How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

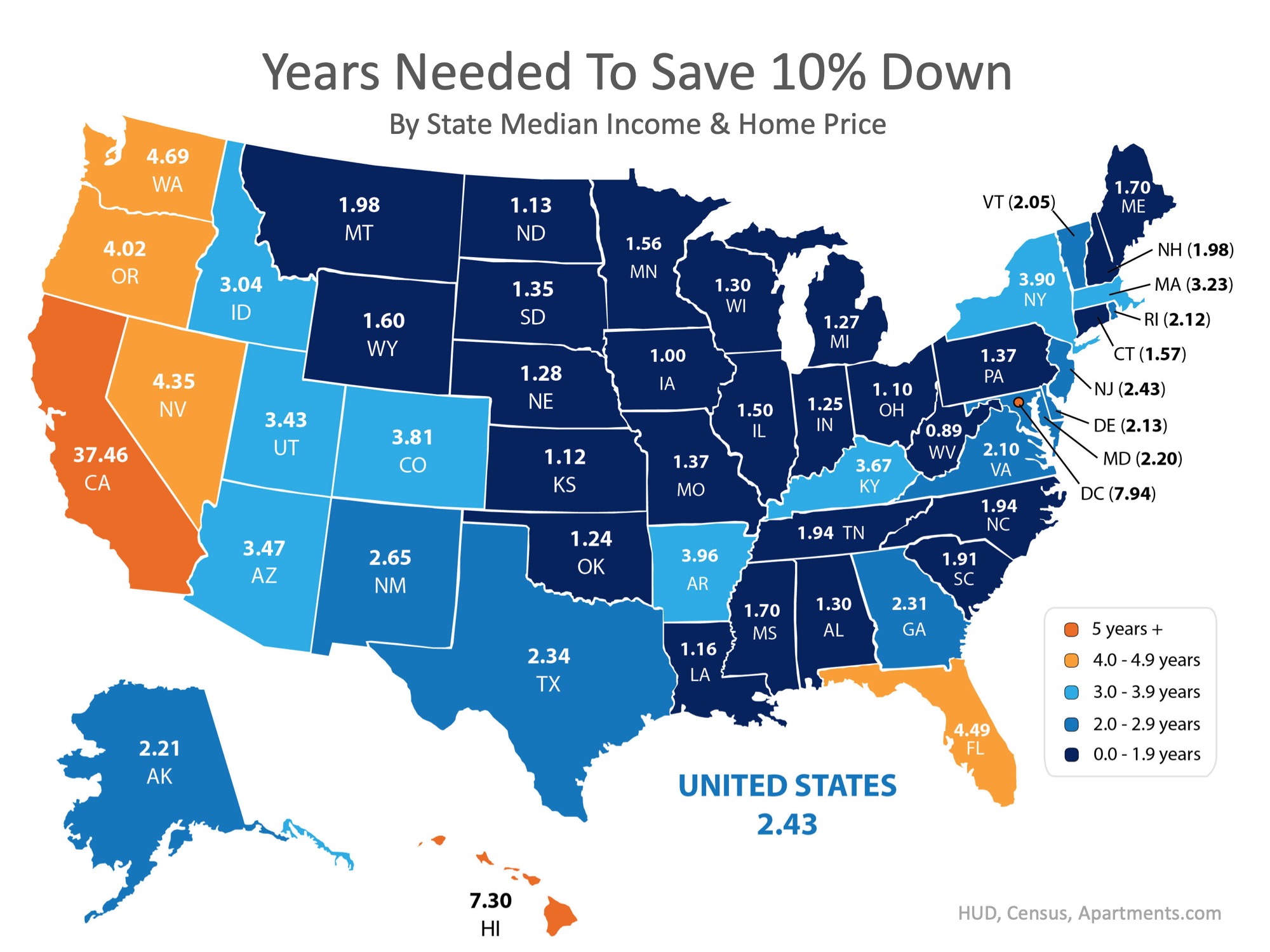

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

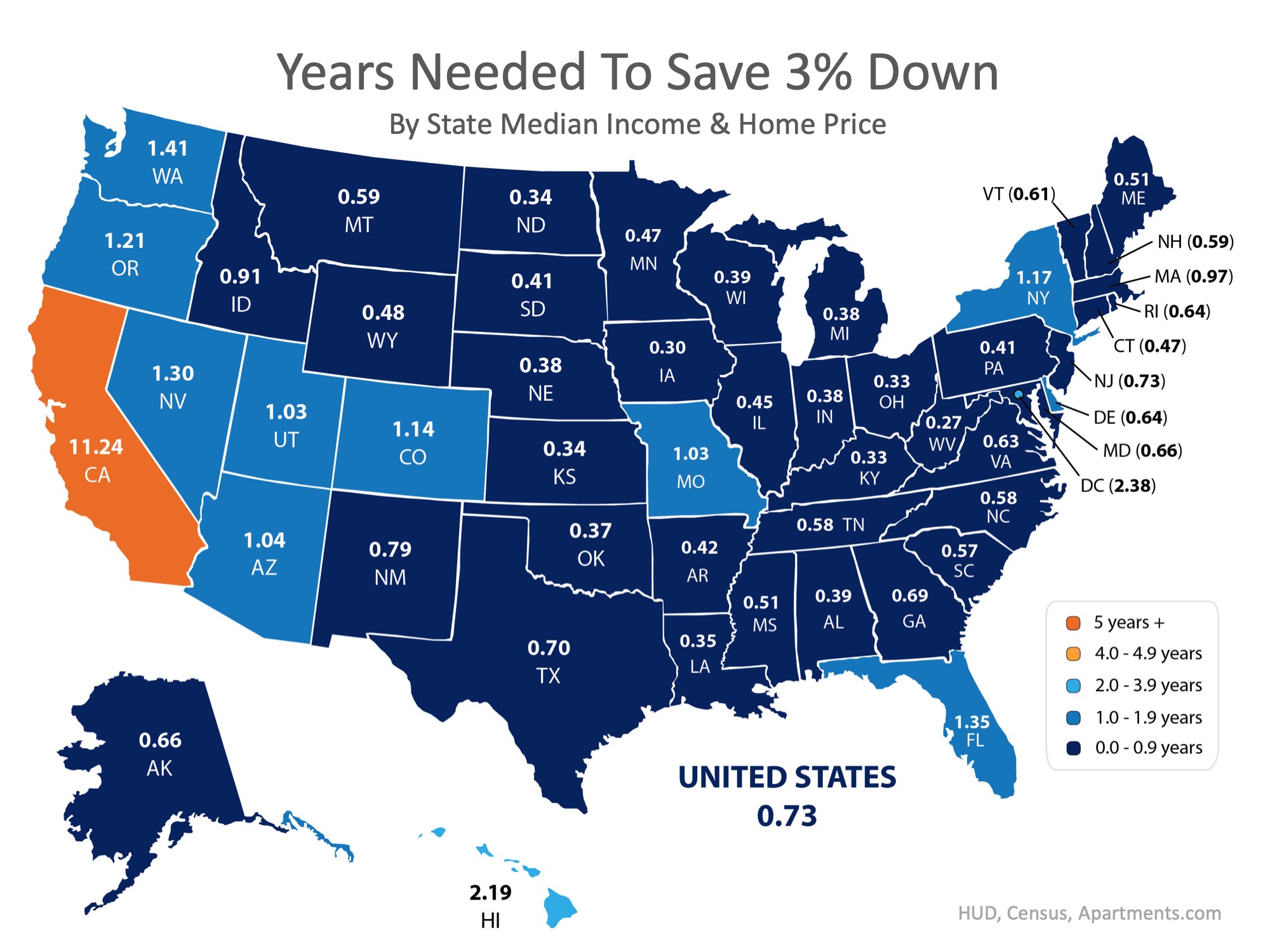

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

Time to Move-Up and Upgrade Your Current Home With Utah Realty

Now’s the Time to Move-Up and Upgrade Your Current Home! Homes priced at the top 25% of the price range for a particular area of the country are considered "premium homes." In today’s real estate market, there are deals to be had at the higher end! This is great news...

10 Steps to Buying a Home This Summer

10 Steps to Buying a Home This Summer [INFOGRAPHIC] Some Highlights: If you are thinking of buying a home, you may not know where to start. Here is a simple list of 10 steps that you will go through to purchase a home. Make sure to ask your agent for details about...

Happy Forth of July!

Happy Independence Day! Wishing you & yours a safe & Happy 4th of July!

Stop Wondering What Your Budget Is & Get Pre-Approved

Stop Wondering What Your Budget Is & Get Pre-Approved! In many markets across the country, the number of buyers searching for their dream homes outnumbers the number of homes for sale. This has led to a competitive marketplace where buyers often need to stand out....

Your 6-Month Mortgage Rate Forecast

Both mortgage interest rates and home prices are projected to rise throughout 2019. If you plan on buying a home this year, the time is now! Let's get together to discuss your plans today!

What You Need to Know About Private Mortgage Insurance (PMI) Utah Realty

What You Need to Know About Private Mortgage Insurance (PMI) Courtesy of Utah Realty Whether it is your first time or your fifth, it is always important to know all the facts when it comes to buying a home. With the large number of mortgage programs available that...

5 Reasons to Sell Your House This Summer with Utah Realty

5 Reasons to Sell Your House This Summer with Utah Realty Here are 5 compelling reasons listing your home for sale this summer makes sense. 1. Demand Is Strong The latest Buyer Traffic Index from the National Association of Realtors (NAR) shows that buyer demand...

Utah Gen X Time For Your Dream Home

Time for Your Dream Home, Gen X! During the housing market crash, Gen X homeowners lost more wealth than other generations. However, things are changing now! A strong economy, increasing home prices, and the recovery of the housing market are helping this generation...

3 Things to Know in the Housing Market Today in Utah!

3 Things to Know in the Housing Market Today! A lot is happening in the world, and it’s having a direct impact on the housing market. The reality is this: some of it is positive and some of it may be negative. Some we just don’t know yet. The following three areas of...

2 Myths Holding Back Utah Home Buyers

2 Myths Holding Back Home Buyers Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that, “For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of...