Homes Are More Affordable Today, Not Less Affordable

There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several years.

It’s not, however, just the price of a home that matters.

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by approximately 3% over the last year.

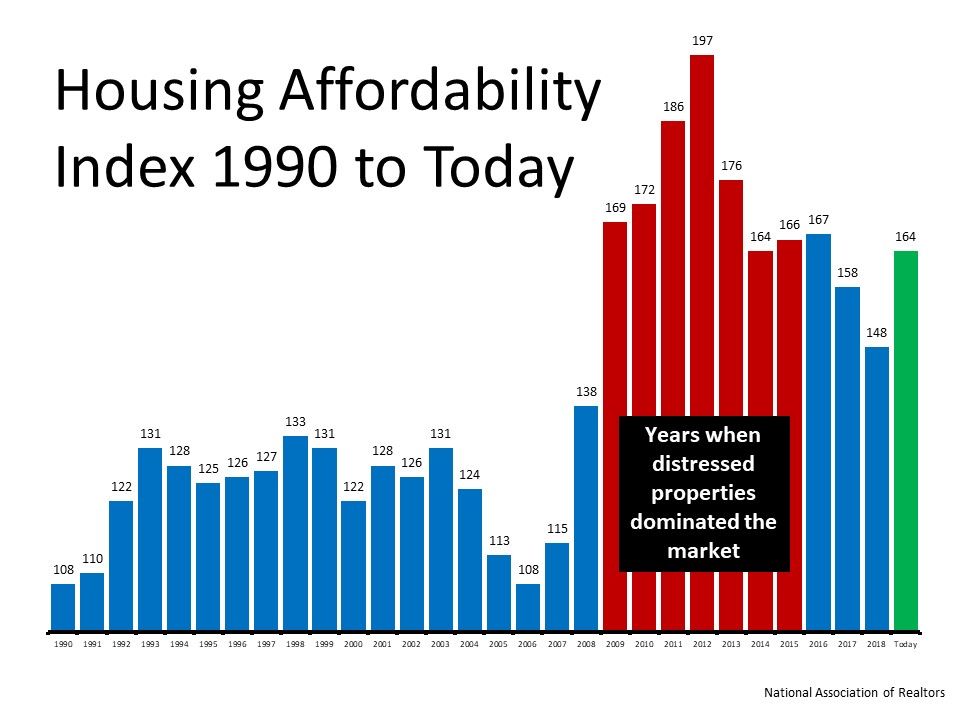

The National Association of Realtors (NAR) releases a monthly Housing Affordability Index. The latest index shows that home affordability is better today than at almost any point over the last 30 years. The index determines how affordable homes are based on the following:

“A Home Affordability Index value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20 percent down payment so that the monthly payment and interest will not exceed 25 percent of this level of income (qualifying income).”

The higher the index, therefore, the more affordable homes are. Here is a graph showing the index since 1990: Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

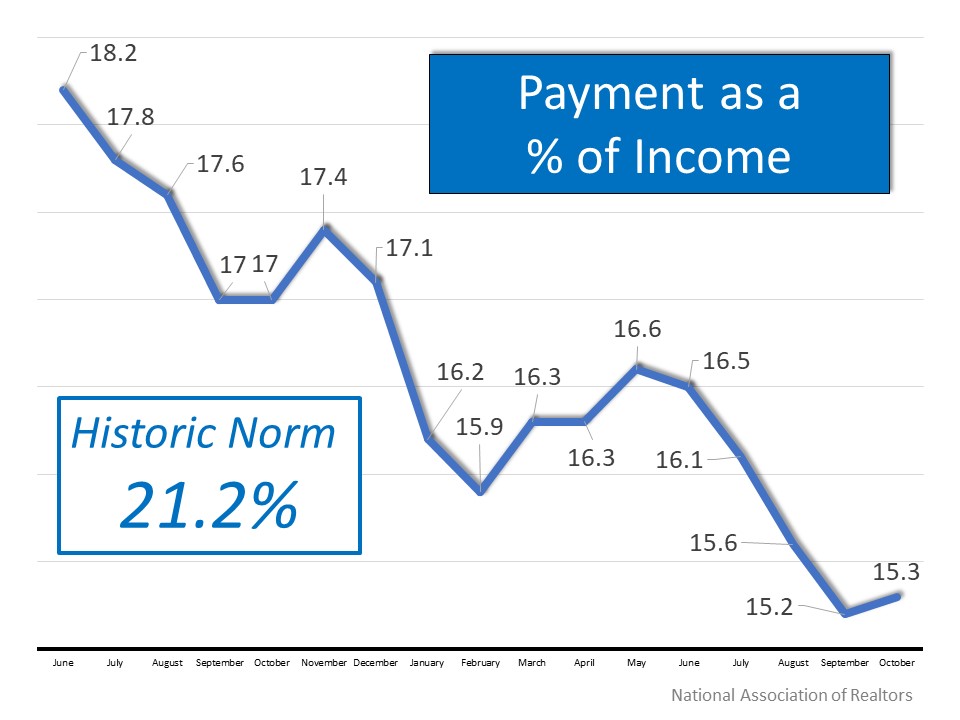

The report on the index also includes a section that calculates the mortgage payment on a median priced home as a percentage of the median national income. Historically, that percentage is just above 21%. Here are the percentages since June of 2018: Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Bottom Line

Whether you’re thinking about buying your first home or moving up to the home of your dreams, don’t let the false narrative about affordability prevent you from moving forward. From an affordability standpoint, this is one of the best times to buy in the last 30 years.

Find The Perfect Home Here

Buyer Guide (Its Free)

Should You Buy a Home Now or Wait Until Next Year?

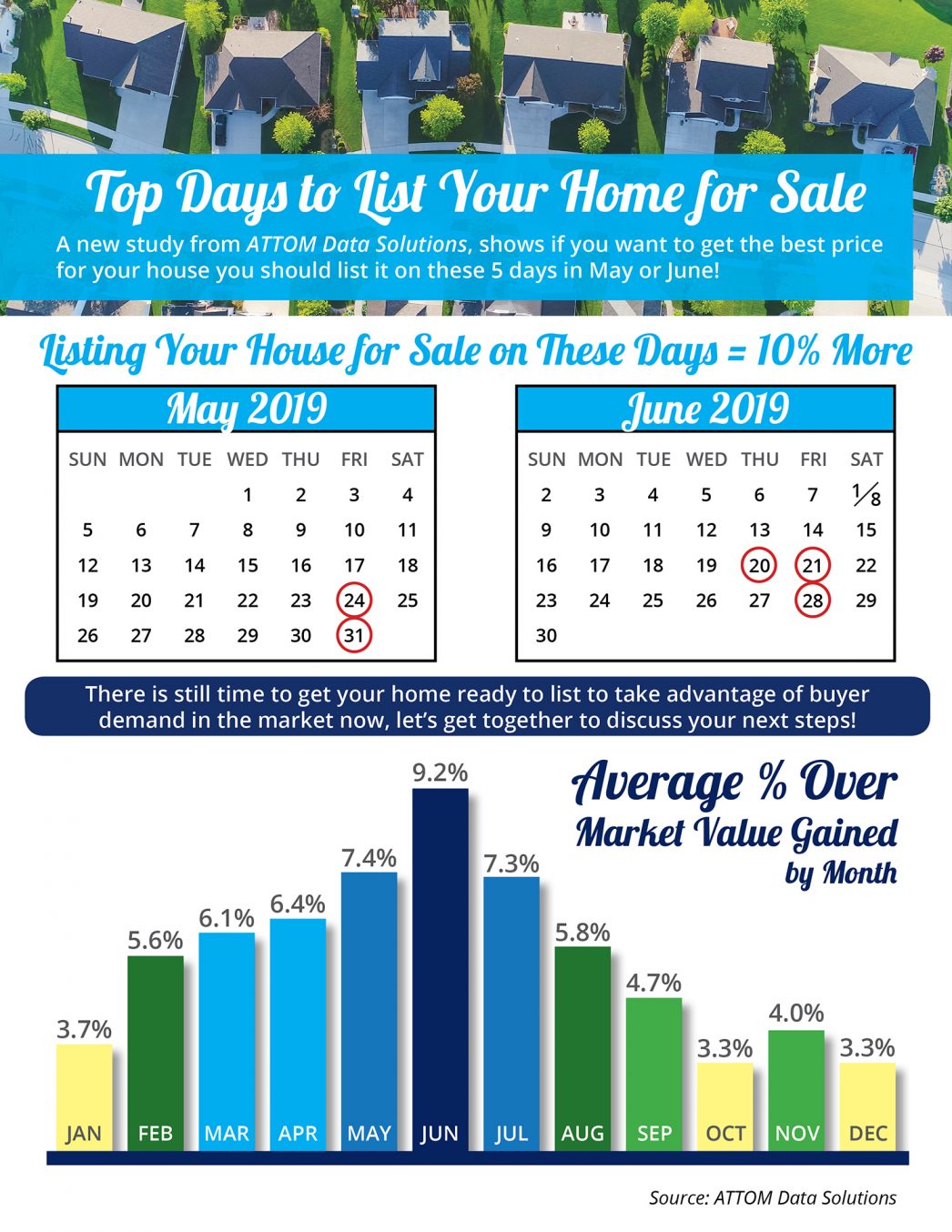

Top Days to List Your Home for Sale in Utah by Utah Realty

Top Days to List Your Home for Sale Some Highlights: ATTOM Data Solutions conducted an analysis of more than 29 million single family home and condo sales over the past eight years to determine the top days to list your home for sale. The top five days to list your...

Are Older Generations in Utah Really Not Selling Their Homes

Are Older Generations Really Not Selling Their Homes? Many studies suggest one of the main reasons for the inventory shortage in today’s market of homes for sale is that older generations have chosen to “age in place” over moving. The 2019 Home Buyers & Sellers...

Searching for your Utah Dream Home

Starting the Search for Your Dream Home? Here Are 5 Tips! In today’s real estate market, low inventory dominates the conversation in many areas of the country. It can often be frustrating to be a first-time homebuyer if you aren’t prepared. In...

Utah Home Prices

Salt Lake City's Home Prices Keep Climbing Salt Lake home prices have increased nearly 47 percent over the past five years, and more than 371 percent since 1991, according to a recent report by the Federal Housing Finance Agency. Nationwide, home prices have...

Parents of Utah Graduates, Are you about to be empty nesters!

Utah Realty Presents A Tale of Two Markets

Utah Realty Presents A Tale of Two Markets [INFOGRAPHIC] Some Highlights: An emerging trend for some time now has been the difference between available inventory and demand in the premium and luxury markets and that in the starter and trade-up markets and what those...

South Jordan Utah Home Buyers are Optimistic About Homeownership

Home Buyers are Optimistic About Homeownership! When we consider buying an item, we naturally go through a research process prior to making our decision. We ask our friends and family members who have made similar purchases about their experience, we get opinions and...

Utah Realty Tip of the Day! Access Important to Getting your Home Sold

Why Access Is One of the Most Important Factors in Getting Your House Sold! So, you’ve decided to sell your house. You’ve hired a real estate professional to help you through the entire process, and they have asked you what level of access you want to provide to your...

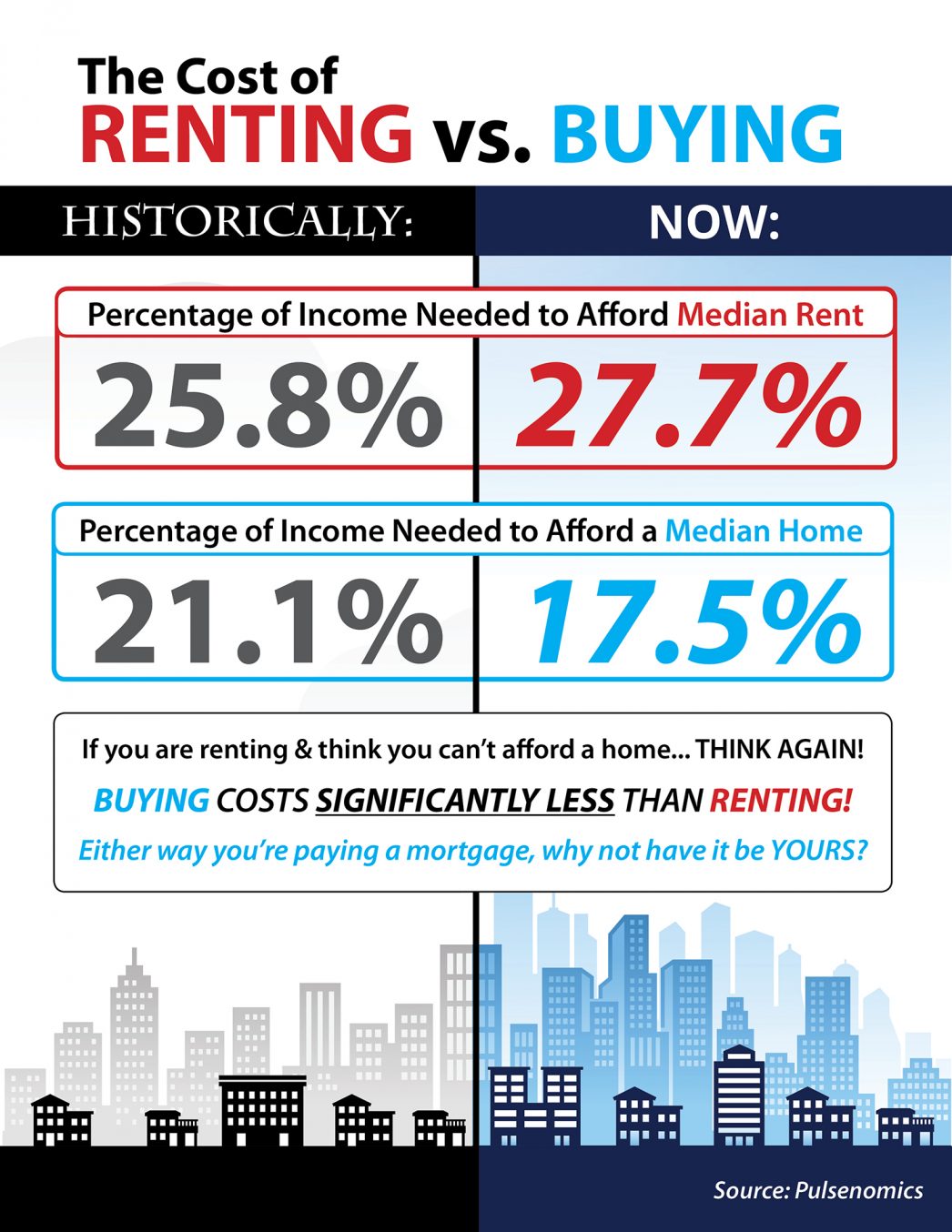

Cost of Renting vs Buying – Utah Realty

The Cost of Renting vs. Buying This Spring Some Highlights: Historically, the choice between renting or buying a home has been a tough decision. Looking at the percentage of income needed to rent a median-priced home today (27.7%) vs. the percentage needed to buy a...