Does the News have you Scared

Don’t Let Frightening Headlines Scare You

There’s a lot of anxiety right now regarding the coronavirus pandemic. The health situation must be addressed quickly, and many are concerned about the impact on the economy as well.

Amidst all this anxiety, anyone with a megaphone – from the mainstream media to a lone blogger – has realized that bad news sells. Unfortunately, we will continue to see a rash of horrifying headlines over the next few months. Let’s make sure we aren’t paralyzed by a headline before we get the full story.

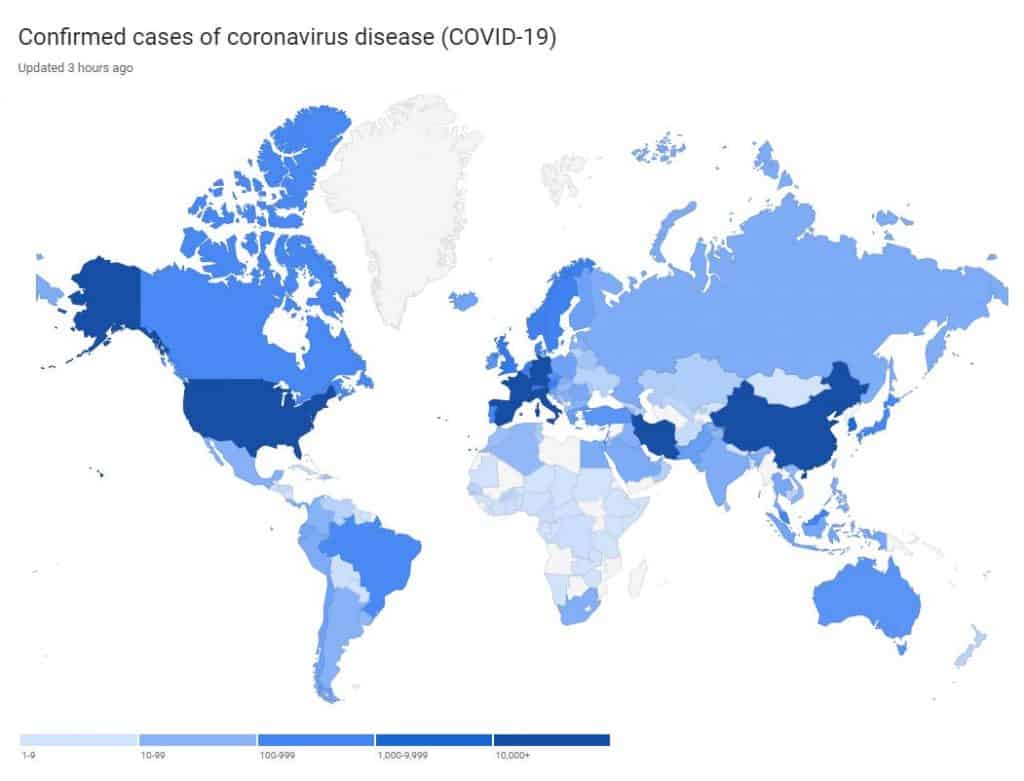

When it comes to the health issue, you should look to the Centers for Disease Control and Prevention (CDC) or the World Health Organization (WHO) for the most reliable information.

Finding reliable resources with information on the economic impact of the virus is more difficult. For this reason, it’s important to shed some light on the situation. There are already alarmist headlines starting to appear. Here are two such examples surfacing this week.

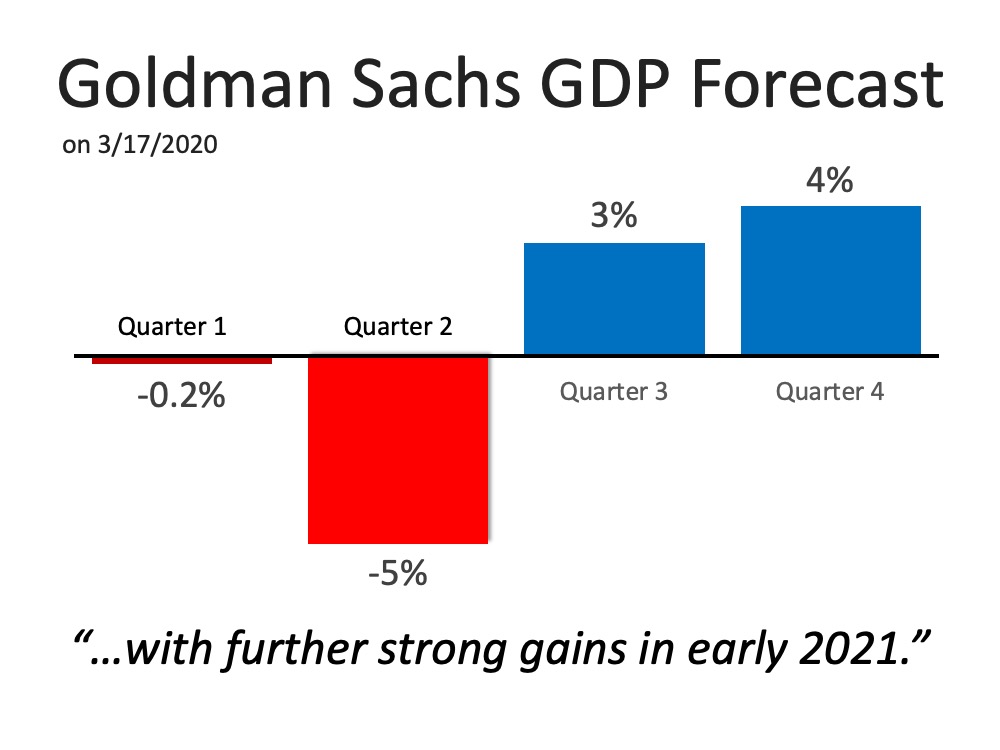

1. Goldman Sachs Forecasts the Largest Drop in GDP in Almost 100 Years

It sounds like Armageddon. Though the headline is true, it doesn’t reflect the full essence of the Goldman Sachs forecast. The projection is actually that we’ll have a tough first half of the year, but the economy will bounce back nicely in the second half; GDP will be up 12% in the third quarter and up another 10% in the fourth.

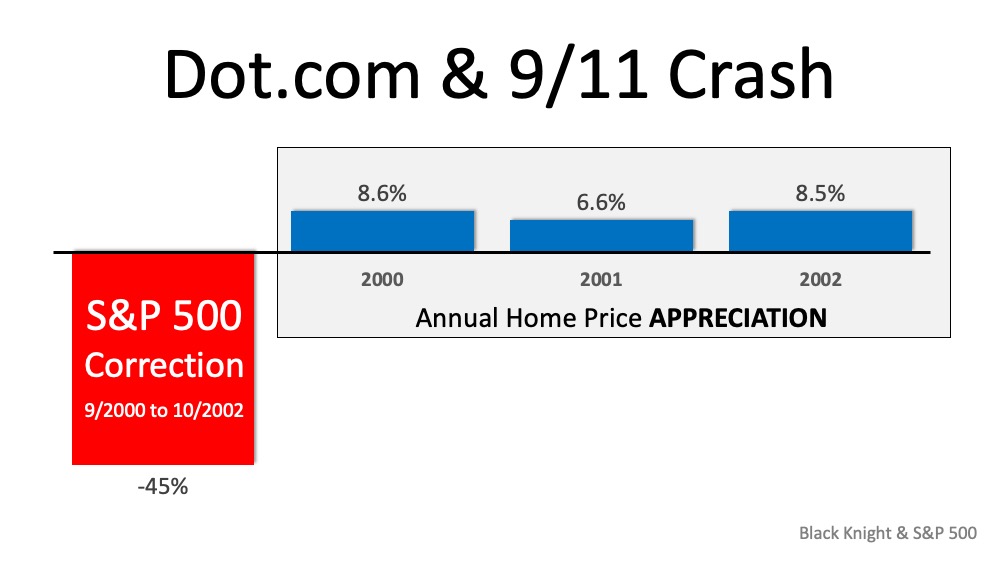

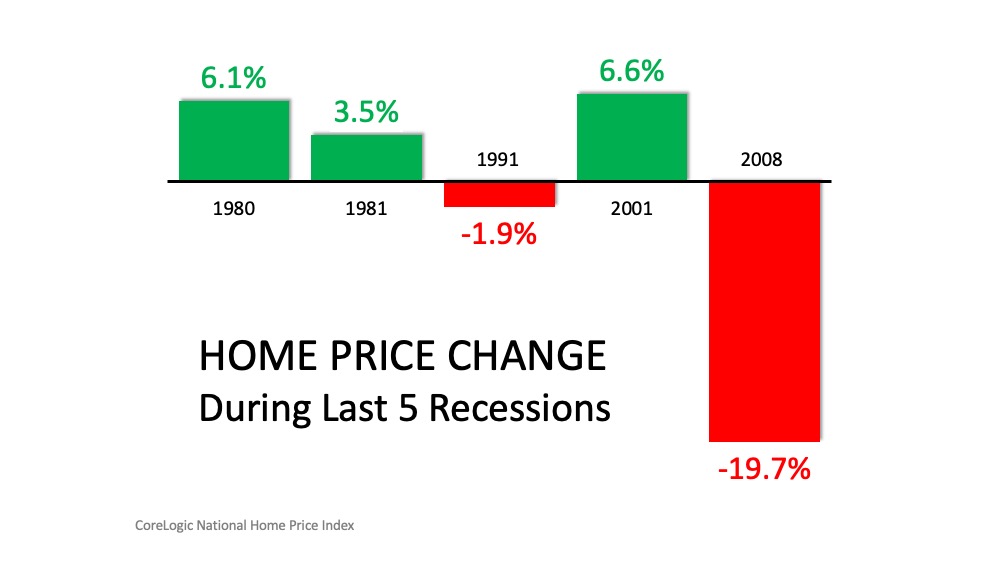

This aligns with research from John Burns Consulting involving pandemics, the economy, and home values. They concluded:

“Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices), and some very cutting-edge search engine analysis by our Information Management team showed the current slowdown is playing out similarly thus far.”

The economy will suffer for the next few months, but then it will recover. That’s certainly not Armageddon.

2. Fed President Predicts 30% Unemployment!

That statement was made by James Bullard, President of the Federal Reserve Bank of St. Louis. What Bullard actually said was it “could” reach 30%. But let’s look at what else he said in the same Bloomberg News interview:

“This is a planned, organized partial shutdown of the U.S. economy in the second quarter,” Bullard said. “The overall goal is to keep everyone, households and businesses, whole” with government support.

According to Bloomberg, he also went on to say:

“I would see the third quarter as a transitional quarter” with the fourth quarter and first quarter next year as “quite robust” as Americans make up for lost spending. “Those quarters might be boom quarters,” he said.

Again, Bullard agrees we will have a tough first half and rebound quickly.

Bottom Line

There’s a lot of misinformation out there. If you want the best advice on what’s happening in the current housing market, let’s talk today.