Homes Are More Affordable Today, Not Less Affordable

There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several years.

It’s not, however, just the price of a home that matters.

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by approximately 3% over the last year.

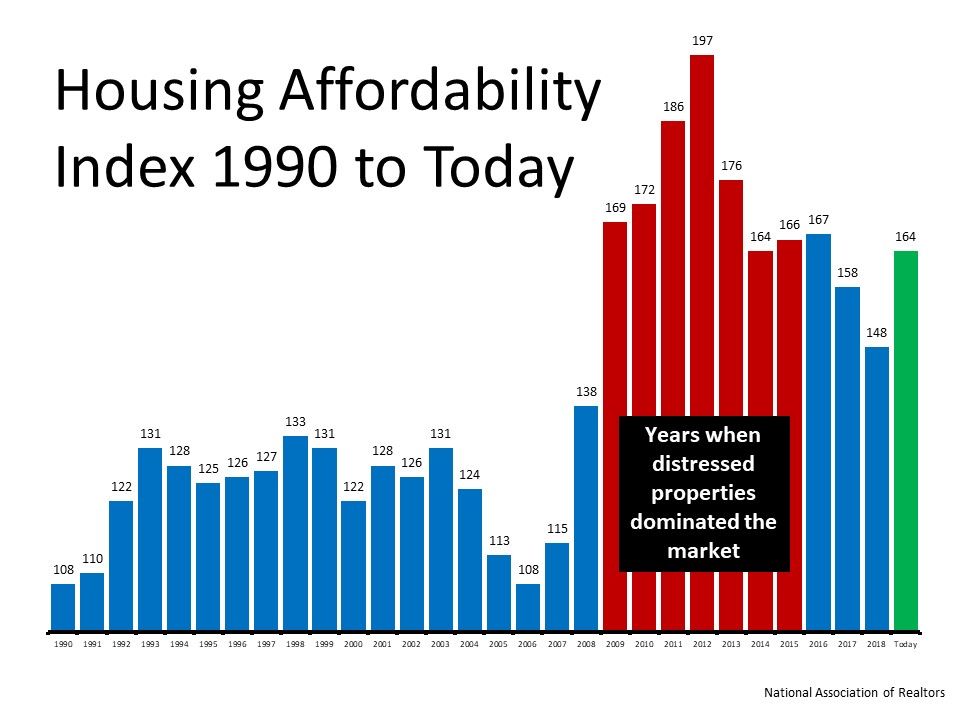

The National Association of Realtors (NAR) releases a monthly Housing Affordability Index. The latest index shows that home affordability is better today than at almost any point over the last 30 years. The index determines how affordable homes are based on the following:

“A Home Affordability Index value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20 percent down payment so that the monthly payment and interest will not exceed 25 percent of this level of income (qualifying income).”

The higher the index, therefore, the more affordable homes are. Here is a graph showing the index since 1990: Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

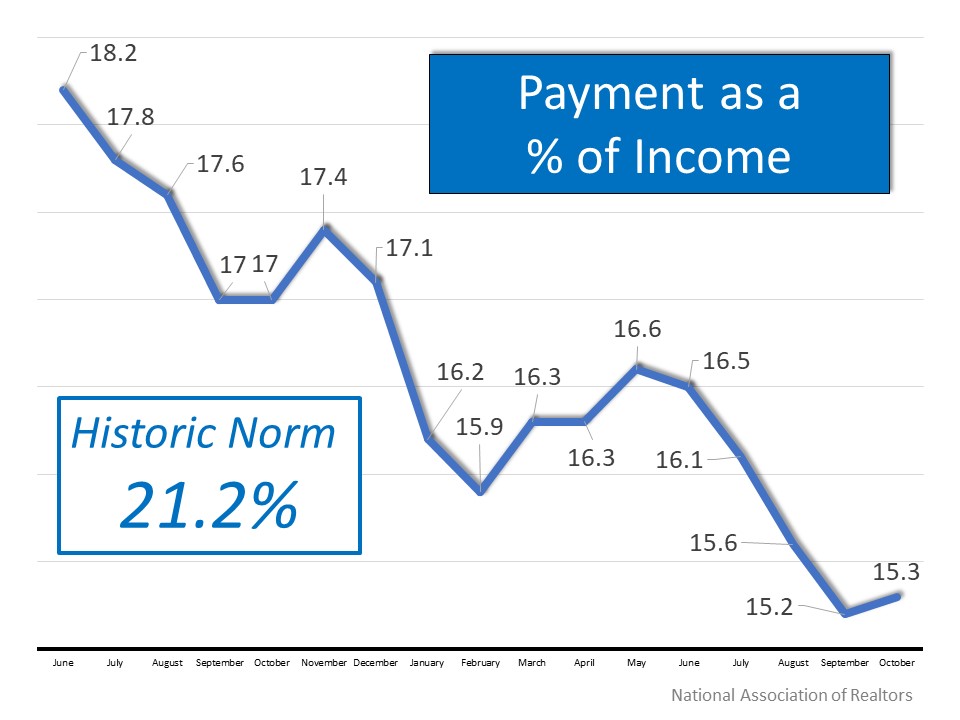

The report on the index also includes a section that calculates the mortgage payment on a median priced home as a percentage of the median national income. Historically, that percentage is just above 21%. Here are the percentages since June of 2018: Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Bottom Line

Whether you’re thinking about buying your first home or moving up to the home of your dreams, don’t let the false narrative about affordability prevent you from moving forward. From an affordability standpoint, this is one of the best times to buy in the last 30 years.

Find The Perfect Home Here

Buyer Guide (Its Free)

Utah top 5 states for Millennial home ownership

Way to Go Millennials! Utah is one of the top 5 states with the Highest Millennial Homeownership! Find or Sell a Millennial Home here>>>https://utahrealtyluxury.com/ We go the extra mile to speak, Text, Instagram your language. Yes I know,...

Getting Ready to Sell My Home, Can I Take My Firearms?

Before moving out of Utah Beware of other States Gun Laws! Read the fine print. If you are moving out of the State of Utah and have Firearms check that State firearm law. Some states will arrest you and charge you for having a firearm in your vehicle....

Get a Master Certified Negotiation Expert in your corner

https://bit.ly/2HYFNq8

How Much do you need to make to buy a home in Utah?

https://goo.gl/7yVLby

Pre-approval is key to offer acceptance

https://goo.gl/4L97Xk

Cheaper to Own a Home Today?

https://goo.gl/kbJBCy

Search Homes in Utah

Now is a great time to check out the market!

midway townhome swiss alpenhof Heber Utah

New Price ! $498,000 Town Home in Scenic Midway Utah Located in the Swiss Alpenholf Planned Unit Development 4775 Square Feet with 4 bedrooms, 3 baths 3 family rooms. Back yard with mountain views. About Midway Midway is a city in Wasatch County, Utah, United...

20 Tips for Preparing Your House for Sale This Spring

https://goo.gl/okk5cA