How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

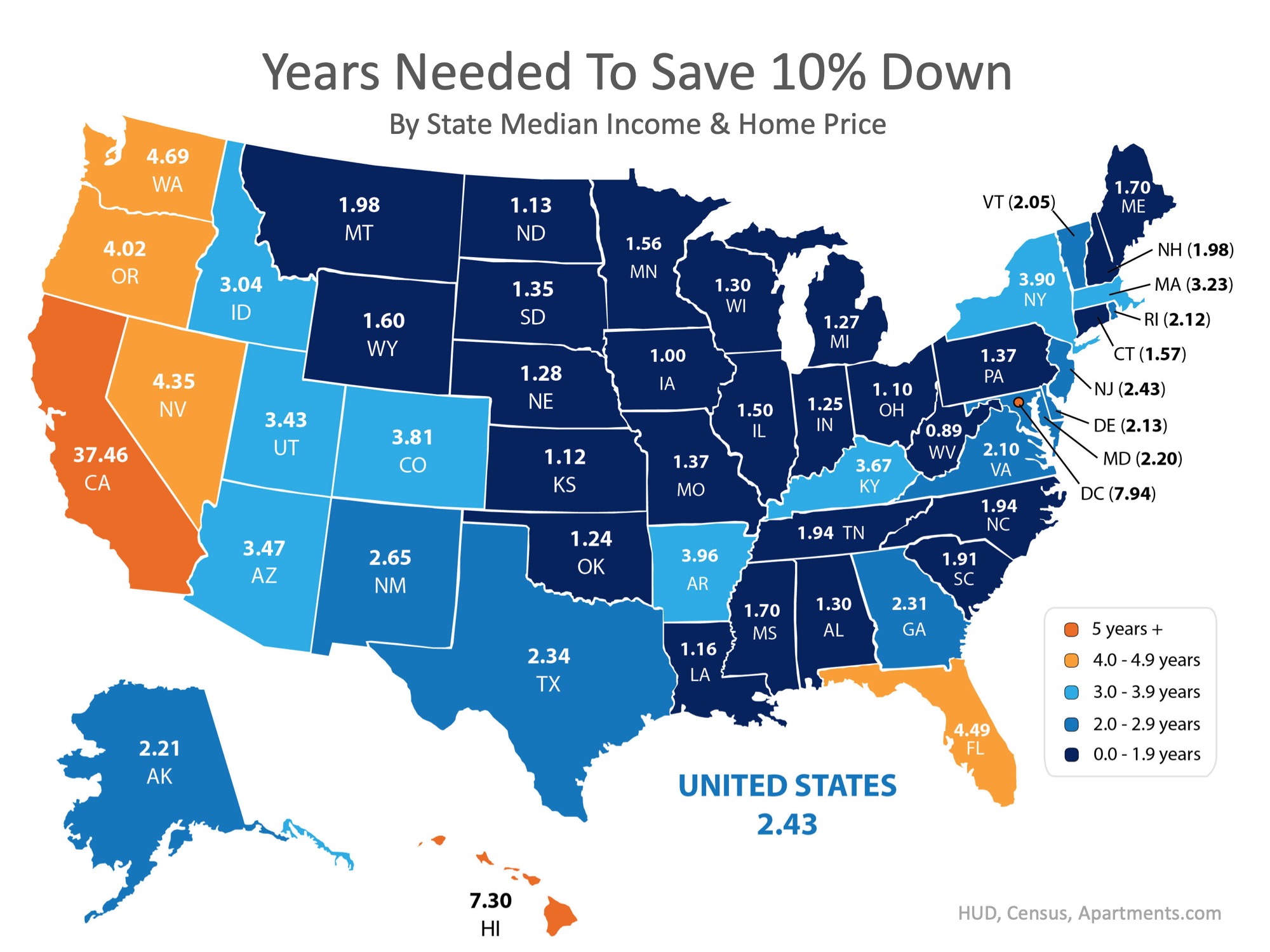

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

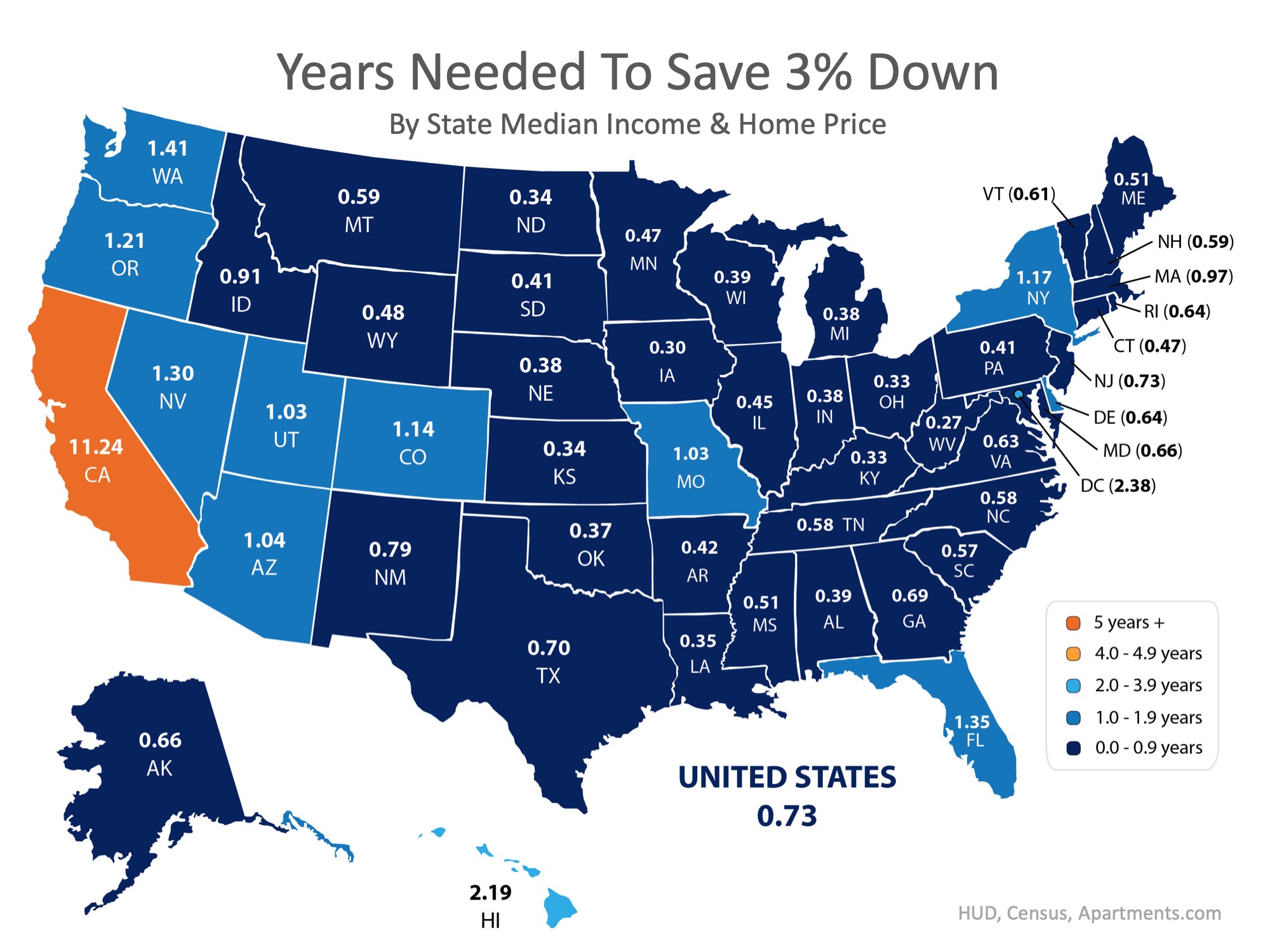

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

Guidance and Support Are Key When Buying Your First Home

Guidance and Support Are Key When Buying Your First HomeIn June, the number of first-time homebuyers accounted for 35% of the existing homes sold, a trend that’s been building steadily throughout the year. According to the National Association of Realtors (NAR):“The...

Is It a Good Time to Buy or Sell a Home?

A Real Estate Pro Is More Helpful Now than Ever

A Real Estate Pro Is More Helpful Now than Ever Some HighlightsA recent study shared by NAR notes that both buyers and sellers think an agent is more helpful than ever during the current health crisis.Expertise and professionalism are highly valued and can save buyers...

Two Reasons We Won’t See a Rush of Foreclosures This Fall

Two Reasons We Won’t See a Rush of Foreclosures This FallThe health crisis we face as a country has led businesses all over the nation to reduce or discontinue their services altogether. This pause in the economy has greatly impacted the workforce and as a result,...

Thinking of Selling Your House? Now May be the Right Time. Utah Realty Can Help

Thinking of Selling Your House? Now May be the Right Time. Experienced Realtors at Utah Realty Can Help! Inventory is arguably the biggest challenge for buyers in today’s housing market. There are simply more buyers actively looking for homes to purchase than there...

Mortgage Rates Fall to 50 year low

Mortgage Rates Fall Below 3% Some Highlights Mortgage rates hit another all-time low, falling below 3% this week. If you’re ready to buy a home, now is a great time to truly get more for your money at this historic moment. Let’s connect today to determine your best...

Real Estate is a Top Investment

Mortgage Rates Hit Record Lows for Three Consecutive Weeks

Mortgage Rates Hit Record Lows for Three Consecutive WeeksOver the past several weeks, Freddie Mac has reported the average 30-year fixed mortgage rate dropping to record lows, all the way down to 3.03%. Last week’s reported rate reached the lowest point in the...

Buyers: Are You Ready for a Bidding War?

Utah Buyers: Are You Ready for a Bidding War?Hiring an Expert with 34 Years of experience might just be what you need to rise to the top! With businesses reopening throughout the country and some experts indicating early signs of a much-anticipated...

Americans Rank Real Estate Best Investment for 7 Years Running

Americans Rank Real Estate Best Investment for 7 Years Running Some Highlights Real estate has outranked stocks, savings accounts, and gold as the best long-term investment among Americans for the past 7 years. The belief in the stability of housing as a long-term...