How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

What’s Going on with Home Prices? Ask a Professional.

What’s Going on with Home Prices? Ask a Professional. If you’re thinking about buying or selling a home this year, you may have questions about what’s happening with home prices today as the market cools. In the simplest sense, nationally, experts don’t expect prices...

Prioritizing Your Wants and Needs as a Homebuyer in Today’s Market

Prioritizing Your Wants and Needs as a Homebuyer in Today’s Market There’s no denying mortgage rates are higher now than they were last year. And if you’re thinking about buying a home, this may be top of mind for you. That’s because those higher rates impact how much...

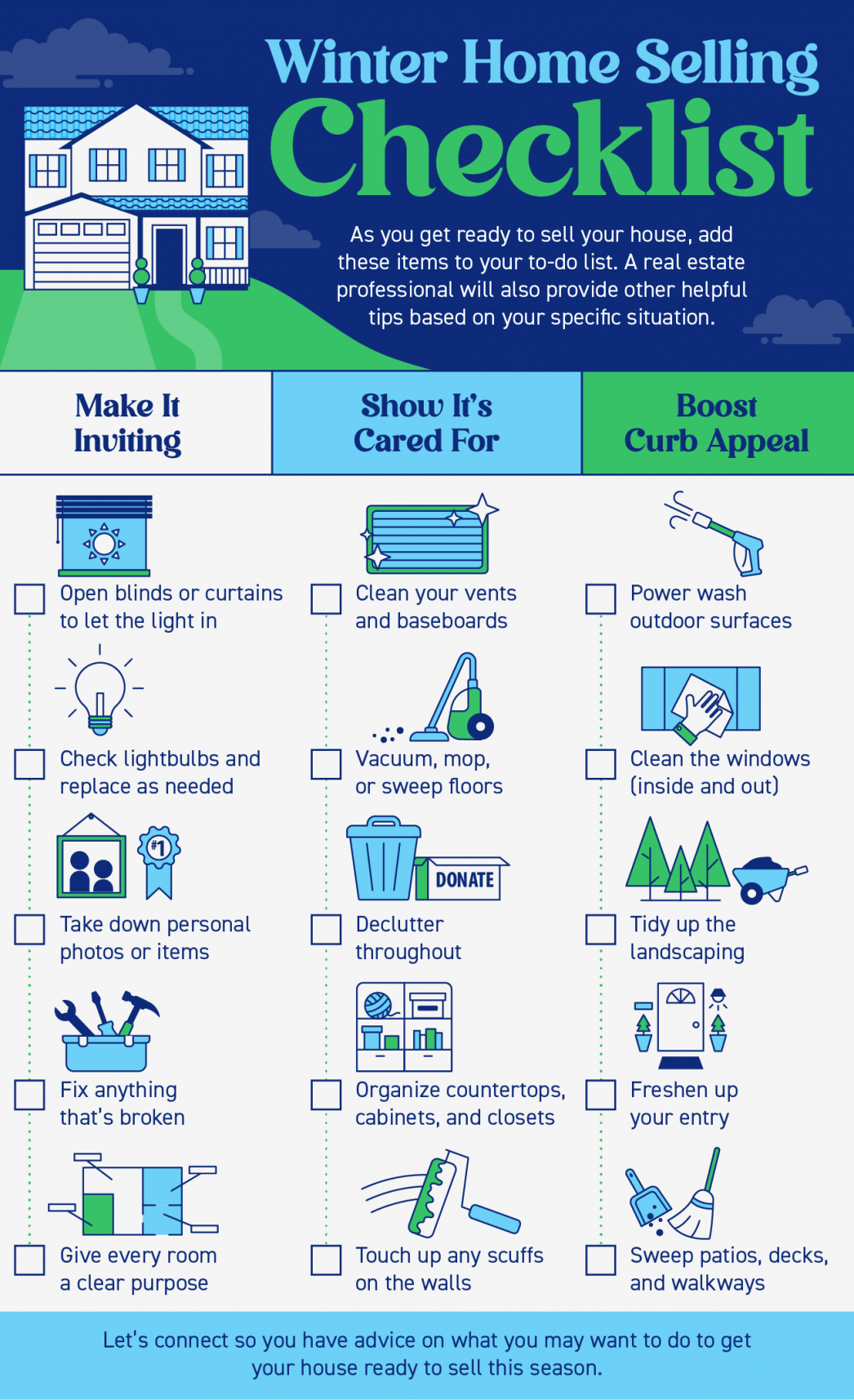

Winter Home Selling Checklist

Winter Home Selling Checklist Some Highlights As you get ready to sell your house, focus on tasks that make it inviting, show it’s cared for, and boost your curb appeal. This list will help you get started, but don’t forget, a real estate professional will provide...

Your House Could Be the #1 Item on a Homebuyer’s Wish List During the Holidays

Your House Could Be the #1 Item on a Homebuyer’s Wish List During the Holidays Each year, homeowners planning to make a move are faced with a decision: sell their house during the holidays or wait. And others who have already listed their homes may think about...

Top Questions About Selling Your Home This Winter

Top Questions About Selling Your Home This Winter There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be...

What Homeowners Want To Know About Selling in Today’s Market

What Homeowners Want To Know About Selling in Today’s Market If you’re thinking about selling your house, you’re likely hearing about the cooling housing market and wondering what that means for you. While it's not the peak intensity we saw during the pandemic, we’re...

Should You Update Your House Before You Sell? Ask a Real Estate Professional

Should You Update Your House Before You Sell? Ask a Real Estate Professional Some Highlights You may be wondering what needs to be renovated before you sell your house. In today’s shifting market, making your house appealing is more important than ever. That’s why...

Home Equity: A Source of Strength for Homeowners Today

Home Equity: A Source of Strength for Homeowners Today Experts agree there’s no chance of a large-scale foreclosure crisis like we saw back in 2008, and that’s good news for the housing market. As Mark Fleming, Chief Economist at First American, says: “. . . don’t...

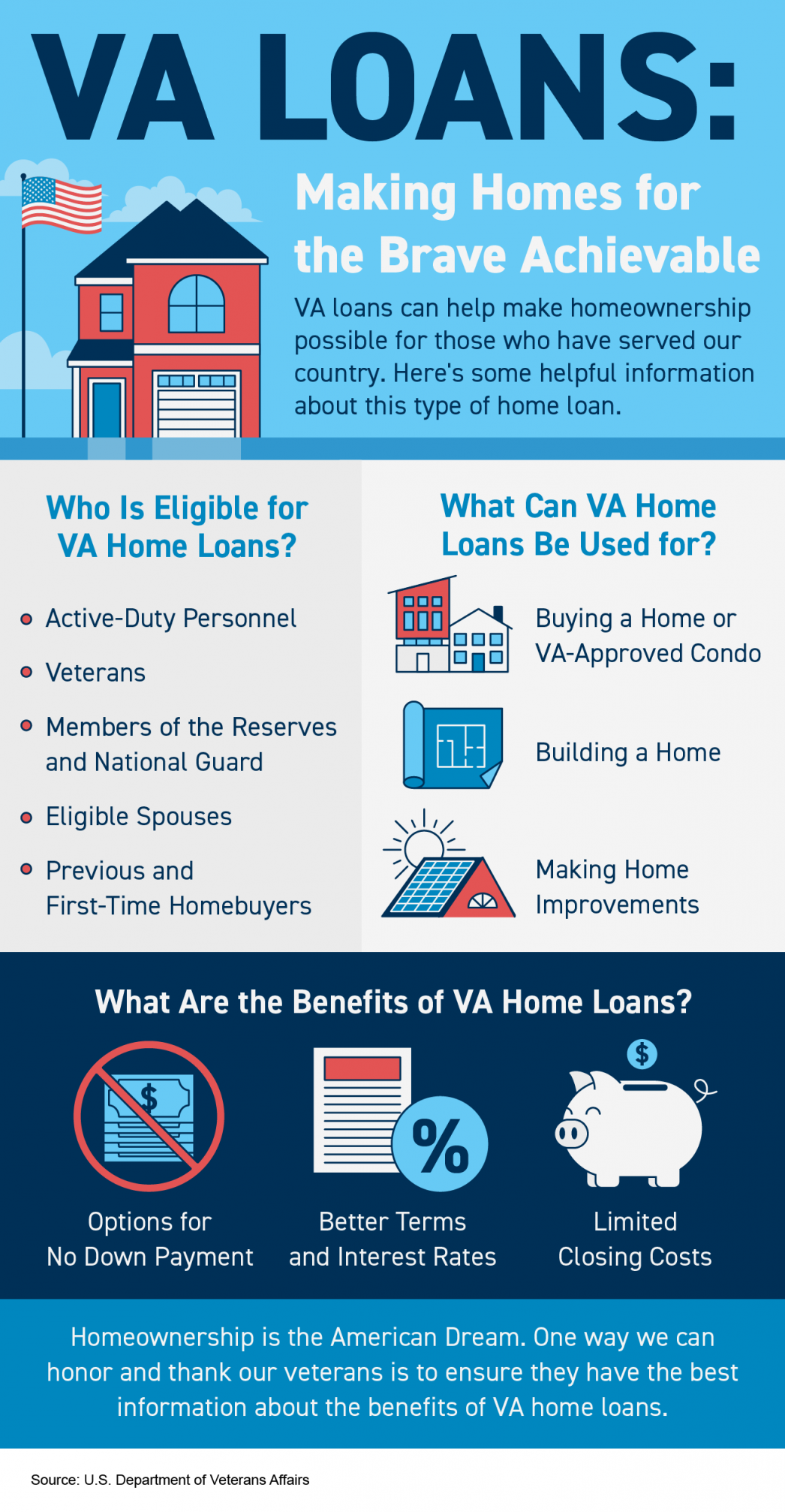

VA Loans: Making Homes for the Brave Achievable

VA Loans: Making Homes for the Brave Achievable Some Highlights VA Loans can help make homeownership possible for those who have served our country. These loans offer great benefits for eligible individuals and can help them buy a VA-approved house or condo, build a...

VA Loans Can Help Veterans Achieve Their Dream of Homeownership

VA Loans Can Help Veterans Achieve Their Dream of Homeownership For over 78 years, Veterans Affairs (VA) home loans have provided millions of veterans with the opportunity to purchase homes of their own. If you or a loved one have served, it’s important to understand...