How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

7 Reasons to Put Your House For Sale This Holiday Season

7 Reasons to List Your House This Holiday Season Around this time each year, many homeowners decide to wait until after the holidays to list their houses. Similarly, others who already have their homes on the market remove their listings until the spring. Let’s unpack...

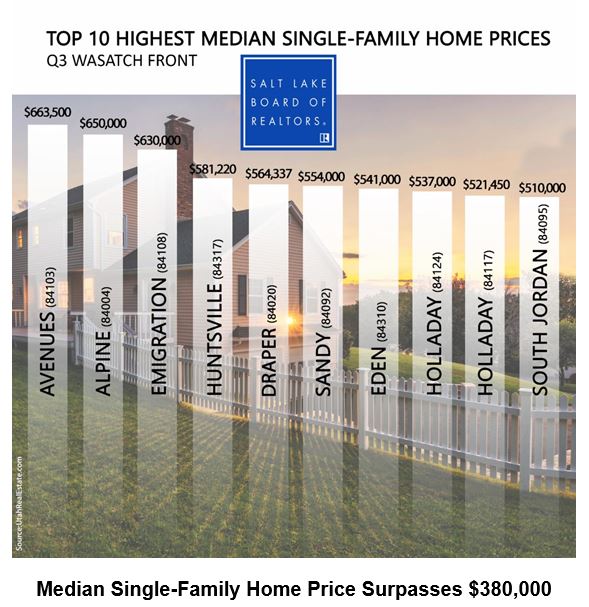

Top 10 Highest Single Family Home Prices Utah

Top 10 Highest Median Single-Family Home Prices along the Greater Wasatch Front Salt Lake County home prices climbed to an all-time high in the third quarter, according to the Salt Lake Board of Realtors®. The median single-family home price in the...

Veterans Day 11-11-19

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice. This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI...

Protected Class

Things you should not have your clients put in a letter to a buyer or seller. Protected Class A group of people with a common characteristic who are legally protected from employment discrimination on the basis of that characteristic. Protected classes are created by...

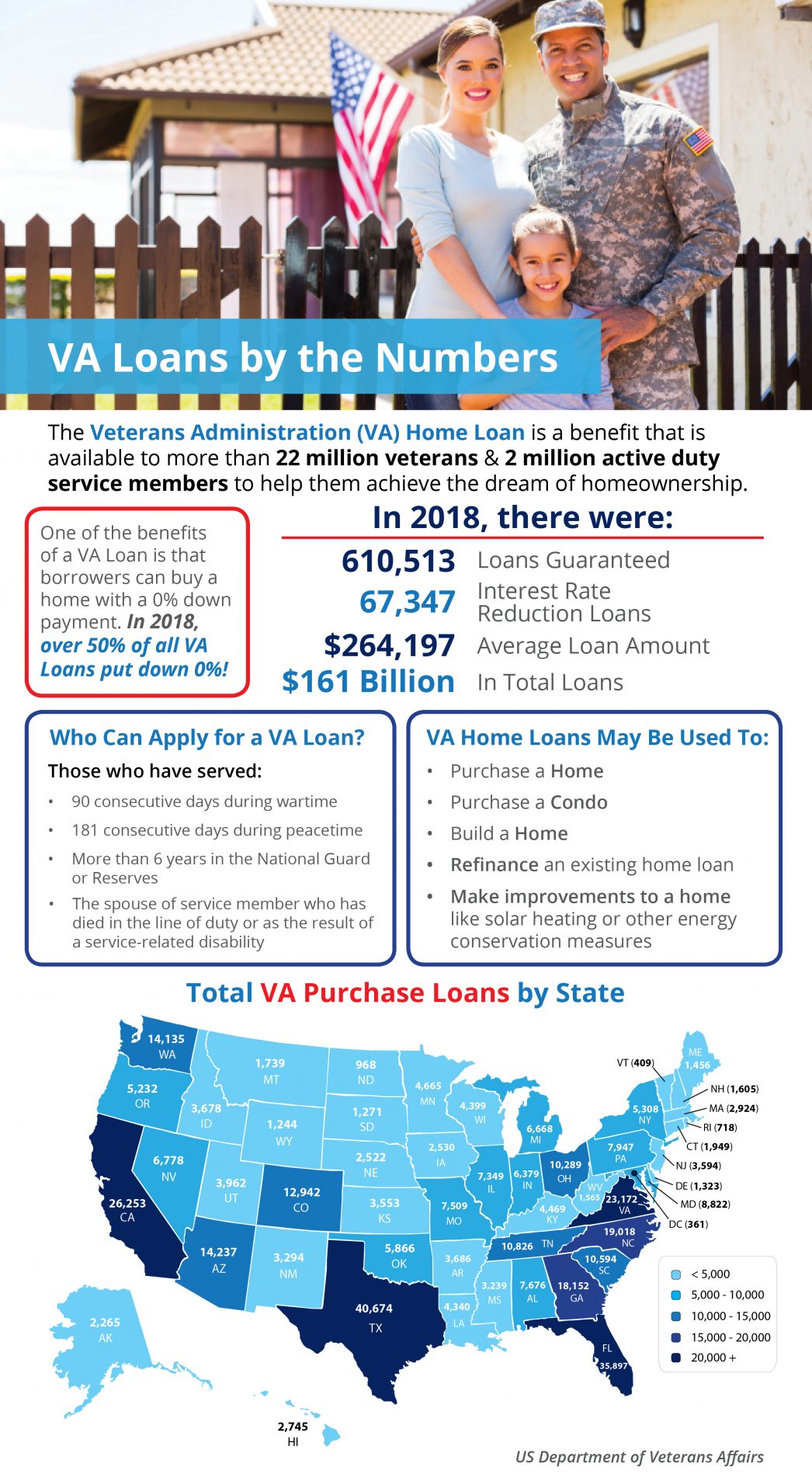

Utah Realty Presents VA Home Loans by the Numbers

Utah Realty Presents VA Home Loans by the Numbers Some Highlights: The Veterans Administration (VA) Home Loan is a benefit that is available to more than 22 million veterans and 2 million active duty service members to help them achieve the dream of homeownership. In...

The #1 Reason to List Your House in the Winter

The #1 Reason to List Your House in the Winter Many sellers believe spring is the best time to put their homes on the market because buyer demand traditionally increases at that time of year. What they don’t realize is if every homeowner believes the same thing, then...

Don’t Get Spooked by the Real Estate Market!

Have a Hauntingly Good Halloween! Having an agent to help guide you is key in today's complex housing...

Taking the Fear Out of the Mortgage Process

Taking the Fear Out of the Mortgage Process A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage. For many, the mortgage process can...

Buying a home can be SCARY…Until you know the FACTS

Buying a home can be SCARY…Until you know the FACTS Some Highlights: Many potential homebuyers believe they need a 20% down payment and a 780 FICO® score to qualify to buy a home. This stops many people from even trying to jump into homeownership! Here are some facts...

What credit Score Do You Need to Qualify for a Mortgage

What FICO® Score Do You Need to Qualify for a Mortgage? While a recent announcement from CNBC shares that the average national FICO® score has reached an all-time high of 706, the good news for potential buyers is that you don’t need a score that high to qualify for a...