How Much Has Your Home Home Increased in Value?

DISCLAIMER: A Home Valuation report is not a substitute for a Real Estate Appraisal in purchase or refinance transactions. Home Valuation report is only available for homes in Utah.

How Much Has Your Home Value Increased?

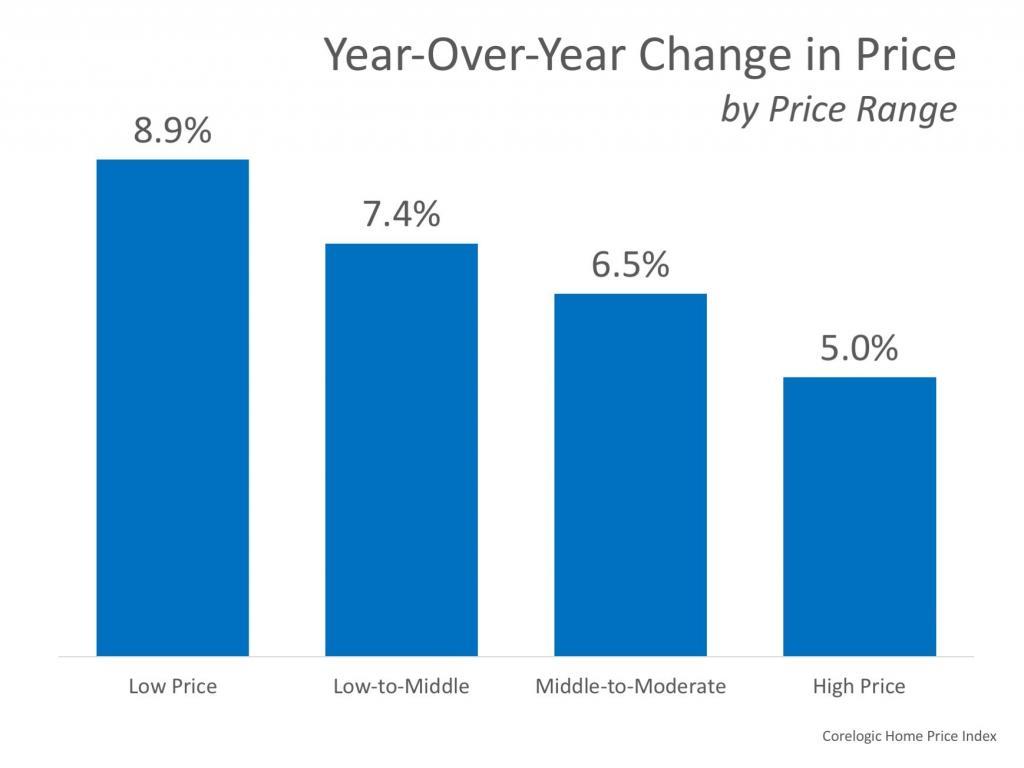

Home values have risen dramatically over the last twelve months. In CoreLogic’s most recent Home Price Index Report, they revealed that national home prices have increased by 6.2% year-over-year.

CoreLogic broke down appreciation even further into four price ranges, giving us a more detailed view than if we had simply looked at the year-over-year increases in national median home price.

The chart below shows the four price ranges from the report, as well as each one’s year-over-year growth from July 2017 to July 2018 (the latest data available).

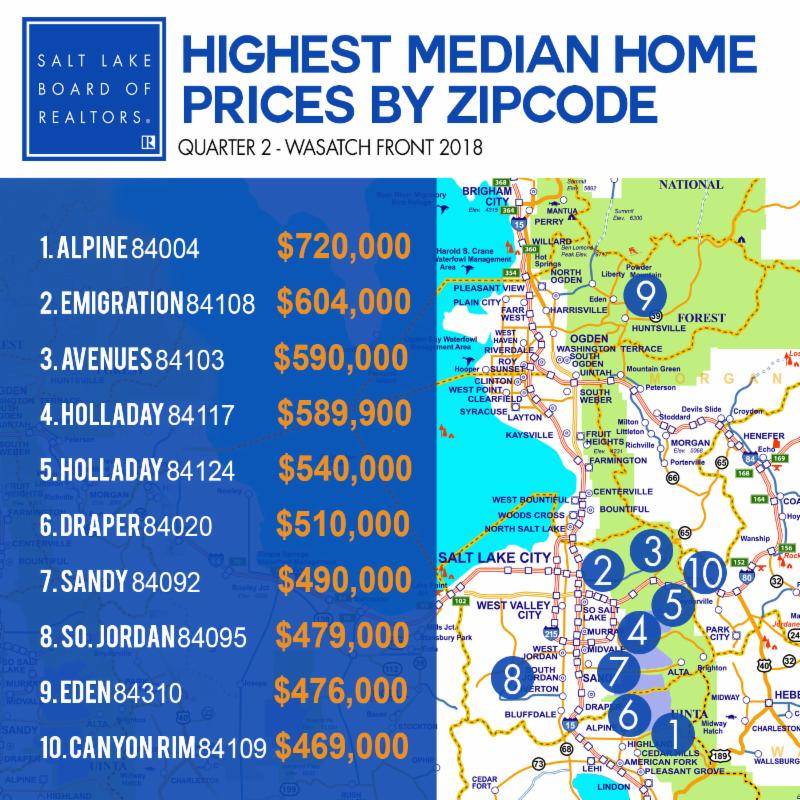

New Home Prices Second Quarter of 2018

For Sale By Owner (FSBO) Statistics

- FSBOs accounted for 8% of home sales in 2016. The typical FSBO home sold for $190,000 compared to $249,000 for agent-assisted home sales.

- FSBO methods used to market home:

- Yard sign: 35%

- Friends, relatives, or neighbors: 24%

- Online classified advertisements: 11%

- Open house: 15%

- For-sale-by-owner websites: 8%

- Social networking websites (e.g. Facebook, Twitter, etc.): 13%

- Multiple Listing Service (MLS) website: 26%

- Print newspaper advertisement: 5%

- Direct mail (flyers, postcards, etc.): 4%

- Video: 2%

- None: Did not actively market home: 28%

- Most difficult tasks for FSBO sellers:

- Getting the right price: 15%

- Understanding and performing paperwork: 12%

- Selling within the planned length of time: 13%

- Preparing/fixing up home for sale: 9%

- Having enough time to devote to all aspects of the sale: 3%

Two Big Myths in the Homebuying Process

Two Big Myths in the Homebuying Process The 2020 Millennial Home Buyer Report shows how this generation is not really any different from previous ones when it comes to homeownership goals: “The majority of millennials not only want to own a home, but 84% of...

5 Simple Graphs Proving This Is NOT Like the Last Time

5 Simple Graphs Proving This Is NOT Like the Last Time With all of the volatility in the stock market and uncertainty about the Coronavirus (COVID-19), some are concerned we may be headed for another housing crash like the one we experienced from 2006-2008. The...

Yes, You Can Still Afford a Home

Yes, You Can Still Afford a Home The residential real estate market has come roaring out of the gates in 2020. Compared to this time last year, the number of buyers looking for a home is up 20%, and the number of home sales is up almost 10%. The increase in purchasing...

Confidence Is the Key to Success for Young Homebuyers

Confidence Is the Key to Success for Young HomebuyersBuying your first home can seem overwhelming. Thankfully, there’s a lot of great information out there to help you feel more confident as you learn about the process. For those in younger generations who aspire to...

Equity Gain Growing Across Utah and in Nearly Every State

Equity Gain Growing in Nearly Every State Rising home prices have been in the news a lot lately, and much of the focus is on whether they’re accelerating too quickly and how sustainable the growth in prices really is. One of the often-overlooked benefits of rising...

Mortgage rates fell to their lowest level March 2020

Mortgage rates fell to their lowest level on record Thursday, pulled down by fears that the spread of coronavirus could weigh on the U.S. economy. The average rate on a 30-year fixed-rate mortgage fell to 3.29 percent from 3.45 percent last week and down from 4.41...

Thinking of Getting Your House Ready to Sell?

Impact of the Coronavirus on the U.S. Housing Market

Impact of the Coronavirus on the U.S. Housing MarketThe Coronavirus (COVID-19) has caused massive global uncertainty, including a U.S. stock market correction no one could have seen coming. While much of the news has been about the effect on various markets, let’s...

How Interest Rates Can Impact Your Monthly Housing Payments

How Interest Rates Can Impact Your Monthly Housing Payments Spring is right around the corner, so flowers are starting to bloom, and many potential homebuyers are getting ready to step into the market. If you’re thinking of buying this season, here’s how mortgage...

How Your Tax Refund Can Move You Toward Homeownership This Year

How Your Tax Refund Can Move You Toward Homeownership This Year If you’re looking to buy a home in 2020, have you thought about putting your tax refund toward a down payment? Homeownership may be one step closer than you think if you spend your dollars wisely this...