Homes Are More Affordable Today, Not Less Affordable

There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several years.

It’s not, however, just the price of a home that matters.

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by approximately 3% over the last year.

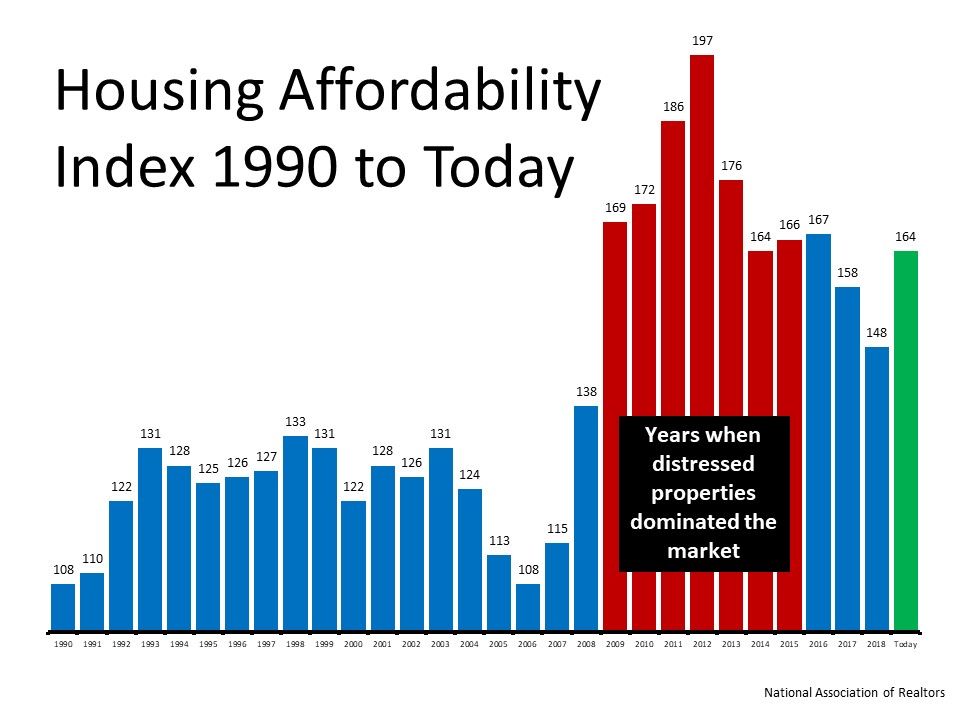

The National Association of Realtors (NAR) releases a monthly Housing Affordability Index. The latest index shows that home affordability is better today than at almost any point over the last 30 years. The index determines how affordable homes are based on the following:

“A Home Affordability Index value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20 percent down payment so that the monthly payment and interest will not exceed 25 percent of this level of income (qualifying income).”

The higher the index, therefore, the more affordable homes are. Here is a graph showing the index since 1990: Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

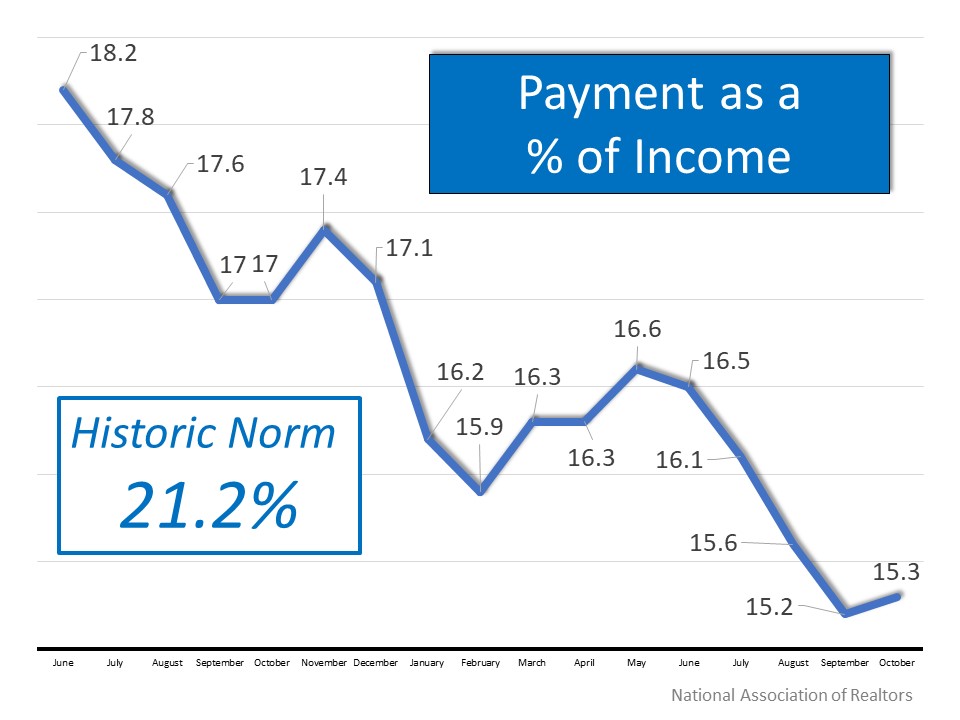

The report on the index also includes a section that calculates the mortgage payment on a median priced home as a percentage of the median national income. Historically, that percentage is just above 21%. Here are the percentages since June of 2018: Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Bottom Line

Whether you’re thinking about buying your first home or moving up to the home of your dreams, don’t let the false narrative about affordability prevent you from moving forward. From an affordability standpoint, this is one of the best times to buy in the last 30 years.

Find The Perfect Home Here

Buyer Guide (Its Free)

Applying For a Mortgage? Here’s What You Should Avoid Once You Do.

Applying For a Mortgage? Here’s What You Should Avoid Once You Do. While it’s exciting to start thinking about moving in and decorating after you’ve applied for your mortgage, there are some key things to keep in mind before you close. Here’s a list of things you may...

Financial Fundamentals for First-Time Homebuyers Are you prepping to buy your first home? If so, one of the steps you should take early on is making sure you’re financially ready for your purchase. Here are just a few of the financial fundamentals you’ll need to focus...

Utah Realty Marty & Laurie Gale

Thank You for All of Your Support

What To Expect From the Housing Market in 2023

What To Expect From the Housing Market in 2023 The 2022 housing market has been defined by two key things: inflation and rapidly rising mortgage rates. And in many ways, it's put the market into a reset position. As the Federal Reserve (the Fed) made moves this year...

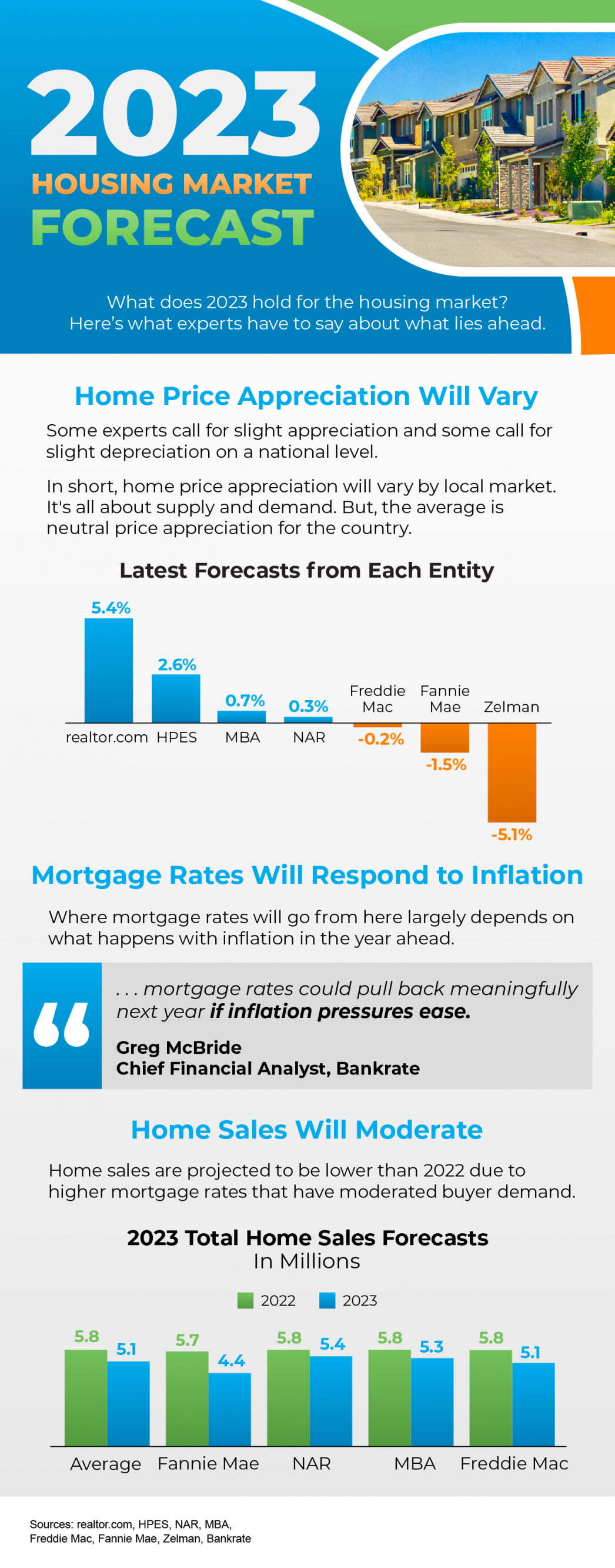

2023 Housing Market Forecast (National)

2023 Housing Market Forecast Some Highlights From home sales to prices, the 2023 housing market will be defined by mortgage rates. And where rates go depends on what happens with inflation. If you’re thinking of buying or selling a home this year, let’s connect so you...

Planning to Retire? It Could Be Time To Make a Move

Planning to Retire? It Could Be Time To Make a Move. If you’re thinking about retirement or have already retired this year, you may be planning your next steps. One of your goals could be selling your house and finding a home that more closely fits your needs....

You May Have More Negotiation Power When You Buy a Home Today

You May Have More Negotiation Power When You Buy a Home Today Did the frequency and intensity of bidding wars over the past two years make you put your home search on hold? If so, you should know the hyper competitive market has cooled this year as buyer demand has...

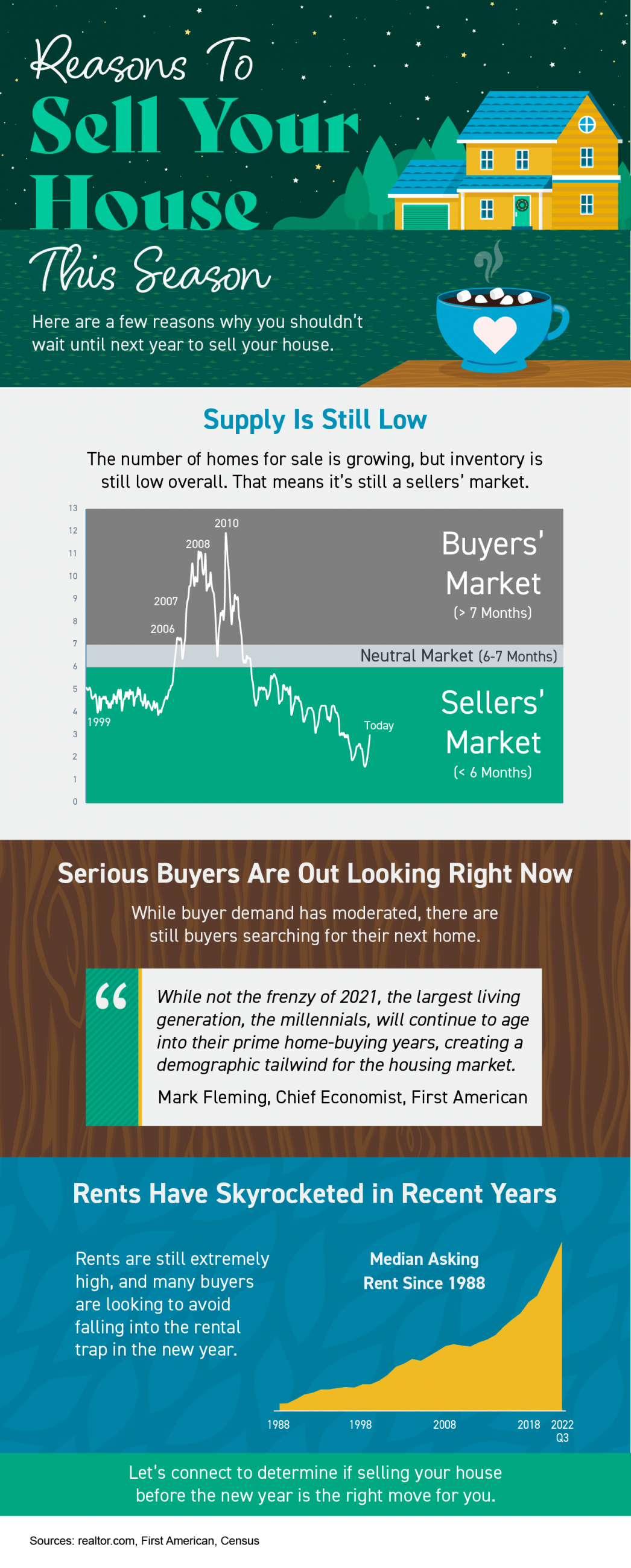

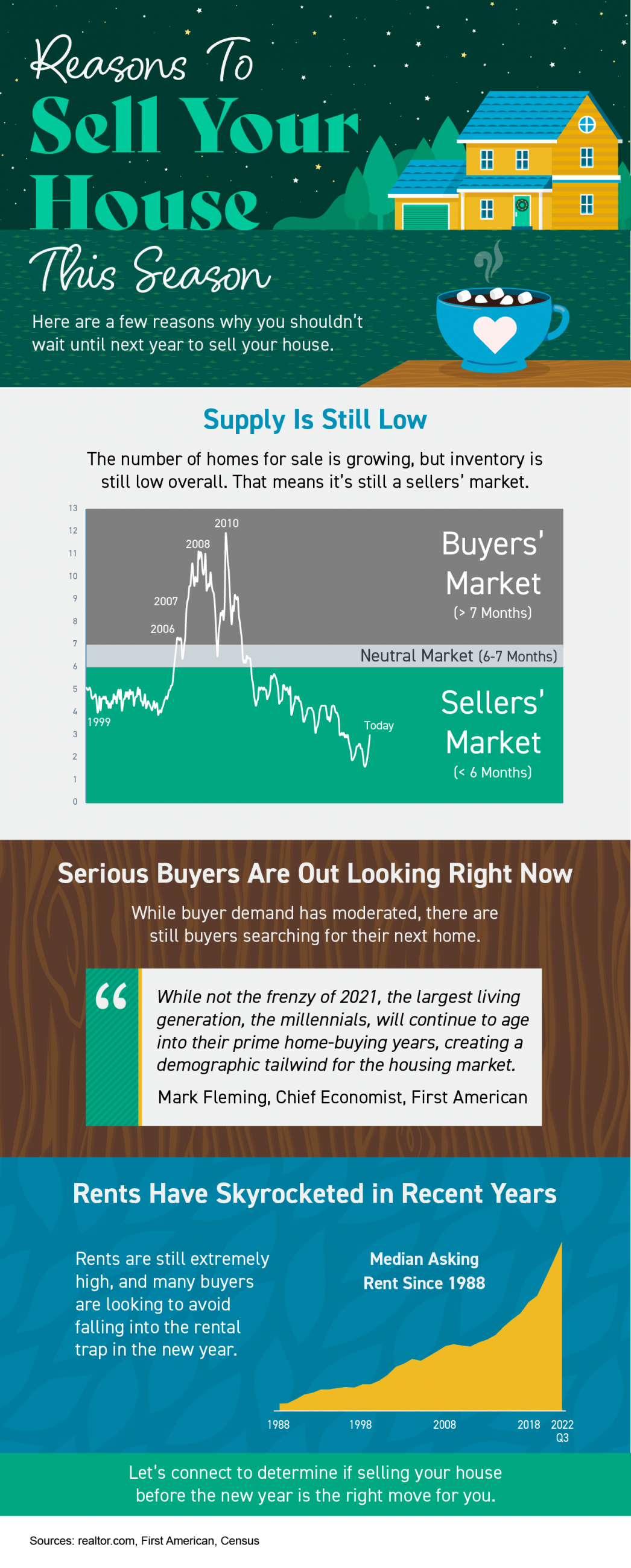

Reasons To Sell Your House This Season

Reasons To Sell Your House This Season Some Highlights If you’re planning to make a move but aren’t sure if now’s the right time, here are a few reasons why you shouldn’t wait to sell your house. The supply of homes for sale, while growing, is still low today....

Reasons To Sell Your House This Season

Reasons To Sell Your House This Season Some Highlights If you’re planning to make a move but aren’t sure if now’s the right time, here are a few reasons why you shouldn’t wait to sell your house. The supply of homes for sale, while growing, is still low today....

Homeownership Is an Investment in Your Future

Homeownership Is an Investment in Your Future There are many people thinking about buying a home, but with everything affecting the economy, some are wondering if it’s a smart decision to buy now or if it makes more sense to wait it out. As Bob Broeksmit, President...