Homeowners: Now Is A Good Time To Sell Your House

Every month, the National Association of Realtors (NAR) releases their Seller Traffic Index as a part of their Realtors Confidence Index. In the latest release, NAR reported that homeowners have been reluctant to sell their houses. This is reflected when broken down by state. Only 11 states have a stable level of seller traffic compared to the remainder of the country, which came in with a weak rating.

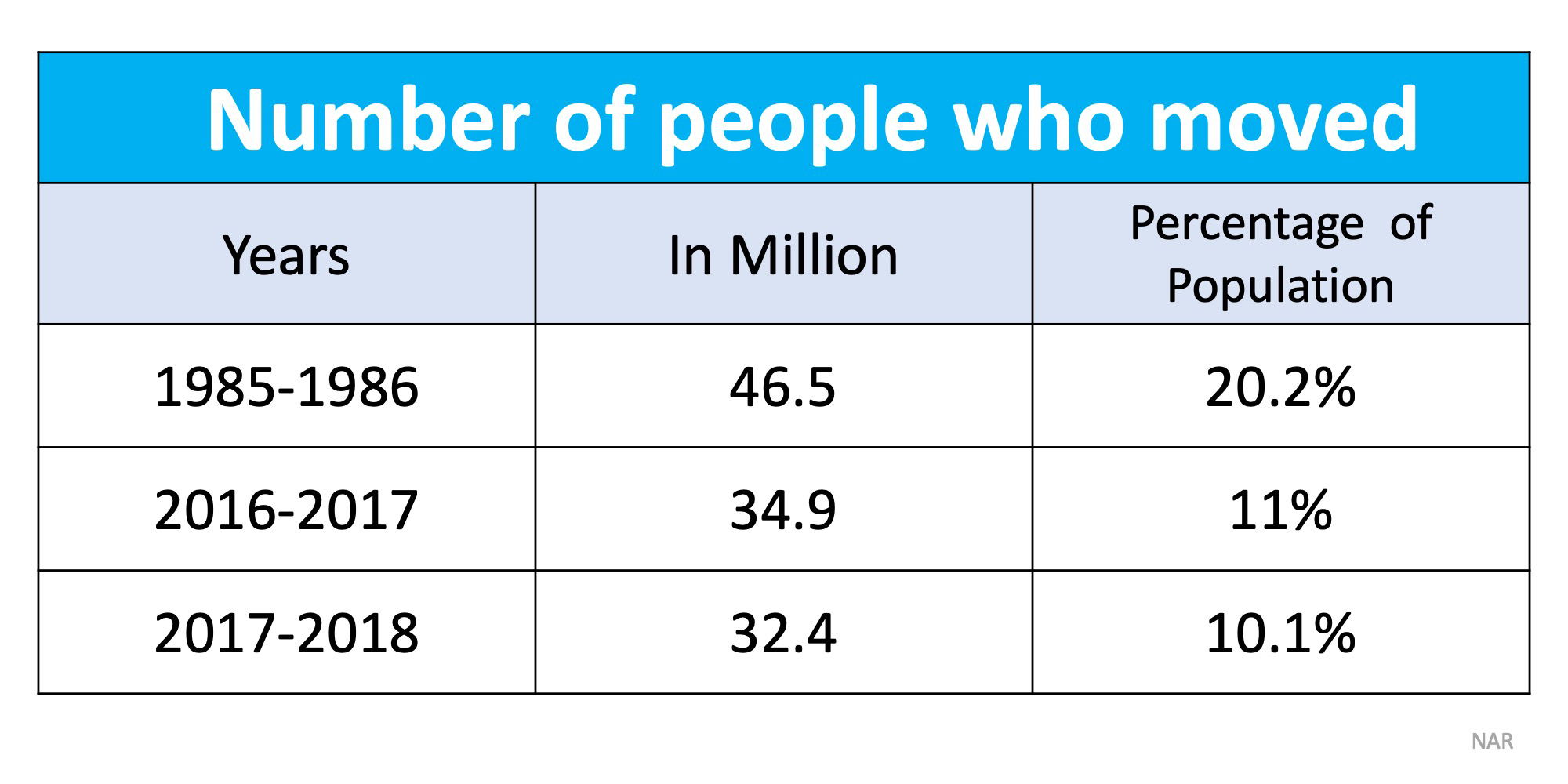

As we can see in the following table, the number of people who moved last year is half of what the rate was in the 1980s.

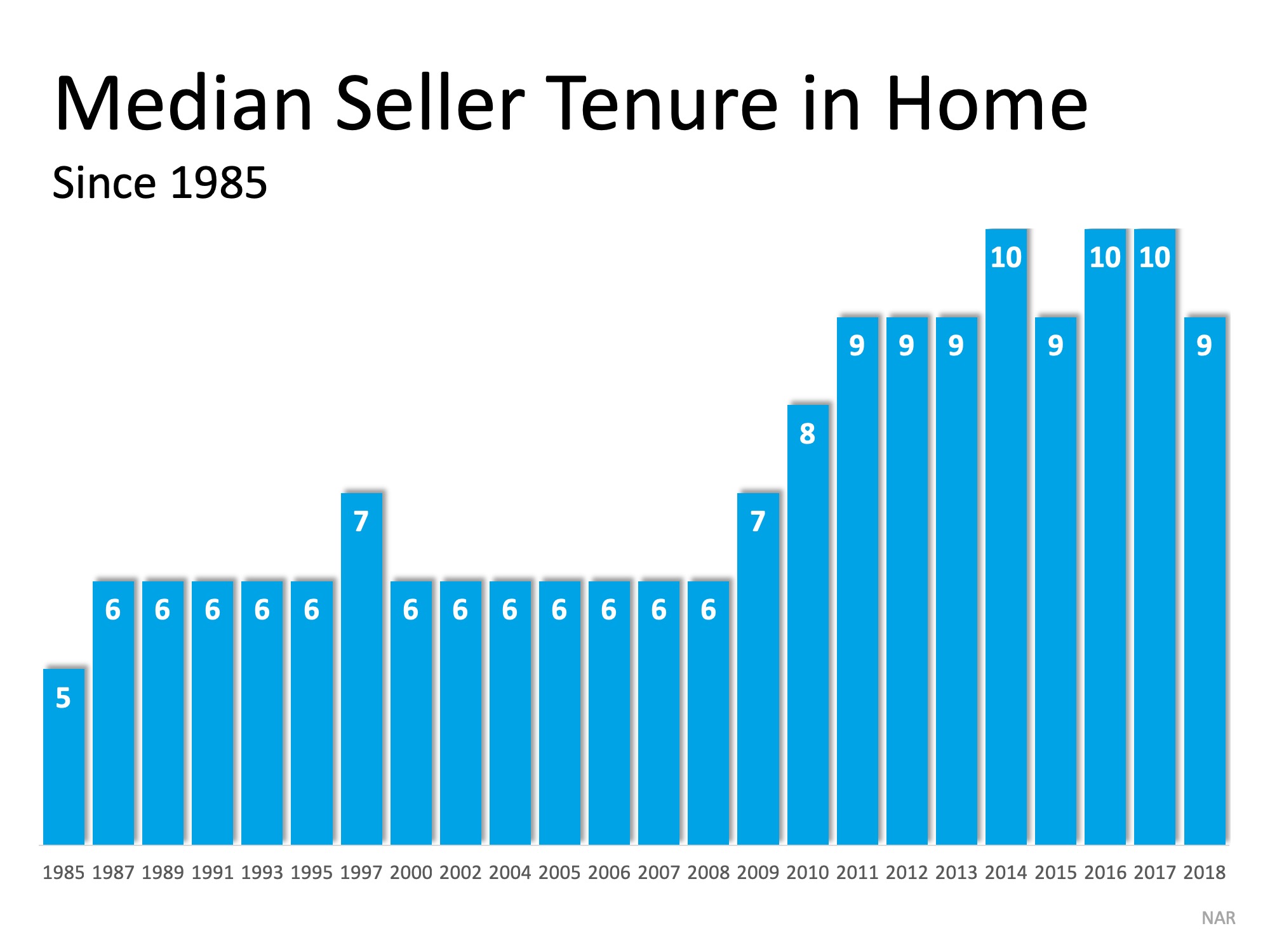

This does not come as a surprise, as tenure length (the number of years someone owns a home before moving again) among existing homeowners has increased. It has risen from an average of 6 years from 1985 to 2008, up to 9.5 years over the last few years. This is shown in the graph below:

As we can see, there is a pent-up seller demand!

What led to this change in behavior? Falling prices during the housing crisis led to many homeowners having negative equity in their home, meaning they owed more on their mortgage than the home was worth. Others were able to secure a low interest rate on their mortgage and have not been quick to obtain a new mortgage with a higher rate.

Will this trend continue?

Recently NAR reported that “69% of people believe now is a good time to sell a home.”

With a strong economy, low interest rates, and wages continuing to rise, some homeowners will be ready to put their house on the market and move up to the home of their dreams!

Bottom Line

There is a great opportunity for sellers to take advantage of the current real estate market before new inventory comes to market. If you are considering selling your house or would like to know your options, let’s get together today to help you understand the possibilities available to you!

How To Make Your Dream of Homeownership a Reality

How To Make Your Dream of Homeownership a Reality According to a recent Harris Poll survey, 8 in 10 Americans say buying a home is a priority, and 28 million Americans actually plan to buy within the next 12 months. Homeownership provides many financial and...

A Smaller Home Could Be Your Best Option

A Smaller Home Could Be Your Best Option Many people are reaching the point in their lives when they need to decide where they want to live when they retire. If you’re a homeowner approaching this stage, you have several options to explore. Jessica Lautz, Deputy Chief...

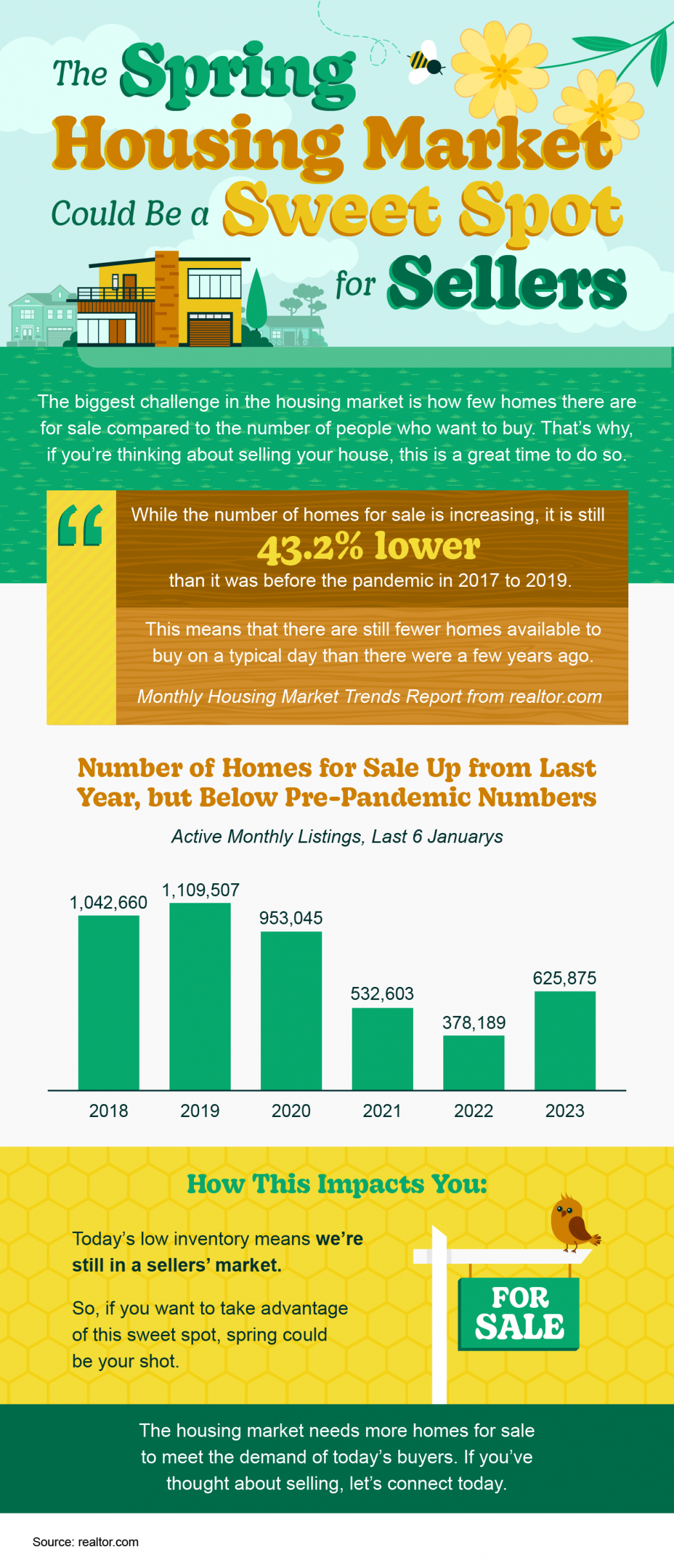

The Utah Spring Housing Market Could Be a Sweet Spot for Sellers

The Utah Spring Housing Market Could Be a Sweet Spot for Sellers Some Highlights The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy. The number of homes for sale is up from last year but...

Now helping navigate the solutions when coping with divorce and Real Property

National Association of Divorce Professionals Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential...

What You Should Know About Closing Costs

What You Should Know About Closing Costs Before you buy a home, it’s important to plan ahead. While most buyers consider how much they need to save for a down payment, many are surprised by the closing costs they have to pay. To ensure you aren’t caught off guard when...

How To Win as a Buyer in Today’s Housing Market In Utah

How To Win as a Buyer in Today’s Housing Market Some Highlights In today’s housing market, you can still be the champion if you have the right team and strategy. To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of...

Are We in a Housing Bubble?

The Top Reasons for Selling Your House

The Top Reasons for Selling Your House Many of today’s homeowners bought or refinanced their homes during the pandemic when mortgage rates were at history-making lows. Since rates doubled in 2022, some of those homeowners put their plans to move on hold, not wanting...

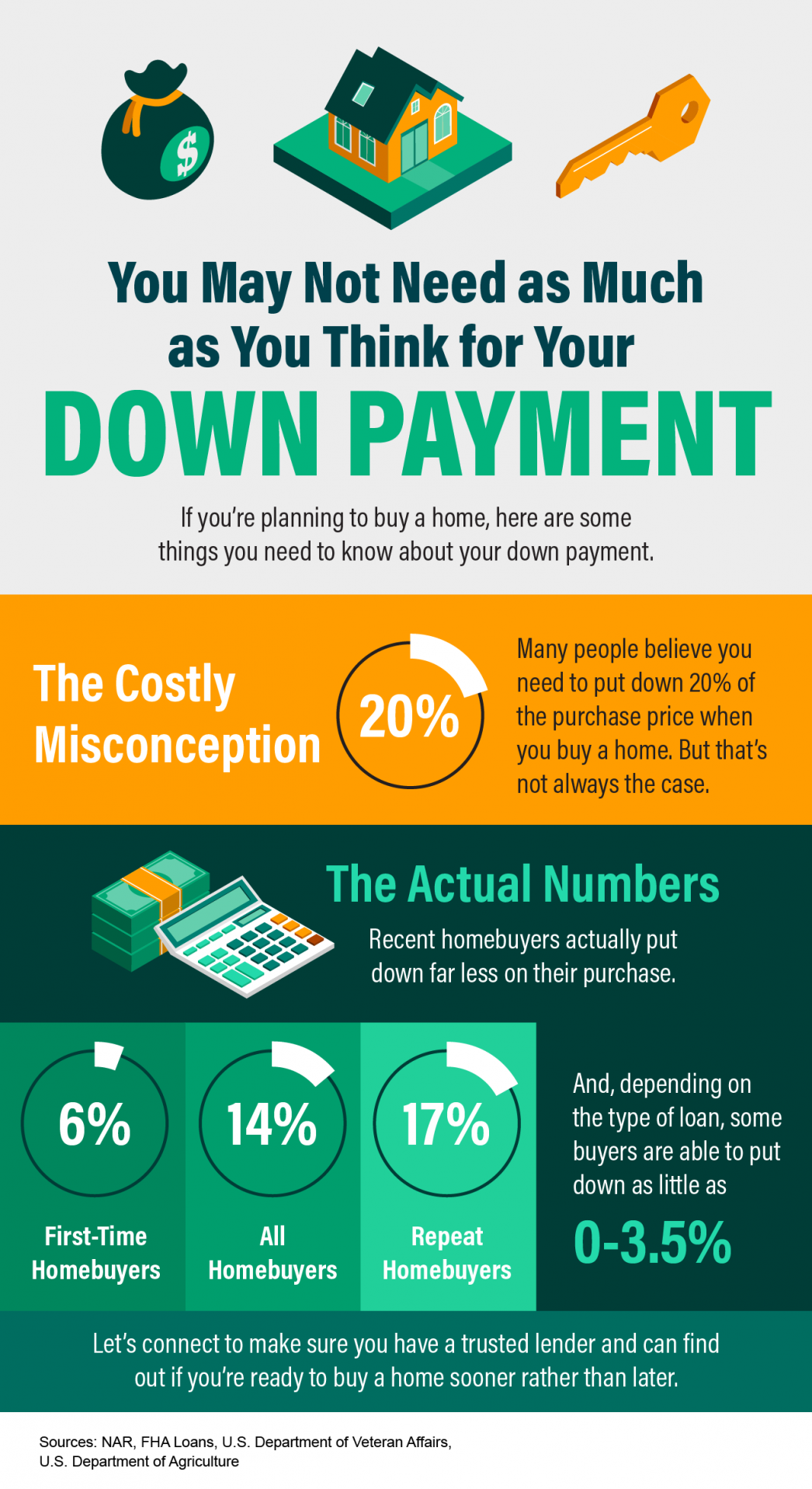

You May Not Need as Much as You Think for Your Down Payment

You May Not Need as Much as You Think for Your Down Payment Some Highlights Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase. And with programs like FHA loans, VA...