Homeowners: Now Is A Good Time To Sell Your House

Every month, the National Association of Realtors (NAR) releases their Seller Traffic Index as a part of their Realtors Confidence Index. In the latest release, NAR reported that homeowners have been reluctant to sell their houses. This is reflected when broken down by state. Only 11 states have a stable level of seller traffic compared to the remainder of the country, which came in with a weak rating.

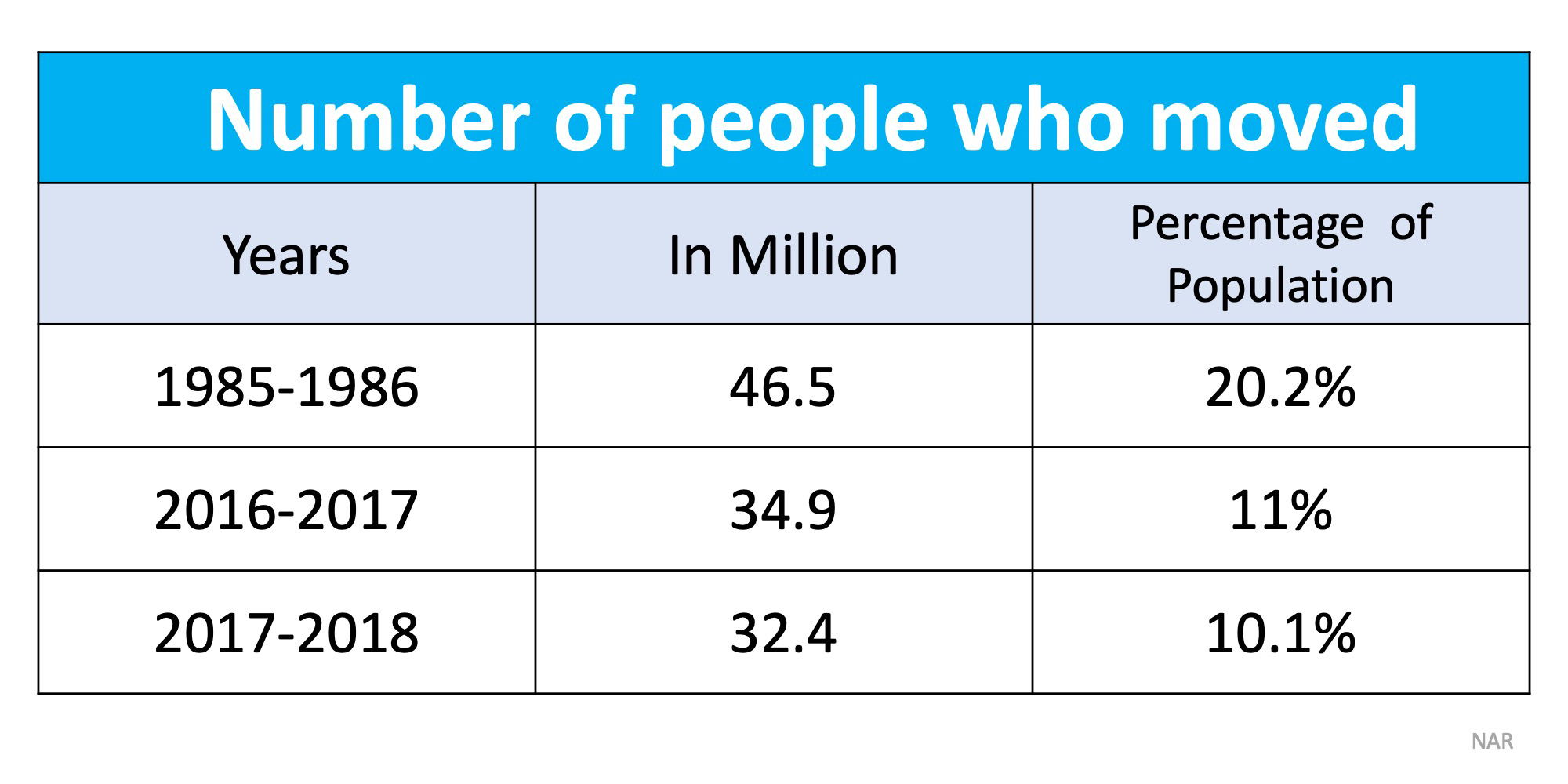

As we can see in the following table, the number of people who moved last year is half of what the rate was in the 1980s.

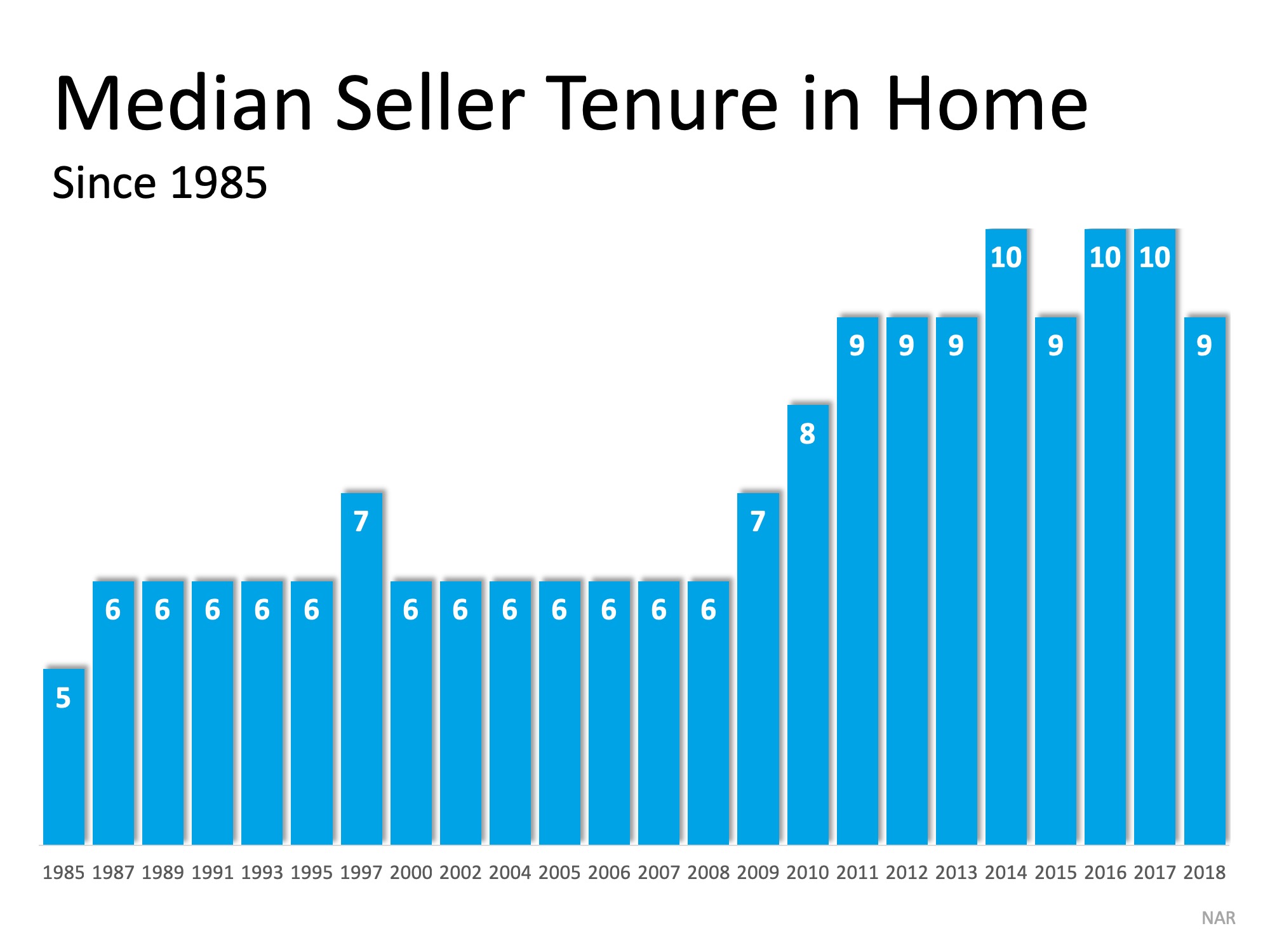

This does not come as a surprise, as tenure length (the number of years someone owns a home before moving again) among existing homeowners has increased. It has risen from an average of 6 years from 1985 to 2008, up to 9.5 years over the last few years. This is shown in the graph below:

As we can see, there is a pent-up seller demand!

What led to this change in behavior? Falling prices during the housing crisis led to many homeowners having negative equity in their home, meaning they owed more on their mortgage than the home was worth. Others were able to secure a low interest rate on their mortgage and have not been quick to obtain a new mortgage with a higher rate.

Will this trend continue?

Recently NAR reported that “69% of people believe now is a good time to sell a home.”

With a strong economy, low interest rates, and wages continuing to rise, some homeowners will be ready to put their house on the market and move up to the home of their dreams!

Bottom Line

There is a great opportunity for sellers to take advantage of the current real estate market before new inventory comes to market. If you are considering selling your house or would like to know your options, let’s get together today to help you understand the possibilities available to you!

Should You Use Your Equity to Move Up

Utah Realty News

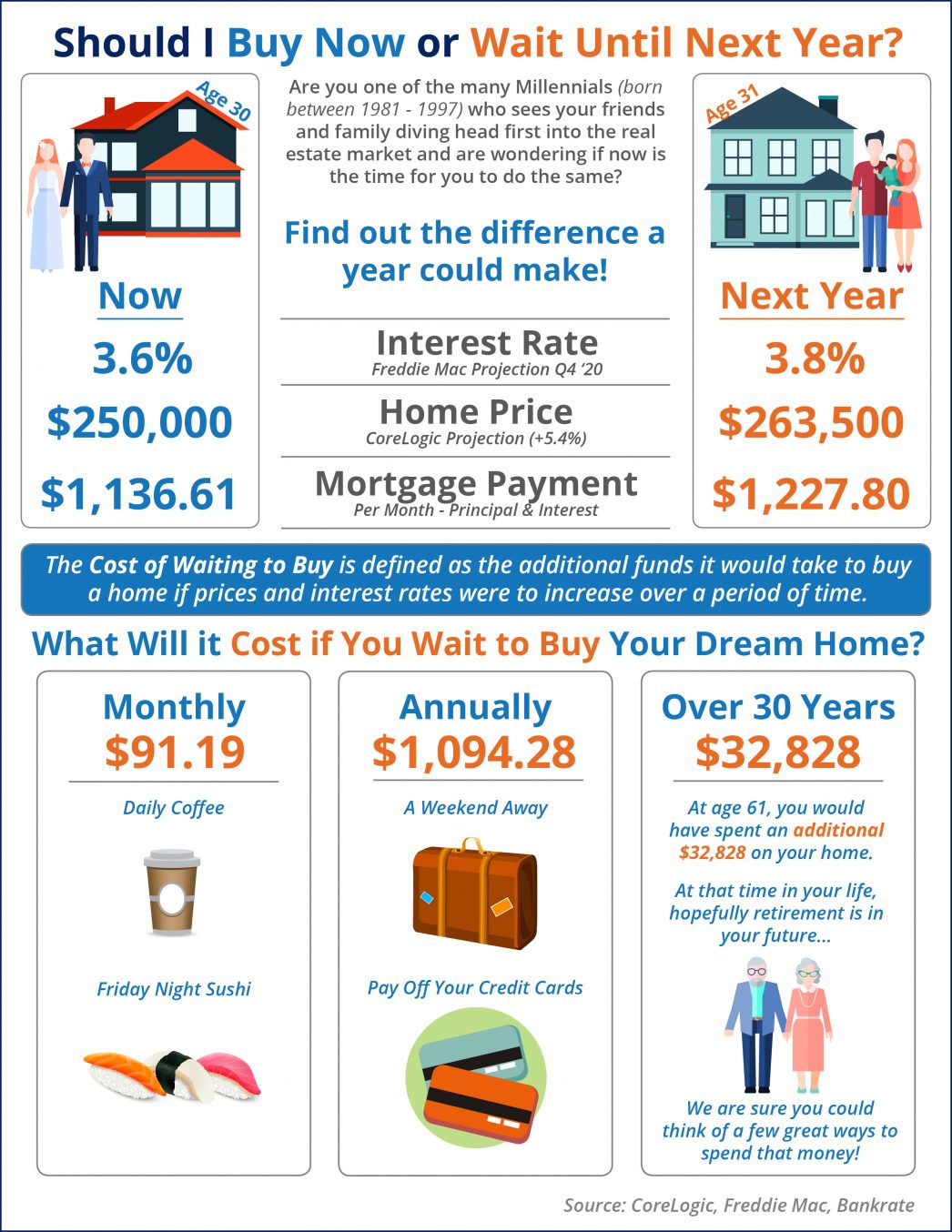

What Is the Cost of Waiting Until Next Year to Buy?

What Is the Cost of Waiting Until Next Year to Buy? Some Highlights: The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time. Freddie Mac forecasts interest rates will...

Is Your House “Priced to Sell Immediately”?

Is Your House “Priced to Sell Immediately”? In today’s real estate market, more houses are coming to market every day. Eager buyers are searching for their dream homes, so setting the right price for your house is one of the most important things you can do. According...

Utah had the second highest house-price appreciation of all states in the second quarter year-over-year

Utah had the second highest house-price appreciation of all states in the second quarter year-over-year Utah had the second highest house-price appreciation of all states in the second quarter year-over-year, according to a new report by the Federal Housing Finance...

What Will Home Prices Look Like Over the Next Few Years

What Will Home Prices Look Like Over the Next Few Years? September 19th, 2019 Home prices will continue to rise throughout 2023. This means that now is a great time to sell! If you're thinking of listing your home, let's get together to determine your best move.

4 Reasons to Sell This Fall In Utah With Utah Realty

Utah Realty 4 Reasons to Sell This Fall Some Highlights: Buyers are active in the market and often competing with one another for available listings. Housing inventory is still under the 6-month supply found in a normal housing market. Homes are still selling...

Three Benefits of Growing Equity in Your Home

The Benefits of Growing Equity in Your Home Over the last couple of years, we’ve heard quite a bit about rising home prices. Today, expert projections still forecast continued growth, just at a slower pace. One of the often-overlooked benefits of rising home prices is...

Utah Mortgage Rates at a 3 Year Low

Utah Mortgage Rates at a 3 Year Low

American Confidence in Housing at an All-Time High

Fannie Mae just released the July edition of their Home Purchase Sentiment Index (HPSI). The HPSI takes information regarding consumers’ confidence in the real estate market from Fannie Mae’s National Housing Survey and condenses it into a single number. Therefore,...