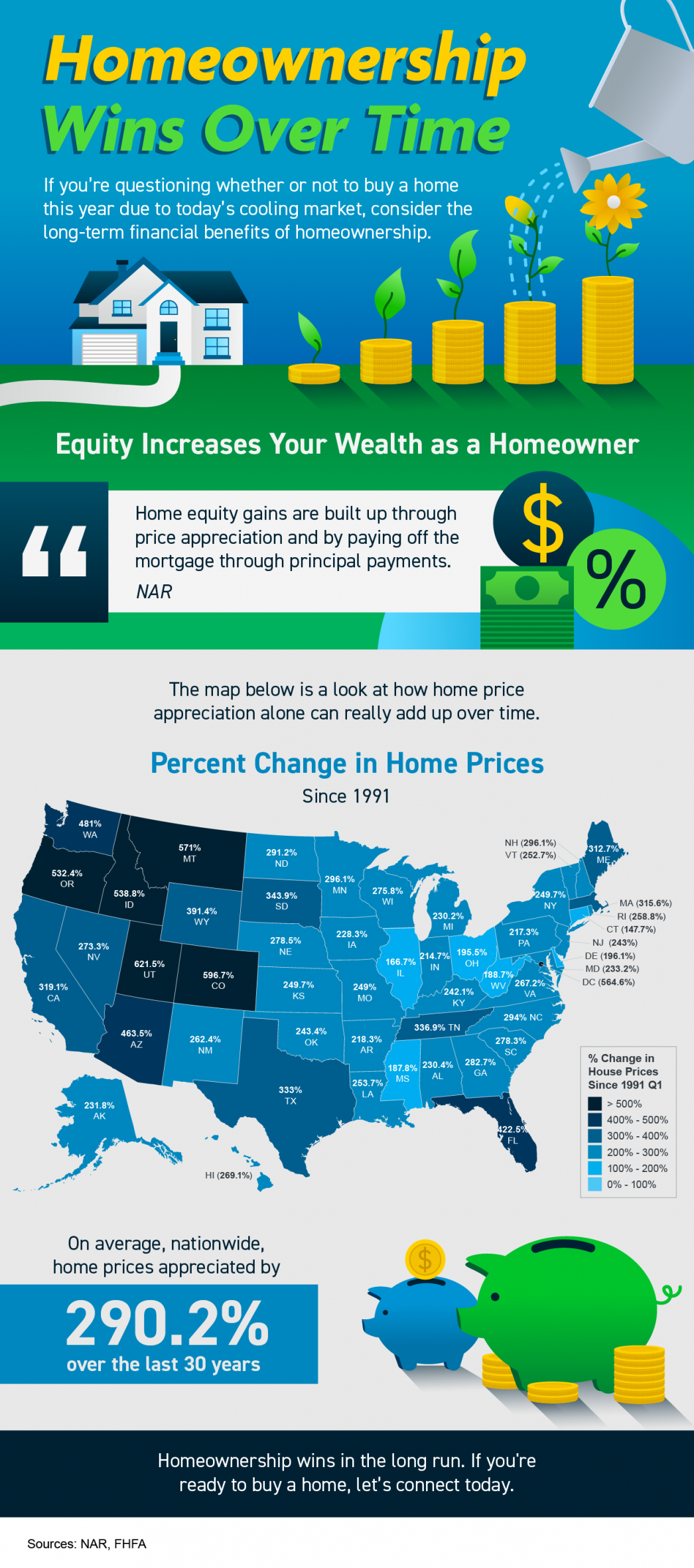

Homeownership Wins Over Time

Homeownership Wins Over Time Some Highlights If you’re questioning whether or not to buy a home this year due to today’s cooling market, consider the long-term financial benefits of homeownership. As a homeowner, equity increases your wealth. On average, nationwide,...

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be.

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be. It turns out, millennials aren’t the renter generation after all. The 2022 Consumer Insights Report from Mynd says there’s a portion of millennial and Gen Z buyers who are pursuing...

Sell Your House Before the Holidays

Sell Your House Before the Holidays As you look ahead to the winter season, you’re likely making plans and thinking about what you want to achieve before the year ends. One of those key decision points could be whether or not you want to move this year. If the...

Taking the Fear out of Saving for a Home

Taking the Fear out of Saving for a Home If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first. But it doesn’t have to be. One way to take the fear out of budgeting is understanding some of the costs you might...

when one door closes

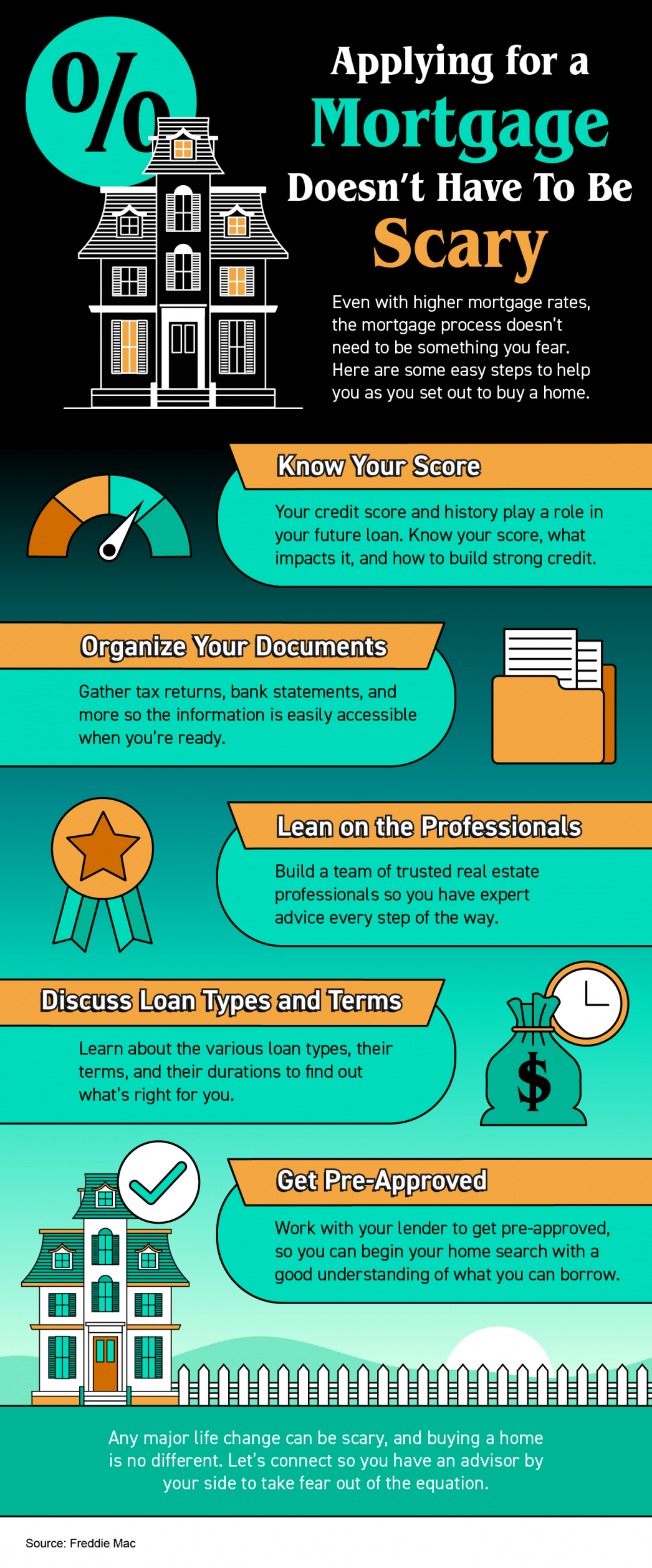

Applying for a Mortgage Doesn’t Have To Be Scary

Applying for a Mortgage Doesn’t Have To Be Scary Some Highlights Even with higher mortgage rates, the mortgage process doesn’t need to be something you fear. Here are some steps to help as you set out to buy a home. Know your credit score and work to build strong...

Millennials Are Still a Driving Force of Today’s Buyer Demand

Millennials Are Still a Driving Force of Today’s Buyer Demand If you’re thinking about selling your house but wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what...