First-Time Buyers Are Searching for Existing Homes This Year In the latest Housing Trends Report, the National Association of Home Builders (NAHB) measured the share of adults planning to buy a home over the next 12 months. The report indicates the percentage of all...

First-Time Buyers Are Searching for Existing Homes This Year

First-Time Buyers Are Searching for Existing Homes This Year

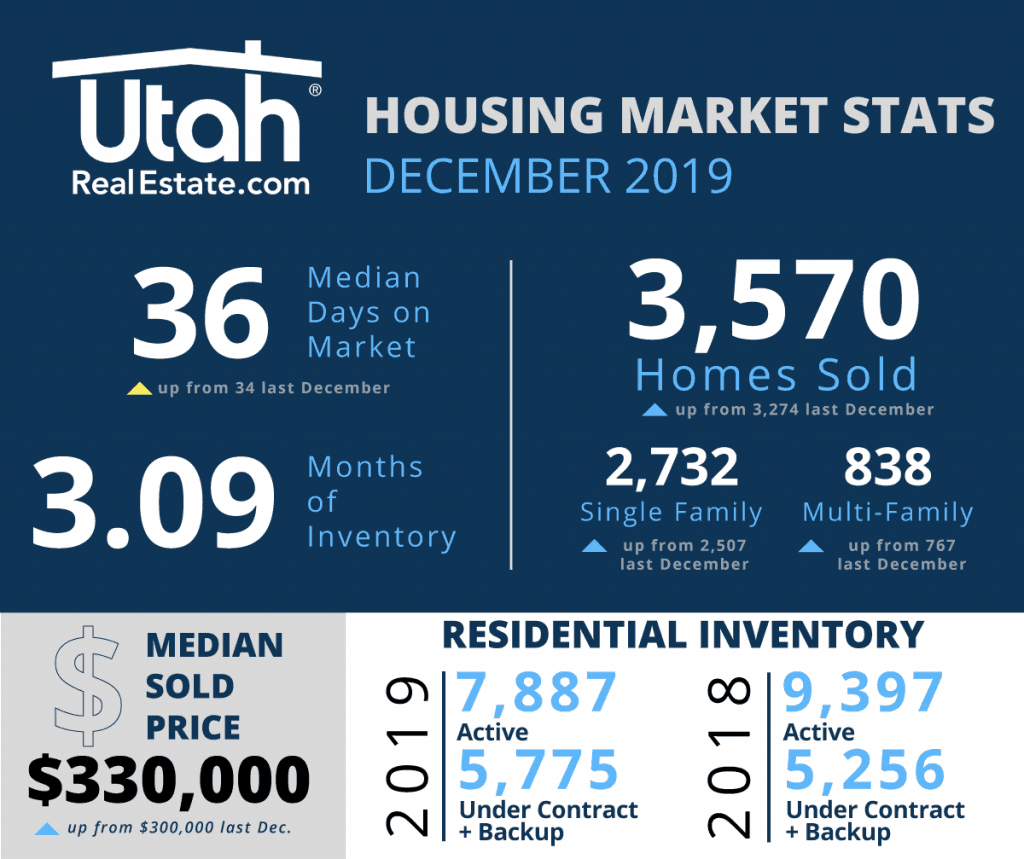

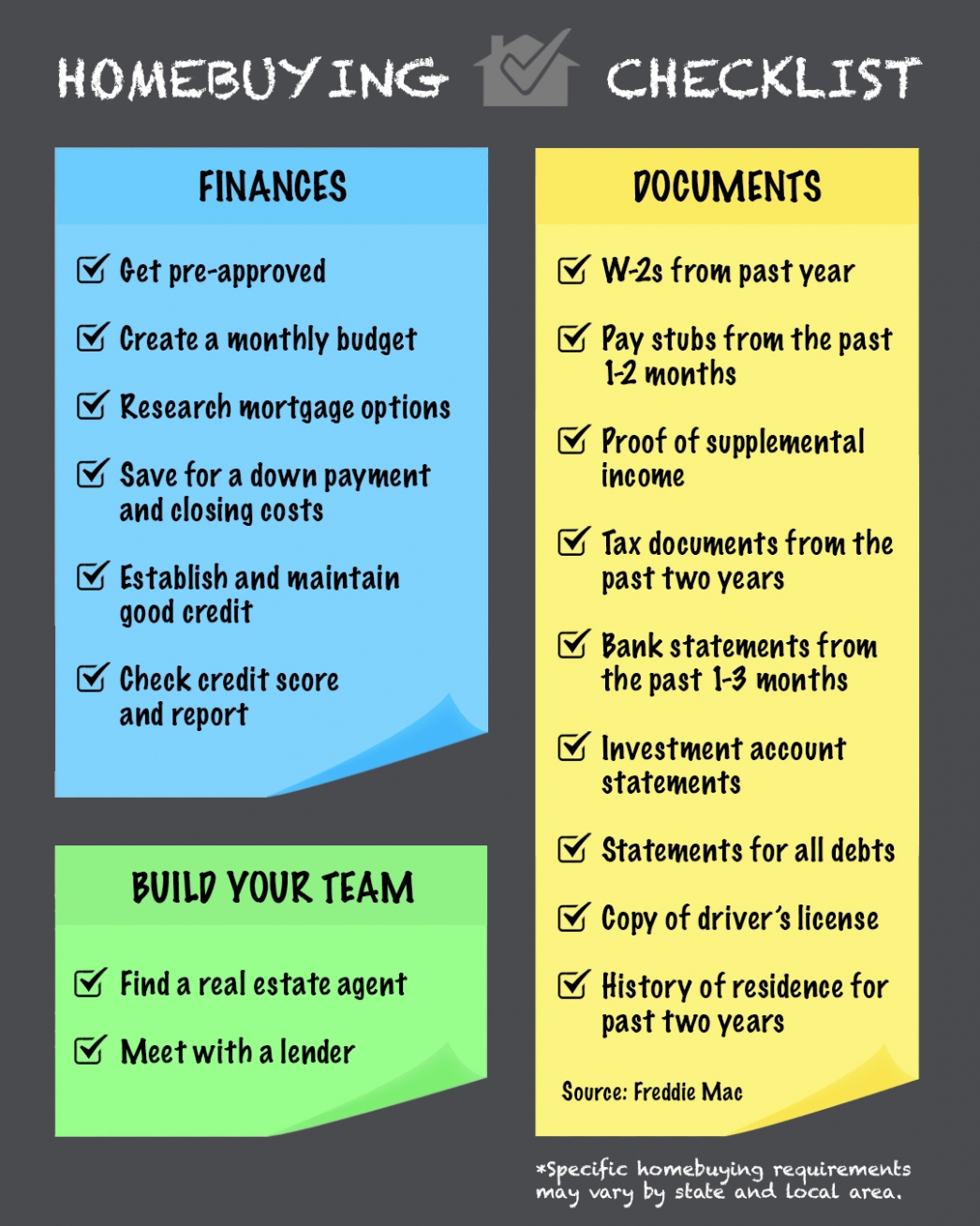

In the latest Housing Trends Report, the National Association of Home Builders (NAHB) measured the share of adults planning to buy a home over the next 12 months. The report indicates the percentage of all buyers that will be first-time buyers looking to purchase a home grew from 58% in Q4 2018 to 63% in Q4 2019.

The results revealed,

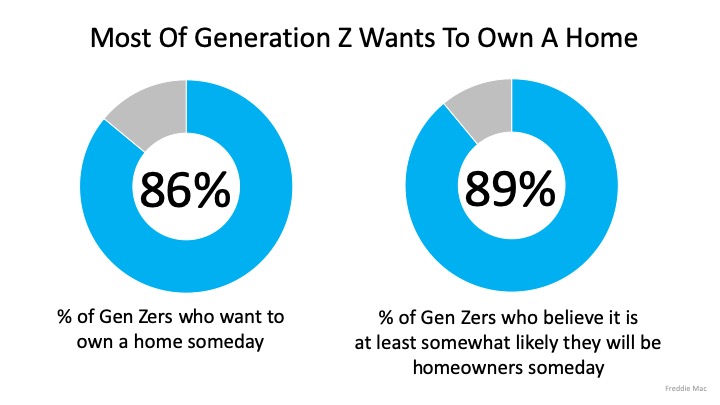

“Millennials are the most likely generation to be making plans to purchase a home within a year (19%), followed by Gen Z (13%) and Gen X (12%)…Prospective buyers in the youngest two generations are primarily first-time buyers: 88% of Gen Z buyers and 78% of Millennial buyers are reaching out to homeownership for the first time in their lives.”

With a high demand from first-time homebuyers and a shortage of inventory in the current market, selling your existing home this year might be your best move. Why? Because when homebuyers begin their search, they’re not all looking for new construction. Many are eager to find a little charm and character in a place to call home – possibly yours.

In fact, according to the same study, there is a significant demand for existing homes:

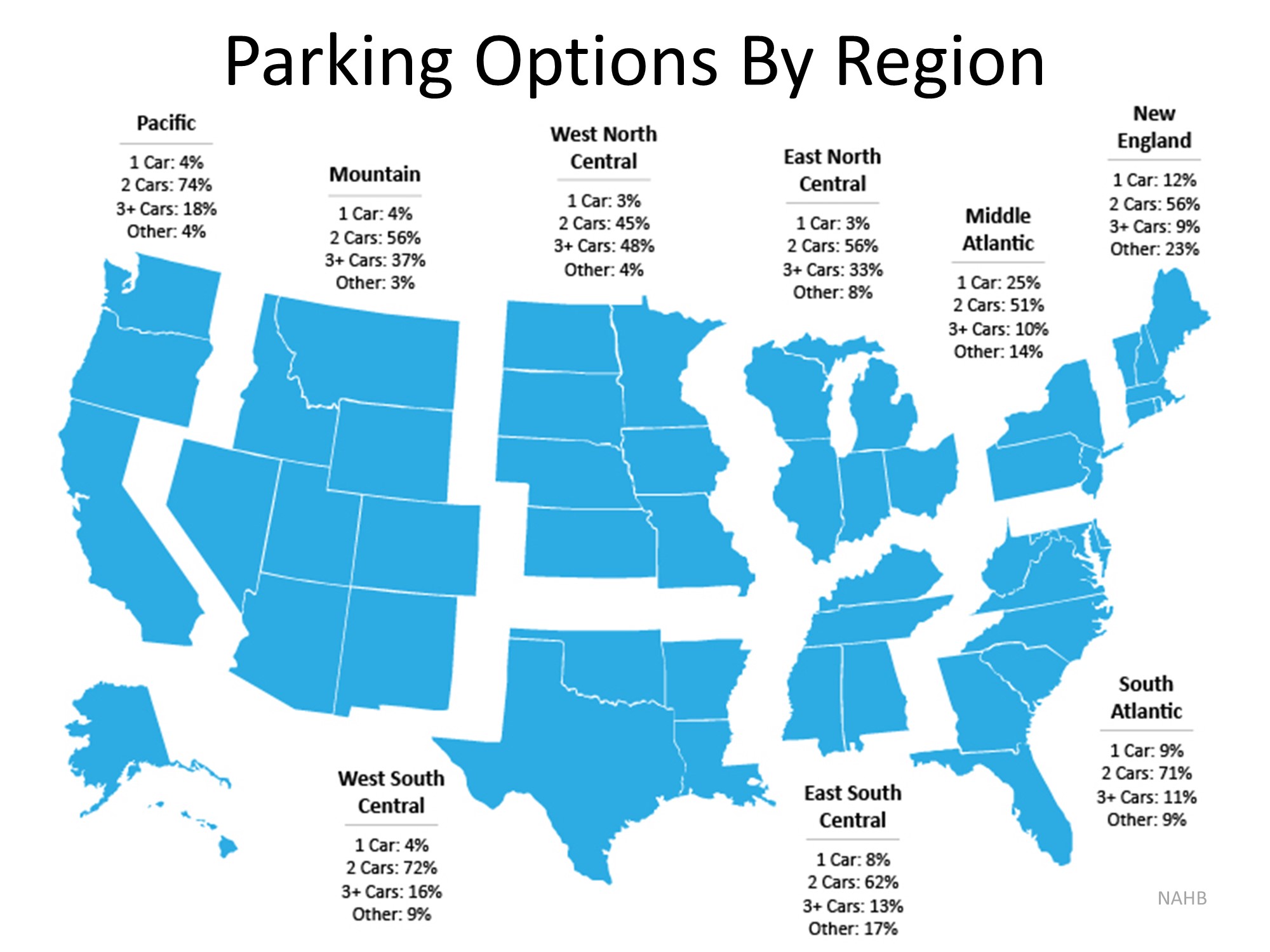

“In terms of the type of home these prospective home buyers are interested in, 40% are looking to buy an existing home and 19% a newly-built home. The remaining 41% would buy either a new or existing home.”

With showing activity up among buyers and more new construction coming to market, as a homeowner, you have the opportunity to sell your existing house now and move up into a new one, or downsize into a home that better fits your current and ever-changing needs.

Bottom Line

Not all buyers are looking for a newly built house. If you’re ready to take advantage of low mortgage rates and a high demand for your existing home, let’s get together to determine how we will market the charming details of your current house to potential buyers.