Homes Are More Affordable Today, Not Less Affordable

There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several years.

It’s not, however, just the price of a home that matters.

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by approximately 3% over the last year.

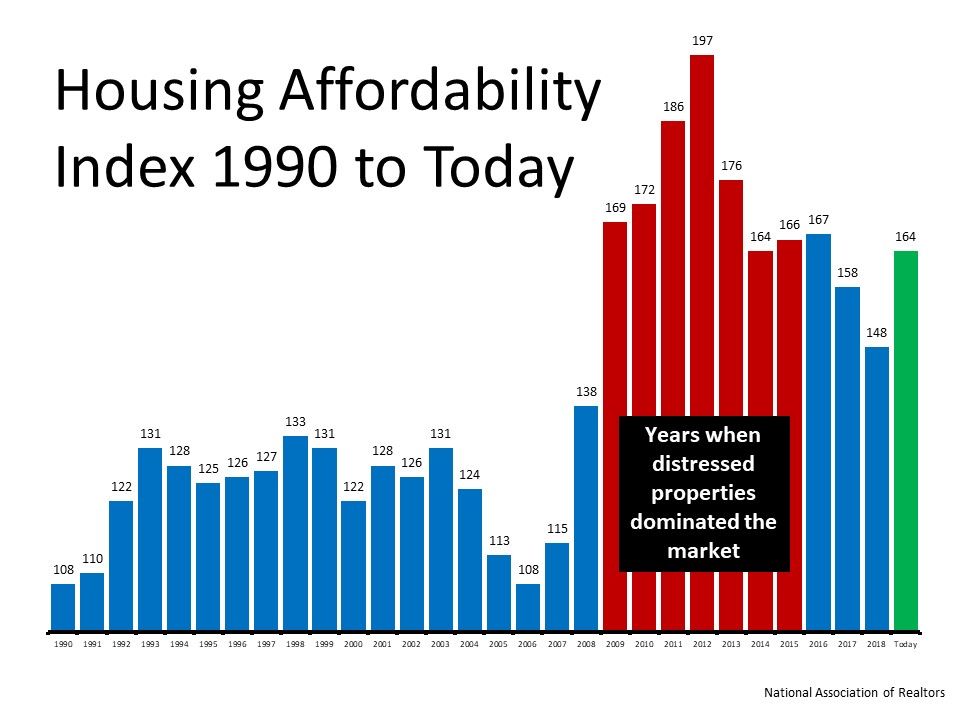

The National Association of Realtors (NAR) releases a monthly Housing Affordability Index. The latest index shows that home affordability is better today than at almost any point over the last 30 years. The index determines how affordable homes are based on the following:

“A Home Affordability Index value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20 percent down payment so that the monthly payment and interest will not exceed 25 percent of this level of income (qualifying income).”

The higher the index, therefore, the more affordable homes are. Here is a graph showing the index since 1990: Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

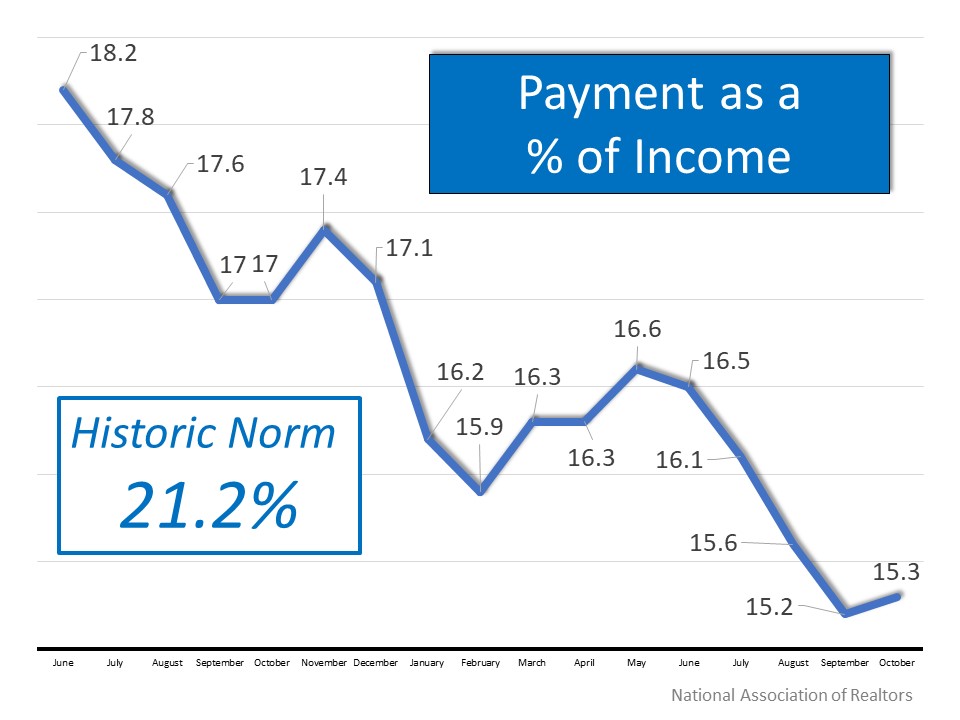

The report on the index also includes a section that calculates the mortgage payment on a median priced home as a percentage of the median national income. Historically, that percentage is just above 21%. Here are the percentages since June of 2018: Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Bottom Line

Whether you’re thinking about buying your first home or moving up to the home of your dreams, don’t let the false narrative about affordability prevent you from moving forward. From an affordability standpoint, this is one of the best times to buy in the last 30 years.

Find The Perfect Home Here

Buyer Guide (Its Free)

10 Steps to Buying a Home This Summer

10 Steps to Buying a Home This Summer [INFOGRAPHIC] Some Highlights: If you are thinking of buying a home, you may not know where to start. Here is a simple list of 10 steps that you will go through to purchase a home. Make sure to ask your agent for details about...

Happy Forth of July!

Happy Independence Day! Wishing you & yours a safe & Happy 4th of July!

Stop Wondering What Your Budget Is & Get Pre-Approved

Stop Wondering What Your Budget Is & Get Pre-Approved! In many markets across the country, the number of buyers searching for their dream homes outnumbers the number of homes for sale. This has led to a competitive marketplace where buyers often need to stand out....

Your 6-Month Mortgage Rate Forecast

Both mortgage interest rates and home prices are projected to rise throughout 2019. If you plan on buying a home this year, the time is now! Let's get together to discuss your plans today!

What You Need to Know About Private Mortgage Insurance (PMI) Utah Realty

What You Need to Know About Private Mortgage Insurance (PMI) Courtesy of Utah Realty Whether it is your first time or your fifth, it is always important to know all the facts when it comes to buying a home. With the large number of mortgage programs available that...

5 Reasons to Sell Your House This Summer with Utah Realty

5 Reasons to Sell Your House This Summer with Utah Realty Here are 5 compelling reasons listing your home for sale this summer makes sense. 1. Demand Is Strong The latest Buyer Traffic Index from the National Association of Realtors (NAR) shows that buyer demand...

Utah Gen X Time For Your Dream Home

Time for Your Dream Home, Gen X! During the housing market crash, Gen X homeowners lost more wealth than other generations. However, things are changing now! A strong economy, increasing home prices, and the recovery of the housing market are helping this generation...

3 Things to Know in the Housing Market Today in Utah!

3 Things to Know in the Housing Market Today! A lot is happening in the world, and it’s having a direct impact on the housing market. The reality is this: some of it is positive and some of it may be negative. Some we just don’t know yet. The following three areas of...

2 Myths Holding Back Utah Home Buyers

2 Myths Holding Back Home Buyers Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that, “For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of...