How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

Expert Insights on the 2022 Housing Market Utah Realty™

Expert Insights on the 2022 Housing Market As we move into 2022, both buyers and sellers are wondering, what’s next? Will there be more homes available to buy? Will prices keep climbing? How high will mortgage rates go? For the answer to those questions and more, we...

Your Best Offer

5 Tips for Making Your Best Offer on a Home As a buyer in a sellers’ market, sometimes it can feel like you’re stuck between a rock and a hard place. When you’re ready to make an offer on a home, remember these five easy tips to help you rise above the competition. 1....

Merry Christmas! Happy New Year! Thank You for All of Your Support

Merry Christmas! Happy New Year! Thank You for All of Your Support

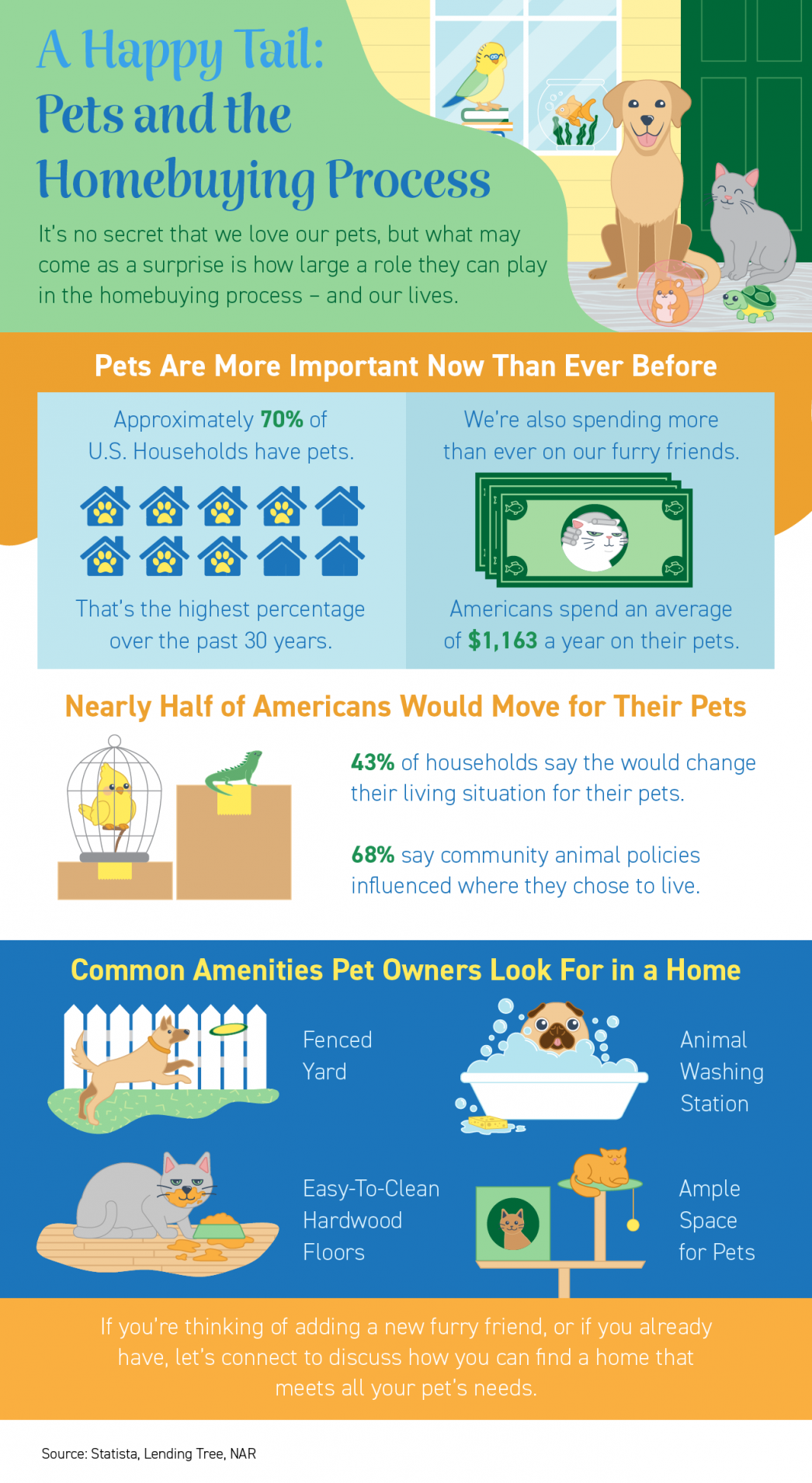

A Happy Tail: Pets and the Homebuying Process

A Happy Tail: Pets and the Homebuying Process Some Highlights It’s no secret that we love our furry friends - about 70% of U.S. households have pets. What may come as a surprise is how large a role they play in the homebuying process. Americans spend $1,163 a year on...

Two Reasons Why Waiting To Buy a Home Will Cost You

Two Reasons Why Waiting To Buy a Home Will Cost You If you’re a homeowner who’s decided your current house no longer fits your needs, or a renter with a strong desire to become a homeowner, you may be hoping that waiting until next year could mean better market...

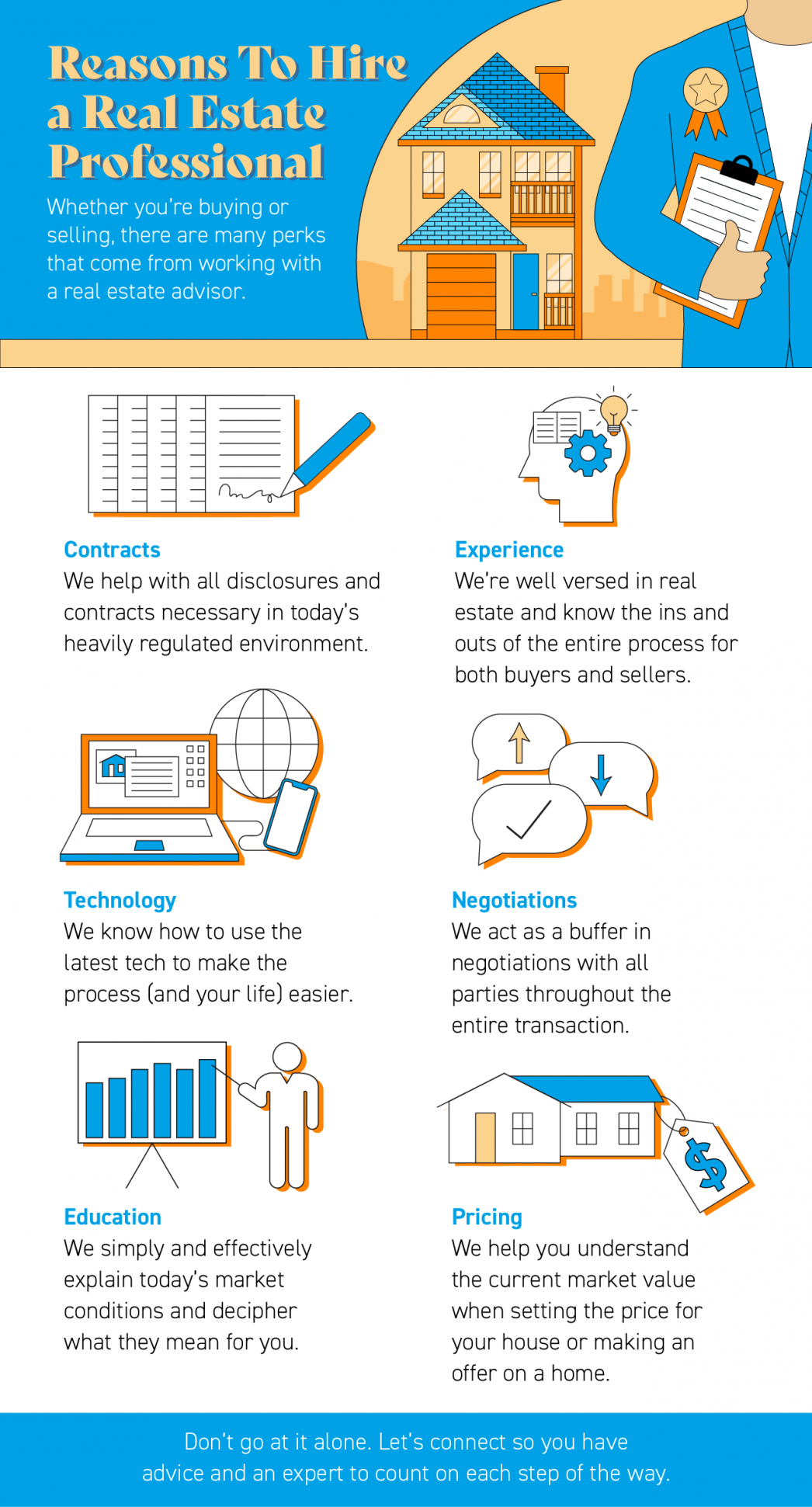

Reasons To Hire a Real Estate Professional

Reasons To Hire a Real Estate Professional Some Highlights Whether you’re buying or selling, there are many perks that come from working with a real estate advisor. Real estate professionals are experts at navigating all aspects of the buying and selling process,...

Happy Thanksgiving This 2021

thank·ful expressing gratitude and relief. "an earnest and thankful prayer OHANA is a Hawaiian term meaning "family" (in an extended sense of the term, including blood-related, adoptive or intentional). THANKSGIVING It began as a day of giving thanks and sacrifice for...

Home Sales About To Surge? We May See a Winter Like Never Before

Home Sales About To Surge? We May See a Winter Like Never Before. Like most industries, residential real estate has a seasonality to it. For example, toy stores sell more toys in October, November, and December than they do in any other three-month span throughout the...

Retirement May Be Changing What You Need in a Home

Retirement May Be Changing What You Need in a Home The past year and a half brought about significant life changes for many of us. For some, it meant entering retirement earlier than expected. Recent data shows more people retired this year than anticipated. According...

Sellers: You’ll Likely Get Multiple Strong Offers This Season

Sellers: You’ll Likely Get Multiple Strong Offers This Season Are you thinking about selling your house right now, but you’re not sure you’ll have the time to do so as the holidays draw near? If so, consider this: even as the holiday season approaches, there are...