Homes Are More Affordable Today, Not Less Affordable

There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several years.

It’s not, however, just the price of a home that matters.

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by approximately 3% over the last year.

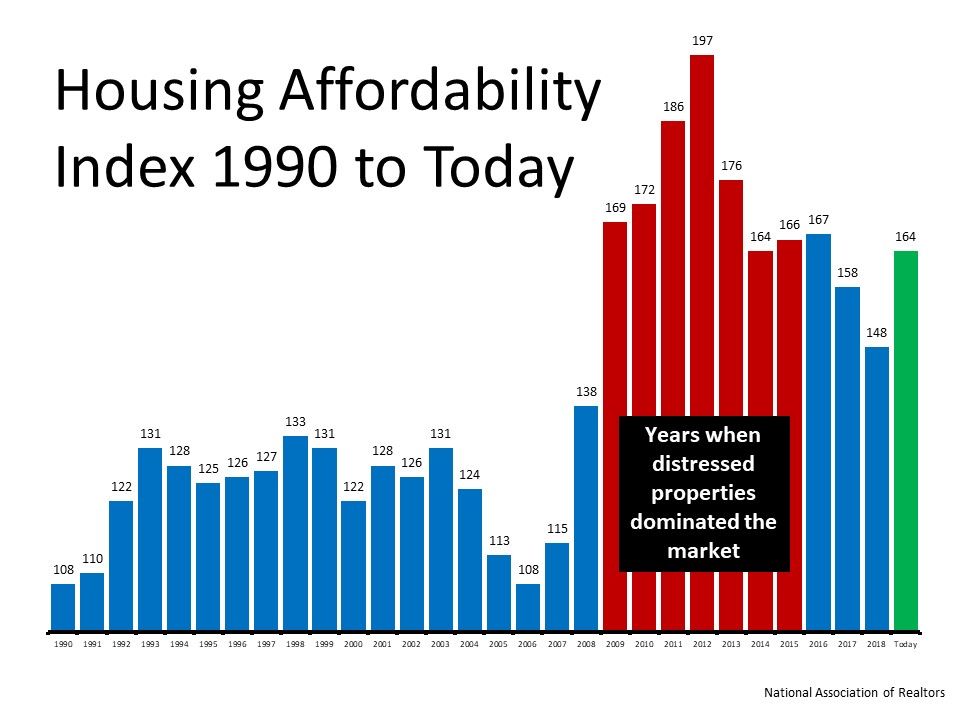

The National Association of Realtors (NAR) releases a monthly Housing Affordability Index. The latest index shows that home affordability is better today than at almost any point over the last 30 years. The index determines how affordable homes are based on the following:

“A Home Affordability Index value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20 percent down payment so that the monthly payment and interest will not exceed 25 percent of this level of income (qualifying income).”

The higher the index, therefore, the more affordable homes are. Here is a graph showing the index since 1990: Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

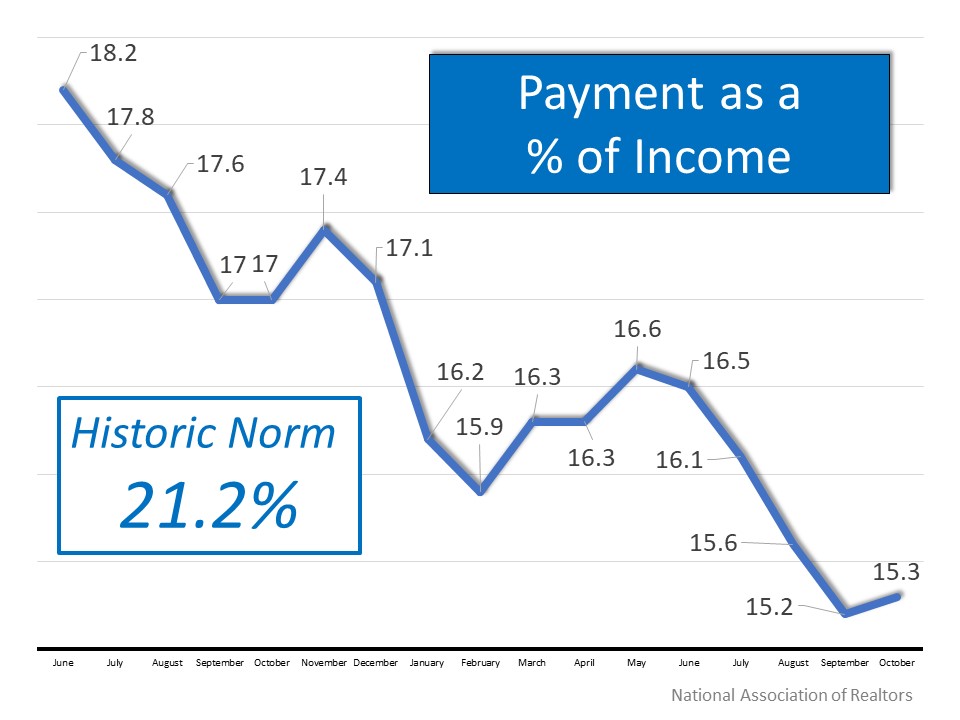

The report on the index also includes a section that calculates the mortgage payment on a median priced home as a percentage of the median national income. Historically, that percentage is just above 21%. Here are the percentages since June of 2018: Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Bottom Line

Whether you’re thinking about buying your first home or moving up to the home of your dreams, don’t let the false narrative about affordability prevent you from moving forward. From an affordability standpoint, this is one of the best times to buy in the last 30 years.

Find The Perfect Home Here

Buyer Guide (Its Free)

Why should I use a Realtor® to sell my home

Why should I use a Realtor® to sell my home? By Marty Gale Does selling my home myself save me money? I recently received a call from a Mortgage originator (Loan Officer) that is a friend of mind. What prompted me to write this article was a discussion he had...

home price appreciation each month for over a year

Home Value Appreciation Stops Falling, Begins to Stabilize The percentage of home price appreciation on a year-over-year basis has decreased each month for over a year. The question was how far annual appreciation would fall. It seems we may now have the answer. In a...

Celebrating a Closing

Yvonne is celebrating the purchase of her lovely rambler home. Congratulations Yvonne!

Utah Buyer Demand Will Be Strong for Years

Home Buyer Demand Will Be Strong for Years to Come There has been a lot written about millennials and their preference to live in city centers above their favorite pizza place. Some have even gone so far as to say that millennials are a “Renter-Generation”. And while...

Pet-Friendly Homes Are in High Demand

Why Pet-Friendly Homes Are in High Demand One of the many benefits of owning your own home is the freedom to find your ‘furever’ friend. By pointing out the aspects of your home that make it ‘pet-friendly’ in your listing, you’ll attract these buyers, rather than...

Selling Your Family Home is a Type of Loss

Selling Your Family Home is a Type of Loss It’s easy to tell yourself that your house is just a building made of walls and ceilings and light fixtures and flooring, but when it comes time to sell, you may start to feel the sting of grief. After all, you don’t know if...

3 Graphs About Today’s Real Estate Market

3 Graphs that Show What You Need to Know About Today’s Real Estate Market The Housing Market has been a hot-topic in the news lately. Depending on which media outlet you watch, it can start to be a bit confusing to understand what’s really going on with interest rates...

Now is the Time to Move-Up

Looking to Upgrade Your Current Home? Now’s the Time to Move-Up! In every area of the country, homes that are priced at the top 25% of the price range for that area are considered to be Premium Homes. In today’s real estate market there are deals to be had at the...

Utah Home Prices Top Three In the Country

Utah home prices increased 9.80 percent in the fourth quarter year-over-year, giving the state the third fastest growing home prices nationally, according to the Federal Housing Finance Agency. Idaho was No. 1, with prices there rising 11.93 percent. North Dakota was...

what credit score do you need to buy a house in utah

What Credit Score Do You Need To Buy A House? There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are...