How Quickly Can You Save Your Down Payment?

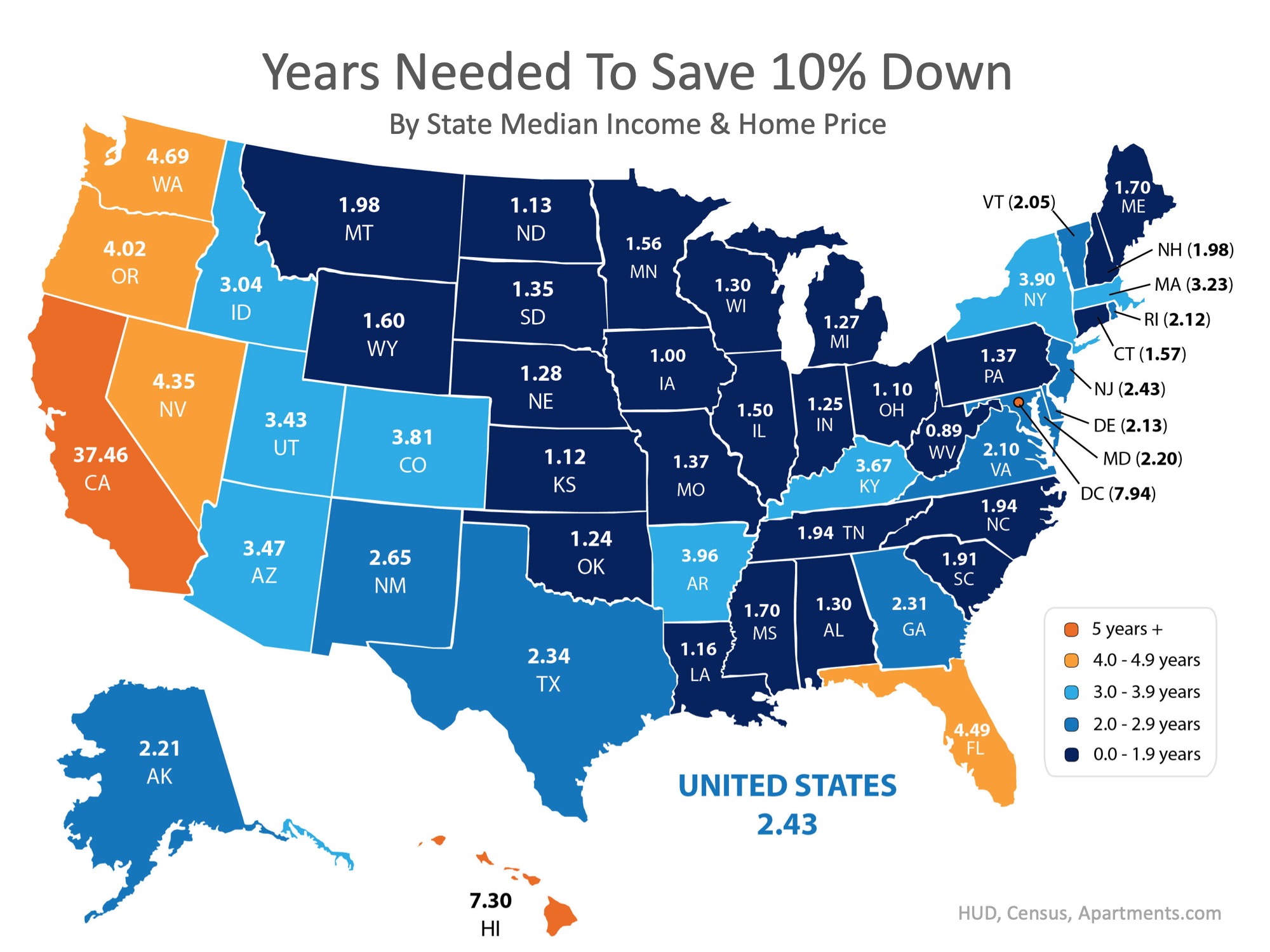

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

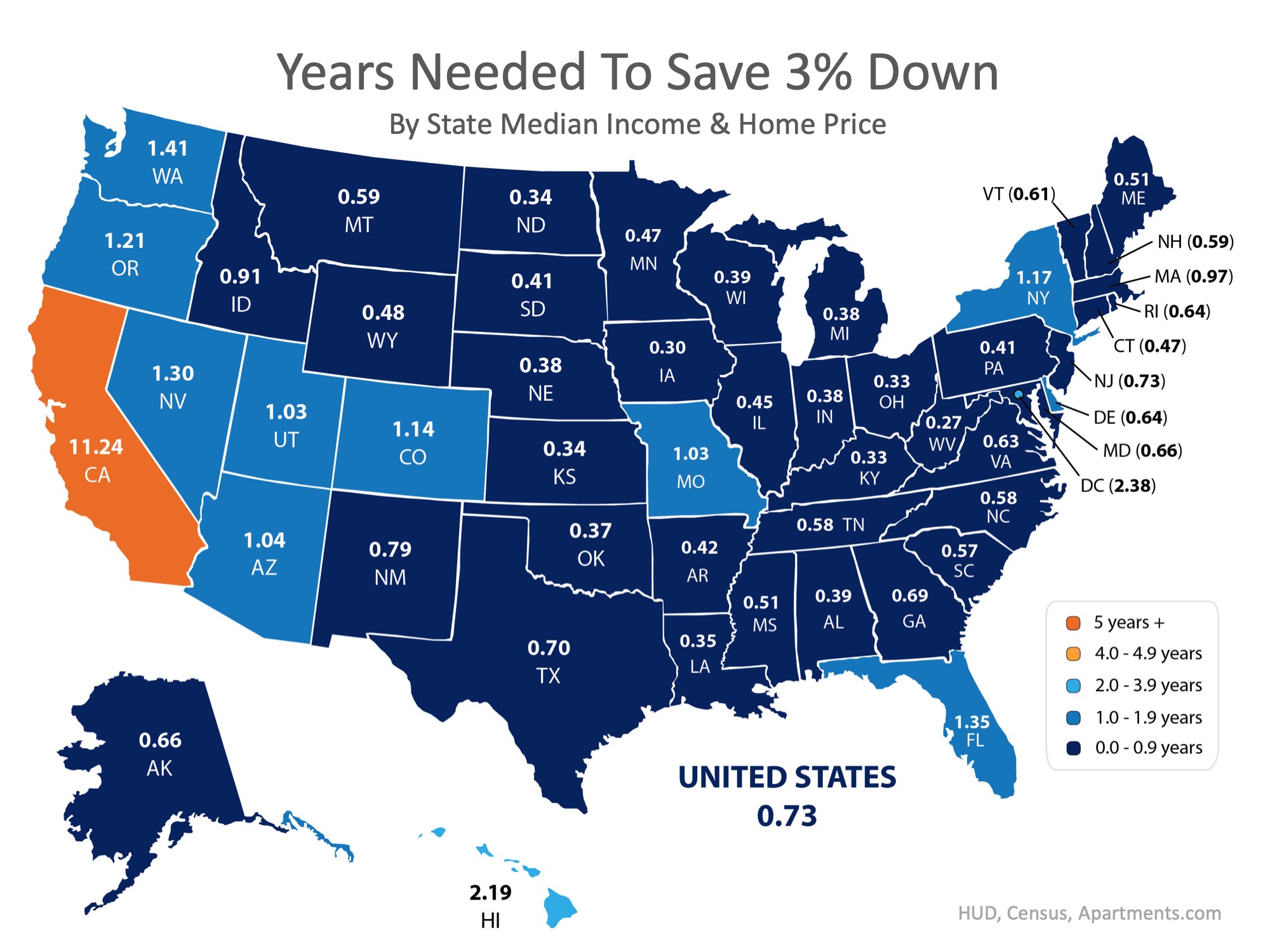

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

The Difference Having a Professional on Your Side Makes

The Difference Having a Professional on Your Side Makes In today’s fast-paced world, where answers are a Google search away, there are some who may wonder what the benefits of hiring a real estate professional to help them in their home search are. The truth is, with...

Utah Housing Loan Changes

Did you know? Utah Housing has made some changes to our Loan Programs; these changes will become effective with Mortgage Purchase Agreements (interest rate locks) issued on or after February 11, 2019. https://utahhousingcorp.org/ HomeAgain: May include an...

Buying a Home this Year?

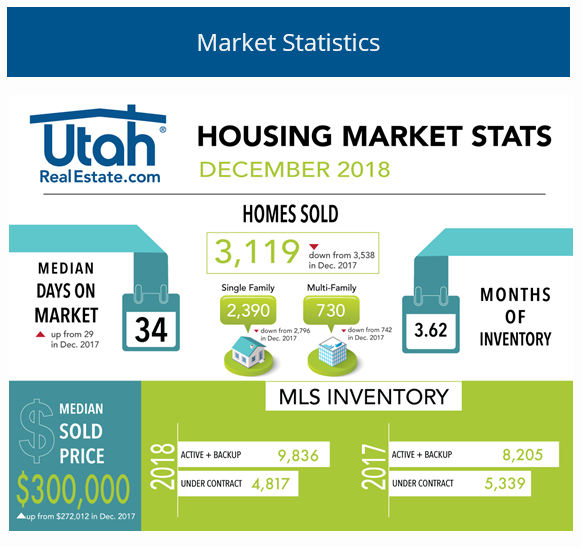

Utah Realty Market Statistics for December 2018

Housing Market Statistics for December of 2018

Average Home Mortgage Rates Over Time

With interest rates still around 4.5%, now is a great time to look back at where rates have been over the last 40 years. Rates are projected to climb to 5.0% by this time next year according to Freddie Mac. The impact your interest rate makes on your monthly mortgage...

The best time to sell in Salt Lake and Utah County

https://bit.ly/2D0WkZv

Question??? Want to get the most money from the Sale of your Home?

Want to Get the Most Money from The Sale of Your Home? Use These 2 Tips! Every homeowner wants to make sure they maximize their financial reward when selling their home. But how do you guarantee that you receive the maximum value for your house? Here are two keys to...

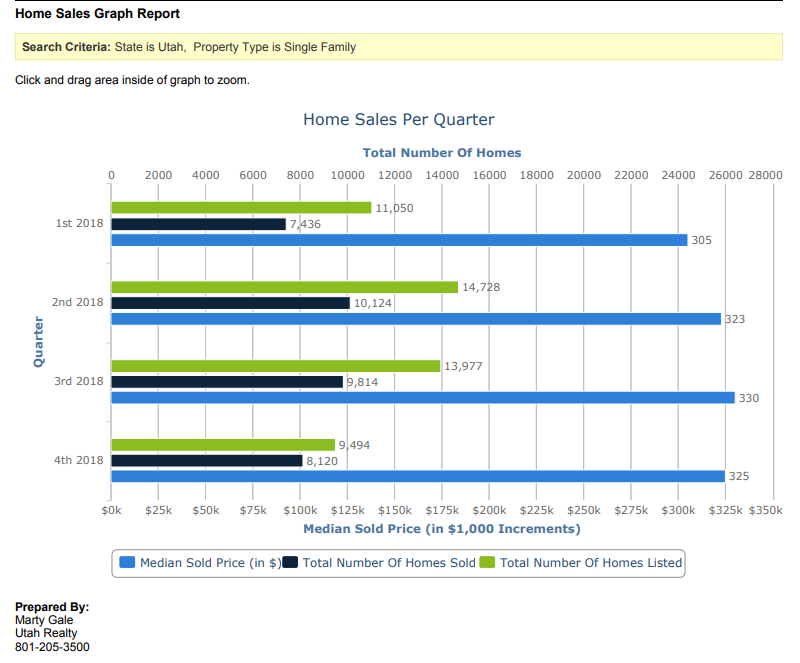

Year End Single Family & Condo Home Sales for Utah 2018

Utah Realty Magazine January 2019

Enjoy Magazine January 2019 Utah Realty PDF Version