Looking to Upgrade Your Current Home? Now’s the Time to Move-Up!

In every area of the country, homes that are priced at the top 25% of the price range for that area are considered to be Premium Homes. In today’s real estate market there are deals to be had at the higher end! This is great news for homeowners who want to upgrade from their current house and move-up to a premium home.

Much of the demand for housing over the past couple years has come from first-time buyers looking for their starter home, which means that many of the more expensive homes that have been listed for sale have not seen as much interest.

This mismatch in demand and inventory has created a Buyer’s Market in the luxury and premium home markets according to the ILHM’s latest Luxury Report. For the purpose of the report, a luxury home is defined as one that costs $1 million or more.

“A Buyer’s Market indicates that buyers have greater control over the price point. This market type is demonstrated by a substantial number of homes on the market and few sales, suggesting demand for residential properties is slow for that market and/or price point.”

The authors of the report were quick to point out that the current conditions at the higher end of the market are no cause for concern,

“While luxury homes may take longer to sell than in previous years, the slower pace, increased inventory levels and larger differences between list and sold prices, represent a normalization of the market, not a downturn.”

Luxury can mean different things to different people. It could mean a secluded home with a ton of property for privacy to one person, or a penthouse in the center of it all for someone else. Knowing what characteristics you are looking for in a premium home and what luxury means to you will help your agent find your dream home.

Bottom Line

If you are debating upgrading your current house to a premium or luxury home, now is the time!

Should You Use Your Equity to Move Up

Utah Realty News

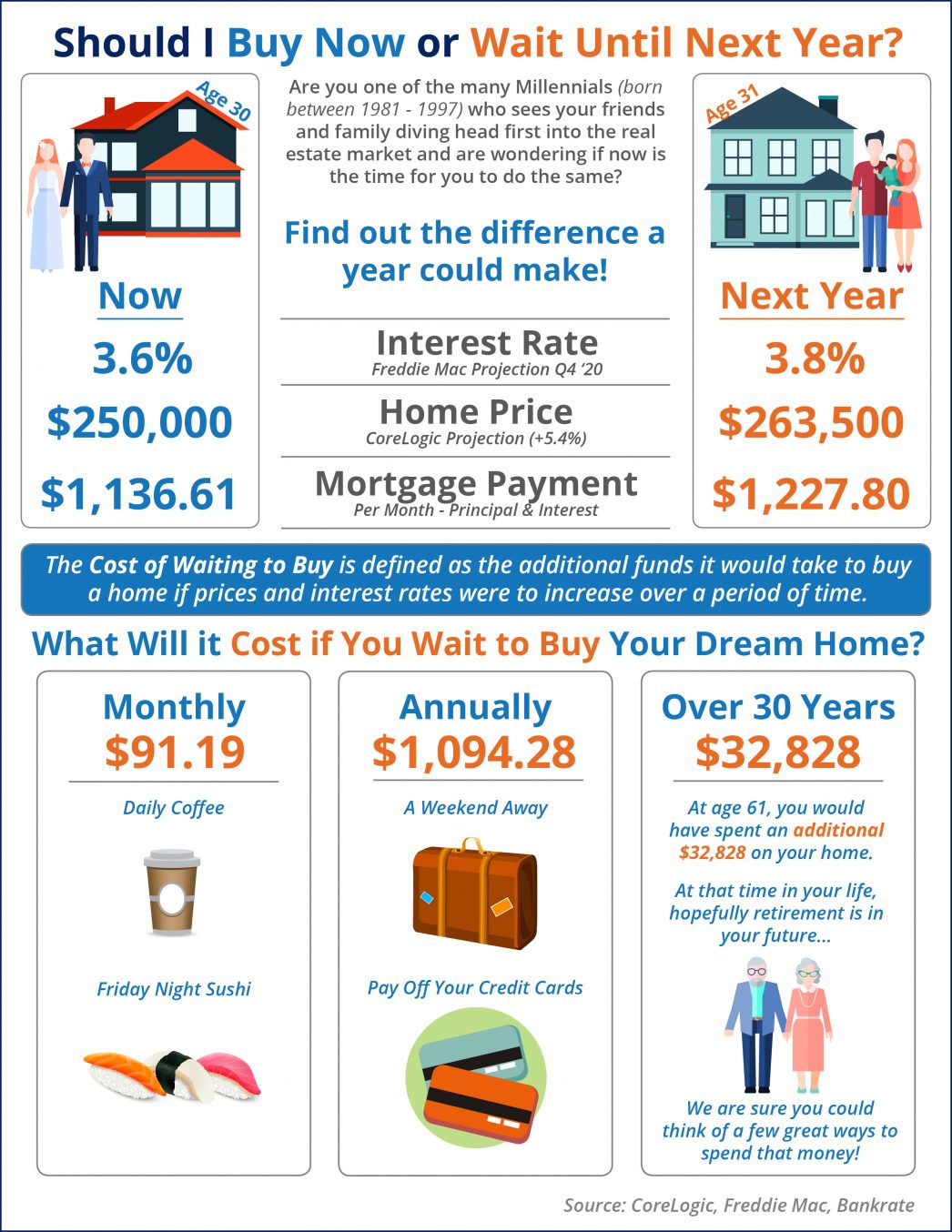

What Is the Cost of Waiting Until Next Year to Buy?

What Is the Cost of Waiting Until Next Year to Buy? Some Highlights: The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time. Freddie Mac forecasts interest rates will...

Is Your House “Priced to Sell Immediately”?

Is Your House “Priced to Sell Immediately”? In today’s real estate market, more houses are coming to market every day. Eager buyers are searching for their dream homes, so setting the right price for your house is one of the most important things you can do. According...

Utah had the second highest house-price appreciation of all states in the second quarter year-over-year

Utah had the second highest house-price appreciation of all states in the second quarter year-over-year Utah had the second highest house-price appreciation of all states in the second quarter year-over-year, according to a new report by the Federal Housing Finance...

What Will Home Prices Look Like Over the Next Few Years

What Will Home Prices Look Like Over the Next Few Years? September 19th, 2019 Home prices will continue to rise throughout 2023. This means that now is a great time to sell! If you're thinking of listing your home, let's get together to determine your best move.

4 Reasons to Sell This Fall In Utah With Utah Realty

Utah Realty 4 Reasons to Sell This Fall Some Highlights: Buyers are active in the market and often competing with one another for available listings. Housing inventory is still under the 6-month supply found in a normal housing market. Homes are still selling...

Three Benefits of Growing Equity in Your Home

The Benefits of Growing Equity in Your Home Over the last couple of years, we’ve heard quite a bit about rising home prices. Today, expert projections still forecast continued growth, just at a slower pace. One of the often-overlooked benefits of rising home prices is...

Utah Mortgage Rates at a 3 Year Low

Utah Mortgage Rates at a 3 Year Low

American Confidence in Housing at an All-Time High

Fannie Mae just released the July edition of their Home Purchase Sentiment Index (HPSI). The HPSI takes information regarding consumers’ confidence in the real estate market from Fannie Mae’s National Housing Survey and condenses it into a single number. Therefore,...