The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

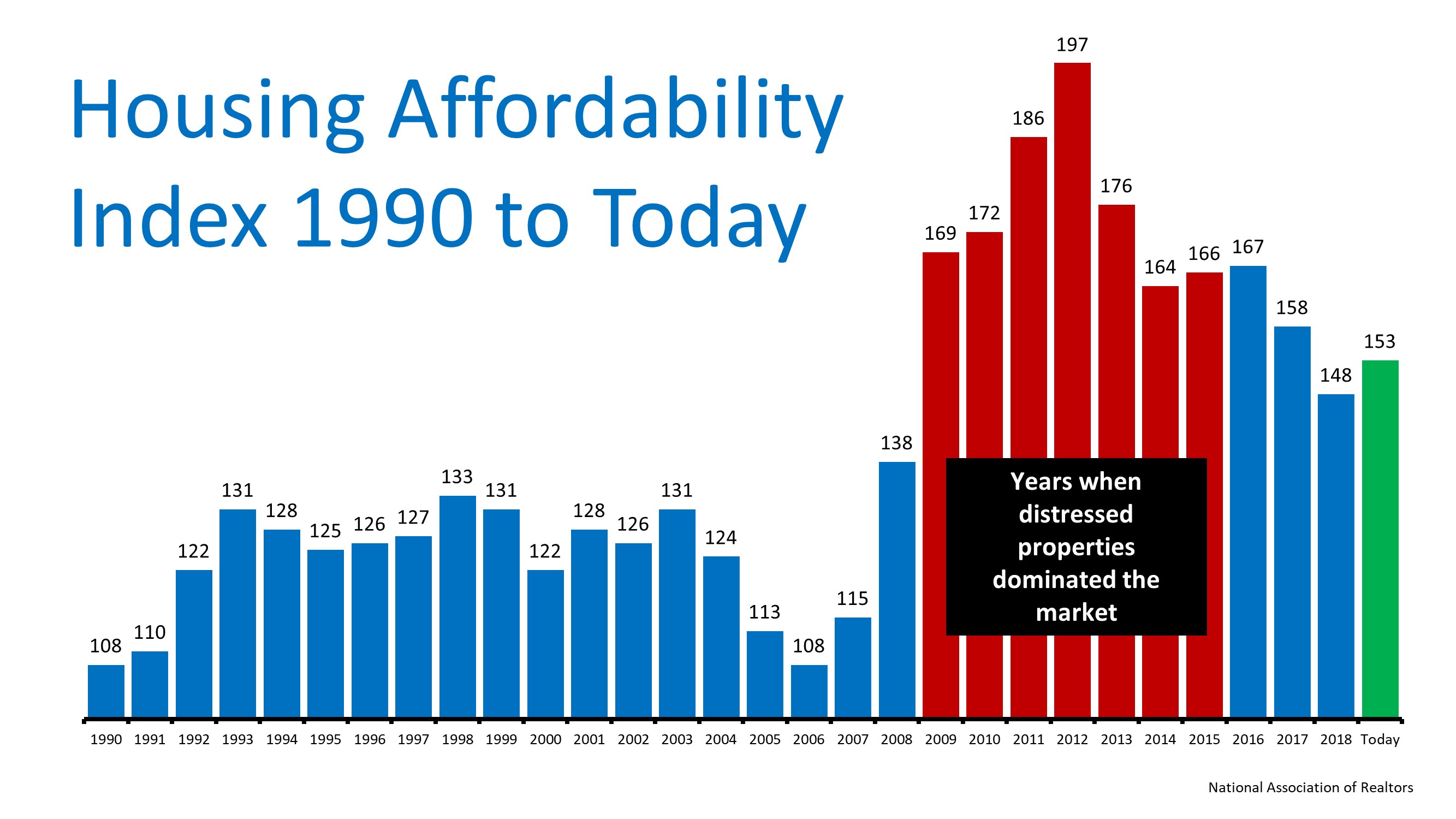

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Thinking of Buying or Selling This Spring? Free How to Guide

>>>> Free Guides to Buying and Selling this spring! <<<<

6 Simple Graphs Proving This Is Nothing Like Last Time

6 Simple Graphs Proving This Is Nothing Like Last Time Last March, many involved in the residential housing industry feared the market would be crushed under the pressure of a once-in-a-lifetime pandemic. Instead, real estate had one of its best years ever. Home sales...

5 Reasons to Sell Your House This Spring

5 Reasons to Sell Your House This Spring When selling a house, most homeowners hope for a quick and profitable transaction that puts them in a position to make a great move. If you’re waiting for the best time to win as a seller, the market is calling your name this...

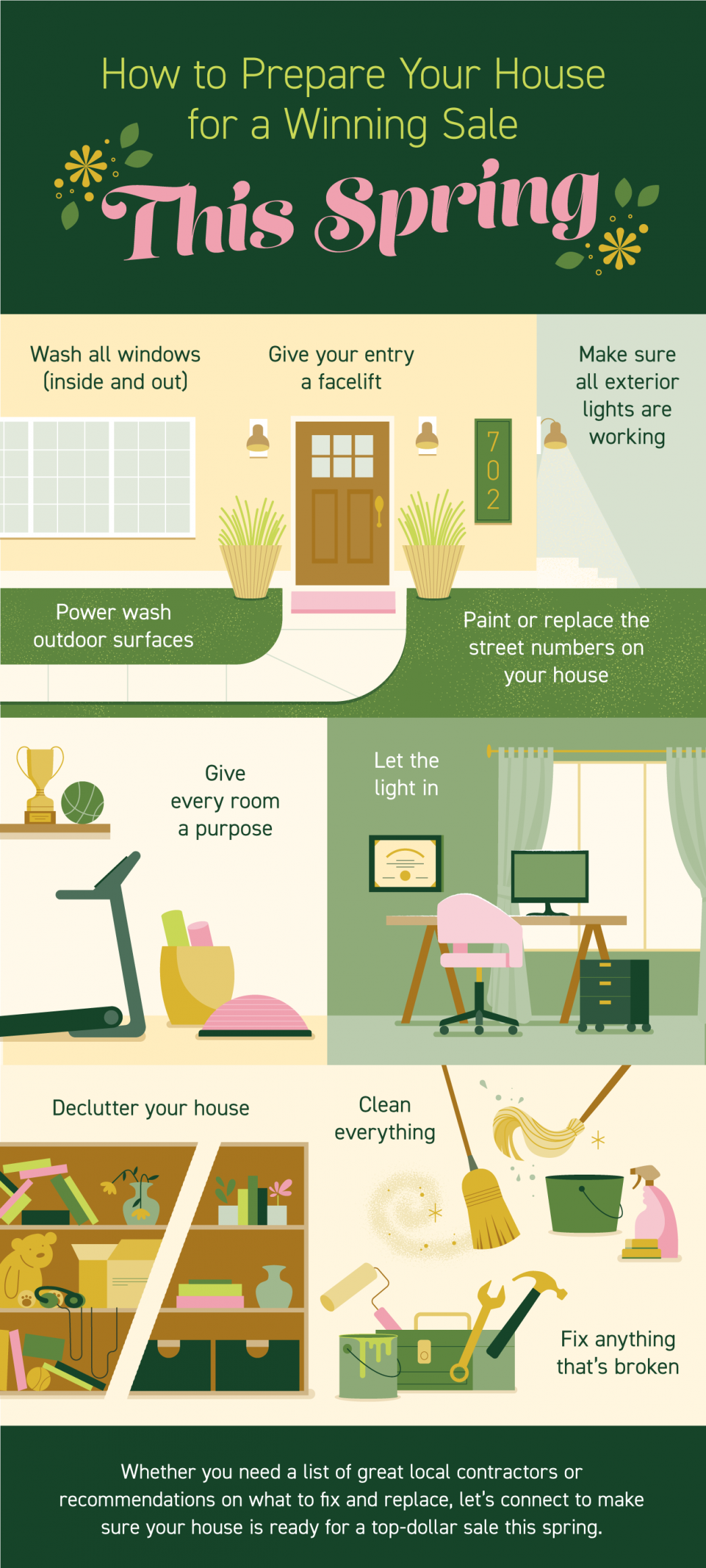

How to Prepare Your House for a Winning Sale This Spring

How to Prepare Your House for a Winning Sale This Spring Some Highlights With so few homes available to buy today, houses are in high demand, and they’re selling fast. That means it’s a great time to sell if you’re ready to make a move. Let’s connect to make sure...

Is It a Good Time to Sell My House in Utah

Is It a Good Time to Sell My House In Utah?Last year, many homeowners thought twice about selling their houses due to the onset of the health crisis. This year, however, homeowners are beginning to regain their confidence when it comes to selling safely. The...

Salt Lake County Market Report by Utah Realty

Looking to sell your home in this intense real estate market?

Looking to sell your home in this intense real estate market? Looking to sell your home in this intense real estate market? If you are, it's possible you will receive multiple offers on your home depending on its condition, location and price. Reviewing multiple...

How Smart Is It to Buy a Home Today

How Smart Is It to Buy a Home Today?Whether you’re buying your first home or selling your current house, if your needs are changing and you think you need to move, the decision can be complicated. You may have to take personal or professional considerations into...

What Are the Benefits of a 20% Down Payment?

What Are the Benefits of a 20% Down Payment? If you’re thinking of buying a home this year, you may be wondering how much money you need to come up with for your down payment. Many people may think it’s 20% of the loan to secure a mortgage. While there are plenty of...

Are There Going to Be More Homes to Buy This Year?

Are There Going to Be More Homes to Buy This Year?If you’re looking for a home to purchase right now and having trouble finding one, you’re not alone. At a time like this when there are so few houses for sale, it’s normal to wonder if you’ll actually find one to buy....