With Inventory Low: Will Your Dream Home Need Some TLC?

According to a new survey from Move.com, the wave of first-time homebuyers hitting the market this summer has resulted in an interesting statistic. Nearly 60% of buyers searching for a home this spring are willing to consider buying a fixer-upper, with 95% believing that the projects needed will increase their new home’s value!

Realtor.com’s Chief Economist, Danielle Hale, pointed to low-inventory at the entry-level price range for the increase in willingness to renovate.

“The combination of rising home prices and limited entry-level homes for sale is prompting many home shoppers to consider homes that need renovating.

Replete with inspiration at their fingertips – like Pinterest, Instagram, and various home renovation TV shows – some home shoppers are comfortable tackling home renovation jobs to find a home that balances their needs with their budget.”

Just over half of all respondents who said they would be willing to buy a home in need of some TLC, would also spend more $20,000 to make the home fit their needs.

The most common ‘expected’ renovation is a kitchen remodel which can run anywhere from $22,000 for a minor remodel to $66,000 for a major remodel.

This isn’t a new trend by any means. According to the Joint Center for Housing Studies at Harvard University, home improvement project spending reached a new high in 2018.

“Americans spent $336.9 billion on remodeling projects, up 7.4% from the $313.6 billion a year earlier.”

Home renovation television shows have given many buyers hope that they could renovate a home they can afford into their dream home!

Bottom Line

If you are one of the many Americans considering buying a home this spring, let’s get together to help you find a house with the potential to be your dream home!

Fall in Love with Homeownership

111,285 Reasons You Should Buy a Home This Year

111,285 Reasons You Should Buy a Home This Year The financial benefits of buying a home versus renting one are always up for debate. However, one element of the equation is often ignored – the ability to build wealth as a homeowner. According to the latest...

What Do Supply and Demand Tell Us About Today’s Housing Market

What Do Supply and Demand Tell Us About Today’s Housing Market? There’s a well-known economic theory – the law of supply and demand – that explains what’s happening with prices in the current real estate market. Put simply, when demand for an item is high, prices...

Early October is the Sweet Spot for Buyers

Early October is the Sweet Spot for Buyers Are you looking to buy a home? If so, we’ve got good news for you. While there’s no denying the housing market is having a great year, many of the headlines are focused on the perks for sellers. But what about buyers today?...

As Home Equity Rises, So Does Your Wealth

As Home Equity Rises, So Does Your Wealth Homeownership is still a crucial part of the American dream. For those people who own a home (and those looking to buy one), it’s clear that being a homeowner has considerable benefits both emotionally and financially. In...

Free Fall Selling Guide is Here! Get Yours!

Selling your home this fall? Free Fall Selling Guide is Here! Get Yours! [3d-flip-book mode="fullscreen" id="14431"][/3d-flip-book]

If You’re a Buyer, Is Offering Asking Price Enough?

If You’re a Buyer, Is Offering Asking Price Enough? In today’s real estate market, buyers shouldn’t shop for a home with the expectation they’ll be able to negotiate a lower sales price. In a typical housing market, buyers try to determine how much less than the...

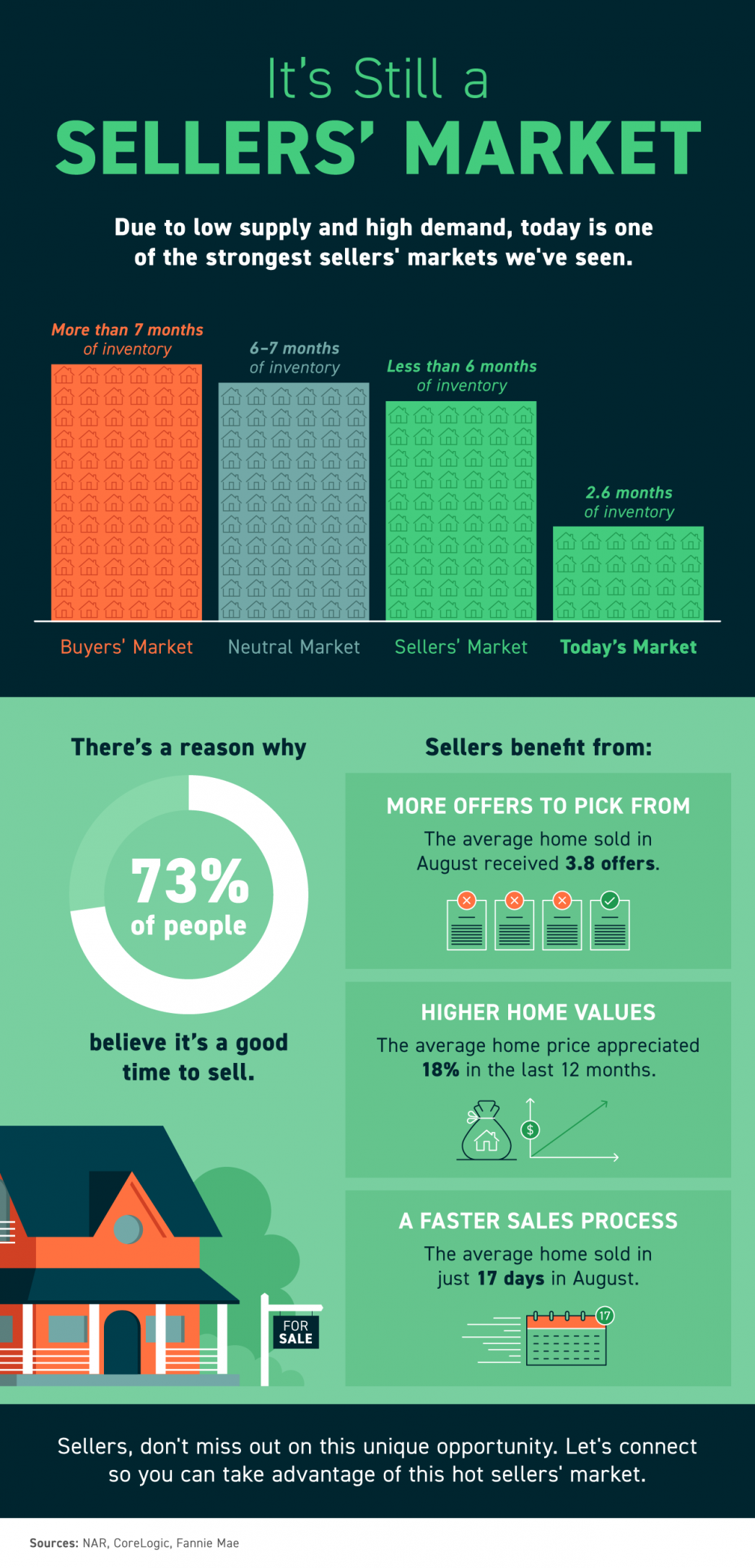

It’s Still a Sellers’ Market In Utah

It’s Still a Sellers’ Market Some Highlights Due to low supply and high demand, today is one of the strongest sellers’ markets we’ve seen. Sellers can benefit from more offers to pick from, higher home values, and a faster sales process. That might be why 73% of...

Is a 20% Down Payment Really Necessary To Purchase a Home?

Is a 20% Down Payment Really Necessary To Purchase a Home? There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from...

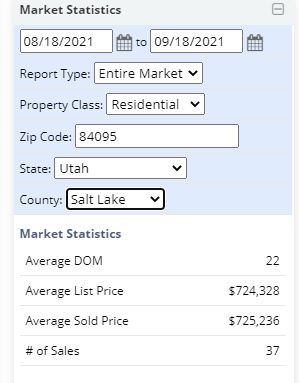

Market Stats for So Jo

South Jordan Market Update